Understanding Token Distribution and Vesting Schedules in Crypto: A Practical Guide

In the crypto world, tokenomics isn’t just about numbers; it’s about trust. This guide translates complex token distribution and vesting concepts into practical steps you can use to assess risk and protect your investment. Think of it as a digital self-defense course for token buyers and project teams.

- What is Token Distribution?

- Understanding Vesting Schedules

- Types of Vesting Schedules

- The Impact of Proper Tokenomics

- Transparency and Reporting

- Real-World Risks

- Investor Protections

- Practical Checklist

- FAQ

What is Token Distribution?

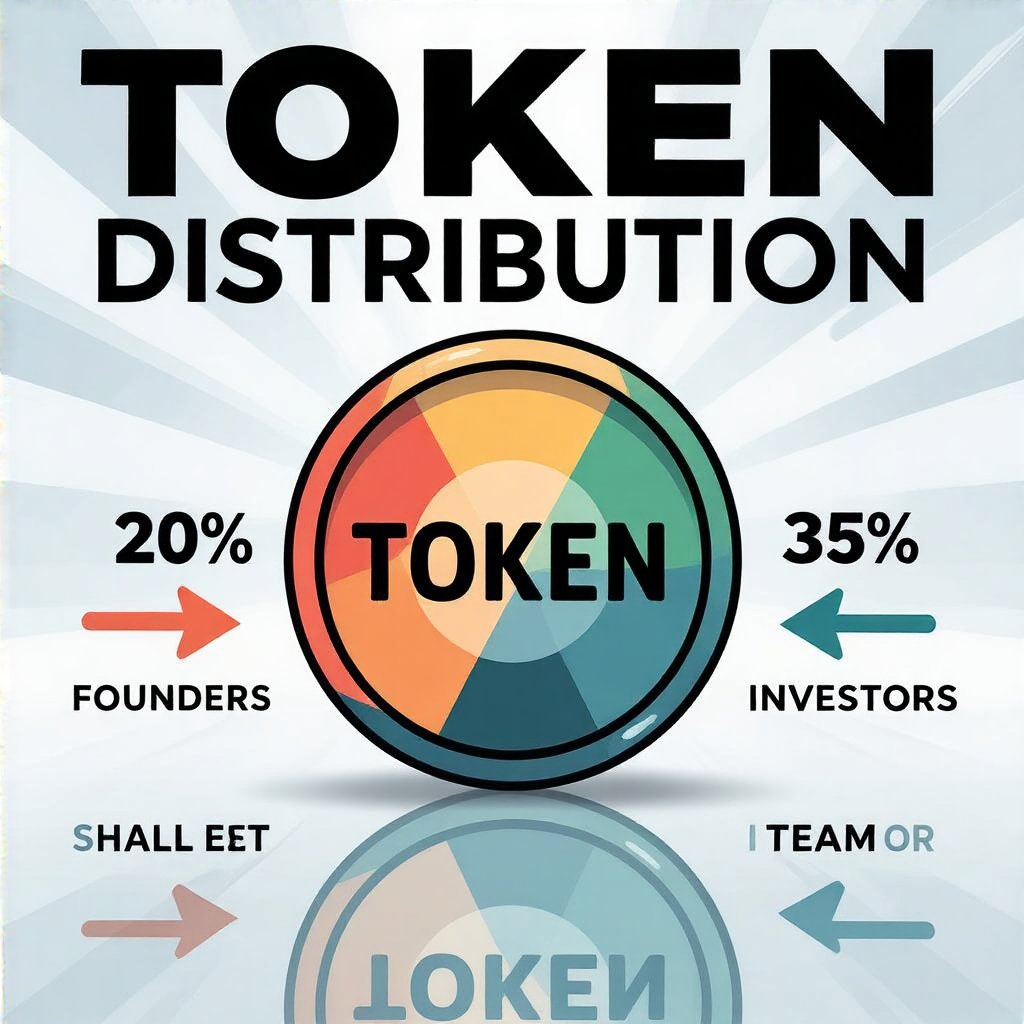

Token distribution is the allocation of tokens to founders, investors, team members, and the community at launch and over time. A fair, transparent plan reduces temptation for unfair grabs and helps prevent dumping that can crash liquidity. For Solana enthusiasts, differences in token standards can influence distribution outcomes; Types of SPL Tokens on Solana provide a useful Solana-specific lens on token design.

Transparent allocation signals sound governance and aligned incentives. If a disproportionate share lands with insiders, the market may penalize the project long before real utility emerges. A clear distribution statement helps investors gauge fairness and long-term value creation.

An essential reference point for readers seeking external benchmarks is tokenomics best practices documented by industry sources, which can be explored for context and depth.

Understanding Vesting Schedules

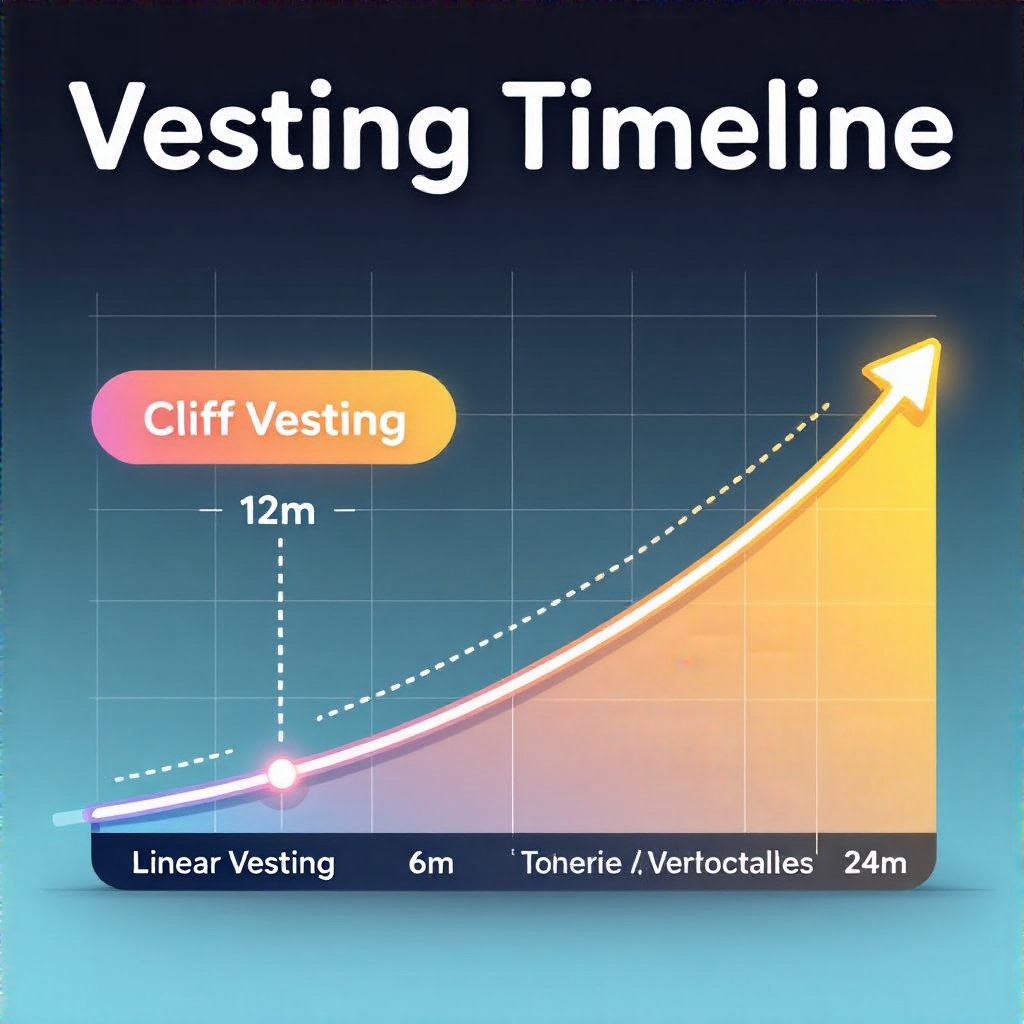

Vesting schedules are structured timelines that gradually release tokens to team members, advisors, or early investors over time. This mechanism is designed to prevent sudden sell-offs that can negatively impact the token’s price. In practice, vesting acts like a security feature for alignment, ensuring long-term participation rather than short-term profit-taking.

Think of vesting as salary paid out in installments instead of a lump sum — it aligns incentives and encourages enduring commitment to the project. For readers conducting thorough due diligence on early-stage projects, consider due diligence techniques that scrutinize vesting timetables, vesting cliff details, and unlock calendars.

Types of Vesting Schedules

There isn’t a one-size-fits-all approach; projects mix schedules to balance incentives and liquidity risk. Common models include:

- Cliff Vesting: Tokens are released after a specific period, often in one chunk after a cliff period (e.g., 6 months).

- Linear Vesting: Tokens are gradually released at regular intervals (monthly, quarterly) over a set duration.

- Hybrid Schedules: Combine cliff and linear vesting for flexible release schedules.

Each model has trade-offs. A robust policy uses a predictable timetable, publicly disclosed unlock dates, and explanations of any accelerated vesting in exceptional circumstances. For security-minded readers, a multi-audit approach ensures the release logic itself is sound; see multi-audit security guidance to reinforce confidence.

The Impact of Proper Tokenomics

A balanced approach to token distribution and vesting schedules can:

- Reduce the risk of early dump attacks that crash liquidity.

- Build long-term community and investor trust through predictability.

- Align the interests of team members with the project’s success.

- Support fairness and stable growth by ensuring accessible token access over time.

When these elements are designed thoughtfully, they reinforce a healthy token economy and clearer governance signals. This is especially important for projects with complex share structures or cross-border investor bases, where transparency becomes a competitive advantage. For readers examining decentralization and governance dynamics, see complementary analyses on decentralization metrics.

Transparency and Reporting

Transparent reporting on token distribution and vesting timelines demonstrates good tokenomics practice. It reassures investors that insiders or whales aren’t disproportionately dumping tokens and that the project is committed to fair growth. Disclosure should include the total supply, breakdown by stakeholder category, vesting quotas, cliff durations, and unlock calendars. For a broader perspective, external benchmarks and audits help elevate credibility.

As you review reports, look for consistency between what’s published and the on-chain reality. A mismatch is a red flag that warrants deeper investigation.

Real-World Risks

Even well-intentioned teams can overlook risks. Poor tokenomics often leads to criticism, price volatility, and eroded trust. A sudden unlock can trigger a cascade of selling pressure if contingency plans are absent. When assessing a project, consider how the team communicates unlocks, updates vesting milestones, and handles exceptions during hard times. For practical context, you can compare governance models and risk disclosures in related cases such as controversial token unlocks in other ecosystems.

For deeper risk context, explore analyses that discuss how token unlocks intersect with security and governance decisions.

Investor Protections

Protect yourself with a disciplined approach to due diligence. Focus on the clarity of the tokenomics report, verified vesting schedules, and consistency between disclosed data and on-chain activity. Where possible, confirm the project publishes regular updates on token unlocks, and watch for any unexplained shifts in supply dynamics. When in doubt, consult the related internal resources that cover governance and decentralization metrics.

Practical Checklist

- Review the token distribution table for founder, investor, advisor, and community shares.

- Verify vesting schedules, cliff periods, and total unlocks with published timelines.

- Look for periodic updates on token unlocks and on-chain activity alignment.

- Avoid projects with opaque or oversized unvested pools that could flood the market.

- Cross-check references with governance and decentralization analyses to assess long-term viability.

FAQ

What is vesting? A schedule that releases tokens over time to prevent sudden selling pressure. Why is transparency important? It builds trust and reduces information asymmetry between project teams and investors. How can I validate token distribution? Read the published tokenomics, verify on-chain unlocks, and check consistency with public disclosures.

For more in-depth reading, see the related articles on tokenization, governance, and security practices linked throughout this guide.