DeltaHub Community Review: Scam or Legit Crypto? Uncovering All The Red Flags

What Exactly Is DeltaHub Community?

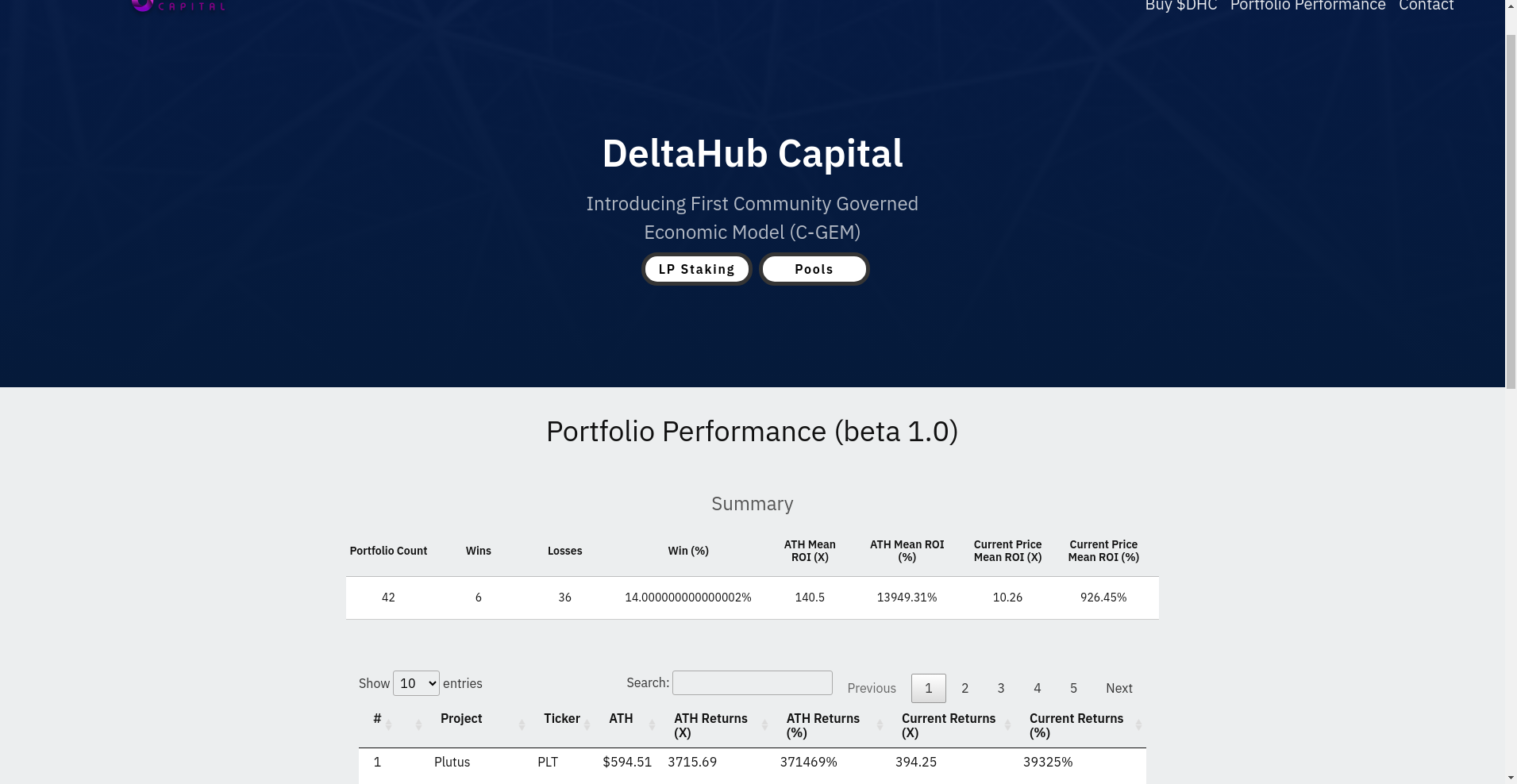

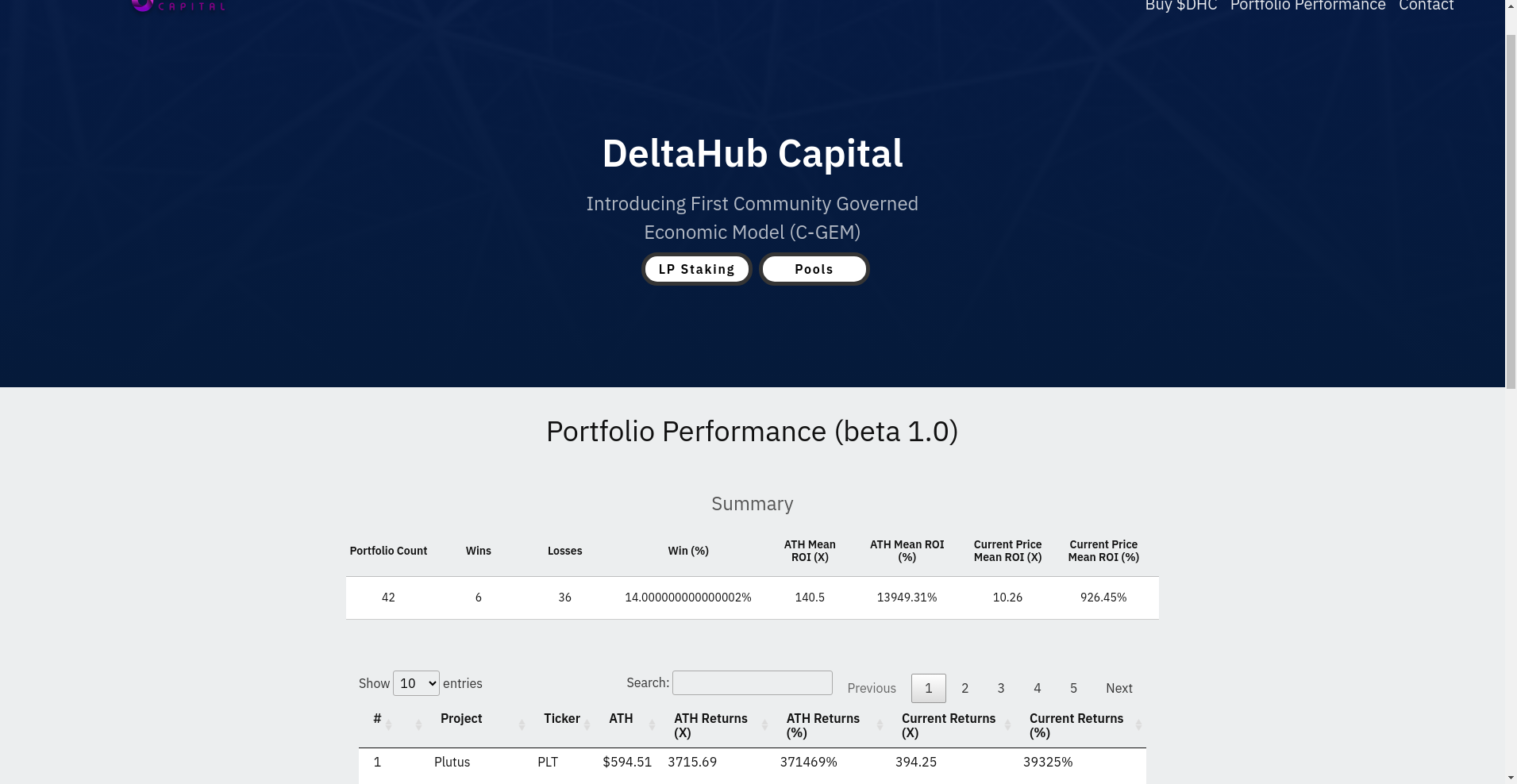

DeltaHub Community markets itself as an innovative platform introducing the "First Community Governed Economic Model (C-GEM)." It promises to foster a vibrant ecosystem where investors, developers, entrepreneurs, and Web 3.0 enthusiasts can collaborate, analyze projects, and partake in a variety of investment activities. According to their promotional material, it combines social features, analysis tools, and financial instruments like staking and pools to create a comprehensive DeFi environment.

However, as part of our crypto due diligence, a thorough investigation is necessary to verify these claims and assess the legitimacy and safety of DeltaHub Community. In this review, we critically analyze their team, security measures, tokenomics, activity levels, and potential red flags to help investors make an informed decision.

Investigating the Founders: A Credibility Check

The first question any serious investor should ask is: Who are the minds behind DeltaHub Community? Unfortunately, available public data provides little insight into their team members. The project’s website and official channels do not list any doxxed founders or key team members.

- Anonymous Leadership: No verifiable identities or professional backgrounds are disclosed, raising immediate suspicion about their credibility.

- Roadmap and Vision: The project talks about advanced features like community governance, data analysis, and staking, but offers no concrete timeline or past achievements to support these claims.

- Community & Social Presence: Active Discord and Telegram channels exist, but these are often used by scam projects to create false engagement and legitimacy.

Summary: The lack of transparency regarding leadership and development history significantly diminishes the project's credibility. An anonymous team does not inherently mean illegitimacy, but it does increase risk, especially in the absence of third-party audits or recognized development backing.

Trust & Security: Analyzing DeltaHub Community's Red Flags

Our security assessment draws mainly on the Cer.live audit, where DeltaHub Community received an overall score of 5.7 out of 10, with a coverage of 80%. The audit was conducted by TechRate, a known auditing firm, and also linked to a separate audit by Zokyo.

- Audit Findings: The audits reveal some vulnerabilities but no critical or exploitable bugs were publicly disclosed. However, the 80% coverage indicates significant parts of the codebase may remain unreviewed.

- Incident Reports: The Cer.live data flags that incidents are present, suggesting potential security issues or exploits in the past.

- Insurance & Bug Bounties: No bug bounty program was active, and insurance coverage appears to be absent, heightening the risk that vulnerabilities could exist or be exploited without recourse.

The overall security rating suggests the project is neither fully trustworthy nor completely insecure, but investors should be cautious, especially given the absence of comprehensive audits and incident reports. It's a red flag that vulnerabilities may remain unpatched, and exploits could still be possible.

Analyzing the DeltaHub Community Token: Supply, Distribution, and Risks

The project mentions a native token, $DHC, which appears to be central to its ecosystem. However, specific details about its tokenomics are scarce, raising concerns about transparency and potential for manipulation.

- Total Supply & Circulation: There is no publicly available data on the total token supply, initial distribution, or vesting schedules.

- Utility & Incentives: The token is implied to be used for staking, governance, and possibly payments within the platform, but clear mechanisms are not disclosed.

- Risks of Dumping & Inflation: Without transparent distribution or vesting, a small team or early investors could dump large holdings on unsuspecting users, causing price crashes.

- Possible Centralization: Lack of clarity hints at central control, increasing the risk of market manipulation.

Given these uncertainties, investors should be wary of sudden token dumps and high inflation risks that are common in projects with opaque tokenomics.

Is DeltaHub Community a Ghost Town? Checking for Real Activity

Our evaluation of the project’s ecosystem activity reveals a stark reality: the platform’s "Portfolio Performance" feature and other supposed engagement tools are currently empty. The data table shows "Showing 0 to 0 of 0 entries," indicating no active projects or updates in their ecosystem at this time.

While the site claims to offer rich discussions, analysis, and community engagement, there’s little evidence of real activity beyond marketing material. The social channels are active, but often such engagement can be artificially inflated by bot accounts or paid promotions.

In addition, the absence of any visible invested projects, active portfolios, or real-time trading data suggests that the platform may be in a very early stage, or possibly a scam project that has not delivered on its promises.

What DeltaHub Community's Legal Documents Are Hiding

An examination of their terms and conditions reveals a few concerning points:

- Vague Disclaimers: The platform emphasizes that all information is for general purposes only, but it also explicitly states that it makes no warranties regarding accuracy or performance, leaving users with minimal legal recourse.

- No Clear Refund or Dispute Resolution: There's no mention of how investor disputes are handled or whether users are protected against losses.

- Potential for Predatory Clauses: The disclaimers heavily favor the platform, asserting that users employ the platform at their own risk, and that the platform is not responsible for any loss, which is typical of high-risk scam projects.

Overall, the legal framework appears to favor the project operators at the expense of investors, a red flag that should not be overlooked.

Final Verdict: Should You Risk Investing in DeltaHub Community?

Based on our investigation, the DeltaHub Community project raises more red flags than red flags. The absence of transparent team information, a mediocre security audit with incident reports, opaque tokenomics, and virtually no active ecosystem activity suggest high risks for investors.

Major Red Flags:

- Anonymous team with no proven track record or credible disclosures.

- Limited scope and coverage of security audits, with known incident flags.

- Unclear tokenomics and risk of token dump or inflation.

- No visible active projects or real-time activity, indicating possible abandonment or scam.

Positive points: The project proposes innovative community governance concepts and offers staking and pools, which can appeal to enthusiasts if the project proved legitimate and active. However, the current evidence does not support these claims.

In summary, exercise caution before considering any investment in DeltaHub Community. Conduct thorough due diligence and avoid rushing into projects lacking transparency, active development, and credible audits. Remember: in the crypto space, skepticism can be your best safeguard.

Jessica Taylor

NFT Market Data Scientist

Data scientist specializing in the NFT market. I analyze on-chain data to detect wash trading, bot activity, and other manipulations that are invisible to the naked eye.

Similar Projects

-

Contrax Finance

Comprehensive Review of Contrax Finance: Crypto Scam Checker & Project Analysis

-

Celer Network

Celer Network ($CELR) Review: A Data-Driven Assessment of Its Tech & Risks

-

VietDoge ($VDOGE)

VietDoge ($VDOGE) Review: Crypto Scam Checker & Project Scam Review

-

ChikoToken

ChikoToken Review: Scam or Legit Crypto? Scam Check & Legitimacy Analysis

-

DEBT RELIEF AI

DEBT RELIEF AI Review - Crypto Project Scam Checker