Trabzonspor Fan Token ($TRAB) Review: A Data-Driven Look at Its Legitimacy and Risks

Project Overview

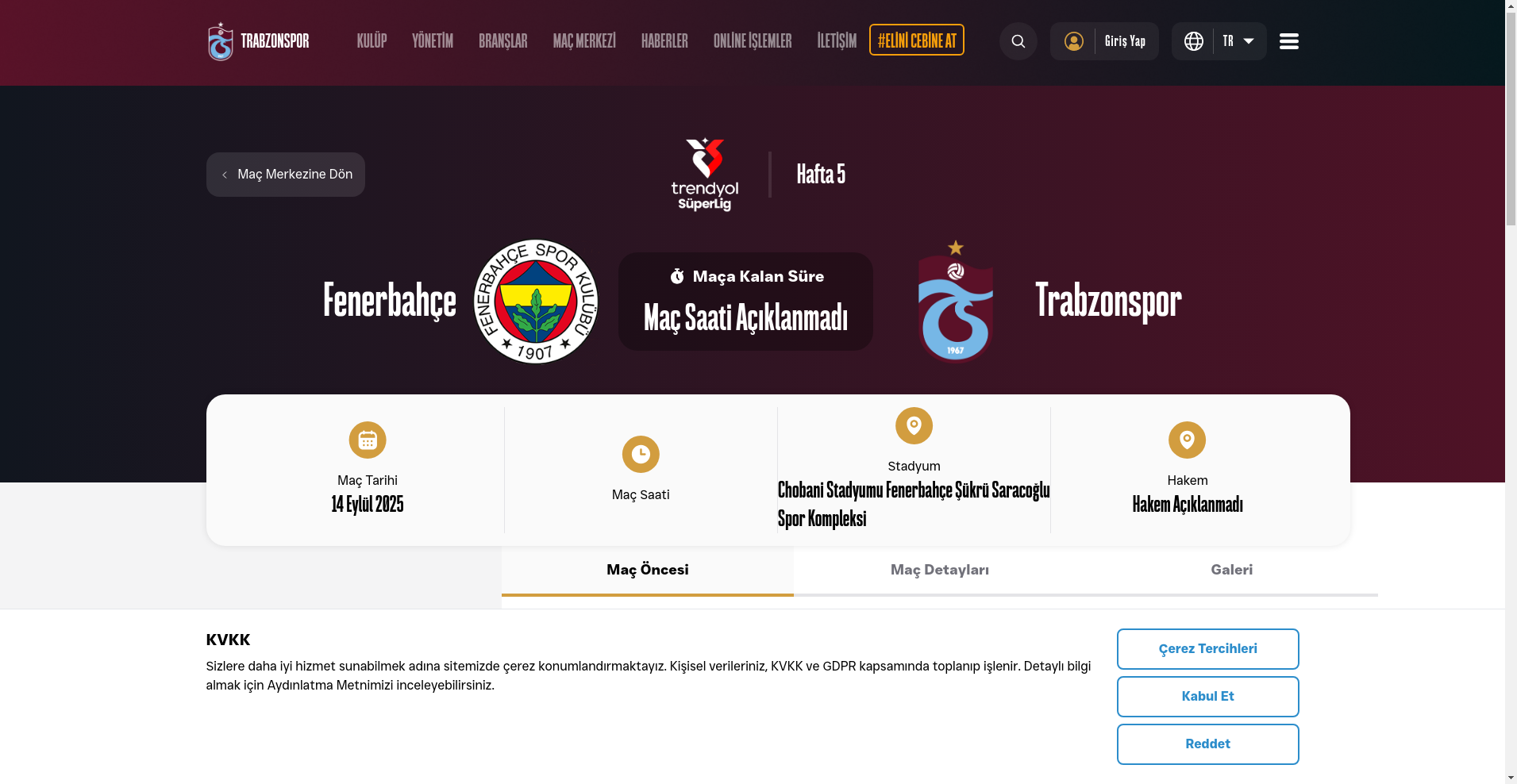

The Trabzonspor Fan Token is a digital asset associated with the Trabzonspor football club, intended to enhance fan engagement through blockchain-based mechanisms. The project appears to aim at creating a digital community of supporters who can participate in club-related activities, voting, or rewards via a dedicated token. According to available audit data, the token's ticker is $TRA.

Based on the data from Cer.live, the Trabzonspor Fan Token exhibits characteristics consistent with many fan tokens issued on third-party platforms, with a total supply of approximately 10 million tokens and a current market cap around $3.38 million. The token trades actively, with a volume exceeding $1.3 million, but its security standing and audit transparency are limited, raising questions about its long-term reliability and credibility. Understanding how to evaluate sports fan tokens used for engagement is crucial for potential investors.

The Team and Roadmap Evaluation

The available data does not definitively specify a dedicated team or detailed roadmap for the Trabzonspor Fan Token project. Most information originates from Cer.live’s audit report, which notes that the token platform lacks comprehensive audits, and platform audits are absent entirely. The audit score indicates significant vulnerabilities, with a rating of just 1.5 out of 10, reflecting poor security practices and high centralization risks.

Furthermore, there are no publicly available details about team members, advisors, or project milestones. The project's roadmap is therefore unclear, and there is no evidence of established development phases or transparent goal-setting. This limited transparency challenges trustworthiness, especially in an environment where security and long-term utility are paramount.

- Absence of a dedicated, publicly verifiable team or advisory board.

- No formal, published development milestones or update schedule.

- Audit scores indicate high vulnerability, with no platform audits performed.

- Lack of community or developer transparency—no active discussions, updates, or verifiable progress.

Overall, the project’s ability to meet its promises and develop in a sustainable way remains uncertain, mainly due to the transparency deficits and poor security posture.

Security and Trust Analysis

As per Cer.live’s security audit, the Trabzonspor Fan Token ($TRA) has not undergone independent platform audits, which is a significant red flag. The audit relevance score is marked as false, and incidents have been recorded, with an audit rating of just 1.5/10. Key findings include:

- Failure to secure smart contracts against common vulnerabilities.

- High levels of centralization, with authority likely controlled by a small group or platform owner.

- Potential issues with token issuance, vesting, and withdrawal controls.

- Lack of bug bounty programs or ongoing security assessments.

This security posture suggests an elevated risk profile for investors or supporters engaging with the token. The absence of any formal external security reviews compounds the potential for exploits or fraud. Understanding how to identify a rug pull is essential in such scenarios.

In terms of trust, limited audit transparency combined with weak security scores diminishes investor confidence. For a blockchain-based fan token, securing community funds and ensuring platform integrity is vital, and current data indicates substantial vulnerabilities.

Tokenomics Breakdown

The Trabzonspor Fan Token ($TRA) offers a typical supply cap of 10 million tokens, but specific details about distribution, initial allocation, or vesting schedules are not publicly detailed. Based on the audit data, key points include:

- Supply Cap: 10,000,000 tokens

- Market Cap: Approximately $3.38 million

- Trading Volume: ~$1.33 million, indicating active trading

- Distribution: Not publicly specified; potential concerns about centralization or pre-sale allocations.

- Utility: Not explicitly detailed but implied to aim at fan engagement, voting, or rewards. Understanding fan token governance mechanisms is key to appreciating their utility.

- Vesting & Utility Risks: Lack of detailed vesting schedules or utility frameworks raises questions about project sustainability and token value retention.

The economic model's sustainability relies heavily on ongoing community interest and security assurances. Given the limited transparency and audit shortcomings, the token could be susceptible to market manipulation or sudden price swings, particularly if large holders or platform operators control significant tokens.

Ecosystem and Development Activity

Public development activity for the Trabzonspor Fan Token appears minimal or non-transparent. The only available data is from the audit report, which signals that the project platform has not undergone comprehensive external security audits. No official roadmap, feature releases, or development milestones have been publicly communicated or verified.

Market activity is active, with reported high liquidity, but the lack of community updates, technological development disclosures, or roadmap progression diminishes trust in its ecosystem viability. The project seems to rely primarily on fan loyalty and club branding rather than technological innovation or active development cycles.

Reviewing the Terms and Conditions

The project’s legal framework appears standard but insufficiently detailed. The audit and platform disclosures lack explicit clauses on user rights, dispute resolution, or detailed privacy policies. Additionally, the absence of platform audits and security assessments suggests potential compliance vulnerabilities, especially in jurisdictions with strict securities or consumer protection laws. Reviewing legal disclaimers in high-risk crypto projects is a vital step for due diligence.

Supporters should exercise caution, as the project’s legal safeguards are not clearly articulated or validated through third-party audits, raising risks of mismanagement, loss of funds, or unauthorized control.

Final Analysis: The Investment Case for Trabzonspor Fan Token

In summary, Trabzonspor Fan Token ($TRA) presents as a high-risk, low-transparency project. While active trading and modest market cap suggest some level of community interest, critical gaps in security, governance, and audit transparency limit its reliability. The absence of a clear development roadmap and verifiable team further compounds the skepticism.

- Pros / Strengths:

- Active trading volume indicating market liquidity

- Association with a major football club, leveraging strong supporter loyalty

- Limited supply cap could favor scarcity if project gains traction

- Cons / Risks:

- Significant vulnerabilities revealed by security audit (score 1.5/10)

- No external platform audits or third-party security reviews

- Limited transparency around team, development roadmap, and governance

- Potential for market manipulation given undisclosed token distribution

- Market volatility driven by fan sentiment rather than fundamental values

Potential supporters and investors should weigh the active trading against the security risks and transparency concerns. Without independent audits and clear project disclosures, the token’s long-term legitimacy remains questionable.

This analysis underscores the importance of rigorous security measures, transparent governance, and verifiable development progress in blockchain projects, especially in the sports fan engagement sector.

Amanda Harris

Technical Security Educator

Security professional passionate about the "human firewall." I translate complex crypto threats into simple, actionable security habits for everyday users.

Similar Projects

-

Bullie

Bullie Review: Scam or Legit Crypto? Cryptocurrency Scam Check

-

CUDIS Ecosystem

In-Depth Review of CUDIS Ecosystem: Crypto Project Scam Checker & Scam Review

-

Contrax Finance

Comprehensive Review of Contrax Finance: Crypto Scam Checker & Project Analysis

-

Sonne Finance

Sonne Finance ($SONNE) Review: Security & Risk Assessment

-

$DONT Crypto

Review of $DONT Crypto Project: Scam or Legit? Crypto Scam Checker & Project Review