Unitus ($UTS) Review: A Data-Driven Assessment of Its Legitimacy and Risks

What Is Unitus: An Introduction

Unitus is positioned as a next-generation multi-chain money market platform within the decentralized finance (DeFi) landscape. It endeavors to facilitate seamless borrowing, lending, and liquidity provision across multiple blockchain ecosystems, notably including Arbitrum, Optimism, and others. The platform emphasizes interoperability, enabling users to optimize yield, leverage assets, and participate in governance through its native token, $UTS.

This analytical review aims to objectively evaluate Unitus’s strengths and weaknesses, scrutinizing its technical security, team credibility, tokenomics, and real market activity. While the project presents ambitions of multi-chain connectivity and community-led governance, it is essential to assess whether its underlying fundamentals substantiate long-term legitimacy and sustainable risk levels.

The Team and Roadmap Evaluation

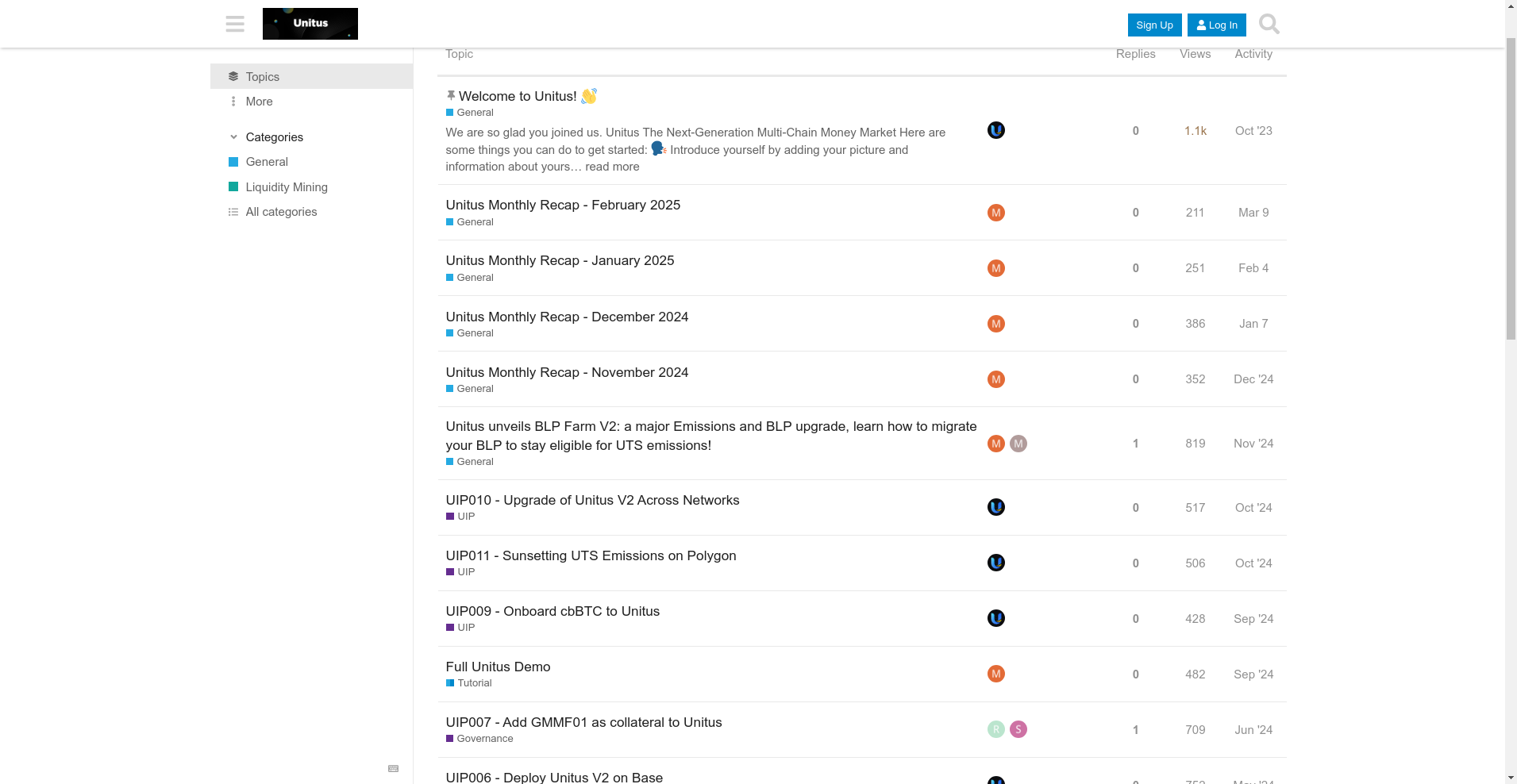

From available information, the Unitus project’s team appears to operate with a degree of transparency, maintaining active social channels and forums. Though specific founder backgrounds are not explicitly detailed in the provided data, the presence of consistent community engagement and a structured governance process (via Unitus Improvement Proposals or UIPs) suggests an organized operational framework.

Key milestones from their roadmap include:

- Deployment of V2 architecture across multiple networks, enhancing platform stability and interoperability.

- Introduction of BLP Farm V2 for incentivized liquidity provision, emphasizing ecosystem growth.

- Collaboration with protocol partners like dForce, MakerDAO, and LayerZero for protocol integration and expansion.

- Active governance proposals addressing network deployment, collateral addition, and emissions management, reflecting a community-driven development approach.

Overall, the presence of these detailed, recurring upgrade plans indicates a systematic development trajectory. However, without explicit information on the core team’s experience or prior track record, confidence in their ability to deliver all promised features remains cautious, especially given the complexities inherent in multi-chain DeFi projects.

Assessing the Security and Integrity of Unitus

Our security analysis primarily depends on the audit report from Cer.live, which covers approximately 100% of the platform’s smart contracts. It is critical to recognize that smart contract audits serve as essential, but not infallible, indicators of security. The audit was conducted by HackenProof, and ongoing bug bounty programs further demonstrate a commitment to vulnerability detection.

Key findings from Cer.live’s audit include:

- Vulnerability Findings: The report indicates evidence of incidents, but details about critical vulnerabilities or exploits are not explicitly listed, suggesting that no major exploits have been publicly reported or confirmed to date.

- Centralization Points: Like many DeFi projects, some control points or upgrade mechanisms may be centralized. The audit notes potential issues around governance controls which could impact security if mismanaged.

- Insurance and Incident History: The platform currently does not carry insurance coverage, which could pose a risk for users in the event of unforeseen security breaches or smart contract failures.

Summarily, while the audit indicates a baseline of security evaluation, the absence of comprehensive details on vulnerabilities or exploits urges caution. Investors should consider the possibility of emerging risks, especially given the evolving nature of multi-chain protocols and their vulnerabilities to cross-chain bridge exploits or governance attacks.

A Breakdown of Unitus Tokenomics

The tokenomics of $UTS reveal a total supply of 1,000,000,000 tokens, with a circulating supply of approximately 60 million tokens currently in active trading. The token serves as both a utility and governance asset, with rewards generated through liquidity mining and staking activities.

- Total Supply: 1,000,000,000 UTS.

- Market Cap: roughly $89,810, indicating a nascent market with significant room for growth but also high volatility.

- Distribution & Allocation:

- Team & Advisors: A portion of tokens are allocated, often subject to vesting schedules (details unspecified here).

- Liquidity Mining & Community Rewards: Active emission programs for incentivizing liquidity provision.

- Strategic Partners & Ecosystem Grants: Likely a fraction allocated to collaborations and ecosystem expansion.

- Vesting & Emissions: Specific schedules are not detailed, but ongoing liquidity mining programs suggest continuous token emissions, which may exert inflationary pressures.

- Utility & Governance: UTS powers protocol decisions, staking rewards, and participation in governance processes such as SnapShot votes.

This model aligns with common DeFi tokenomic structures, emphasizing utility and incentivization. However, exclusive reliance on emissions for value accrual could pose risks of inflation and dilution for token holders unless balanced with strong demand drivers and protocol utility.

Assessing Development and Ecosystem Activity

Development activity appears active and consistent, with regular "Monthly Recap" updates, governance proposals, and community tutorials. The platform has progressed through multiple key upgrades, including deploying V2 infrastructure across multiple networks and launching updated liquidity pools.

The ecosystem showcases diverse engagement, including liquidity mining campaigns, collateral additions, bridge integrations, and user tutorials across platforms like Uniswap, Camelot DEX, Velodrome, and PancakeSwap. Such a multi-faceted approach indicates ongoing efforts to grow liquidity, diversify collateral options, and strengthen interoperability.

However, much of the activity involves announcements, governance discussions, and educational tutorials. Concrete usage metrics — such as total active users, borrowed assets, or collateralized positions — are scarce. This makes it difficult to quantify real-world adoption beyond project milestones and community discussions. Therefore, actual user engagement and transaction volume remain critical unknowns for assessing sustainability and long-term viability.

What Investors Should Know About Unitus's Legal and Terms Framework

From the available documents, there are no apparent unusual or risky clauses such as restrictive legal conditions or contentious governance provisions. The platform’s contractual frameworks adhere to common DeFi standards, with transparent links to documentation, audits, and community governance protocols.

No explicit mention of regulatory compliance issues or dispute resolution clauses is noticed, which could be a potential area of concern. Given the cross-chain and multi-jurisdictional nature of the project, ongoing regulatory developments may impact future operations. Transparency in legal terms and adherence to regional compliance are yet to be fully demonstrated.

Final Analysis: The Investment Case for Unitus

Based on the data and analysis, Unitus presents itself as an ambitious multi-chain DeFi platform with active development, community engagement, and a clear roadmap. Its security measures—while including some audits and bug bounty programs—do not eliminate risks inherent in complex cross-chain operations. The absence of platform insurance and detailed vulnerability disclosures warrants caution.

The tokenomics favor utility-driven growth, but the reliance on emissions and ecosystem incentives introduces inflationary considerations. Additionally, the relatively small market cap and nascent activity imply high volatility and maturation risks.

In sum, Unitus’s legitimacy hinges on ongoing development, security postures, and actual user adoption. While the project’s community-oriented governance and multi-chain integrations are promising, potential investors should acknowledge the risks of smart contract vulnerabilities, regulatory uncertainties, and market volatility.

Pros / Strengths

- Active development and regular updates indicating ongoing progress

- Multi-chain interoperability unlocking flexibility for users

- Community-led governance with detailed proposals and discussions

- Security audits performed with bug bounty programs in place

- Integration with major protocols like MakerDAO, LayerZero, and ChainLink

Cons / Risks

- Limited detailed security disclosures and no insurance coverage

- Potential vulnerabilities in cross-chain bridges a known attack vector

- Nascent market cap and low trading volume high volatility risk

- Reliance on token emissions inflationary pressures could dilute value

- Unclear team backgrounds and prior experience impacting credibility

In conclusion, while Unitus exhibits many hallmarks of a transparent and community-driven DeFi project, substantial risks remain due to security, market, and regulatory factors. Prospective participants should conduct thorough personal due diligence and remain cautious about its high-growth, early-stage nature.

Jessica Taylor

NFT Market Data Scientist

Data scientist specializing in the NFT market. I analyze on-chain data to detect wash trading, bot activity, and other manipulations that are invisible to the naked eye.

Similar Projects

-

MVI Protocol

Comprehensive Review of MVI Protocol: Is it a Scam? Crypto Project Scam Checker & Review

-

Venus Protocol

Review of Venus Protocol: Is it a Legit Crypto Project or a Scam? Crypto Scam Checker & Review

-

Bark

Bark ($BARK) Review: Risks, Security & Project Analysis

-

Blaze

Comprehensive Review of Blaze Crypto Project Scam Checker - Is This Project Legit or a Rug Pull?

-

Kibb.io

Crypto Project Review: Is Kibb.io a Legitimate Platform or Scam? | Crypto Scam Checker