KnightSwap Review: Scam or Legit Crypto? Uncovering All The Red Flags

What Exactly Is KnightSwap?

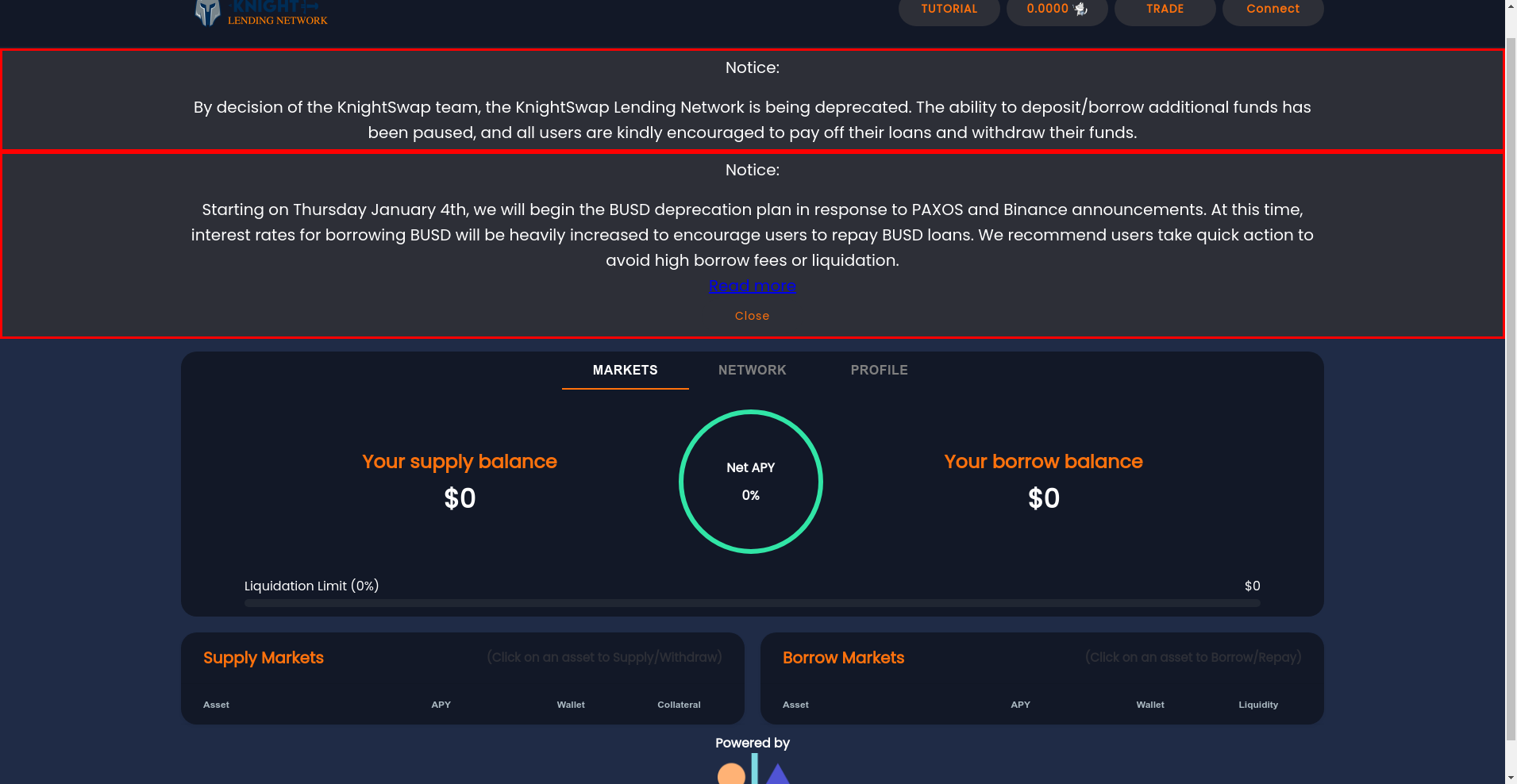

KnightSwap appears on the surface as a multifaceted DeFi platform claiming to offer a suite of services including decentralized trading, yield farming, lotteries, NFTs, and a native $KNIGHT token. Promoted as a community-oriented project built on the BNB Smart Chain, it emphasizes ease of use, passive income, and security features. However, as investigators, our role is to cut through the marketing hype and scrutinize its actual legitimacy and potential risks.

In this article, we will critically analyze the available evidence, technical audits, and platform activity to determine whether KnightSwap is a trustworthy project or a potential scam.

Who Is The Team Behind KnightSwap?

One of the first questions in any crypto project review is whether the team is transparent and credible. Unfortunately, KnightSwap’s publicly available information provides no clear evidence of a verified or doxxed team. The project’s website and social channels lack founder profiles, addresses, or verifiable team credentials.

- Anonymous developers with no public identities.

- No official roadmap or published team members.

- Engages in aggressive marketing language and themed branding (e.g., knights, castles, etc.).

- Claims to have hundreds of thousands of users and millions in staked value, but no verifiable backing for these figures.

The lack of transparency raises red flags about accountability and the potential for malicious intent. Without credible leadership, the risk of a rug pull or abandonment increases significantly.

KnightSwap Security Audit: A Deep Dive into the Code

Based on the Cer.live audit data available, KnightSwap has undergone some third-party review. The platform received an 80% coverage score from the Cer.live audit, which is moderate at best. It also claims to be insured through InsurAce, suggesting some level of risk mitigation.

- Audit report from TechRate is publicly accessible, but no detailed vulnerabilities or exploit risks are explicitly documented in the summary.

- Presence of incidents listed, raising questions about past issues or unresolved bugs.

- Partial inspection and no indication of comprehensive security vetting imply potential vulnerabilities.

- While insurance coverage exists, it does not replace sound smart contract development or ongoing vulnerability assessments.

Overall, the security review offers some reassurance but cannot eliminate all risks. Its complexities and partial audits mean investors should remain cautious, especially given the lack of continuous bug bounty programs or ongoing audits.

KnightSwap Tokenomics: A Fair System or a Trap?

The $KNIGHT token is touted as the core asset of the platform, with a total supply of approximately 308 million tokens and a current price around $0.00048. Key metrics such as circulating supply, market cap, and team allocation appear undisclosed or poorly documented, which is typical of projects hiding token distribution details.

- Token utility includes staking, farming, buying, and governance participation.

- Emissions are set at 7.5 tokens per block, indicating inflationary pressure.

- No clear token distribution plan, vesting schedule, or transparency about pre-mined vs. community-held tokens.

- Potential for high inflation if emissions continue unchecked, leading to rapid token devaluation.

This opacity, coupled with unchecked inflation, could facilitate a dump by early holders, severely affecting new investors. High token emissions without a clear utility or burn mechanism may further contribute to devaluation over time.

Is KnightSwap a Ghost Town? Checking for Real Activity

Despite claiming millions of users and extensive trading volume, available data indicates minimal actual on-chain activity. The project’s aggregated metrics show only a few thousand in trading volume and very low staking or farming participation (often zero), which casts doubt on its claimed popularity.

The platform’s social presence and external listings like CoinGecko and CoinMarketCap lack detailed activity or verified user engagement metrics. Additionally, the absence of live beta or recent development updates suggests the project might be dormant or primarily marketing-driven.

Platforms like Cer.live show incidents and partial audits, but consistent real-world activity or developments seem sparse, reinforcing suspicion that the project may be a facade designed to attract quick investors without delivering substantive progress.

What KnightSwap's Legal Documents Are Hiding

Unlike well-established projects, KnightSwap provides minimal legal transparency. There are no publicly available Terms of Service, Privacy Policy, or detailed legal disclaimers. The project also emphasizes phishing warnings, which, although responsible, raises concerns about potential impersonation or impersonator-driven scams.

- No verifiable licensing, registration, or legal entity disclosures.

- Absence of a clear user agreement or risk disclosures.

- Potential for malicious code or fraud, especially given the anonymous team and lack of formal legal backing.

This opacity indicates a risky environment for investors relying solely on the promise of high yields without understanding the legal protections or remedies available.

Final Verdict: Should You Risk Investing in KnightSwap?

Based on the available evidence, KnightSwap bears significant red flags that warrant caution. Its opaque team, limited security auditing, questionable on-chain activity, and absence of transparent tokenomics make it a high-risk proposition. Promises of millions of users and extensive trading volume are either exaggerated or fabricated, typical signs of a project struggling to deliver real value.

- Positive Points:

- Some security audit and insurance coverage claim to mitigate risks.

- Multiple integrations and listings that suggest some level of ecosystem presence.

- Major Red Flags:

- Anonymous and unverifiable team with no transparent roadmap.

- Partial security audits with incidents listed, indicating potential vulnerabilities.

- Little to no real on-chain activity supporting large user claims.

- Absence of legal and regulatory disclosures, heightening scam suspicion.

Investors should approach KnightSwap with extreme caution. Its red flags suggest it may be either a low-quality scam project or an abandoned venture masquerading as a thriving ecosystem. Never invest money you cannot afford to lose, especially in anonymous projects lacking transparency and credible audits.

Olivia Lewis

Sociotechnical Systems Analyst

I analyze the intersection of social networks and blockchain systems. I use data to expose how scammers manipulate communities with bots, FUD, and engineered hype.

Similar Projects

-

Bao Bao Panda

Bao Bao Panda Review: Crypto Project Scam Checker

-

Snake

Snake ($SNK) Review: Risks and Lessons from Its Collapse

-

Tranchess

Tranchess ($CHESS) Review: A Deep Dive into Its Technology & Risks

-

ChillDebt

Crypto Project Scam Check and Review: ChillDebt Meme Token on Solana

-

DRAGON ON TRON

DRAGON ON TRON ($DGTRON) Review: Risks and Legitimacy Explored