Tectonic ($TONIC) Review: A Data-Driven Look at Its Legitimacy and Risks

What Is Tectonic: An Introduction

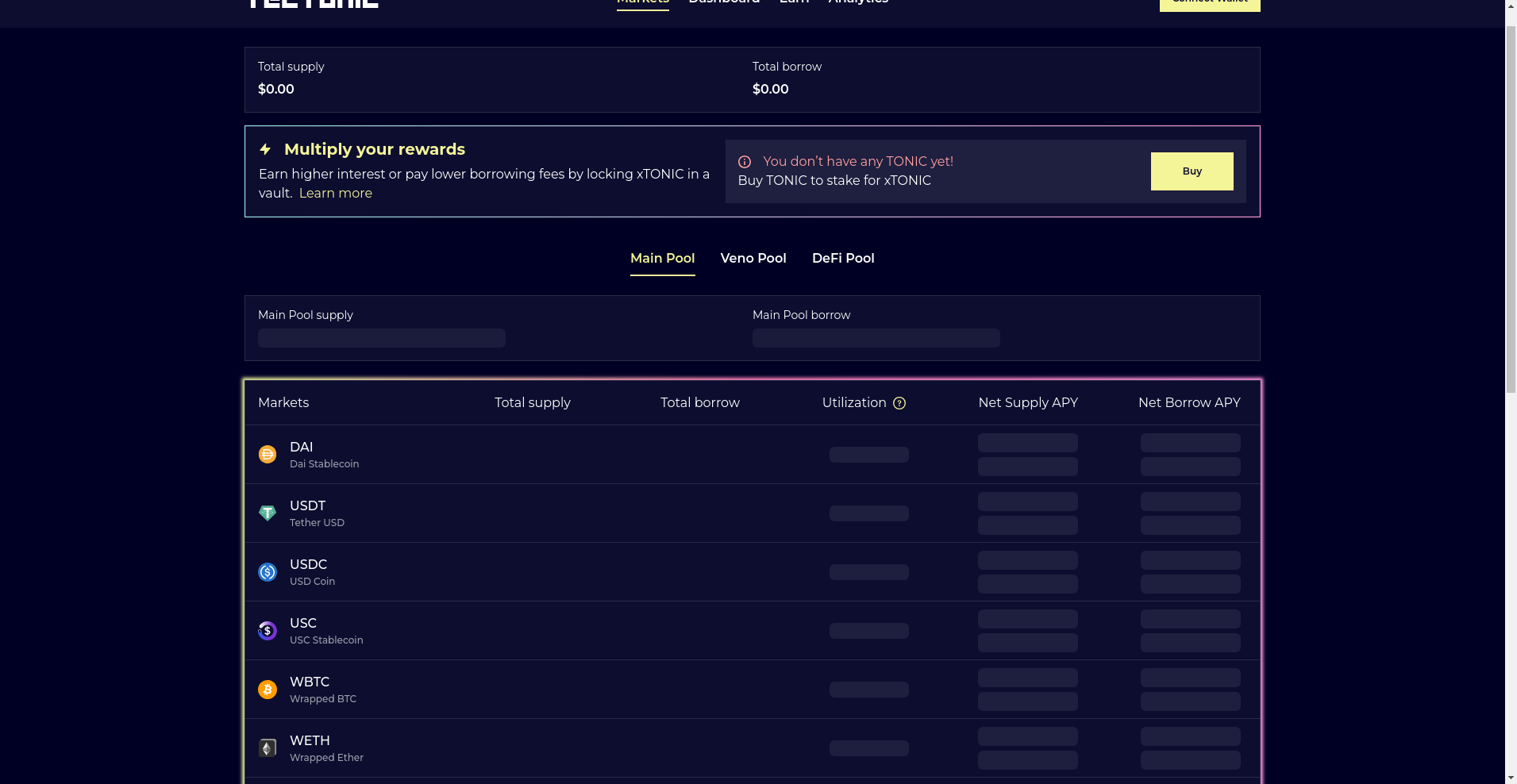

Tectonic is a decentralized, cross-chain money market protocol positioned within the DeFi sector. Its core proposition involves offering users the ability to earn passive yields on their holdings and access instant, collateralized loans in a non-custodial manner. The project emphasizes interoperability, smart contract automation, and community governance, highlighting its alignment with foundational DeFi principles.

Positioned as a significant player within the decentralized lending and borrowing landscape, Tectonic aims to balance transparency with user-centric features. Its primary instruments are liquidity pools where users deposit assets to earn returns, and a native governance token, $TONIC, which entitles holders to participate in protocol decisions and staking rewards. This review provides an impartial analysis of Tectonic's strengths, vulnerabilities, and long-term potential, grounded in publicly available data and technical audits.

The Team and Roadmap Evaluation

While detailed information about Tectonic's core team is limited in the provided data, the project's online presence suggests that it operates in collaboration with established audit firms, such as SlowMist, which conducted security assessments. The emphasis on open-source code and cross-chain compatibility indicates a decentralized development approach, likely involving multiple contributors or firms rather than a single centralized team.

Key milestones outlined by the project and supported by audit reports include:

- Smart Contract Audits: Multiple audits conducted by SlowMist, covering core modules and staking components [Audit Report].

- Community Building: Ongoing efforts to expand user engagement, with platforms for governance participation and liquidity provision.

- Insurance Fund Development: A planned safety mechanism intended to protect users in case of protocol undercollateralization, funded by interest payments. This feature is crucial for mitigating risks in DeFi.

- Product Enhancements: Continuous updates to increase cross-chain support, UI/UX improvements, and new market listings.

While the project demonstrates a clear roadmap emphasizing security and ecosystem expansion, the nascent nature of its development and the absence of publicized team credentials warrant caution. Its ability to meet ambitious milestones depends on sustained community support and effective security management.

Assessing the Security and Integrity of Tectonic

Based on the available Cer.live audit report, Tectonic's smart contracts have been reviewed with a focus on vulnerabilities, security measures, and overall robustness. The analysis reveals several noteworthy points:

- Audit Coverage & Score: The audit covers approximately 50% of the platform's functions, with certain modules pending further review. The overall security rating is moderate, indicating room for improvement.

- Incidents & Vulnerabilities: The report indicates that some incidents have been identified; however, detailed exploit conditions or critical flaws are not explicitly documented here. The presence of ongoing bug bounties suggests active vulnerability hunting.

- Core Security Assurances: The project employs standard measures such as multi-signature wallets, governance controls, and code audits aimed at minimizing risks.

- Insurance & Safety Nets: The introduction of a planned insurance fund, funded by a percentage of borrower interest, could bolster user confidence. The fund's efficacy depends on proper implementation and management.

While the audit provides a foundational overview, the absence of a comprehensive platform audit and limited incident disclosure implies that potential investors should remain cautious. Runtime security depends heavily on ongoing audits, bug bounty initiatives, and community vigilance. The current measures, though aligned with industry standards, do not fully eliminate risks inherent to DeFi protocols.

A Breakdown of Tectonic Tokenomics

The native token, $TONIC, serves as the governance and staking utility within the ecosystem. Its economic model influences the platform’s sustainability, security, and attractiveness to investors and community members.

- Total Supply: 500,000,000,000,000 TONIC tokens, a notably high figure that has implications for inflation and token value. This high supply can be a considerable factor in crypto token supply and inflation risks.

- Market Cap & Price: Approximately $8.1 million with a circulating supply of 261.3 billion tokens; trading volume stands around $13,950, indicating relatively low liquidity and trading activity.

- Distribution & Vesting: Details on initial allocation, vesting schedules, and release mechanisms are not explicitly provided, raising questions about centralization and inflationary pressures.

- Token Utility:

- Governance rights—users can influence protocol parameters.

- Staking for community insurance and security enhancement.

- Potential rewards from staking pools and liquidity provision.

- Inflation & Supply Dynamics: The large supply suggests possible inflationary risks, especially if new tokens are continuously minted or if vesting schedules are aggressive. Without explicit deflationary mechanisms, long-term value appreciation faces significant hurdles.

In sum, the tokenomics appears geared towards incentivizing community participation and security, but the vast token supply and limited trading volume present potential risks of dilution and low market traction. These factors could impact the value stability and incentivize speculative behavior rather than sustainable ecosystem growth.

Assessing Tectonic's Development and Ecosystem Activity

Analysis of Tectonic’s ecosystem activity indicates a modest but ongoing development effort. The project has conducted multiple security audits, and its smart contracts are live on the blockchain with a tangible market presence, including a market cap of roughly $8 million.

Trading volume remains relatively low (~$13,950 over the recent period), reflecting limited liquidity and community engagement at present. However, the active bug bounty program and the transparent audit reports are positive signs of a security-conscious approach.

Community engagement initiatives—such as outreach, governance participation, and cross-chain support—are likely still in early phases. Future development progress will depend on increasing user adoption, deeper protocol integrations, and successful implementation of safety measures like the planned insurance fund.

The Fine Print: Analyzing Tectonic's Legal Framework

Based on the available documentation, there are no explicit mentions of complex legal clauses or disclaimers that might pose unique risks. The project follows standard DeFi legal structures typical of open-source, non-custodial protocols. There is no evidence of controversial clauses or conditions that could undermine investor protection.

However, users should be aware of the general risks linked with unregulated DeFi protocols, including smart contract vulnerabilities, liquidity risks, and the absence of traditional legal recourse. The planned insurance fund aims to mitigate some specific risks, but its effectiveness remains to be seen.

Final Analysis: The Investment Case for Tectonic

Overall, Tectonic presents itself as a technically aligned, open-source DeFi platform with a focus on cross-chain interoperability, active community participation, and security through audits. However, its relatively small market cap, limited trading volume, and still-developing security infrastructure introduce notable risks.

Investors should consider the following before engaging:

- Pros / Strengths:

- Decentralized, non-custodial lending and borrowing platform with cross-chain support.

- Active security audits and bug bounty programs enhance trustworthiness.

- Community governance via $TONIC token empowers user participation.

- Plans for insurance funds could increase protocol resilience.

- Cons / Risks:

- High token supply with low liquidity may lead to value depreciation.

- Partial audit coverage; potential undisclosed vulnerabilities remain.

- Pseudo-centralization risks if token distribution is uneven or if vesting is not transparent.

- Dependent on future implementation of safety mechanisms like the insurance fund.

- Inherent risks typical of DeFi, including smart contract exploits, impermanent loss, and regulatory uncertainties.

In conclusion, Tectonic exhibits promising DeFi features underpinned by an audit-aware security approach, but its early-stage status and economic design impose cautionary considerations for potential users and investors. Due diligence is essential, and continuous monitoring of the project's development and security updates is recommended to assess its evolving legitimacy and risk profile.

Daniel Clark

On-Chain Quantitative Analyst

I build algorithmic tools to scan blockchains for signals of manipulation, like whale movements and liquidity drains. I find the patterns in the noise before they hit the charts.

Similar Projects

-

Quest Life

Quest Life ($QLIFE) Review: Analysis of Security & Abandonment

-

Gremly (The Meme King)

Review of Gremly: Is This Meme Coin a Scam or Legit? Crypto Project Scam Checker

-

$BUIDL Official

$BUIDL Official ($BUIDL) Review: Risks and Insights for 2024

-

DeFiAI

DeFiAI Review: Scam Check & Legitimacy Analysis of the Dead Crypto Project