WasabiX ($WASABI) Review: A Data-Driven Look at Its Legitimacy, Risks, and Long-Term Potential

What Is WasabiX: An Introduction

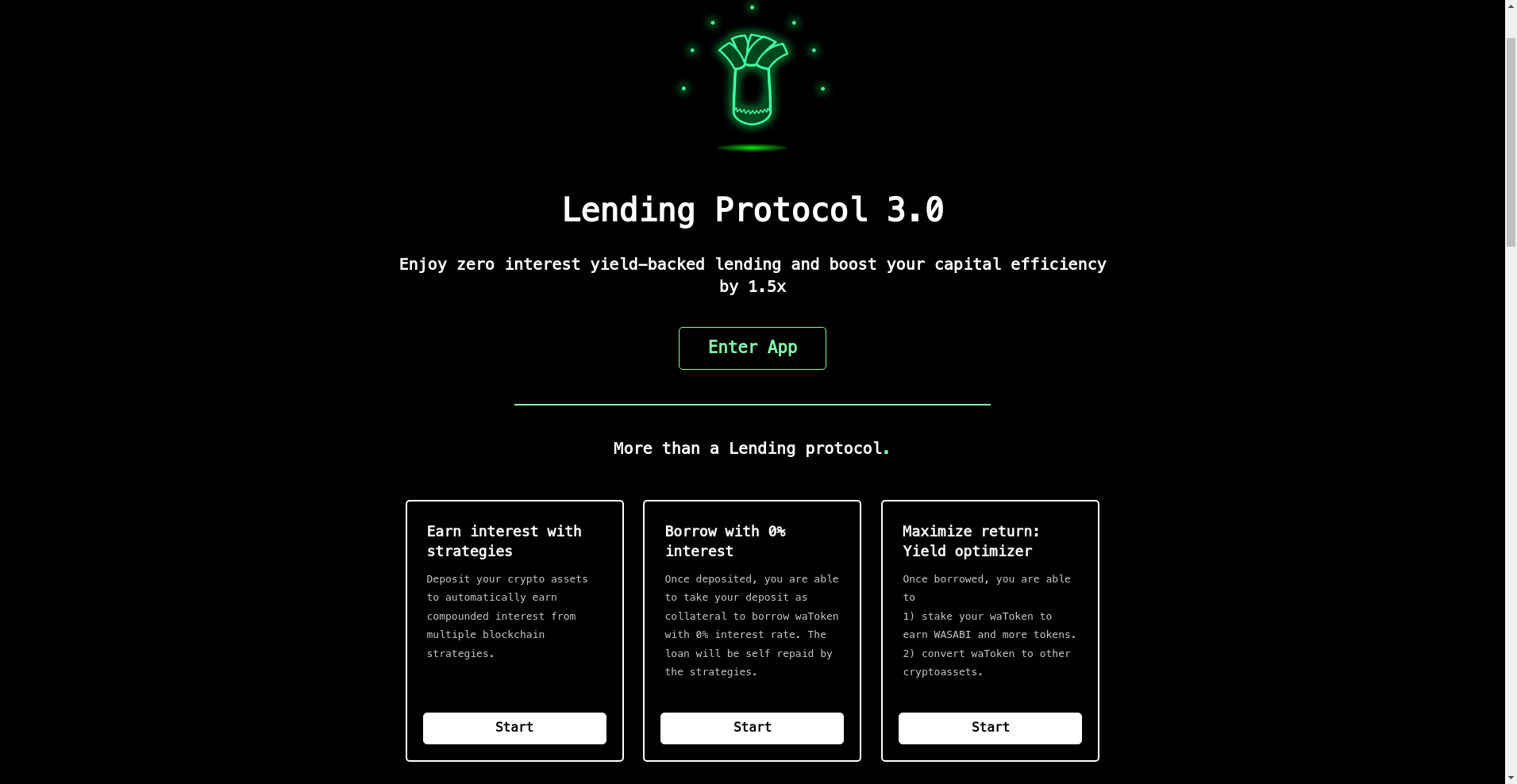

WasabiX is a decentralized finance (DeFi) protocol positioned as an advanced lending platform built around the concept of capital efficiency and yield optimization. According to its official materials, WasabiX offers a multi-faceted suite of features, including auto-compounding deposits, zero-interest borrowing, and yield strategies designed to maximize user returns. Its core innovation, the Lending Protocol 3.0, combines traditional lending mechanisms with innovative functionalities like borrowing against future yields and active yield optimization.

The project claims to harness blockchain strategies to generate compounded interest, while enabling users to borrow with minimal or zero interest rates. By integrating these functionalities, WasabiX aims to appeal both to passive yield-seeking investors and more sophisticated traders looking to leverage their crypto assets. This review provides an impartial, data-based analysis of its strengths, vulnerabilities, and potential risks.

The Team and Roadmap Evaluation

One of the foundational elements to assess when evaluating any DeFi project is the credibility of its team and the clarity of its roadmap. As per publicly available information, WasabiX does not list detailed team members or their backgrounds directly on its official channels. The project seems to operate with a certain degree of anonymity, which is common in DeFi but warrants scrutiny.

However, its development milestones and roadmap suggest an ongoing commitment to expanding its platform. Key publicly outlined phases include:

- Launch of Lending Protocol 3.0: Incorporating multiple lending strategies and yield optimization tools.

- Security Audits: Contract audits conducted by reputable firms, which indicates an awareness of security best practices.

- Community Engagement: Illustration of active social media presence via Telegram and Discord, with plans for continuous development.

- Feature Expansion: Roadmap hints at future integrations, including new strategies and possible cross-chain functionality.

While the roadmap indicates ambitious goals, the lack of transparency about the core team and comprehensive development timeline presents some questions about execution reliability. The project’s capacity to deliver promised features hinges on these unpublicized factors, which remain an area of due diligence for potential investors.

Assessing the Security and Integrity of WasabiX

Our evaluation of WasabiX’s security posture is primarily based on the audited reports available from Cer.live and Certik. The audit data reflects an initial assessment, with a focus on the platform’s smart contracts and overall code integrity.

Key findings from the audits include:

- Audited Status: The platform's smart contracts have been verified through formal audits, enhancing its credibility.

- Audit Reports: Available from RDAuditors and Certik, with documented vulnerabilities and fixes addressed.

- Security Score: The Cer.live overall rating is approximately 5.05 out of 10, indicating moderate security assurance but also highlighting areas of concern.

- Known Vulnerabilities: The audits mention incidents and vulnerabilities, but no critical exploits are publicly reported as of now. The presence of incidents on Cer.live suggests ongoing security risks.

- Centralization Aspects: The audit does not specify any outstanding issues with centralization, but the platform's reliance on specific strategies and governance may introduce some risks.

While the platform has engaged reputable auditing firms, the moderate security score and incidents underline the inherent risks associated with smart contract vulnerabilities. Investors should be aware of how to interpret these scores and the ongoing need for vigilance.

A Breakdown of WasabiX Tokenomics

The utility and economic model of the WASABI token are central to understanding its long-term sustainability. Based on available summaries, the token’s detailed macroeconomics are not fully disclosed; however, some key aspects can be inferred:

- Total Supply: Information not explicitly provided in the core data, but typical DeFi tokens vary widely in supply models.

- Inflation/Deflation: No specific token inflation schedule or deflationary mechanics are documented, raising questions about supply dynamics over time.

- Distribution & Allocation:

- Team & Advisors: Unknown percentages, but vital for assessing potential sell pressure.

- Public Sale / Community: Details unconfirmed; ideally, a significant portion should be allocated to community incentives.

- Reserve Funds: Not specified, which affects long-term sustainability.

- Vesting Schedules: No publicly available vesting information, crucial to evaluate team issuance and insider sales risk.

- Token Utility: The roles include governance participation, staking for yields, and possibly fee payments. The exact utility remains to be clarified by the project’s documentation.

In financial terms, the absence of detailed tokenomics transparency makes it challenging to assess potential inflationary risks or value prop stability. A limited supply with well-controlled distribution would bolster confidence, but this information remains lacking. Understanding tokenomics, including inflation and deflation, is crucial for any investor.

Assessing WasabiX's Development and Ecosystem Activity

Monitoring real-world development activity helps separate genuine progress from marketing noise. Based on the available data, WasabiX has conducted multiple security audits and maintains active social channels, which are positive signs of ongoing effort and transparency.

Frequent updates on social media and the presence of functional features—such as yield optimizers and zero-interest borrowing—suggest active development. However, there are no publicly documented recent code releases or community-driven metrics (e.g., GitHub activity, transaction volume) to definitively confirm significant adoption or organic growth.

The platform’s promising technological features hint at potential utility, but without demonstrable traction or substantial user metrics, the ecosystem’s growth remains speculative. Future development milestones and clear roadmap execution will be key indicators of long-term viability. Failure to maintain development could lead to signs of project abandonment.

What Investors Should Know About WasabiX's Legal and Terms Conditions

From the available documentation, no unusual legal clauses or risky contractual provisions stand out. The platform claims to operate transparently, with links to audit reports and technical documentation. However, as with many DeFi protocols, users should scrutinize:

- Potential risks of smart contract bugs or exploits that could lead to loss of funds.

- Vague details regarding the legal jurisdiction and user protections.

- Unclear liability or recourse in case of platform failure or security breach.

Investors should perform due diligence, especially around the absence of comprehensive legal safeguards, before committing assets.

Final Analysis: The Investment Case for WasabiX

WasabiX emerges as an innovative DeFi platform with sophisticated features aimed at maximizing capital efficiency and yield. Its multi-layered lending protocols, zero-interest borrowing, and yield optimization strategies position it as a potentially compelling service for experienced crypto users.

However, the project faces several red flags, primarily the lack of transparency regarding its team, detailed tokenomics, and the moderate security score indicated by audits. While security audits are a positive, their moderate rating and history of incidents call for cautious engagement. Moreover, the absence of demonstrable user traction limits confidence in sustained growth.

In summary, WasabiX’s technological ambitions are promising, but the current risk profile is non-negligible. Investors considering exposure should weigh the innovative features against security vulnerabilities, transparency gaps, and market adoption concerns. Like all emerging DeFi projects, thorough due diligence is essential before allocating significant capital.

Pros / Strengths- Innovative multi-functional lending protocol integrating auto-compounding, yield optimization, and future-yield borrowing

- Audited smart contracts from reputable firms, indicating a baseline of security review

- Active community engagement via social media and ongoing updates

- Potential for high capital efficiency and passive income streams for users

- Lack of transparency about the core team and detailed tokenomics

- Moderate security score with some incidents reported, indicating potential vulnerabilities

- Absence of clear legal protections or dispute resolution mechanisms

- Limited third-party validation or proven user adoption metrics

While WasabiX presents an intriguing blend of innovative DeFi functionalities, potential investors must actively weigh its promising features against substantial uncertainties. The platform’s long-term success depends on transparent development, improved security posture, and broader market acceptance.

Daniel Clark

On-Chain Quantitative Analyst

I build algorithmic tools to scan blockchains for signals of manipulation, like whale movements and liquidity drains. I find the patterns in the noise before they hit the charts.

Similar Projects

-

Bitnium

Crypto Project Review: Is Bitnium a Legitimate DeFi Platform or a Scam? In-Depth Scam Checker & Risk Analysis

-

DeltaHub Community

DeltaHub Community Review: Scam or Legit Crypto? Full Legitimacy Check

-

Lyra Finance

Lyra Finance ($LYRA) Review: A Data-Driven Analysis of Risks & Strengths

-

Flux

Flux ($Flux) Review: Technology, Security & Risks Explored