Trendify Token Review: Scam or Legit Crypto? Uncovering All The Red Flags

Project Overview

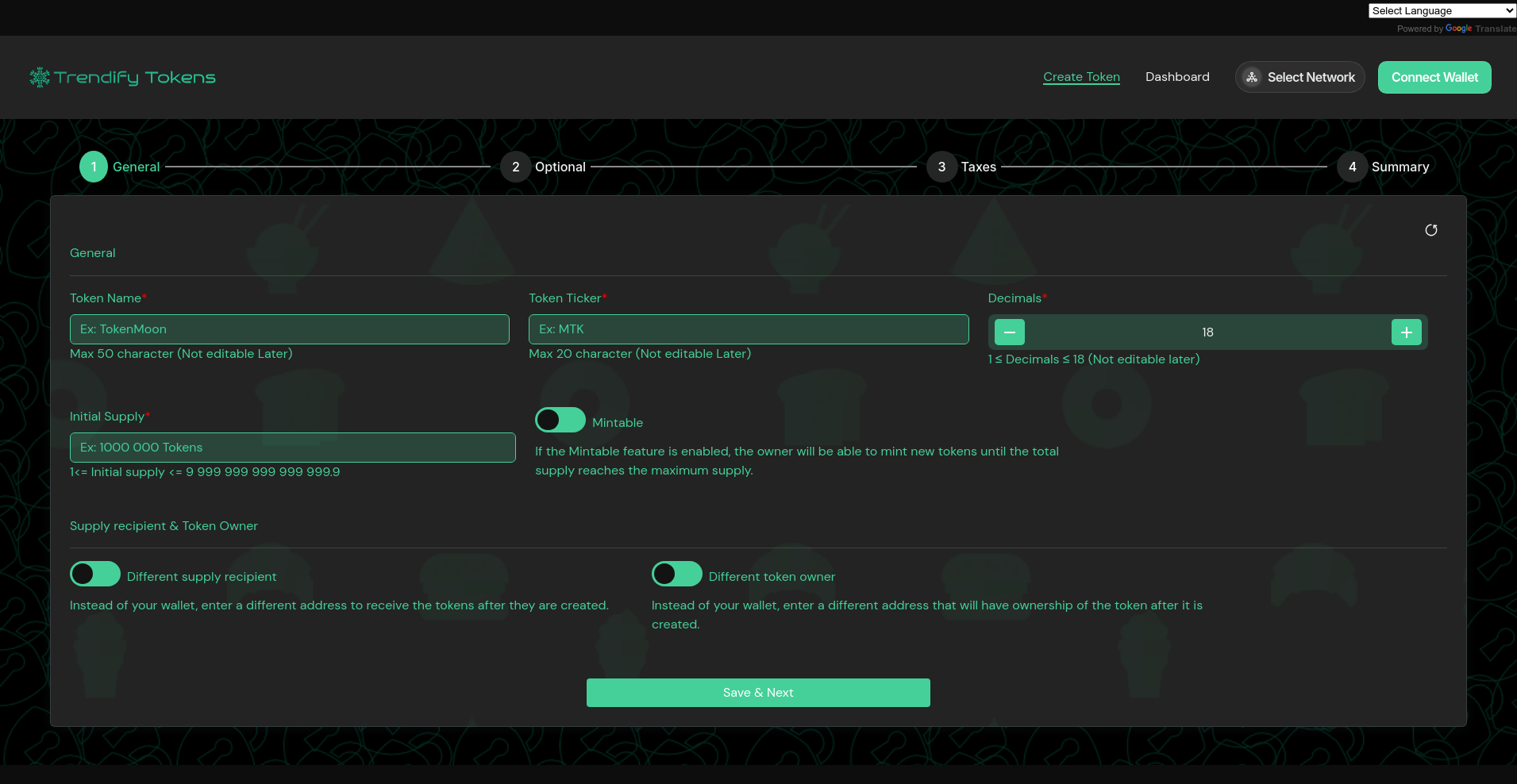

Trendify Token presents itself as a multi-chain cryptocurrency platform that simplifies the process of creating and managing digital assets across various blockchain networks. Its website claims to offer a user-friendly interface with extensive customization options, including tokenomics, advanced features, and cross-chain support.

Despite these lofty promises, it is crucial to approach such projects with a healthy dose of skepticism. This investigation aims to scrutinize the available evidence, audit reports, and community presence to assess whether Trendify Token is a genuine project or potentially a scam designed to mislead investors.

Team and Vision Analysis

One of the first red flags in evaluating any crypto project is transparency regarding its team and leadership. In the case of Trendify Token, there is no publicly available information about the founders or core developers. The absence of doxxed team members raises concerns about accountability and legitimacy.

- Anonymous team members: No verifiable identities or professional backgrounds shared.

- Roadmap visibility: The project touts multi-chain token creation capabilities, but lacks detailed development timelines or milestones.

- Community backing: A small, inactive Telegram community hints at limited real-world engagement.

- Clear vision or strategy?: The platform’s broad feature set seems to be a copy-paste of generic token creation tools, lacking innovative or unique elements.

Overall, the lack of transparency casts doubt on the project's credibility, making it difficult for potential investors to trust its long-term viability.

Security and Trust Audit

The sole available audit report from Cyberscope indicates that Trendify Token underwent a basic security assessment, focusing primarily on its token standards and smart contract architecture. While it earned a high security score of approximately 95%, this alone does not guarantee the absence of vulnerabilities, especially considering the high-criticality issues flagged in its audit iterations.

- Audit transparency: Minimal data available; no comprehensive source code review reported publicly.

- High-criticality flags: Multiple audit iterations flagged potential vulnerabilities, though specific details remain undisclosed.

- Centralization concerns: No KYC or audit from reputable third-party platforms, increasing the risk of centralized control or malicious code.

- Code review limitations: Lack of open-source code or independent audits means investors are essentially relying on a superficial report.

Therefore, although the technical security appears promising on paper, the lack of in-depth audits, transparency, and community verification exposes investors to significant risks.

Tokenomics Deep Dive

Analyzing the available information, Trendify Token’s tokenomics appears simplistic but potentially deceptive. The platform promotes token creation with features like mintability and optional control over token supply, but the real risks lie in how these features can be exploited.

- Total supply: 100 million tokens, with minting enabled by default, leading to inflation risks.

- Ownership control: The token creation interface suggests that the owner can retain or revoke minting and freeze authorities, which centralizes power.

- Utility claims: No clear utility or real-world backing is demonstrated, only basic token functions.

- High inflation potential: Enabled minting and lack of detailed distribution plans suggest a dangerous environment for token holders, especially if the team or owners decide to generate more tokens at will.

Without transparent token distribution or locking mechanisms, investors are likely exposed to dump risks and high inflation, severely diminishing any perceived value.

Ecosystem and Development Activity

Based on the summaries and available data, there is minimal evidence of active development or community engagement beyond the initial website and basic token creation tools. The platform boasts over 1000 tokens created and 400+ community members, but these figures could be inflated or artificially maintained.

Real activity indicators—such as frequent updates, transparent development progress, or active governance—are missing. The absence of a functioning marketplace, active forums, or partnerships further reinforces the impression that Trendify Token exists largely as a website offering token deployment services rather than a vibrant ecosystem.

This stagnation raises questions about the long-term sustainability and genuine use case of the project.

The Fine Print

Careful review of the project’s legal and operational terms reveals a concerning lack of transparency or protections for investors. Some notable issues include:

- Unclear token ownership rights: No detailed Terms of Service or user protection clauses are publicly available.

- Premium pricing for basic services: Deployment costs are high relative to the scarce technological innovation provided.

- Potential for centralized control: The platform’s interface suggests the ability for owners to revoke minting or freeze tokens at will, increasing risk of malicious manipulations.

- Lack of KYC or AML procedures: No verification steps or anti-fraud measures are evident, heightening chances of nefarious use.

Overall, the legal environment appears hostile to the average user, with significant potential for exploitation and limited safeguards.

Final Verdict: Should You Risk Investing in Trendify Token?

This investigative review highlights multiple red flags suggesting that Trendify Token is more likely a platform for quick token deployment rather than a reputable blockchain project. The absence of transparent team info, limited community activity, superficial audits, and questionable tokenomics collectively undermine its legitimacy.

Potential investors must weigh these risks carefully. While the project offers extensive features and multi-chain support, the opacity and centralization risks make it a high-stakes gamble rather than a safe investment. Proceed with extreme caution, and consider seeking projects with proven transparency, active development, and verified security audits.

- Positive Points:

- Multiple blockchain support (Ethereum, Solana, TON, etc.)

- Basic security score is high

- Feature-rich token creation interface

- Major Red Flags:

- No publicly verified team or founders

- Limited transparency and no external audits

- Potential for centralized control and inflation risks

- Minimal community engagement and ongoing development activity

Ultimately, due diligence suggests that Trendify Token should be approached with skepticism until further transparent evidence of legitimacy emerges. Always perform your own research and never invest more than you can afford to lose.

Christopher Anderson

Smart Contract Auditor & Legal Tech Analyst

I have a dual background in law and computer science. I audit smart contracts to find the critical gap between a project's legal promises and its code's reality.

Similar Projects

-

dForce Token

dForce Token ($DF) Review: Key Insights into Its Technology and Risks

-

LegacyX Token

In-Depth Review of LegacyX Token: Is It a Crypto Scam or Legit Project? | Crypto Scam Checker

-

SKALE

SKALE Review: Scam or Legit Crypto? Find Out Now

-

Skyren

Skyren ($SKYRN) Review: A Deep Dive into Its Tech & Risks

-

Buddha1.xyz

Crypto Project Scam Checker Review: Is Buddha1.xyz a Scam or Legit?