Is $BUIDL Official ($2-BUIDL) a Legitimate DeFi Project? A Comprehensive Risk & Legitimacy Assessment

Project Overview

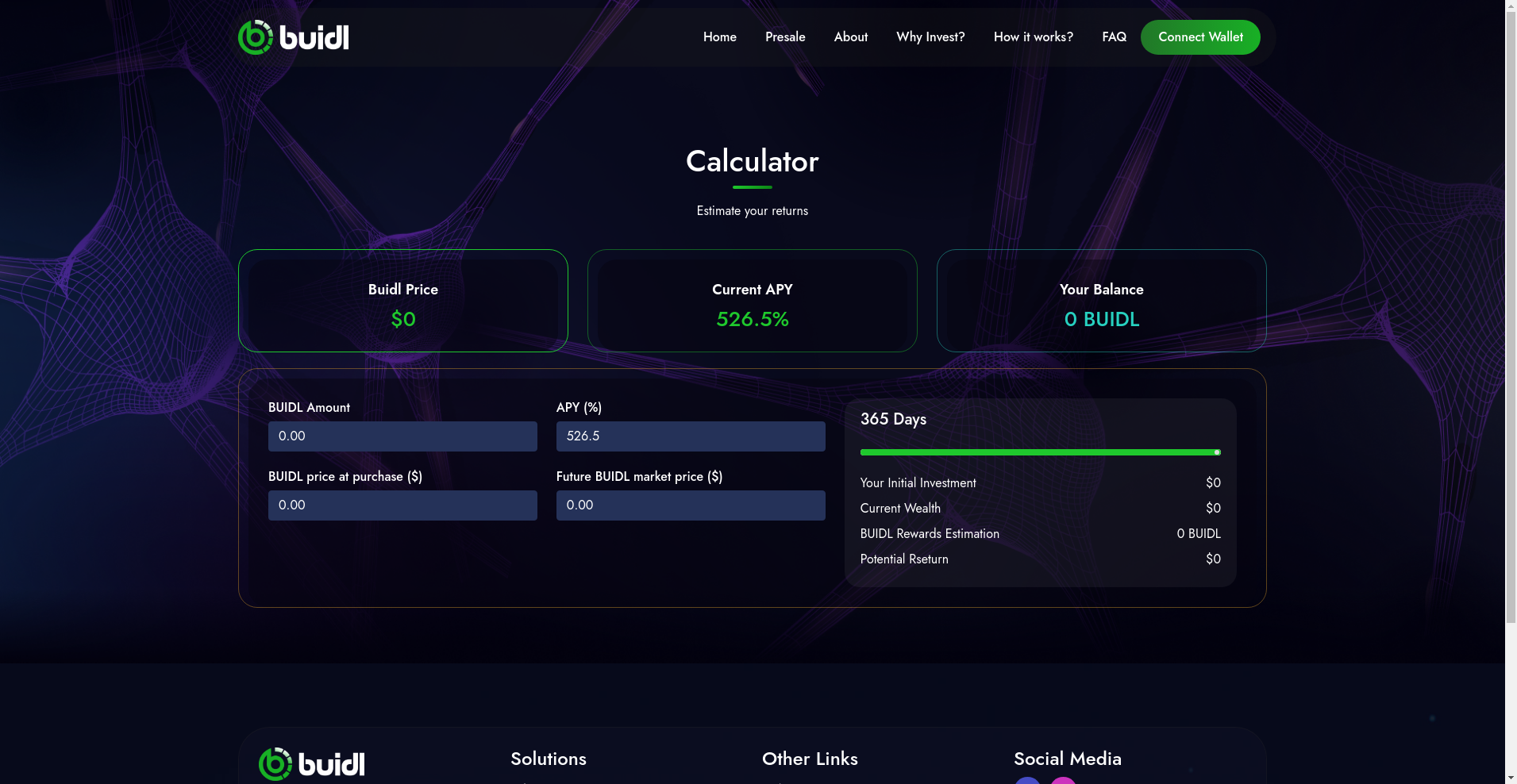

$BUIDL Official is a decentralized finance (DeFi) protocol that positions itself as an innovative "auto-staking" and high-yield earning platform on Binance Smart Chain (BSC). Its core proposition revolves around offering investors a seemingly unparalleled fixed APY of 526.5% through an autostaking mechanism where rewards are compounded automatically within user wallets. The project emphasizes sustainability features like deflationary measures, liquidity auto-injection, and insurance funds to bolster stability and investor confidence.

This review provides an impartial assessment based on available data, including audit results, tokenomics, development activity, and community engagement, to understand the project's potential for legitimacy and the risks it might pose to investors. For those interested in high fixed yields, understanding evaluating high fixed APY DeFi projects is crucial.

The Team and Roadmap Evaluation

The transparency surrounding the team behind $BUIDL Official remains limited. The project’s founders are anonymous, a common trait among many high-yield DeFi protocols, which raises questions about accountability and long-term commitment. Despite this, the project claims to concentrate on sustainability by employing mechanisms like RFV (Risk-Free Value) reserves, auto-liquidity, and insurance funds designed to stabilize the token's price and reward system.

Key roadmap milestones highlight intentions rather than completed milestones:

- Q1 2025: Presale and initial liquidity provisioning, with plans for decentralized governance deployment.

- Q2 2025: Expansion of ecosystem features including yield farming, staking pools, and community governance platforms.

- Q3 2025 and beyond: Continual development for protocol upgrades, partnerships, and potentially adding cross-chain interoperability.

Given the early stage and the lack of transparent development milestones with tangible proof of delivery, coupled with anonymous leadership, the project’s ability to follow through with its ambitious roadmap remains uncertain. Nonetheless, the roadmap details are aligned with typical DeFi growth plans, but whether they are achievable hinges on community trust and technical delivery.

Security and Trust Analysis

The security assessment hinges on a Cyberscope audit report, which indicates that $2-BUIDL is subject to only one primary audit review. The audit covers token security aspects pertinent to smart contract vulnerabilities but highlights some critical points that warrant scrutiny.

- Audit Findings: The audit identified high-criticality issues, which, although marked as addressed, raise some cautiousness about contract robustness. Understanding high-criticality vulnerabilities is key here.

- Security Score: The project scored an outstanding 95.52% in security, placing it in a relatively safe zone when considering technical safeguards. However, the singular audit means it's important to also consider the dangers of unverified code and the completeness of provided reports.

- Decentralization and Community Security: The decentralization score is moderate at 61.36%, reflecting some reliance on the project's central points of control or governance mechanisms. Community scores can also provide insight into governance robustness.

- Limitations: It’s important to note that only a single audit was referenced, which does not comprehensively vouch for overall security, especially considering potential vulnerabilities outside the scope of the audited smart contracts (i.e., ecosystem or governance risks). Investors should be wary of partial audit reports if they are incomplete.

For an investor, this security score suggests a reasonably secure foundation but does not eliminate risks associated with smart contract exploits, development bugs, or potential governance attacks. The absence of multiple audits or third-party reviews warrants caution but indicates at least some level of vetting.

Tokenomics Breakdown

The tokenomics of $2-BUIDL are designed to sustain an extremely high fixed APY while ensuring long-term viability through deflationary and stability measures.

- Total Supply: 21,000,000 tokens, comparable to Bitcoin’s capped supply, aiming to introduce scarcity. Understanding token distribution and vesting schedules is essential for any project.

- Initial Supply: 21,000 tokens, with a dynamic elastic supply model driven by positive rebases, intended to grow the supply based on rewards.

- Distribution Breakdown:

- Presale: 40%

- Liquidity Pool: 20%

- LP Rewards: 20%

- Burn Mechanism: 10%

- Bonus & Airdrops: 6%

- Strategic Partnerships & Bounty: 3%

- Tax Structure: Buy: 13% (RFV 5%, Liquidity 5%, BIF 2%, Burn 1%)

Sell: 15% (RFV 6%, Liquidity 5%, BIF 3%, Burn 1%) - Utility: The token facilitates governance, auto-staking, yield farming, and ecosystem participation, with rewards generated via transaction taxes and rebasing.

While the high APY sounds attractive, the sustainability of such a rate hinges on how effectively the protocol manages inflation, taxes, and the RFV/BIF pools. Excessively high yields can be a red flag, especially if they are driven primarily by inflationary token issuance or unsustainable incentives, which could lead to rapid depreciation once the promised yield cannot be maintained. Examining BSC transaction tax structures is key to understanding this.

Ecosystem and Development Activity

The project’s development activity appears to be progressing, with ongoing updates on their website and a clear roadmap indicating future features. Despite the promising features, community engagement remains modest; the Telegram group has around 2024 members, and the project's social media following is not publicly detailed, raising questions about active community participation. A strong community score is often indicative of sustained interest.

Consistent development updates, transparent reporting, or third-party audits are limited, making it difficult to gauge the actual progress beyond the initial promotion. The high community score (~42/100) and security robustness suggest a foundational platform but with room for improvement in transparency and real-world traction.

Review of Terms & Legal Conditions

The project’s legal and terms conditions are not fully disclosed within the accessible materials, which is a notable concern. Absence of explicit terms regarding user rights, dispute resolution, or legal safeguards introduces risk, especially for investors in jurisdictions with strict regulatory environments. The lack of KYC/AML processes is also a signal for potential regulatory issues.

Potential issues include:

- Limited transparency around legal protections or disclaimers.

- No clear information on user liabilities or rights if the platform faces security breaches or smart contract flaws.

- Absence of KYC/AML processes, common in High APY projects, increases susceptibility to regulatory scrutiny or misuse.

In summary, the legal framework seems minimal, and investors should exercise caution regarding potential legal or jurisdictional risks.

Final Analysis: The Investment Case for $BUIDL Official

Based on the available data, $BUIDL Official presents an intriguing but high-risk DeFi opportunity. The project showcases innovative features like automatic rebasing, auto-liquidity, and deflationary mechanisms aimed at providing sustained, high fixed yields. Its security score is promising, but the lack of multiple audits and transparency about the team and legal conditions warrants caution.

Similarly, the ambitious APY of 526.5%, while attractive, raises concerns about sustainability and whether the tokenomics can support such yields long-term without depleting value or leading to inflationary risks. The limited community engagement and early-stage development status further underscore the need for investors to proceed prudently. It's vital to remember that common red flags in blockchain projects often include anonymous teams and unsustainable yields.

Pros / Strengths

- High fixed APY (526.5%) driven by innovative rebasing and deflationary mechanisms.

- Security audit score of 95.52% suggests robust smart contract protections.

- Transparent tokenomics with clear fee and distribution structures.

- Sustainable token supply capped at 21 million to prevent uncontrolled inflation.

- Core features include auto-liquidity, RFV buffer, and insurance fund designed to enhance stability.

Cons / Risks

- Anonymous founders raise questions about accountability and project longevity.

- High yield percentages could be unsustainable or indicative of inflated incentives.

- Limited third-party audits and transparency on security beyond the initial assessment.

- Modest community engagement and social presence, which can impact trust and long-term adoption.

- Minimal legal and compliance disclosures increasing regulatory risks for investors.

This analysis suggests that while $BUIDL Official incorporates promising technological features and rigorous security measures, potential investors should remain cautious due to transparency deficits and the inherent risks of high-yield DeFi projects. It is imperative to conduct thorough personal due diligence and consider the project’s early developmental stage before committing capital.

James Carter

Chief On-Chain Analyst

On-chain analyst with a background in financial fraud detection. I use data science to dissect blockchains, find the truth, and expose scams. My motto: code doesn't lie.

Similar Projects

-

Niza Global

In-Depth Review of Niza Global: Crypto Scam Checker & Project Scam Review

-

Catwifmask ($MASK)

Crypto Project Scam Checker: In-Depth Review and Safety Analysis of Catwifmask ($MASK) - Is It a Scam or Legit?

-

Long Dragon

Long Dragon Review: Crypto Project Scam Checker & Risk Analysis 2025

-

BRICS GOLD

BRICS GOLD Review: Is This Crypto Project a Scam or Legit? Crypto Scam Checker & Detailed Review

-

Liquity USD

Liquity USD ($LUSD) Review: Security, Risks & Long-Term Potential