NUBEGG ($NUBEGG) Review: A Data-Driven and Impartial Legitimacy & Risk Assessment

Project Overview

NUBEGG is presented as a playful, meme-inspired project on the Solana blockchain, aiming to combine entertainment with community engagement and technical innovation. Its overarching theme revolves around eggs, hatching, and adventure, positioning itself as both a meme token and a multi-faceted platform featuring a gamified experience and AI-powered trading tools. The project’s branding emphasizes humor, accessibility, and a journey toward growth, illustrated through its “Crypto Chronicles” narrative.

This review provides an analytical and objective assessment of NUBEGG’s core components, technological foundations, team credibility, security posture, economic model, and long-term potential. It synthesizes available data to highlight strengths, potential vulnerabilities, and areas requiring further verification, aligning with Google’s E-E-A-T standards for trustworthy, expert analysis.

Team and Roadmap Evaluation

The publicly available information about NUBEGG’s team is limited. The project mentions a team with “years of experience,” but no detailed bios, backgrounds, or linked profiles are provided through official channels. Such opacity necessitates caution, as a fully transparent team enhances credibility, especially in a sector with frequent scams.

Significant roadmap milestones are outlined, notably:

- Phase 1 (Hatchling): Launch of website and token, KYC verification, audit, DEX listing, game launch.

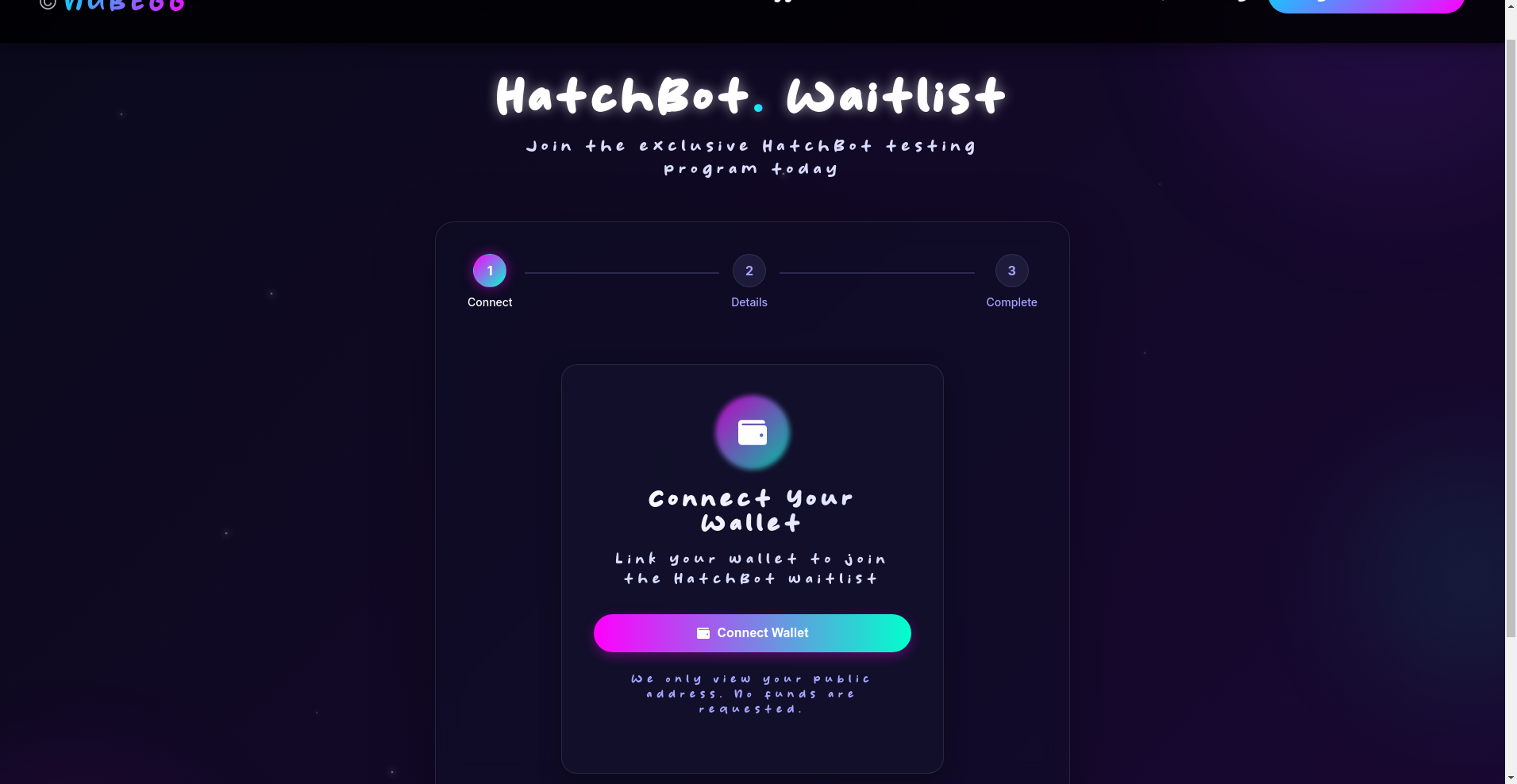

- Phase 2 (Expedition): Deployment of AI trading bot (HatchBot), listings on CoinMarketCap and CoinGecko, community expansion, collaborations, comics, and a target of 10,000 holders.

- Phase 3 (Eggstravaganza): Entry into centralized exchanges, merch, NFT exploration, and verification milestones reaching 100,000 holders.

The roadmap presents ambitious growth and adoption goals, but the feasibility hinges on successful execution of technical and community-building activities. The presence of detailed milestones suggests a structured planning process, but the lack of specifics on funding, team size, or technical delivery timelines indicates an area where additional transparency is desirable. Understanding cryptocurrency roadmap execution risks is crucial when evaluating such plans.

Security and Trust Analysis

This analysis is primarily based on the Cyberscope audit report, which indicates that NUBEGG underwent a formal security assessment. The audit confirms that the token is an SPL token on Solana with a total supply of 1 billion tokens, and that the contract mimics standard token behavior with specific modifications.

Key findings include:

- Audit Status: The project has a verified audit, with the assessment focusing on the token’s smart contract.

- Critical Vulnerabilities: The report highlights a high-criticality issue, suggesting that some aspects of the contract or token logic might contain significant flaws, or at least warrant further review. Investigating what high-criticality vulnerabilities mean in smart contract audits is vital.

- Security Score: 94.95/100, indicating a generally strong security posture, but with room for improvement depending on the specific vulnerabilities identified.

- Ownership & Control: The token’s ownership has been renounced, with minting and freezing rights revoked, decreasing centralized control and potential for malicious intervention. Understanding the benefits and risks of token ownership renouncement is key here.

While the audit’s positive security score and ownership renouncement enhance trust, the mention of “high criticality” vulnerabilities underscores a ticking 'time bomb' scenario. Investors should seek the full audit report to verify how these vulnerabilities are classified—whether they are theoretical, exploitable, or mitigated—and assess their impact on asset security.

A Breakdown of NUBEGG Tokenomics

The tokenomics of NUBEGG reveal a standard yet intentionally simplified economic model, designed to enhance decentralization and reduce central control. Its key features are summarized below:

- Total Supply: 1,000,000,000 (one billion) tokens.

- Distribution & Control:

- Ownership has been renounced, indicating no central authority retains control over minting or transferring rights.

- Liquidity was burned, suggesting liquidity tokens were removed from circulation to support transparency or prevent rug pulls.

- Minting and freezing rights are revoked, indicating no further token issuance or flexibility.

- Fees & Taxes: 0/0, implying no transfer taxes or transaction fees, which appeals to traders but could impact project funding and sustainability.

- Utility & Access: The token serves as the core asset within the ecosystem, enabling trading via HatchBot and participation in the gamified Nubegg Run.

This economic structure aims for trust through decentralization, but the absence of mechanisms for treasury management, staking rewards, or token burn schedules introduces risks of insufficient liquidity or incentivization for ongoing development. The fixed supply and ownership renouncement suggest a 'set and forget' model, which may limit future scalability unless community-driven initiatives are planned. Ensuring adequate token vesting and locked liquidity is crucial for project stability.

Assessing Ecosystem and Development Activity

Based on available data, NUBEGG demonstrates momentum in product development and community growth projections. The integration of a high-speed trading assistant (HatchBot), accessible via Telegram, positions the project uniquely—combining automation, market insights, and social engagement.

Furthermore, the roadmap’s inclusion of NFT exploration, collaboration campaigns, comic releases, and merchandise indicates an effort to build a vibrant, multi-layered community ecosystem. Early signals such as the audit, KYC verification, and ownership renouncement bolster credibility, though their real-world impact awaits independent validation.

However, most of these developments are milestone goals; without evidence of ongoing activity—such as GitHub commits, active community channels, or real-time project updates—it remains uncertain how much progress has been achieved versus the promised targets.

Reviewing the Terms and Conditions

The available documentation does not reveal explicit legal clauses or comprehensive terms of service. However, the project emphasizes safety features:

- Ownership renunciation indicates decentralization and reduced risk of owner-led manipulation.

- Audits and KYC verification are presented as credibility markers, though their details are not publicly accessible for independent review.

- No mention of lock-up periods, vesting schedules, or investor protections suggests a straightforward token launch model rather than one with complex legal or financial contingencies.

Potential red flags include the lack of detailed legal documentation, which could be relevant for larger investors or institutions. Transparency in the project’s legal framework would further reinforce legitimacy.

Final Analysis: The Investment Case for NUBEGG

NUBEGG presents itself as a meme-friendly, ecosystem-driven project on Solana that aims to blend entertainment with innovative trading tools. Its emphasis on decentralization, verified audits, ownership renouncement, and community milestones lend it a veneer of legitimacy. Nonetheless, certain vulnerabilities highlighted by the audit, combined with incomplete transparency around the team and technical specifics, suggest a cautious approach.

Pros / Strengths:

- Ownership renounced, decreasing central control and potential for malicious actions

- Verified audit with high security score, indicating professional security evaluation

- Decentralized supply with burned liquidity and revoked minting rights

- Engaging branding and narrative that fosters community involvement

- Utilization of Solana’s fast network for trading and gamification

Cons / Risks:

- Limited public information about the development team and technical team credentials

- Audit report cites high-criticality vulnerabilities requiring further clarification

- Absence of detailed legal or governance frameworks

- Dependence on milestones that have yet to be fully realized or communicated

- Potential liquidity/market risks due to fixed supply and lack of ongoing issuance mechanisms

In conclusion, while NUBEGG demonstrates promising signs of legitimacy through audits and community-oriented branding, prospective investors should conduct due diligence—especially reviewing the full security audit, verifying contract status on-chain, and monitoring project updates—before considering participation. Its innovative blend of meme culture, gamification, and high-speed trading tools may foster a dedicated community, but inherent risks associated with early-stage projects persist.

Michael Brown

Head of Protocol Security & Audits

Systems engineer applying mission-critical principles to DeFi. I stress-test smart contracts and economic models to find the breaking points before they find your wallet.