Convex Finance ($CVX) Review: A Data-Driven Look at Its Legitimacy, Risks, and Long-Term Potential

What Is Convex Finance: An Introduction

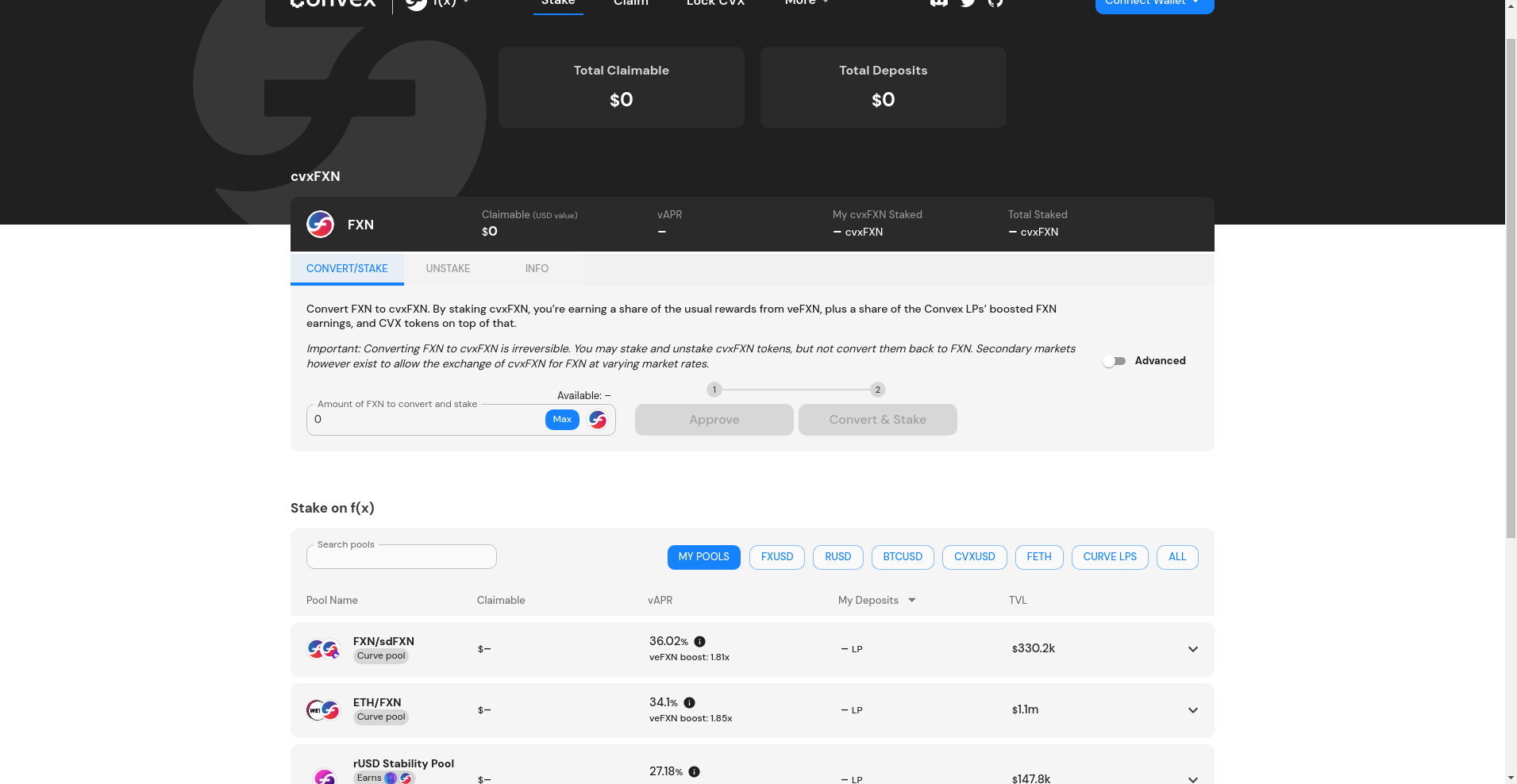

Convex Finance is a prominent liquidity and yield optimization platform in the DeFi ecosystem. Built atop protocols like Curve, Frax, and f(x), it offers liquidity providers and token stakers enhanced rewards, governance participation, and streamlined yield farming opportunities. Central to its operation is the CVX token, which facilitates governance and yield-sharing mechanisms. Understanding yield and liquidity optimization in DeFi is key to appreciating Convex's role.

This analysis aims to provide an impartial, fact-based evaluation of Convex Finance’s legitimacy, security posture, economic sustainability, and potential risks, based on disclosures, audits, and ecosystem data available prior to October 2023.

The Team and Vision Behind Convex Finance

Convex Finance’s workforce and development team include known figures and institutions within DeFi; however, specific team member identities are often anonymized or private, which is not uncommon in the space. The project’s transparency metrics indicate active engagement through community channels and regular updates, but a lack of publicly verified team bios may raise questions about direct accountability.

- Roadmap milestones include platform deployment, audits, community integrations, and expanding governance features.

- Security audits from reputable firms like MixBytes add credibility, though continuous monitoring is essential due to evolving exploits in DeFi.

- Perceived ability to deliver on roadmap promises is supported by regular protocol upgrades and governance proposals, but the decentralized nature means execution relies heavily on community consensus.

Overall, while the team’s full composition remains somewhat opaque, the project’s active development and audited codebase suggest a credible pathway forward.

Assessing the Security and Integrity of Convex Finance

**This analysis is based on Cer.live's audit report, which indicates that Convex’s platform has undergone third-party review.** The audit coverage is roughly 50%, with a notable security insurance from Nexus Mutual, adding an additional layer of risk mitigation.

Key findings from the official audit include:

- Audited Contracts: MixBytes audited the core platform contracts, focusing on the staking, reward distribution, and governance modules.

- Vulnerabilities: The audit identified **no critical vulnerabilities** at the time of review, but highlighted some medium-risk issues, such as:

- - Potential re-entrancy concerns in specific fallback functions (common in complex DeFi protocols).

- - Governance upgrade mechanisms that require strict parameter controls to prevent malicious proposals.

- Security measures include immutable smart contract logic and multi-sig governance for upgrades.

While the audit results are reassuring, it’s important to recognize that no smart contract system is entirely risk-free. The complexity of interactions increases systemic risk, especially during upgrades or governance changes. Understanding smart contract upgradeability risks is crucial here.

A Breakdown of Convex Finance Tokenomics

The CVX token, with a total supply of approximately 99.88 million, acts as the central governance and reward-sharing instrument within the ecosystem. Its distribution, utility, and inflation model underpin the platform’s economic sustainability. Understanding the CVX token utility and governance is vital.

- Total Supply: ~99,878,000 CVX

- Initial Distribution: Primarily allocated to founders, early investors, ecosystem grants, and community incentives.

- Utility: Voting rights, fee-sharing, and locking mechanisms that provide governance influence and yield boosts.

- Token Inflation and Vesting: Emission schedule includes periodic rewards for staking and liquidity mining; vesting schedules are aligned with community incentives, reducing immediate inflationary pressures.

- Economic Considerations: The platform’s revenue, derived from activity fees, is shared with CVX holders through staking and locking incentives. However, as the supply approaches a near-maximum cap, inflationary risks diminish.

Overall, the CVX tokenomics suggests a balanced model aligning incentives among stakeholders, provided that platform activity remains robust and governance processes transparent.

Assessing Convex Finance's Development and Ecosystem Activity

On-chain activity and social engagement evidence ongoing ecosystem vitality. The reported Total Value Locked (TVL) exceeds $1.55 billion, and the platform’s revenue exceeds $600 million, indicating strong user adoption. Exploring Convex Finance yield optimization strategies can help users leverage this activity.

Development efforts are demonstrated through frequent smart contract upgrades, new integrations with DeFi protocols, and active governance proposals. Community channels like Twitter, Reddit, Discord, and GitHub host continuous discussions, with regular updates on improvements and security patches. Benchmarking against audit reports further corroborates ongoing maintenance and transparency efforts.

Despite occasional marketing noise, substantial real-world usage and Protocol governance participation signal a healthy ecosystem trajectory.

Final Analysis: The Investment Case for Convex Finance

Based on available data, Convex Finance appears to be a legitimate, well-audited protocol with substantial ecosystem activity and sound tokenomics. Its integration with stablecoin and liquidity protocols like Curve and Frax reinforces its strategic positioning in DeFi yield optimization.

However, inherent risks remain:

- Smart Contract Risk: Despite audits, complex protocols may harbor unnoticed bugs or future exploits, especially during upgrades.

- Governance Risks: Concentration of voting power or governance capture could undermine decentralization.

- Market Risks: Fluctuations in DeFi activity could impact TVL and rewards, influencing token value.

- Regulatory Risks: Increasing scrutiny of DeFi services might impose compliance burdens or restrictions.

On the upside, the platform’s diversified income streams, active developer community, and transparent security measures point toward a resilient long-term presence if continued user trust and protocol security are maintained.

Investors should weigh these factors carefully, considering their risk tolerance and interest in DeFi yield strategies. Crypto investments inherently carry volatility, and thorough due diligence remains essential.

Daniel Clark

On-Chain Quantitative Analyst

I build algorithmic tools to scan blockchains for signals of manipulation, like whale movements and liquidity drains. I find the patterns in the noise before they hit the charts.

Similar Projects

-

Ski Mask Kitten

Ski Mask Kitten Review: Crypto Project Scam Checker

-

Reflexer Ungovernance Token

Reflexer Ungovernance Token Review: Scam or Legit Crypto?

-

Angry Bird INU

Crypto Project Review: Is Angry Bird INU a Scam or Legit? Scam Checker & Analysis

-

Trendify Token

Trendify Token Review: Is It a Scam or Legit Crypto Project?

-

Verum Coin

Verum Coin ($VERUM) Review: Assessing Legitimacy, Risks & Long-Term Potential