Verum Coin ($VERUM) Review: A Data-Driven Look at Its Legitimacy, Risks, and Long-Term Potential

What Is Verum Coin: An Introduction

Verum Coin ($VERUM) emerges as a decentralized digital currency associated with the Verum Messenger platform, developed by the BitCoinPay Trade team. Its core proposition claims to facilitate swift, low-cost transactions globally, leveraging blockchain technology primarily on the Binance Smart Chain (BEP20). The project emphasizes security driven by mathematical principles and aims to provide users with greater control over their assets.

This analysis offers an impartial evaluation of Verum Coin’s technological foundation, team credentials, tokenomics, and overall project viability. By scrutinizing available data, audit reports, and developmental milestones, this review aims to present a balanced view informed by the quantitative and qualitative aspects of the project’s current standing.

The Team and Vision Behind Verum Coin

The development team behind Verum Coin is identified as the BitCoinPay Trade team. Currently, there is limited publicly available information regarding the team members’ backgrounds, prior experience, or community engagement, which raises questions about transparency and credibility.

Careful assessment of the project's roadmap and milestones indicates an intent to develop a comprehensive ecosystem, including distribution channels, white papers, and ongoing development plans extending through 2025. Notably, the roadmap appears high-level, with broad timeframes without detailed deliverables, which may impede accountability.

- Development Milestones: Roadmap from 2021 to 2025, emphasizing ongoing improvements.

- Community Engagement: Limited public presence; Telegram and Twitter accounts have little to no followers, indicating nascent community activity.

- Transparency & Credibility: Lack of detailed team profiles and verifiable credentials suggests a cautious approach to assessing team credibility.

Overall, the team’s ability to deliver will depend heavily on transparent communication, technical execution, and engagement with the broader crypto community, which currently appears limited.

Verum Coin Security Audit Results

According to the Cyberscope audit report, Verum Coin has undergone a formal security assessment focusing on its smart contract code deployed on Binance Smart Chain (BSC). The audit was completed on October 26, 2024, and is the sole publicly available formal review at this point.

Key findings from the audit include:

- Security Score: Approximately 95.5%, indicating a high level of security based on the audit criteria.

- Critical Issues: The report mentions "high criticality" vulnerabilities, though specific vulnerabilities are not detailed in the summary. It warrants further examination of detail audit findings for potential attack vectors.

- Vulnerabilities: The audit notes some critical points needing addressing, which could include re-entrancy issues, access control flaws, or other common smart contract risks.

- Score Interpretation: The near-top security score (above 95%) suggests robust contract coding, but the presence of critical issues indicates residual security risks that could be exploited if not mitigated.

While the high security score is reassuring, the noted critical vulnerabilities necessitate ongoing monitoring and possibly further patches. For investors, this implies that although the code appears generally sound, residual risks remain, especially if vulnerabilities are not yet fully remediated.

A Breakdown of Verum Coin Tokenomics

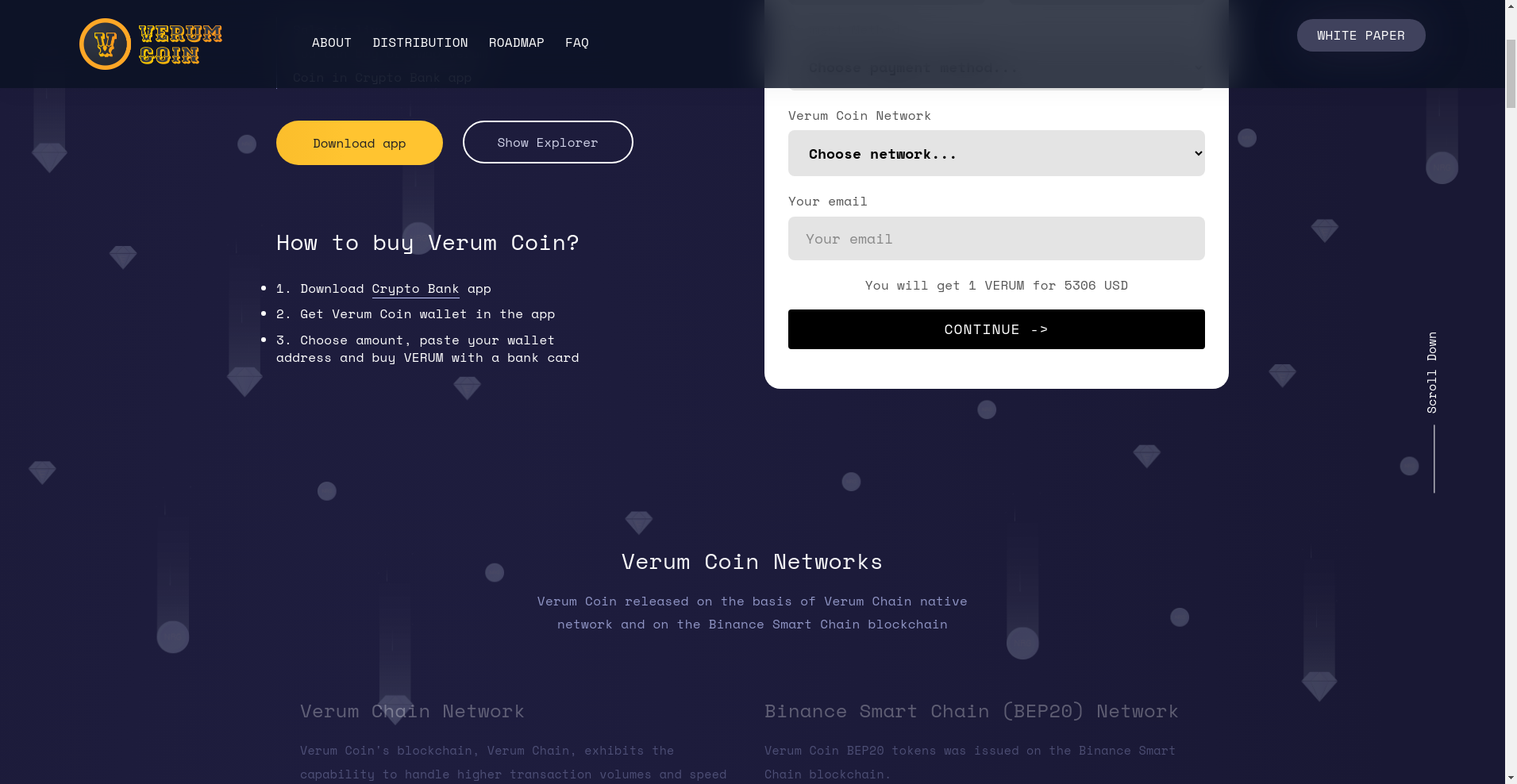

Verum Coin’s tokenomics are foundational for understanding its potential sustainability and investor risk profile. The project’s current market cap is approximately $442.7 million, with a circulating and total supply effectively unspecified in the available data, raising questions about liquidity and distribution. The reported price of around $5,306 per VERUM is exceptionally high by typical crypto standards, suggesting a unique pricing model or possibly an unorthodox valuation approach. Understanding the implications of such high token prices is crucial.

- Total Supply: Not explicitly specified in the available documentation, indicating opacity in token issuance or distribution caps.

- Utility: The primary utility appears to be integrated with the Verum Messenger ecosystem and facilitating transactions via the Binance Smart Chain.

- Distribution & Allocation: The project promises a 'Distribution of Coins' section, but detailed breakdowns of initial allocation—team, advisors, early investors, community rewards—are not disclosed.

- Vesting Schedule: Absent from available information, leaving open whether tokens are subject to lock-ups or release schedules that could impact supply dynamics.

- Economic Model & Risks: The scant transparency on tokenomics could potentially lead to centralization risks, inflationary pressures, or liquidity issues—especially if large allocations to insiders are not publicly disclosed.

Given the high valuation per token and limited data on supply and distribution, the model appears potentially leaky, resembling a 'leaky bucket.' Investors should be cautious of hidden issuance policies or undisclosed large holders that could influence market stability and price performance.

Assessing Verum Coin's Development and Ecosystem Activity

From the available development summaries, Verum Coin maintains ongoing efforts, with milestones spanning recent years up to 2025. The project’s roadmap indicates continual updates, and the presence of a White Paper, distribution plan, and ecosystem features suggests an intent to build a comprehensive platform.

However, the ecosystem’s actual traction remains questionable due to limited real-world activity. Social media presence is minimal, with negligible engagement on Telegram (only 3 members) and sparse updates on Twitter, where the project has no followers. Although the project claims to facilitate transactions and integrates with the Crypto Bank app, there is a lack of verifiable trading volume or active user base data outside the reported $172,167.07 in trading volume.

It appears that much of the project’s progress might be academic or developmental rather than demonstrating active adoption. Without substantial user engagement or liquidity, the ecosystem's growth potential remains uncertain, especially if marketing efforts and community development are limited.

What Investors Should Know About Verum Coin's Legal and Terms Framework

The available documentation mentions standard legal references such as AML & KYC policies and a legal opinion. However, there are no indications of comprehensive legal disclosures or detailed terms of conduct, investor protections, or jurisdictional limitations. Examining the legal and compliance frameworks of crypto projects is essential.

Potential risks include the absence of explicit KYC controls, which could expose investors to regulatory scrutiny, and the lack of transparency regarding the legal standing of the token in different jurisdictions. Furthermore, the project’s high token price and limited disclosures about supply and distribution could pose hidden risks—such as dilution or token trapping—that should be scrutinized by potential investors before engagement.

Final Analysis: The Investment Case for Verum Coin

Overall, Verum Coin presents a blend of promising technical attributes—particularly its security audit score—and notable opacity regarding fundamental aspects like tokenomics, team transparency, and ecosystem activity. Its high security score suggests a technically sound smart contract infrastructure, but vulnerabilities flagged in the audit highlight the importance of ongoing security evaluations.

On the other hand, the lack of detailed public team credentials, opaque token distribution, minimal community engagement, and uncertain adoption levels complicate a straightforward investment decision. The high unit price per token and limited supply data further cast doubts on the economic sustainability and transparency of the project.

Given the current evidence, Verum Coin appears to be a high-risk project with a potentially leaky economic model and limited real-world traction. It might appeal to speculative investors willing to accept the considerable uncertainties, but cautious investors should demand greater transparency, verifiable development progress, and clear tokenomics before considering it as a long-term holding.

Pros / Strengths

- High security audit score (over 95%) indicates robust smart contract coding, reducing technical risk.

- Ongoing development efforts with planned milestones up to 2025 suggest a structured project roadmap.

- Decentralization score (50%) and community score (~35-75%) reflect emerging decentralization and community engagement metrics.

- Integration with Binance Smart Chain (BEP20) provides a solid technological foundation for transaction speed and low fees.

Cons / Risks

- Limited team transparency without detailed member credentials or public profiles.

- Opaque tokenomics with undisclosed supply, distribution, and vesting schedules.

- Minimal real-world ecosystem activity and community engagement posing questions around adoption and liquidity.

- Existing vulnerabilities flagged in the security audit require vigilance and further patching.

- High token valuation / price per unit, potentially disconnected from intrinsic utility or market fundamentals.

In summary, Verum Coin stands as a technically somewhat promising but economically opaque project. Its future success hinges on transparent disclosures, active community growth, and resolution of security concerns. Investors should weigh these factors carefully, recognizing that this project embodies appreciable risks with uncertain long-term potential.

Jessica Taylor

NFT Market Data Scientist

Data scientist specializing in the NFT market. I analyze on-chain data to detect wash trading, bot activity, and other manipulations that are invisible to the naked eye.

Similar Projects

-

DRAGON ON TRON

DRAGON ON TRON ($DGTRON) Review: Risks and Legitimacy Explored

-

The Emperor Penguin

The Emperor Penguin ($TEP) Review: Data-Driven Analysis of Risks & Legitimacy

-

Quarashi Network

Comprehensive Review of Quarashi Network: Crypto Project Scam Checker and Investment Analysis

-

Cirus

Cirus ($CIRUS) Review: A Deep Dive into Its Tech & Risks

-

Shirtum

Shirtum Review: Scam or Legit Crypto? Scam Check & Analysis