Synthetix (SNX) Review: A Data-Driven Look at Its Legitimacy and Risks

What Is sUSD: An Introduction

sUSD is a core stablecoin in the Synthetix ecosystem, primarily used to facilitate trading, staking, and liquidity provision within the decentralized derivatives and synthetic assets platform. Built as an algorithmic stablecoin, sUSD aims to maintain its peg roughly at $1, providing a reliable medium of exchange and collateral within the protocol.

This review presents an impartial analysis of sUSD's strengths and vulnerabilities based on available audit reports, tokenomics, security evaluations, and ecosystem developments. The primary focus is to assess the project's legitimacy, examine its risk factors, and determine its long-term viability within the rapidly evolving DeFi landscape.

The Team and Vision Behind sUSD

The Synthetix project was initiated by a team associated with offering decentralized synthetic asset and derivatives platforms on Ethereum. While specific team members' backgrounds range from experienced DeFi developers to strategic advisors, much of the core team operates publicly or is affiliated with the broader Synthetix community. The project’s development history emphasizes innovation, with a strategic focus on scalability, security, and user experience.

Key milestones in their roadmap include:

- 2018: Launch of initial stablecoin mechanisms (Havven founders).

- 2019: Deployment of Synthetix v2, supporting synthetic assets, governance, and staking.

- 2019-2021: Transition to Layer 2 solutions like Optimism to improve scalability.

- 2025 (Q2-Q3): Return to Ethereum Mainnet with a new perps (perpetual futures) exchange architecture, emphasizing user experience and security.

- Upcoming: Integration with mainstream financial instruments, enhanced derivatives trading, and ecosystem expansion.

Overall, the team’s ability to execute promises hinges on rolling out complex derivatives features and maintaining protocol security — a challenge given the ambitious scope and prior upgrades. For a deeper understanding of future plans, an analysis of the Synthetix revised roadmap would be beneficial.

Assessing the Security and Integrity of sUSD

This analysis is primarily based on the Cer.live audit report, which evaluates the Synthetix protocol’s smart contracts. Despite the absence of multiple audits at the platform level, several critical findings are relevant:

- Audit Coverage: Approximately 80%, indicating that core code underwent significant inspection, with ongoing bug bounty programs (Immunefi).

- Vulnerabilities: Certain incidents or vulnerabilities were flagged, but no critical exploits or backdoors were publicly recorded. The protocol’s design minimizes operational risks, leveraging Ethereum’s security model.

- Vulnerabilities & Risks: Noted issues include potential re-entrancy risks, upgrade process risks, and dependence on multi-sig control for governance functions. The protocol is not fully platform-audited, increasing the importance of future comprehensive security reviews.

- Centralization Concerns: While core contracts are audited, governance and upgrade mechanisms involve multi-sigs and permissioned control points, which pose centralization risks if compromised.

- Implications for Investors: Relying on a limited audit scope should prompt caution; security remains robust but not infallible. Users must be aware of residual smart contract risk, especially given the complex nature of derivatives protocols.

In sum, while the protocol demonstrates rigorous effort in security, the high-stakes nature of derivatives trading and limited audit coverage warrant ongoing oversight. Investors should monitor audit updates and community assessments.

A Breakdown of sUSD Tokenomics

The economic model of sUSD hinges on its peg stability and its utility within Synthetix. The tokenomics of sUSD demand careful scrutiny to evaluate sustainability:

- Total Supply: ~35.58 million sUSD tokens in circulation, as per the latest data.

- Market Cap: Approximately $31.4 million, with recent slight fluctuations in price (~$0.88).

- Price Dynamics: The token has experienced recent declines (~-40%) reflecting broader market sentiment or protocol-specific issues.

- Utility: sUSD is used as collateral for minting synthetic assets, for staking in pools like 420, and as a trading pair for derivatives.

- Incentives & Rewards: sUSD staking pools incentivize liquidity provision, with rewards in SNX tokens and native platform benefits.

- Token Distribution & Vesting: Details on initial issuance, VC or team allocations, and vesting schedules are sparse, raising questions about centralization risk if large early holders exist.

- Economic Sustainability: The peg stability depends heavily on collateral management, market liquidity, and the protocol’s ability to absorb shocks. Past peg deviations (e.g., SIP-420 adjustments) indicate ongoing efforts to maintain peg integrity amid market volatility.

Overall, the economic model appears designed for use within a sophisticated derivatives ecosystem but carries inherent risks typical of algorithmic stablecoins, especially in liquidity or market shocks.

Assessing Synthetix’s Development and Ecosystem Activity

Recent development activity indicates a highly active ecosystem, especially following the major move back to Ethereum Mainnet in 2025. The protocol’s quarterly updates highlight significant progress on:

- Mainnet Relaunch: Transition from Layer 2 to full Ethereum mainnet deployment, aiming for enhanced security and institutional appeal.

- Perpetual Futures Launch: Development of orderbook-based trading with off-chain matching, designed for professional traders requiring advanced infrastructure.

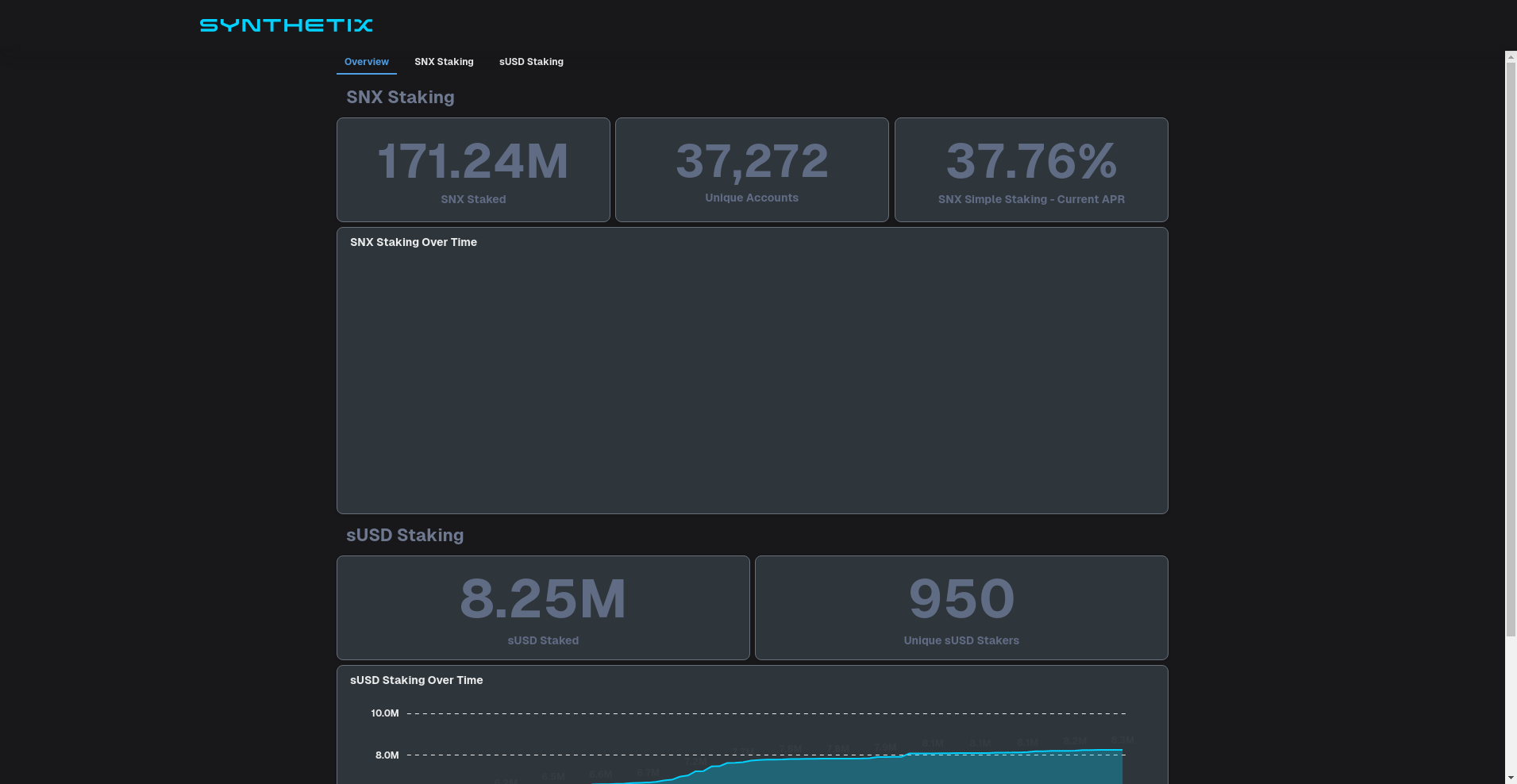

- Staking & Incentives: Introduction of the 420 Pool with multi-million SNX rewards, enabling high-yield participation in protocol health.

- Community Engagement: Active governance via SIP proposals, community votes, and participation programs like early access codes, indicating vibrant community oversight.

While many features are in deployment or testing phases, the ecosystem’s overall momentum and technical sophistication suggest a project committed to consistent innovation and growth.

The Fine Print: Analyzing sUSD’s Terms

The legal framework surrounding Synthetix emphasizes decentralization and user sovereignty. The terms include:

- User Agreement: Users must accept comprehensive terms of service, acknowledging the risks inherent in DeFi and derivative trading.

- Risk Disclaimers: Participation is at user’s own risk, and the protocol is provided “as is,” emphasizing the community’s responsibility for security and compliance.

- Legal & Jurisdictional Risks: The protocol restricts access from certain jurisdictions (e.g., North Korea, Iran, sanctioned regions) due to legal liabilities, which could impact global accessibility.

- Liability & Indemnification: Users release claims against Synthetix DAO and agree to indemnify the project in case of losses stemming from protocol use.

- Regulatory Uncertainty: Given the evolving nature of DeFi regulations, users should consider jurisdictional legalities before participation.

No unusual clauses were found beyond standard risk disclaimers common in DeFi projects. However, centralization controls via multisig and protocol upgrade processes could pose future concerns if compromised.

Final Analysis: The Investment Case for sUSD

Based on the gathered data, sUSD and the broader Synthetix ecosystem present a compelling yet complex proposition. Its strengths include a robust security posture (albeit with some limitations), a well-established community, ongoing product upgrades, and a clear strategic pivot back to Ethereum Mainnet, promising enhanced security and developer experience.

However, notable risks must be acknowledged:

- Smart Contract Risks: Despite audits, residual vulnerabilities and the complexity of derivatives protocols pose potential security threats.

- Economic Model Risks: Algorithmic peg stability mechanisms are susceptible to market shocks, liquidity crises, and collective behaviors that could destabilize sUSD.

- Centralization & Governance Risks: Critical control points, including multisig and upgrade procedures, could be exploited or lead to governance capture.

- Regulatory Risks: Uncertain legal landscape for derivatives and stablecoins could impact operations or user access in various jurisdictions.

Conversely, the project’s ongoing innovation, active security audits, and community participation support its legitimacy in the DeFi space. Its move to improve user experience and contrive high-performance trading infrastructure signal a focus on viability and user adoption, which are essential for long-term success.

Informed investors should consider sUSD as a potentially strategic component of a diversified DeFi portfolio, with the understanding of the inherent technical and regulatory uncertainties involved. The project’s future hinges on continued security diligence, ecosystem expansion, and regulatory navigation.

David Martinez

Quantitative Risk Modeler

Quantitative analyst focused on crypto. I cut through the hype by modeling tokenomics and risk from a purely mathematical standpoint. If the numbers don't work, nothing else matters.

Similar Projects

-

MBXAU

In-Depth Review of MBXAU Crypto Project: Scam Checker & Detailed Analysis

-

Contrax Finance

Comprehensive Review of Contrax Finance: Crypto Scam Checker & Project Analysis

-

Possum Labs

Possum Labs Review: Scam or Legit Crypto? Full Investigation

-

Boa Hancock Inu (BOAINU)

Crypto Project Review: Is Boa Hancock Inu a Scam or Legit? Comprehensive Scam Checker

-

Convex Finance

Convex Finance ($CVX) Review: Legitimacy, Risks & Long-Term Potential