Risk-Free Value (RFV) in DeFi: Stability, Risks, and Real-World Use

Risk-Free Value (RFV) creates a treasury-backed safety net designed to dampen volatility in high-yield DeFi protocols. This guide expands on how RFV works, why it matters, and how to evaluate RFV-enabled projects in a crowded risk landscape. By examining real-world dynamics, we move from theory to practical diligence.

- What is RFV?

- How RFV Works

- Benefits and Why It Matters

- Risks and Pitfalls

- RFV in Practice

- Best Practices and Implementation

- FAQ

What is RFV?

RFV stands for Risk-Free Value—a treasury-based metric that anchors the value of a protocol's circulating assets by pairing them with secure reserves. It represents the theoretical safety of assets deemed low-risk within a protocol's treasury, helping to back collateralized tokens and incent users. In practice, RFV aims to keep a high-yield system resilient, so withdrawals and redemptions are protected during stress. For a broader view of related reserve strategies, token burns and other mechanisms can complement RFV, offering an additional control lever for supply dynamics. See how token burns function in crypto projects here: token burns.

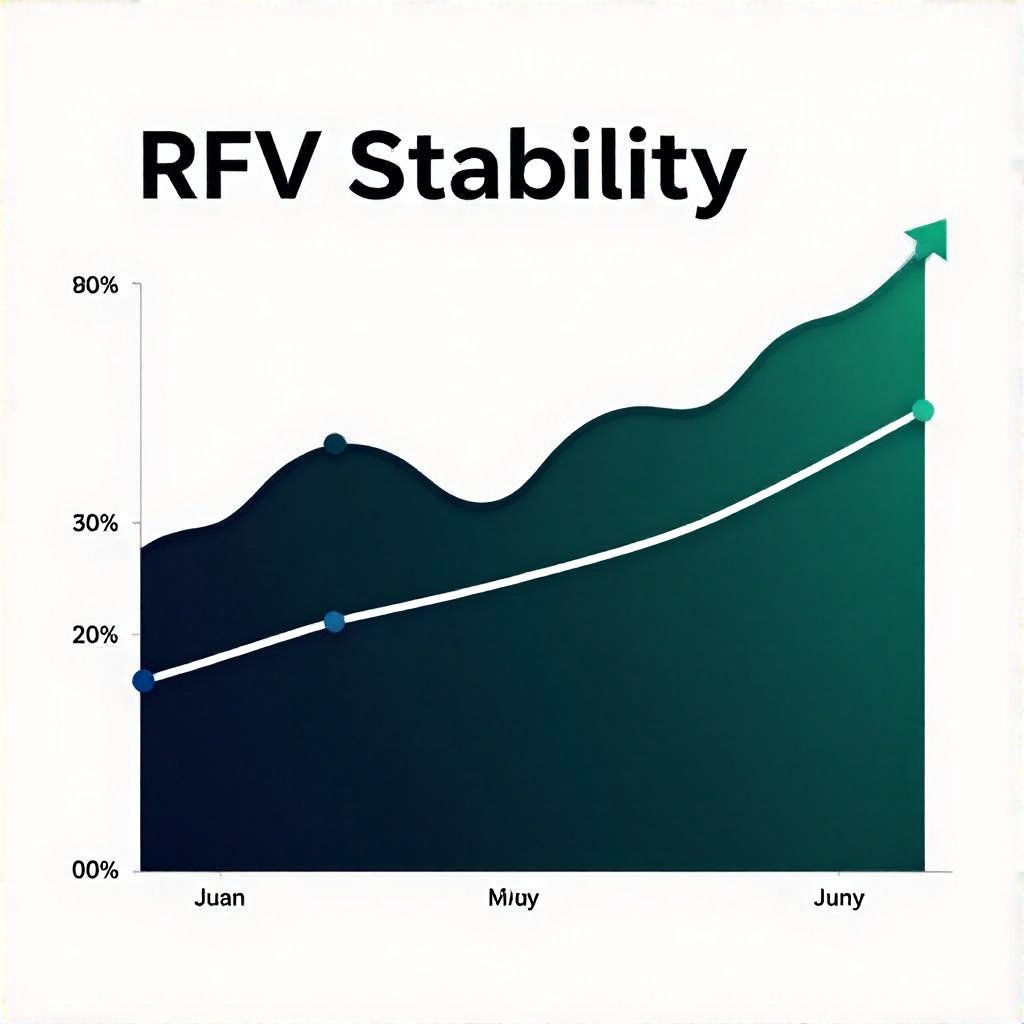

How RFV Works

RFV aggregates safe assets—stablecoins, secured collateral, and diversified reserves—inside a protocol’s treasury, forming a backstop that underpins the value of tokens tied to the system. When reserves rise or align with risk controls, a protocol can mint or burn tokens to maintain peg stability and ensure sufficient liquidity for withdrawals. As described by Cointelegraph, RFV serves as a central pillar for aligning incentives and building investor confidence in high-yield DeFi projects. Governance considerations matter here as well; for instance, the dynamics of token ownership renouncement can influence how decisions about RFV are enacted and audited. For governance insights, see token ownership renouncement.

The mechanism is not a silver bullet. RFV is a buffer that absorbs shocks from volatile assets and downturns, supporting liquidity and trust. However, over-reliance on RFV or miscalculation of reserve health can create a false sense of security. It’s essential to couple RFV with explicit risk-management policies and transparent reporting, so users understand where safety nets exist and where incentives align with real value creation. For security-focused readers, it also helps to be mindful of smart-contract vulnerabilities that could affect RFV’s effectiveness.

Benefits and Why It Matters

- Enhanced stability by providing a safety buffer during volatility.

- Improved investor confidence through prudent treasury management and transparent risk controls.

- Protocol longevity by reducing the probability of liquidity crunches and abrupt de-pegging.

Risks and Pitfalls

RFV is not a cure-all. Mismanaged reserves, over-concentration in a single asset class, or a misalignment between RFV and actual user incentives can erode trust. Market crashes, misreported reserves, or external exploits can undermine RFV’s effectiveness. Moreover, an overemphasis on reserve accumulation might divert attention from real user utility, resulting in a disconnect between stability and value creation. For those exploring security risks, be aware of potential blind spots highlighted in analyses of smart-contract vulnerabilities and governance gaps.

RFV in Practice: Case Studies

Industry watchers note increasing RFV adoption in sustainable DeFi models, particularly where algorithmic stability mechanisms intersect with treasury resilience. For a broader industry perspective, see CoinDesk on DeFi stability mechanisms. Investors should connect RFV signals with practical signals like reserve health, governance transparency, and offense/defense in risk management. In this context, understanding exit risks alongside RFV can sharpen due diligence.

Best Practices and Implementation

To responsibly implement RFV, teams should publish clear reserve breakdowns, stress-test scenarios, and governance procedures. Integrate lessons from related risk analyses such as smart-contract vulnerability analyses, and remain vigilant against mispricing of safe assets. For governance and decentralization considerations, token ownership renouncement can influence transparency and accountability in RFV management. Additionally, watching for warning signs of scams and exit schemes is prudent, as discussed in exit-scam red flags guidance.

FAQ

Q: Is RFV the same as a reserve-backed loan model?

A: Not exactly. RFV is a framework for valuing treasury safety nets and backstopping tokens, not a loan product. It emphasizes risk control and reserve integrity to back token value.

Q: Can RFV prevent all liquidity crises?

A: It helps; however, robust risk management, transparency, and diversified reserves are also essential to withstand extreme events.

Q: How should an investor evaluate RFV claims?

A: Look for transparent reserve composition, independent audits, and governance processes that show how RFV decisions are made and reviewed.