Streamflow Finance Review: Scam or Legit Crypto? Uncovering All The Red Flags

What Exactly Is Streamflow Finance?

Streamflow Finance presents itself as an all-in-one platform offering token management tools such as vesting, airdrops, staking, token locking, and payroll solutions, primarily supporting the Solana blockchain, with integrations on Aptos and Sui. The platform emphasizes automation, transparency, and security, claiming to be trusted by over 5000 projects and managing a Total Value Locked (TVL) of more than $686 million.

However, as is common with many crypto projects promising broad utility, this article aims to scrutinize the claims, assess potential risks, and determine whether Streamflow Finance is a legitimate project or a possible scam waiting to happen.

Who Is The Team Behind Streamflow Finance?

One of the first red flags when evaluating any crypto project is transparency regarding its founders. In the case of Streamflow Finance, there is limited publicly available information about the team members. The platform states it is "Made with by a distributed team," but provides no specific names, identities, or backgrounds. This lack of doxxed leadership makes it difficult to verify expertise and intentions.

- No clear information about founders or core developers.

- Limited social presence; the GitHub link is provided but lacks transparency about individual contributors.

- Roadmap and vision seem ambitious but are vague, with no detailed milestones or development timeline publicly disclosed.

This opacity raises concerns about accountability and increases the risk that the project may be operated by anonymous actors with unclear motives, which is a common feature in many scams.

Trust & Security Audit: A Deep Dive into the Code

The available audit data from Cer.live indicates that Streamflow Finance's platform has undergone some security review, but the details are limited. The platform has an audit coverage score of 100%, with only one external audit linked to their Rust SDK by OpCodes.

- The audit report is publicly accessible at https://github.com/streamflow-finance/rust-sdk/blob/main/.

- There is no mention of multiple independent audits or comprehensive smart contract security assessments.

- Furthermore, the rating from Cer.live is a modest 5.65 out of 10, which suggests vulnerabilities or at least that the system is not fully secure.

- Incidents are marked as true, indicating prior security issues, although not necessarily exploited.

While a single audit is better than none, the lack of multiple independent reviews or bug bounty programs reduces confidence. The modest security score suggests that potential vulnerabilities may exist, exposing investors or users to risk if they rely blindly on the platform's safety claims.

Streamflow Finance Tokenomics: A Fair System or a Trap?

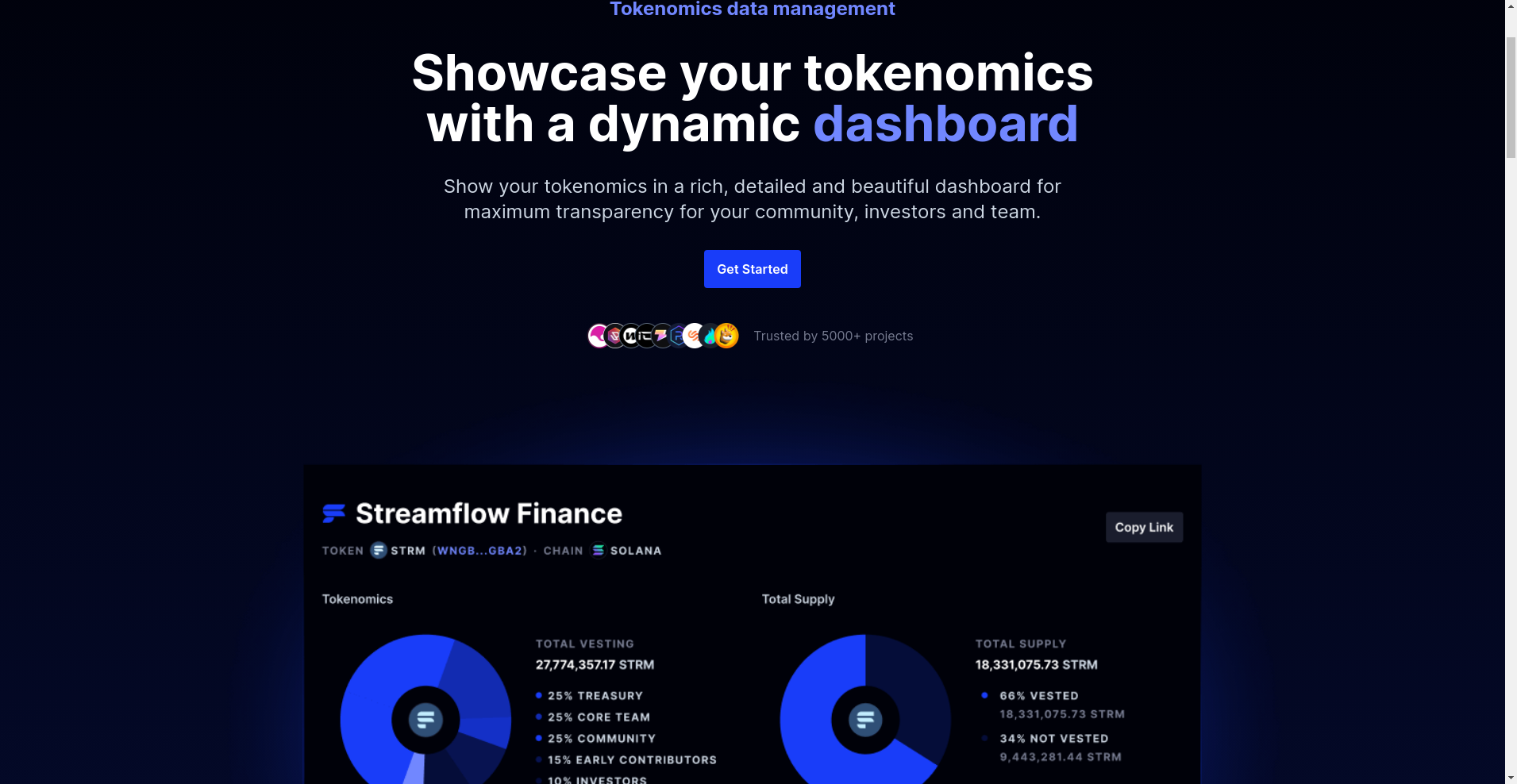

Tokens are a core aspect of any project claiming to be a DeFi or Web3 facilitator. Streamflow issues its native token, "STR," which is listed with detailed tokenomics. The platform claims to support transparent on-chain tokenomics, but a closer look raises several red flags.

- The total supply of STR tokens is outlined in their dashboards, with significant allocations to team, community, early contributors, and investors. Exact numbers are visible, but the distribution percentages heavily favor the team and early investors—common in many projects with high inflation risk.

- Funding and vesting schedules show large portions of tokens being locked or vested, but the specifics of unlock timelines are opaque or not reliably disclosed.

- High token allocations to the team and advisors often lead to dumps, especially if lock-up periods terminate unexpectedly, which could plummet the token price.

- The utility of the token is primarily for staking and governance within Streamflow Ecosystem, but these are often used as fluff to justify high initial token allocations.

Investors should be wary of such tokenomics structures as they tend to favor insiders and may lead to sudden dumps that wipe out retail investors’ holdings.

Is Streamflow Finance a Ghost Town? Checking for Real Activity

The activity within the Streamflow Ecosystem appears minimal beyond initial marketing hype. While their website showcases numerous features and an impressive user base of over 5,000 projects, the actual on-chain activity, GitHub contributions, or development progress remain elusive.

Based on their social references and community engagement, there are some signs of ongoing development, but no substantial updates, code commits, or new features have been recently announced, suggesting the project may be dormant or merely riding a hype wave.

Furthermore, the reliance on a single audit, lack of transparency about team activity, and no clear public roadmap contribute to the suspicion that the project might be a "product" built mostly for attracting investors rather than delivering real utility or innovation.

What Streamflow Finance's Terms of Service Are Hiding

The project’s legal and operational documents are sparse, and none explicitly mention anti-fraud measures, ownership rights, or exit clauses. Typical issues include:

- Potential for token or asset lock-in with no guarantee of liquidity or exit strategies for investors.

- Absence of clear dispute resolution policies, which could be exploited in scam scenarios.

- Lack of explicit clauses on project shutdown or asset recovery, leaving investors vulnerable.

Combined with anonymous leadership and limited audit transparency, these legal ambiguities could signal a scam or at least an untrustworthy project designed to benefit insiders at the expense of new investors.

Final Verdict: Should You Risk Investing in Streamflow Finance?

After analyzing the available data, it’s evident that while Streamflow Finance markets itself as a comprehensive, secure, and widely adopted platform, several red flags suggest caution. The lack of transparency about the team, limited independent audits, modest security scores, and opaque tokenomics all contribute to a high-risk profile.

Below is a summary of the key risks and positives to consider:

- Positive Points:

- Says it is trusted by thousands of projects

- Provides comprehensive token management tools

- Supports multiple blockchains, indicating technical versatility

- Major Red Flags:

- No verifiable team members publicly disclosed

- Only one limited security audit with a modest score

- Historical incidents marked on the audit platform

- Opaque tokenomics and high insider allocations

- Limited real-world activity or development updates

In conclusion, unless you have high risk tolerance and are prepared to do further due diligence, it’s advisable to approach Streamflow Finance with skepticism. Its current profile aligns more with a high-risk project than a trustworthy, fully audited platform ready for long-term investment.

Daniel Clark

On-Chain Quantitative Analyst

I build algorithmic tools to scan blockchains for signals of manipulation, like whale movements and liquidity drains. I find the patterns in the noise before they hit the charts.

Similar Projects

-

Book Of Squid Wif Hat

Crypto Project Scam Checker Review: Is Book Of Squid Wif Hat a Scam or Legit?

-

DISTRIBUTE

DISTRIBUTE Project Review: Crypto Scam Checker & Future Insights

-

M2Money.io

Review of M2Money.io: Crypto Project Scam Checker and Investment Risk Analysis

-

Beat Maker Token

Review of Beat Maker Token: Is This Crypto Project a Scam or Legit?

-

Superbasedd

Superbasedd Review | Crypto Project Scam Checker & Honest Analysis