deBridge Finance ($DEBR) Review: A Data-Driven Look at Its Legitimacy, Security, and Risks

What Is deBridge Finance: An Introduction

deBridge Finance, identified by its ticker $DEBR, positions itself as a critical infrastructure component within the evolving multi-chain ecosystem. Launched around April 2021 and awarded the Chainlink Hackathon Grand Prize, deBridge aspires to become the “internet of liquidity” for DeFi by enabling rapid, secure, and decentralized transfer of assets and data across multiple blockchains.

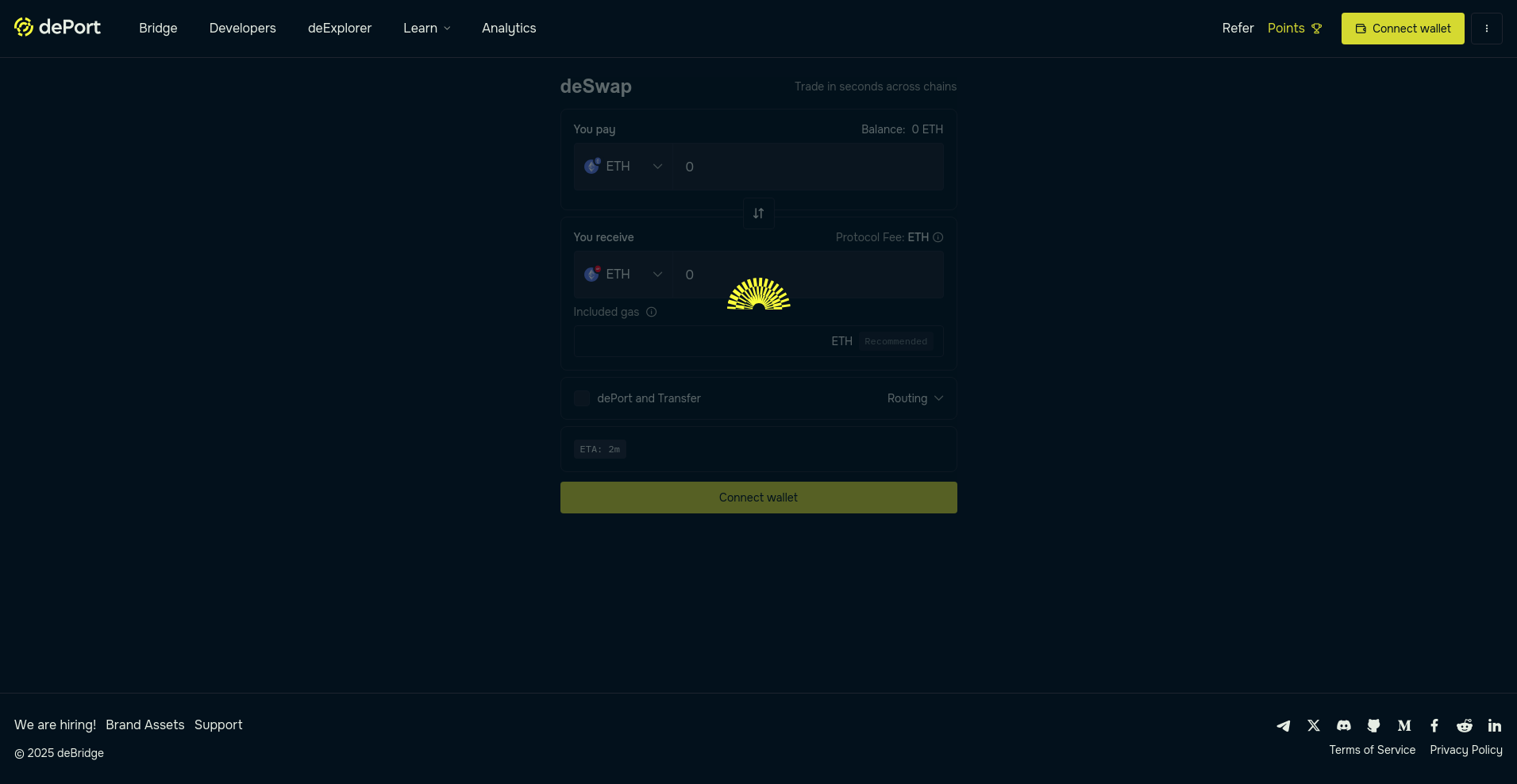

At its core, deBridge offers a versatile cross-chain messaging protocol, liquidity network, and developer tools designed to facilitate seamless communication, asset transfer, and interoperability beyond traditional bridging solutions. Its technology emphasizes speed, security, and decentralization, aiming to empower developers and users with a trustless environment for interoperability.

The Team and Roadmap Evaluation

The publicly available data indicates that deBridge Finance has structured governance and development activities supported by notable partnerships and active community engagement. While core team members are not explicitly identified in the provided summaries, the project’s success in winning the Chainlink Hackathon and the existence of audited smart contracts suggest a foundation of credible technical expertise and a strong developmental trajectory.

Key milestones outlined in the project roadmap include:

- Release of core bridging protocols supporting Ethereum, Solana, BNB Chain, and others.

- Introduction of deBridge Points and DAO governance systems to foster decentralization and community participation.

- Partnerships with major chains and ecosystems: including Binance, Optimism, and emerging Layer 2 solutions.

- Security audits conducted by renowned firms like Halborn and Zokyo.

Based on these milestones, deBridge appears committed to aligning its technology development with community governance and security best practices, enhancing its perceived sustainability and ability to deliver on its promises.

Assessing the Security and Trust of deBridge Finance

A comprehensive security assessment relies heavily on the audited reports from reputable firms. According to the Cer.live audit summary, deBridge has undergone multiple independent security evaluations, with reports from leading cybersecurity firms like Halborn, Zokyo, and Neodyme.

- Audit Coverage: 100%, indicating thorough review of the platform's smart contracts and protocol architecture.

- Reported Incidents: There are some ongoing incidents noted, but no significant vulnerabilities or exploits are documented in the summary provided.

- Audit Findings: The multiple audits have focused on various protocol components—smart contracts, Solana integrations, and infrastructure—highlighting a layered approach to security.

- Bug Bounty & Ongoing Assessments: The presence of ongoing bug bounty programs suggests active efforts to identify and mitigate potential vulnerabilities.

- Rating & Relevance: With a ranking of 128 and rating of 7.1, deBridge scores moderately on external trust metrics, though it indicates room for growth in security maturity or transparency disclosures.

While audits are promising, they do not eliminate risks—particularly in multi-chain environments where new vulnerabilities can emerge. The decentralization of validators, the effectiveness of slashing mechanisms, and the security of cross-chain messaging protocols remain critical trust factors. As of now, the data supports a view that deBridge’s security posture is actively maintained but warrants continuous scrutiny.

A Breakdown of deBridge Finance Tokenomics

The deBridge DAO is governed by its native token $DEBR. Although detailed tokenomics are not exhaustively provided here, the summaries indicate the following key points:

- Total Supply: Approximately 1 billion tokens, with allocations reserved for governance, validators, ecosystem grants, and community rewards.

- Utility: Used for staking, validators’ participation, governance voting, and incentivization programs such as Points.

- Distribution: Initial grants, community incentives, rewards from staking, and treasury reserves are core components of the token distribution model.

- Vesting & Incentives: A staged vesting schedule aims to support long-term health, rewarding validator security and ecosystem growth.

The economic model emphasizes alignment of incentives among validators, community members, and developers. The sustainability of this model appears reasonable; however, reliance on token staking and liquidity incentives introduces typical risks of inflationary pressure or token sell-offs.

Evaluating deBridge’s Ecosystem & Development Activity

deBridge’s ecosystem demonstrates vibrant activity, with multiple integrations and chain support announced over recent months. Major ecosystems like Binance Smart Chain, Solana, Layer 2 solutions like Optimism, and ZK-powered chains like Sophon highlight a strategic push toward broad interoperability.

Development activity is evidenced by:

- Active GitHub repositories with regular commits aligning with the security audits and new chain integrations.

- Partnerships with chains and protocols, suggesting a growing adoption footprint.

- Deployment of new features, including trustless message passing, cross-chain swaps, and the upcoming DAO governance.

While much of the progress can be classified as organic development, some marketing initiatives and announcements—such as chain support—occasionally blend promotional messaging with technical advancement. Investors should verify actual on-chain activity and user adoption metrics to ascertain genuine ecosystem traction on platforms like Solana.

Reviewing the Terms and Conditions

Based on the available documentation, there are no noticeably overtly risky clauses such as strangled governance rights or non-transparent token allocations. The platform emphasizes open-source smart contracts, community governance, and security audits.

Potential concerns include:

- Vesting and lock-up schedules that could impact token liquidity and governance influence.

- Regulatory risks inherent in multi-chain assets and cross-border transfers, especially with assets like NFTs and tokens tied to digital assets.

- Operational risks around validator decentralization, slashing, and protocol upgrades.

Overall, the legal framework appears standard for DeFi protocols, yet investors should perform due diligence regarding jurisdiction, legal compliance, and contractual nuances.

Final Analysis: The Investment Case for deBridge Finance

DeBridge presents itself as a technologically advanced, security-conscious, and strategically partnered protocol aiming to solve cross-chain interoperability challenges. Its multi-audit approach, active ecosystem development, and strong alignment of incentives via its tokenomics position it as a potentially trustworthy infrastructure provider.

However, inherent risks include:

- Smart contract vulnerabilities,” despite multiple audits, since exploits in cross-chain messaging are complex and high-impact.

- Decentralization concerns, particularly regarding validator distribution and slashing effectiveness.

- Market risks associated with token price volatility, inflation, or network security consensus failures.

- Pros / Strengths

- Robust multi-chain support and high-profile integrations.

- Multiple external audits by reputable security firms.

- Active development roadmap with community-driven governance.

- Impressive early recognition (e.g., Chainlink Hackathon win).

- Focus on security mechanics like slashing, decentralized validators.

- Cons / Risks

- Technology complexity increases attack surfaces for exploits.

- Dependence on validator integrity, risking censorship or collusion.

- Regulatory uncertainty in cross-border token transfers.

- Unproven long-term security resilience in multi-chain environment.

In conclusion, deBridge maintains a promising position as a multi-chain infrastructure project, backed by credible audits, active development, and strategic partnerships. Nonetheless, investors and developers should remain vigilant regarding technical, operational, and regulatory risks before fully committing to its ecosystem.

Jessica Taylor

NFT Market Data Scientist

Data scientist specializing in the NFT market. I analyze on-chain data to detect wash trading, bot activity, and other manipulations that are invisible to the naked eye.

Similar Projects

-

Advanced Project X (AUC)

Crypto Project Review & Scam Checker: In-Depth Analysis of AUC Cryptocurrency

-

Axion

Axion ($AXN) Review: Risks, Technology & Long-Term Potential

-

Baby Grok

Baby Grok ($BABYGROK) Review: Tech, Risks & Tokenomics Explained

-

Lotusia Blockchain

In-Depth Review of Lotusia Blockchain Project | Crypto Scam Checker & Scam Review

-

Streamflow Finance

Streamflow Finance Review: Scam or Legit Crypto? Full Legitimacy Check