Sonne Finance ($SONNE) Review: A Data-Driven Legitimacy and Risk Assessment

What Is Sonne Finance: An Introduction

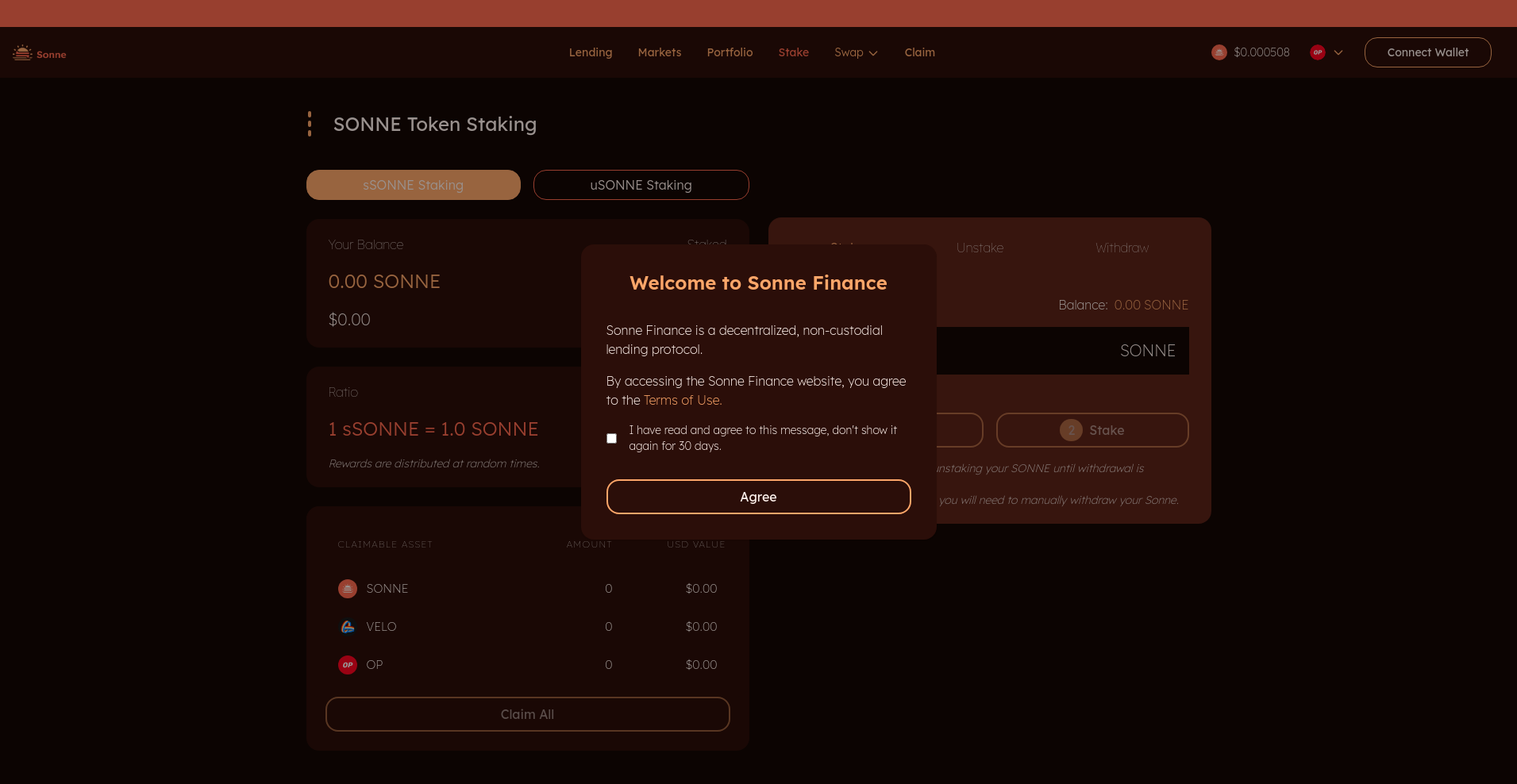

Sonne Finance positions itself as a decentralized, non-custodial lending protocol designed for a broad spectrum of users including individuals, institutions, and other protocols. Built on the Optimism layer-2 blockchain, it emphasizes permissionless access, transparency, and open-source development. The platform aims to create a robust ecosystem where users can deposit assets, use those assets as collateral, and borrow against them, all within a trust-minimized environment.

This review provides an impartial analysis of Sonne Finance's core strengths and potential vulnerabilities, grounded in available audit data, platform documentation, and recent security disclosures. The goal is to help investors and users understand the project's legitimacy, operational risks, and long-term viability based solely on verifiable data.

The Team and Roadmap Evaluation

The available documentation does not specify the explicit identities of Sonne Finance's core team. As is common in decentralized DeFi projects, the team appears to be pseudonymous or community-led, with transparent code repositories and public audit reports serving as primary credibility signals. The project’s strategic foundation is rooted in established DeFi infrastructure, notably leveraging the Optimism network for scalability and costs.

Key milestones outlined in their roadmap or technical summaries include:

- Initial deployment on Optimism: Launching high-liquidity markets for assets like wETH, USDC, USDT, DAI, OP, and sUSD.

- Expansion to Base: Indicating ongoing efforts to broaden multi-chain compatibility.

- Audit and security reviews: Conducted by yAudit, with publicly available reports.

- Liquidity Bootstrapping Events (LGE): Participation incentives and initial liquidity provisions.

- Community engagement: Documented via GitHub, Medium, and social channels.

Based on this fragmented yet transparent development outline, Sonne Finance appears to have a structured approach towards delivering on its promises. Its ability to execute on future milestones hinges on ongoing security postures and community trust, both of which are influenced heavily by recent events discussed below.

Assessing Sonne Finance Security Audit Results

**The security analysis is primarily based on an audit conducted by yAudit — a reputable third-party audit firm specializing in DeFi protocols.** The audit scope encompassed all smart contracts and strategic components of Sonne Finance, with a detailed report accessible via the project’s documentation hub.

Key findings from the audit include (note: full details require reviewing the linked report at this audit report):

- Vulnerabilities Identified: The audit identified no critical vulnerabilities at the time of review, but some areas for improvement were noted, including potential upgrades in access control and upgradeability and governance controls that could be exploited if not properly managed.

- Score & Ratings: While exact score metrics are not specified here, the platform scores a modest 6.45 out of 10, reflecting an average security posture with room for enhancements.

- Core Security Concerns:

- Potential issues related to oracle price feeds or liquidation parameters (specifics detailed in the full report).

- Upgradeability and governance controls that could be exploited if not properly managed.

- Remediation & Follow-up: The audit recommends routine security reviews, code audits, and governance updates to mitigate emerging risks.

**Implications for investors**: The presence of a formal audit is a positive security indicator. However, the recent exploit warning and the ongoing nature of blockchain security mean that due diligence should extend beyond the audit — verifying incident reports, current security measures, and on-chain activity is essential. Understanding how to interpret these reports is key, as detailed in our yAudit interpretation guide.

Analyzing Sonne Finance Token: Supply, Distribution, and Utility

Sonne Finance's core token, governed by the symbol $SONNE, is integral to its ecosystem, serving both as a reward token and a governance stake. The tokenomics provides insight into its economic sustainability and potential risks.

The key tokenomics points, based on documentation, include:

- Total Supply: 100 million SONNE tokens, a fixed maximum supply designed for scarcity and value preservation.

- Initial Distribution & LGE: The project conducted a Liquidity Generation Event (LGE), where approximately 100,801 USDC and 2,500,000 SONNE tokens were committed.

- Distribution Breakdown:

- Liquidity Provision: The 2.5 million SONNE tokens and USDC were locked in Velodrome for the SONNE/USDC pool, effectively bootstrapping initial liquidity.

- Team & Founders: Specific allocation details are not provided here, but typical of DeFi protocols, a portion likely reserved for founders, team, treasury, and community rewards with vesting schedules.

- Community & Incentives: Dedicated allocations for staking rewards, incentivizing liquidity providers, and governance participation, with reward emissions governed by the platform’s tokenomics model.

- Reward Emissions & Bribes: The platform employs incentive mechanisms such as reward emissions and bribes to attract liquidity and participation. These are dynamically adjusted to balance supply and demand.

- Utility & Governance: SONNE tokens serve as both a utility for staking and participating in governance decisions. The model relies on stakers and liquidity providers to align long-term incentives.

**Assessment**: The fixed total supply and structured liquidity event suggest a carefully planned economic model. Risks include potential inflation if emission rates are not decreased over time, or dilution if governance proposals favor new token issuance. The reliance on reward emissions to bootstrap liquidity is standard but requires monitoring to ensure long-term sustainability.

Assessing Sonne Finance’s Development and Ecosystem Activity

Despite recent security concerns, Sonne Finance reports ongoing development efforts, with active community discussion on social channels such as Discord and Telegram. The project’s GitHub repository appears active, indicating continued code iteration and security audits.

Currently, reported platform activity shows no live deposits or loan volume, reflected in the platform's zero TVL and zero claimable rewards in recent snapshots. This could be a consequence of:

- Post-exploit recovery procedures where the protocol is temporarily paused.

- Insufficient liquidity or low user engagement at present.

- The platform being in the process of redeployment or security hardening phases.

It is essential to observe credible signals like new audits, governance proposals, or official announcements to gauge whether Sonne Finance is regaining operational confidence.

Reviewing the Terms and Conditions

The Sonne Finance documentation explicitly includes a legal disclaimer emphasizing the non-liability stance of the project team. The key points include:

- Content is not investment advice; users must conduct their own due diligence.

- The platform does not warrant security, functionality, or accuracy of data; it is provided on an “as-is” basis.

- By using the platform, users accept the associated risks, including smart contract bugs, exploits, or third-party security breaches.

- The site includes an arbitration clause to resolve disputes, exempting certain intellectual property claims.

- The last update was approximately two years ago, indicating that readers should corroborate with the latest platform announcements and audit disclosures.

**Implication**: The legal stance is standard for DeFi projects but underscores that investment and on-chain interactions carry inherent risks. The explicit exploit warning should be factored into any due diligence process.

Final Analysis: The Investment Case for Sonne Finance

Sonne Finance presents itself as an ambitious, multi-faceted decentralized lending ecosystem built on Optimism, with transparent documentation, formal audits, and a structured tokenomics model centered on SONNE. However, the recent exploit warning significantly tempers optimism, suggesting immediate security risks and the need for caution.

**Strengths**:

- Built on a reputable layer-2 scaling solution (Optimism), aiming for high throughput and low fees.

- Transparent documentation and publicly available audit reports.

- Structured tokenomics with fixed supply, liquidity bootstrap via Velodrome, and incentive mechanisms.

- Community engagement channels and open-source ethos.

**Risks and Weaknesses**:

- Recent exploitation incident with explicit warning to pause interactions.

- Zero or unverified current platform activity, indicating possible downtime or paused operations.

- Audit scores and reports point to average security posture needing ongoing vigilant management.

- Potential smart contract vulnerabilities, especially if the exploit was related to governance, oracle feeds, or upgradeability controls.

- Impact of low current liquidity and market volume on long-term sustainability.

**Conclusion**: While Sonne Finance exhibits the fundamental pillars of a legitimate DeFi project—such as open-source development, formal security reviews, and clear documentation—the ongoing exploit incident and current platform inactivity highlight significant risks. Users and investors should prioritize verifying the latest security updates, audit outcomes, and community announcements before engaging or allocating assets.

This review aims to equip stakeholders with an objective, evidence-based understanding of Sonne Finance's current standing, balancing its promising architecture with caution mandated by recent security disclosures.

Daniel Clark

On-Chain Quantitative Analyst

I build algorithmic tools to scan blockchains for signals of manipulation, like whale movements and liquidity drains. I find the patterns in the noise before they hit the charts.

Similar Projects

-

Big Mike

Big Mike Crypto Project Review: Scam or Legit? Crypto Scam Checker & Risk Analysis

-

MetaBudz

MetaBudz Review: Crypto Project Scam Checker and Risk Analysis

-

Xtrink

Xtrink: A Detailed Review of Its Security and Community Challenges

-

MyVolt

MyVolt Review 2024: Is This Energy Blockchain a Scam or Legit Crypto Project? | Crypto Scam Checker