Shadows ($DOWS) Review: A Data-Driven Look at Its Legitimacy and Risks

What Is Shadows: An Introduction

Shadows, with its native token $DOWS, presents itself as a comprehensive decentralized finance (DeFi) platform focused on derivatives, asset issuance, trading, and collateral management. The project's core aim is to bridge traditional assets—such as fiat currencies, stocks, commodities, and indices—with blockchain technology, thereby bringing a broad array of financial instruments into the DeFi realm.

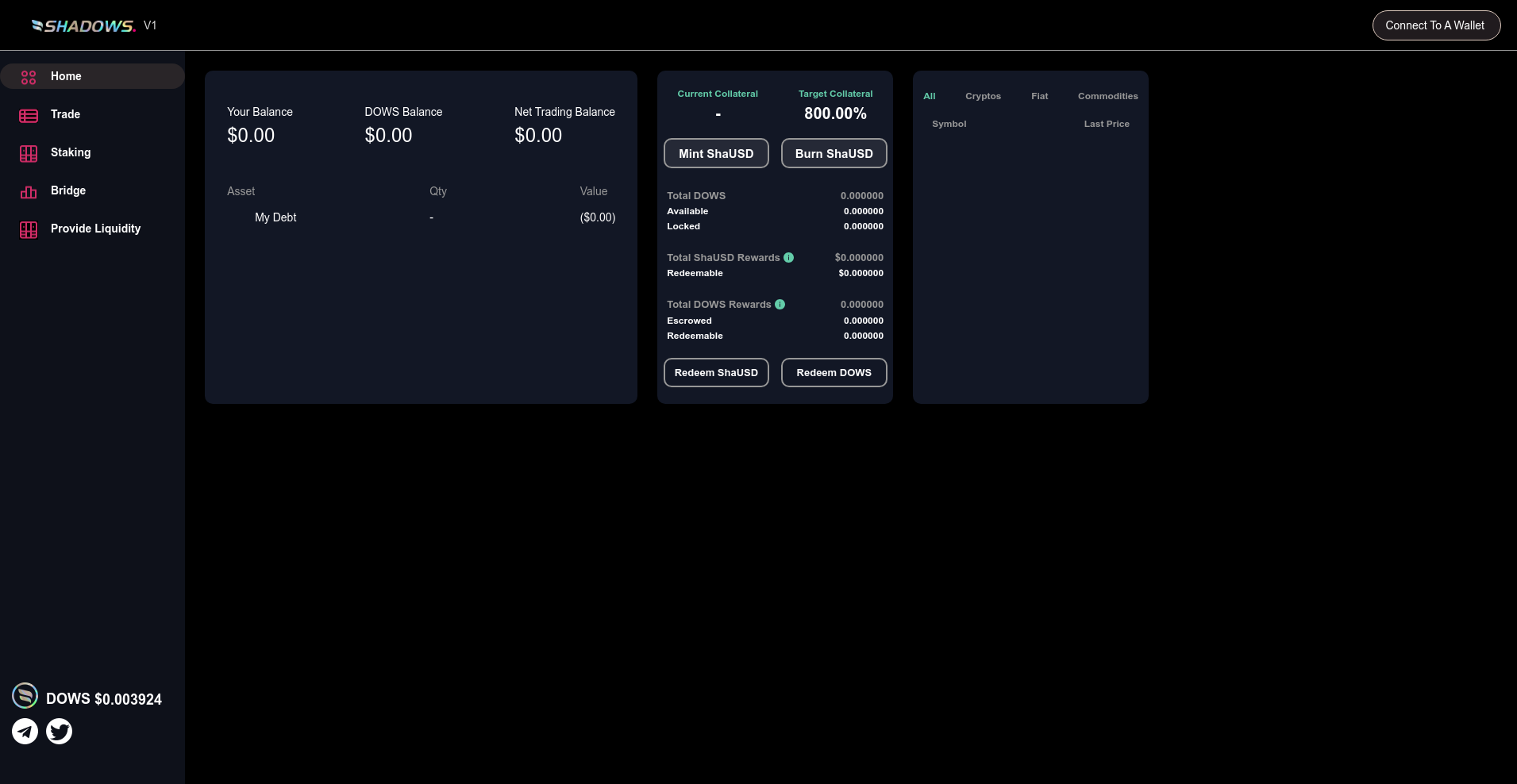

According to available summaries, Shadows offers functions including derivative issuance, trading, staking, bridging assets across blockchains, and providing liquidity. It emphasizes interconnectivity between ecosystems, notably Binance Smart Chain and Polkadot, seeking to unlock scalability and interoperability for a wide user base. The platform also introduces a stablecoin or synthetic asset, ShaUSD, positioned as a USD-pegged token. Despite ambitious goals, the current state of the platform appears nascent, with all key balances and metrics showing zero, indicating early development or staging phases.

The Team and Vision Behind Shadows

Based on publicly available information, the specific team behind Shadows has not been explicitly identified or featured in the audit reports or whitepapers. The lack of transparent team profiles is a common trait among early-stage projects but raises questions about credibility and execution capability. This anonymity is a significant red flag, and understanding the risks associated with anonymous crypto teams is paramount for any informed investor.

Assessing the project's roadmap and promised milestones, the following key points are noteworthy:

- Prototype and Platform Launch: The project appears to have introduced a working dashboard and trading interface, but with no active token balances or trading data, it suggests an early build or a limited beta, highlighting issues with its on-chain activity metrics.

- Integration with Major Blockchains: The plan to integrate with Binance Smart Chain and Polkadot indicates a vision for scalability, yet concrete timelines or successful interoperability implementations are not publicly verified.

- Market Expansion and Asset Support: The roadmap mentions support for multiple asset classes—cryptos, fiat, commodities—but specific launches or partnerships are not detailed. This ambition directly relates to the concept of synthetic assets in DeFi, aiming to bring these traditional instruments on-chain.

Overall, the lack of demonstrable development progress or a transparent team diminishes confidence in their ability to deliver on these strategies within projected timelines.

Assessing the Security and Integrity of Shadows

This analysis relies primarily on the Cer.live audit report, which evaluates Shadows’s smart contract security. The audit indicates a modest coverage level of about 50%, with the main platform contracts audited by HashCloak. The report notably shows the project has incidents, but no ongoing bug bounty initiatives are active, and there is no insurance coverage. Understanding the value of security audits, such as those provided by entities like CertiK, is crucial before investing in any project.

Key security findings from the audit include:

- Score and Vulnerability Status: The specific security score is not provided, but the audit report highlights the presence of incidents, which warrants further scrutiny.

- Code Exposure and Critical Risks: No explicit mention of critical vulnerabilities or exploit vectors is included in the summary, but the fact that incidents occurred implies potential security concerns.

- Centralization and Governance Risks: There is limited information on governance structures or upgrade mechanisms. Given the early stage and zero balances, operational infrastructure might be minimal or untested.

In conclusion, reliance on a single audit source with partial coverage and no insurance coverage introduces significant risk. For an investor, this underscores the importance of waiting for more comprehensive audits, higher coverage, and formal security assurances before engaging with Shadows’s protocols.

A Breakdown of Shadows Tokenomics

The available data on Shadows’s tokenomics is limited but suggests a nascent economic model. The primary token $DOWS appears to be in early phases, as its supply, trading price, and rewards are listed as zero or not yet initialized. The presence of a stablecoin or synthetic USD, ShaUSD, adds functional utility, but current totals and balances are also at zero, emphasizing that following launch, active utility and liquidity are still to be developed. A robust understanding of tokenomics and token utility drivers is essential for assessing a project's long-term viability.

- Total Supply: Data not available; tokens have not been minted or distributed as of now.

- Token Allocations: Not specified, but typical allocations include team, advisors, reserves, and community incentives.

- Vesting and Unlock Schedules: No explicit details are present, leaving questions about potential dumping risks or liquidity lockups.

- Utility: Used for trading rewards, staking, collateralization, and governance within the Ecosystem.

- Economic Sustainability: Ironically, with zero circulating or locked tokens, current economic incentives are non-functional, suggesting the tokenomics is still under development or not yet live.

Given this snapshot, the economic model appears either incomplete or awaiting launch. Risks include token inflation, insufficient liquidity, and the absence of clear utility or governance powers at this stage.

Assessing Shadows’s Development and Ecosystem Activity

The current activity levels within Shadows seem minimal, primarily reflective of an alpha or testing environment. The platform’s interface exists, allowing users to connect wallets and interact with functions like minting or redeeming ShaUSD, but actual transactional data, balances, or active trading are absent. This lack of on-chain activity is a critical indicator that can be evaluated by examining on-chain activity metrics for crypto projects.

Social media and community engagement highlight the project’s presence—through a Telegram channel and Medium articles—but these are largely promotional or informational at present.

Without observable on-chain activity, liquidity pools, or traded volumes, Shadows’s ecosystem remains in a pre-launch or very early beta phase. This limits its immediate utility and signifies high development risk for potential early investors or users.

The Fine Print: Analyzing Shadows’s Terms

Information about Shadows's legal terms, user agreements, or governance structures is sparse in the provided summaries. No explicit legal clauses or disclaimers are highlighted, raising concerns about transparency and consumer protections. This absence suggests that it's essential to scrutinize smart contract code, terms of use, and jurisdiction specifics once available, especially considering the early developmental state. The implications of team anonymity, often linked to a lack of transparency in terms and conditions, can be further explored in articles discussing anonymous teams in crypto.

Without clear legal frameworks, investors are exposed to risks stemming from unspecified governance mechanisms, upgradeability flaws, or potential regulatory vulnerabilities. Therefore, due diligence must extend beyond code to legal documentation once it becomes publicly accessible.

Final Analysis: The Investment Case for Shadows

As of now, Shadows positions itself as a potentially ambitious platform aiming to revolutionize derivatives and asset management on-chain. However, current indicators paint a picture of a project in nascent stages, with minimal actual activity, unlaunched token metrics, and limited security transparency. The reliance on a single, partial security audit and absence of active liquidity or trading further heighten caution. This scenario highlights the importance of comparing different types of exchanges, such as understanding the nuances of a DEX aggregator versus a standalone DEX, as different models can offer varied levels of efficiency and security.

Looking ahead, the project’s long-term success hinges on transparent team disclosure, comprehensive smart contract audits, active ecosystem development, and real-world adoption. For cautious investors, Shadows’s promising vision is overshadowed by significant risks related to unproven technology, incomplete tokenomics, and security uncertainties.

Pros / Strengths

- Ambitious vision to unify derivatives, assets, and DeFi functionality

- Plans for interoperability across Binance Smart Chain and Polkadot

- Presence of foundational platform components (trading, staking, bridging)

Cons / Risks

- Minimal current development activity and zero active balances or token metrics

- Limited security review with only 50% coverage and no insurance coverage

- Lack of transparent team, governance details, or legal disclosures

- High early-stage development risk with untested smart contracts and no active liquidity

- Potential tokenomics or utility concerns due to uninitialized supply and balances

Investors should approach Shadows with caution, prioritizing transparency, security, and demonstrable progress before considering any engagement or capital deployment. This analysis aims to provide an impartial foundation for understanding the project's current state and inherent risks, enabling informed decision-making based on available data.

Jessica Taylor

NFT Market Data Scientist

Data scientist specializing in the NFT market. I analyze on-chain data to detect wash trading, bot activity, and other manipulations that are invisible to the naked eye.

Similar Projects

-

Solmana Launchpad

Solmana Launchpad ($SOLMA) Review: Risks and Project Analysis

-

CatWiF Hats

Crypto Project Review & Scam Checker: Is CatWiF Hats on Solana Safe or a Scam?

-

PoolTogether

PoolTogether ($POOL) Review: Risks, Security & Long-Term Viability

-

KnightSwap

KnightSwap Review: Scam or Legit Crypto? Scam Check & Analysis

-

Unitus

Unitus ($UTS) Review: Assessing its Security, Tokenomics & Risks