In-Depth Review, Scam Check, and Risk Analysis of Advanced Project X (AUC) – Is It Legit? Latest Update & Red Flags

Overview of Advanced Project X (AUC): What You Need to Know Before Investing

Advanced Project X, popularly known by its token "AUC," presents itself as a multi-faceted ecosystem aiming to bridge traditional finance with the emerging Web3 landscape. Operating primarily on the Ethereum network, AUC is positioned as a proof-of-value protocol that combines blockchain interoperability, decentralized finance (DeFi), and real-world utility applications. Its official website (https://aucunited.com/) claims ambitions to revolutionize financial inclusion, especially targeting underbanked regions such as Africa and Southeast Asia.

For potential investors considering AUC, understanding both its technological foundation and operational transparency is crucial. This review provides an in-depth analysis of the project’s goals, team, ecosystem, tokenomics, and, most importantly, the red flags that warrant caution.

Team, Mission, and Strategic Goals

The core team comprises experienced professionals in logistics, blockchain, and business development, including CEO Ashiek Anandhaw and COO Rendani Ramaphosa. Their backgrounds in logistics, government relations, and market expansion suggest a focus on real-world financial services, especially remittance and digital payments.

Mission: To create a Web 2.5 universe that integrates regulated financial services with blockchain technology, fostering financial inclusion, cross-border remittance, and digital identity solutions.

Their roadmap underscores a comprehensive expansion strategy—including integrations with mobile apps like TIER, development of cross-chain bridges utilizing LayerZero, and launching innovative user engagement features such as staking, mining, and play-to-earn games. The long-term vision appears to be an all-in-one financial ecosystem with interoperability, digitization, and security at its core.

- Image data (JSON)

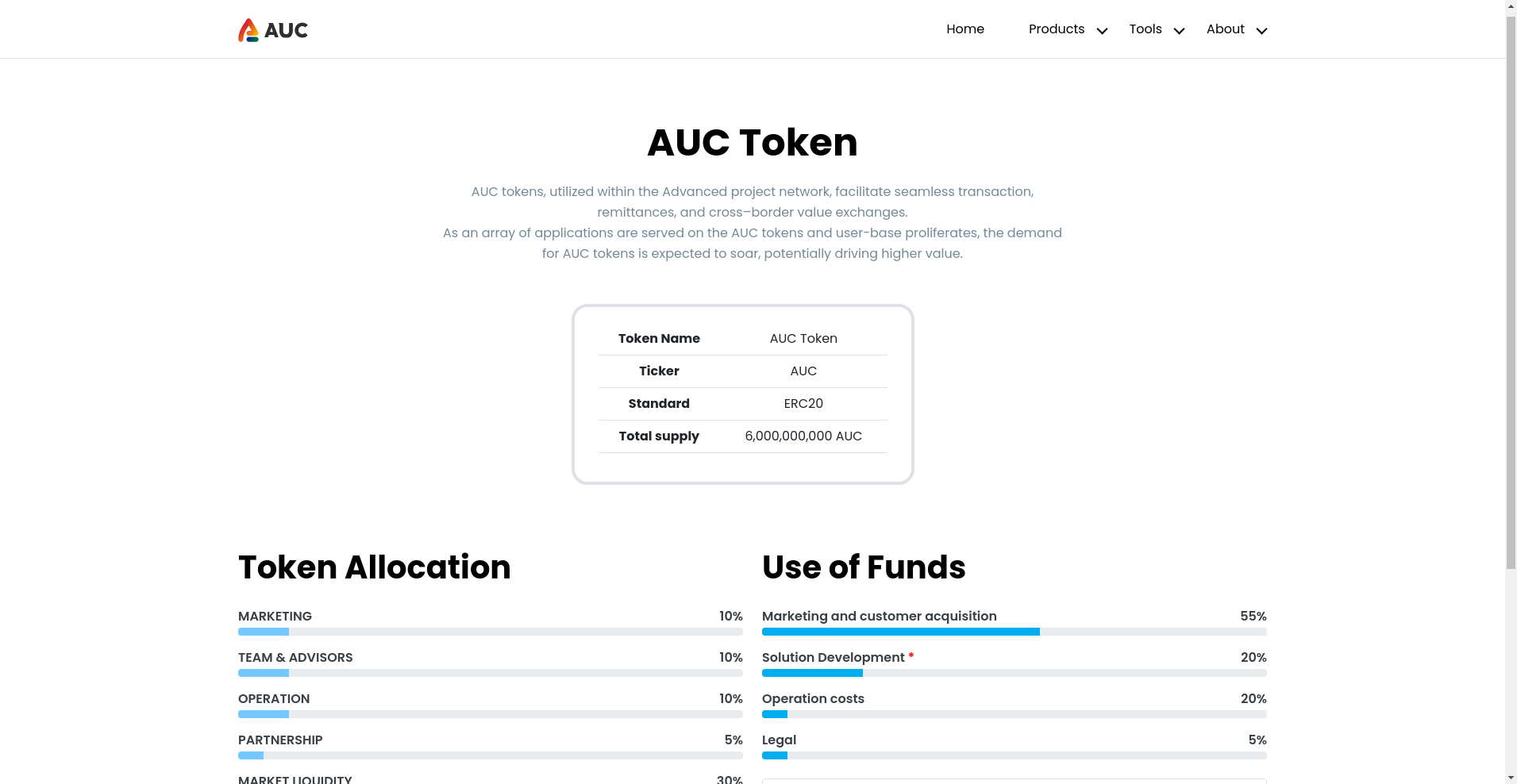

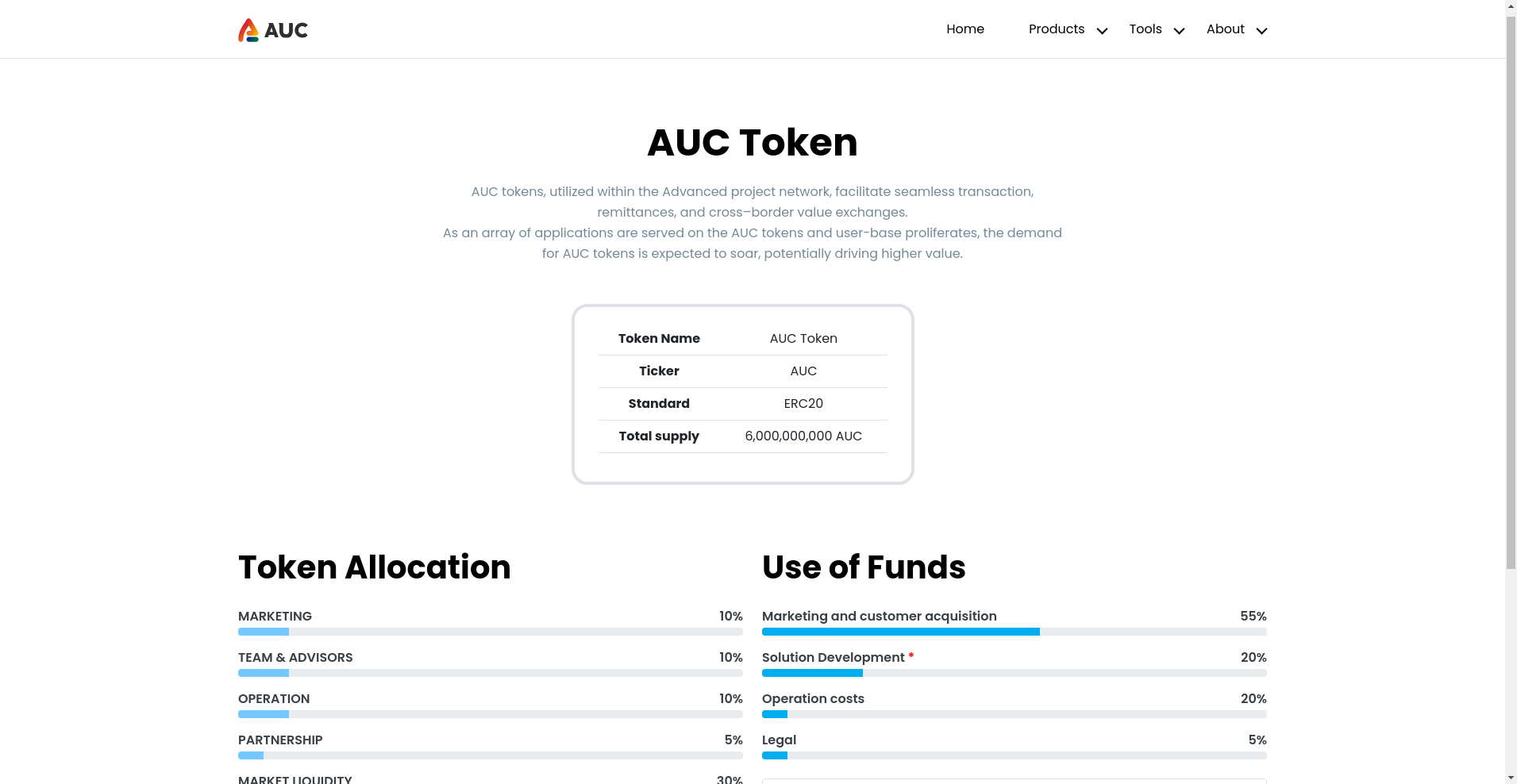

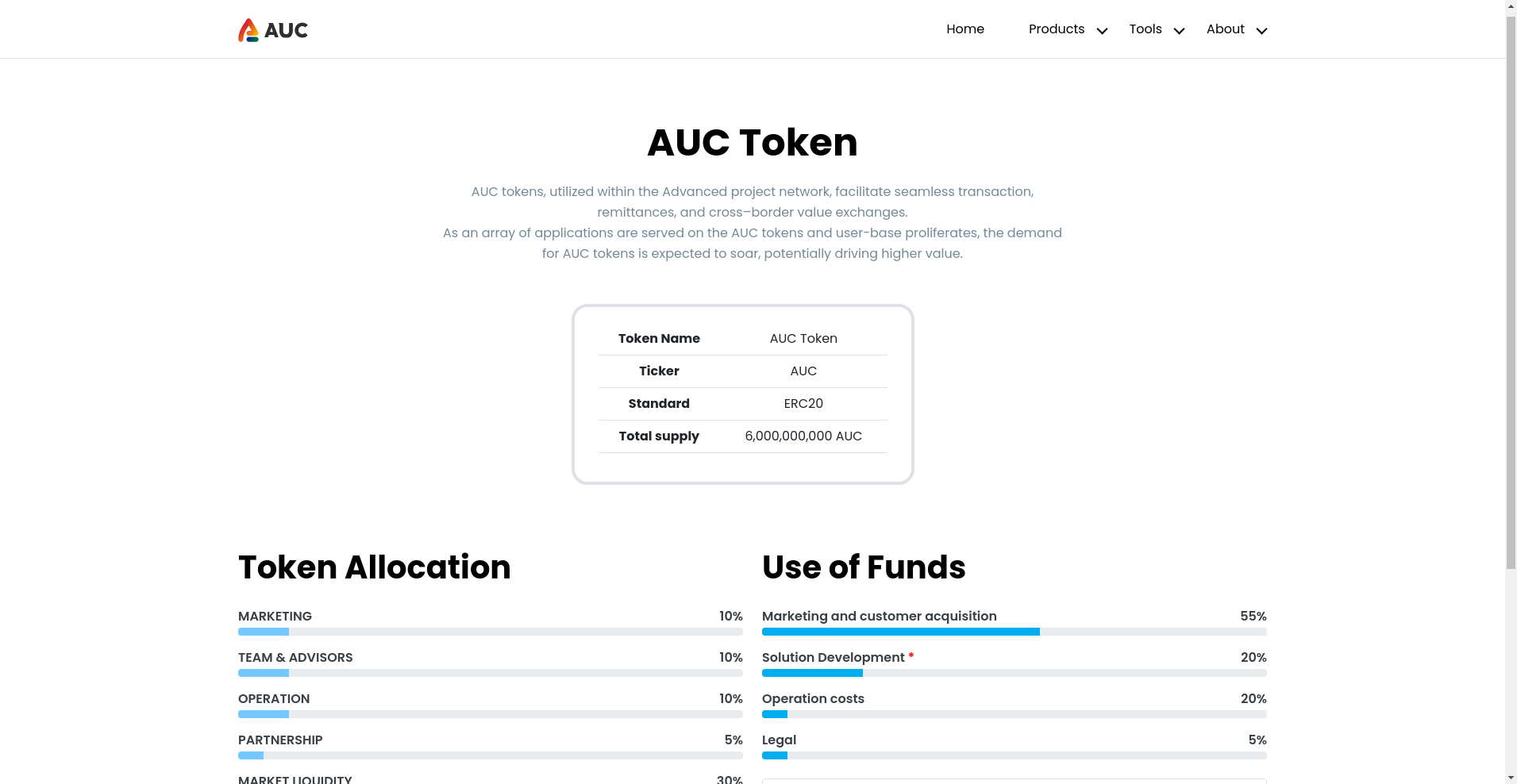

Visual content showcases the token overview, allocation breakdown, and use-of-funds diagrams, which are crucial for understanding the project's economic model.

Terms of Service, Privacy Policy, and Legal Framework

A quick review of the available legal documents (not directly linked here but likely accessible via the official site) shows standard clauses about user privacy, KYC compliance, data security, and intellectual property rights. However, a notable gap is the absence of specific regulations or compliance standards cited for the regions they target, especially Africa and Southeast Asia.

Key points:

- Limited so far transparency regarding legal adherence to local financial regulations.

- Potential risks if the project accelerates without full compliance, risking regulatory crackdowns or delisting.

Roadmap and Development Milestones

The project’s roadmap, publicly accessible at https://aucunited.com/roadmap., indicates phases spanning 2024-2025. Key milestones include:

- Integration of AUC within the TIER app and South African merchants (Q1 2024).

- Launching big data analytics, utility bill payment solutions, and interoperability with multiple chains via LayerZero (Q2-Q3 2024).

- Expanding to East Asian markets, developing AMT services, NFT initiatives, and broad merchant acceptance (2025).

While ambitious, these goals depend heavily on successful technical implementation, user adoption, and regulatory approval—areas fraught with risk in this industry.

Recent Activity and Signs of Project Vitality

The team maintains active communication channels, including Twitter (https://x.com/AUC_Project), Discord (https://discord.com/invite/aucproject), and Telegram (https://t.me/aucproject). Their social media indicates ongoing development, partnership announcements, and community engagement, which are positive signs compared to many scam projects.

However, community size (~34,927 Telegram members) does not necessarily equate to project legitimacy; larger communities can be bought or artificially inflated.

Project Ecosystem, Tools, and Use Cases

The ecosystem revolves around several core components:

- Staking & Mining: Aims at incentivizing users to lock assets and contribute to network security.

- Cross-Chain Bridge: Powered by LayerZero, designed for interoperability across chains like Ethereum, Avalanche, and Base.

- Payment Gateway: Offers remittance, online/offline payments, and utility bill solutions.

- Big Data & AI: Developing data analytics for credit scoring, AML, and personalized services.

While these features are promising on paper, their actual implementation quality and security are critical for long-term viability.

Tokenomics and Airdrop Details

The AUC token (ERC20 standard) has a total supply of 6 billion AUC tokens, allocated as follows:

- Marketing: 10%

- Team & Advisors: 10%

- Operations: 10%

- Partnerships: 5%

- Market Liquidity: 30%

- Reserved: 20%

- Ecosystem: 15%

Funds are primarily directed toward marketing (55%), solution development (20%), and operations (20%). The platform aims for significant growth via regional expansion, partnerships, and technological innovation.

Notably, there is no mention of upcoming airdrops, nor do they currently declare explicit incentives beyond staking and gaming.

Developer Documentation & Audits

The project has undergone some formal security assessments, with a CyberScope audit indicating an 88 out of 100 security score and community trust score of 91%. The audit report (https://www.cyberscope.io/audits/68684486024067cc3f87a9fa) reveals:

- High criticality findings in smart contracts, though assets seem relatively secure so far.

- Absence of KYC/AML controls at the protocol level, which raises concerns about regulatory compliance.

Important to note: A high community score does not replace rigorous, third-party smart contract audits. Investors should seek GAS-scrutinized reports and developmental transparency.

Red Flags and Investment Risks

- Limited transparency and undisclosed governance: The project operates largely through community channels with no clear governance model or decentralized decision-making framework.

- Technical reliability concerns: The CyberScope audit identified high criticality issues—without visible remediations or security patches, smart contract vulnerabilities could be exploited.

- Regulatory uncertainty: Operating in multiple regions with varying compliance standards, especially in Africa and Southeast Asia, entails legal risks if regulators clamp down on unregulated or poorly licensed crypto initiatives.

- Market saturation and competition: The remix of remittance, payments, and DeFi features faces stiff competition from established players like Stellar, Ripple, and Binance Smart Chain projects.

- Community and market manipulation: Despite a large Telegram following, community strength does not guarantee project success or security; pump-and-dump schemes are possible in such ecosystems.

- Token utility and liquidity: The token’s utility depends on widespread adoption of AUC-based apps, which are still in development. Without end-user traction, token demand might remain low, risking depreciation.

Final Verdict: Is AUC Legit?

While AUC presents an ambitious and technically comprehensive ecosystem, several red flags should caution prospective investors. The project's security assessment indicates vulnerabilities, and its reliance on future integrations and regional expansion introduces regulatory and operational risks. Community engagement appears strong but does not compensate for transparency gaps or technical uncertainties.

Investors should conduct due diligence, verify smart contract security patches, and monitor ongoing development before committing funds. At current stages, AUC seems more promising as a speculative project than a safe, established investment.

Summary & Recommendations

- Do your own research: Review all technical audit reports and follow the project's progress via official social channels.

- Exercise caution: Consider the risks of smart contract vulnerabilities, regional compliance issues, and community-driven pump potential.

- Stay updated: Follow recent developments and test the ecosystem's features in controlled environments before engaging significantly.

Ultimately, AUC’s potential lies in its ability to execute its roadmap securely and transparently—a benchmark yet to be fully demonstrated.

Daniel Clark

On-Chain Quantitative Analyst

I build algorithmic tools to scan blockchains for signals of manipulation, like whale movements and liquidity drains. I find the patterns in the noise before they hit the charts.

Similar Projects

-

dTRINITY

Comprehensive Review of dTRINITY: Crypto Project Scam Checker & Risk Analysis

-

Evolution Finance

Evolution Finance ($EVN) Review: Data-Driven Risk & Security Analysis

-

Zeebu

Comprehensive Review of Zeebu: Is This Telecom Blockchain Project a Scam or Legit?

-

SexCoin.cash

Crypto Scam Checker: In-Depth Review of SexCoin.cash - Scam or Legit?

-

IoTeX

IoTeX Review: Scam or Legit? Crypto Project Investigation