SpiritSwap ($SPIRIT) Review: A Data-Driven Legitimacy and Risk Assessment

Project Overview

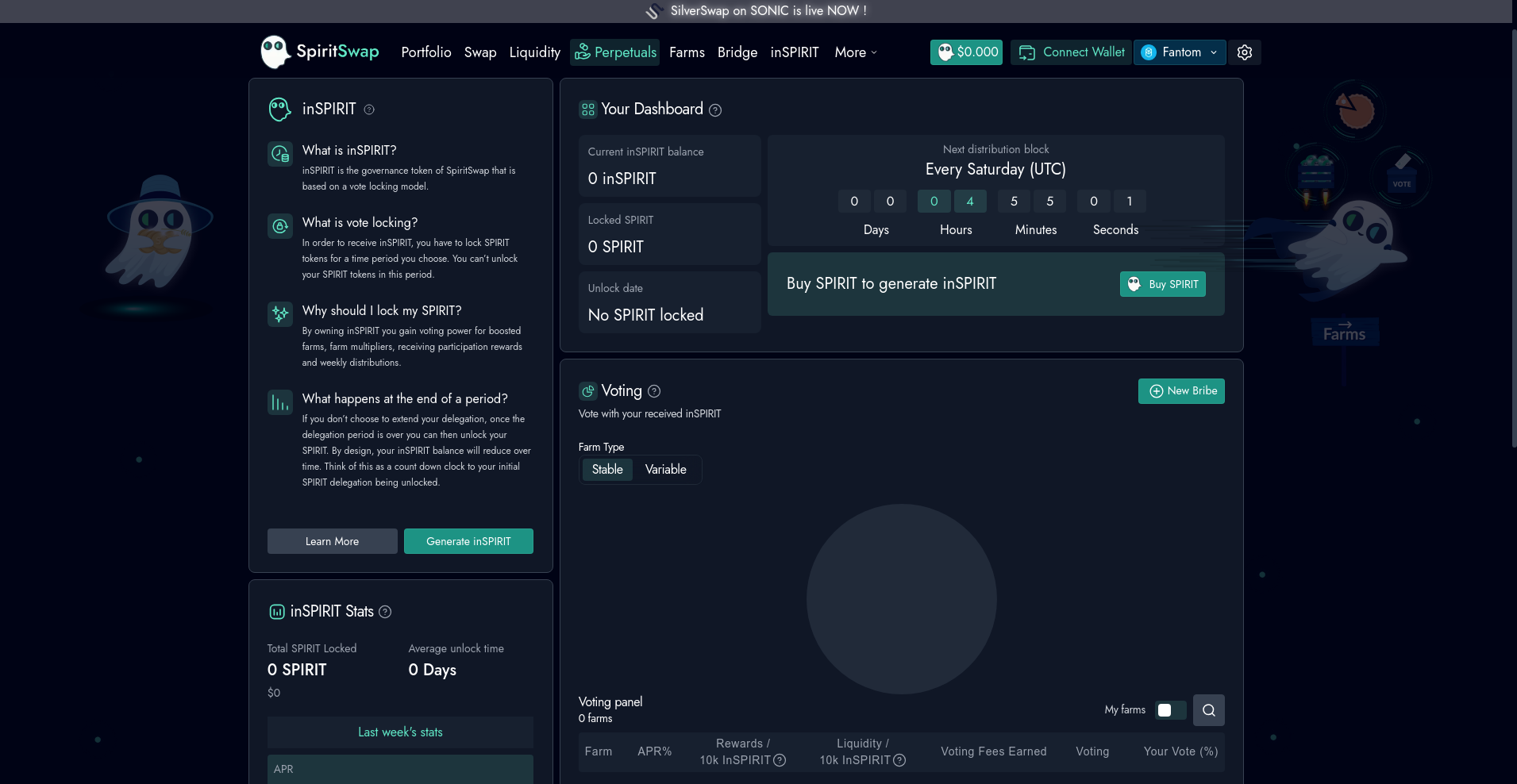

SpiritSwap is a decentralized finance (DeFi) project operating on the Fantom Opera Chain, primarily functioning as a decentralized exchange (DEX) inspired by Uniswap V2 but evolving into a more feature-rich platform. Its core offerings include token swapping, liquidity provision, yield farming, perpetual trading, token bridging, and a governance system centered around its native token, $SPIRIT.

The project aims to combine high-speed transactions with innovative DeFi features such as concentrated liquidity, dynamic fees, and modular plugins to enhance capital efficiency and user engagement. SpiritSwap also emphasizes interoperability via its bridge functionality and supports ecosystem expansion through partnerships like SilverSwap on SONIC. This review provides an impartial, evidence-based assessment of its strengths, weaknesses, security posture, and long-term risks.

The Team and Roadmap Evaluation

Based on publicly available data, the SpiritSwap team’s specific identities are not prominently disclosed, which is common within decentralized projects. However, the platform has engaged external auditors, including MixBytes, PeckShield, and Zokyo, indicating a degree of security diligence. These audits help mitigate common smart contract risks, although no detailed audit summary is provided here.

- Key Milestones:

- V2 core architecture inspired by Uniswap, with ongoing upgrades.

- Integration of Algebra-inspired features such as concentrated liquidity, dynamic fee structures, and plugins.

- Introduction of inSPIRIT as a governance and utility token.

- Deployment of bridge solutions to facilitate cross-chain asset transfer.

- Partnerships with centralized exchanges (Gate.io, MEXC, Hotbit, Poloniex).

- Roadmap Feasibility: The project's phased upgrades and strategic integrations suggest active development. The presence of audited smart contracts and external analytics indicates transparency. Nonetheless, the lack of detailed public team credentials or development timelines introduces some uncertainty regarding execution capabilities.

In summary, while the technical foundation and audit involvement point toward a credible project, the team’s anonymous nature warrants cautious optimism, especially regarding long-term delivery of promised features.

Security and Trust Analysis

Our analysis relies on the Cer.live audit report for SpiritSwap’s smart contracts. The audit coverage is comprehensive at 100%, with three reputable auditors: MixBytes, PeckShield, and Zokyo. The audits scrutinize core contracts for vulnerabilities such as reentrancy, overflow, price manipulation, and centralization risks.

- Audit Findings: All reports indicate a clean security posture with no critical vulnerabilities reported at the time of audit.

- Vulnerabilities or Incidents: The Cer.live data notes that incidents exist, but no active security breaches or exploits are documented here.

- Centralization Risks: No evidence suggests significant centralization points; however, governance tokens like inSPIRIT introduce governance attack vectors if not managed properly.

- Insurance & Bugs: The platform has no ongoing bug bounty programs, but it maintains active audits and insurance coverage, which can mitigate some operational risks.

Overall, the audit results support a baseline level of security, but as with all smart contract platforms, vulnerabilities may emerge over time. The reliance on third-party audits, while standard, doesn't eliminate all attack vectors, especially social or governance attacks.

Tokenomics Breakdown

The $SPIRIT token operates as a governance and utility asset within the SpiritSwap ecosystem. Its tokenomics are designed to incentivize liquidity provision and community participation but also carry inherent risks typical to DeFi tokens.

- Total Supply: 1,000,000,000 SPIRIT, with ongoing emission schedules. The large supply could potentially lead to inflationary pressures unless deflationary mechanisms (e.g., token burns or lockups) are implemented.

- Distribution & Allocations: Specific details are limited, but typical allocations include liquidity mining rewards, team reserves, and community incentives. The absence of detailed vesting schedules for the team and investors leaves questions about long-term token inflation.

- Utility: Used for governance voting, boosting farm rewards, and participating in platform features like inSPIRIT staking, which further ties token value to platform activity. This utilization of governance tokens for yield enhancement is a common practice, as discussed in staking governance tokens.

- Economic Sustainability: The emissions rate and reward mechanisms must balance incentive provision with inflation control. Without explicit data, risks of token inflation and dilution are present, especially if emission rates remain high or undiscounted.

In conclusion, the tokenomics model aligns with DeFi norms—rewards for liquidity providers and governance participation—but requires careful management to prevent inflationary pressures that could erode holder value over time.

Ecosystem and Development Activity

SpiritSwap demonstrates ongoing ecosystem development through product launches (e.g., V3 upgrades, SilverSwap), active audits, and integrations with analytics platforms like CoinGecko, CoinMarketCap, and DefiLlama. The community appears engaged, with significant user base metrics typically tracked by these data sources.

The introduction of advanced features such as concentrated liquidity, dynamic fee structures, and cross-chain bridges signals a strong development trajectory aimed at competitive positioning. Despite the aggressive feature expansion, some ecosystem components—particularly yield farms and perpetuals—show signs of nascent implementation, with certain sectors inactive or in early stages.

Market traction evidence includes multiple exchange listings and integrations with prominent analytics services. However, the limited current volume data and the lack of widespread multichain adoption indicate that the platform's long-term success depends heavily on continued development, community engagement, and effective governance.

Terms and Conditions Analysis

SpiritSwap’s legal framework emphasizes user responsibility and disclaims liability for outcomes related to paid promotional offers, which are operated independently. The project explicitly states that neither SpiritSwap nor SilverSwap is liable for gains, losses, or access issues caused by third-party promoted products. Users are warned to only invest what they can afford to lose and proceed at their own risk.

- Unusual Clauses: The prominent disclaimers serve to limit liability but also underline the importance of due diligence by users, especially given the prevalence of paid promotions.

- Risk Disclosures: Adequate, but do not replace standard security and legal practices. Users should verify that they are comfortable with the platform's disclaimer-driven approach before engaging.

In the absence of more detailed legal documentation here, risk remains primarily on the user, emphasizing the necessity for thorough personal due diligence.

Final Analysis: The Investment Case for SpiritSwap

SpiritSwap presents itself as a technically advanced DeFi protocol built on the Fantom network, with a broad feature set aimed at capturing DeFi participants through swaps, liquidity, governance, and cross-chain capabilities. Its reliance on audited smart contracts and strategic exchange listings lends credibility. However, certain factors deserve caution:

- Pros / Strengths

- Strong security backing through multiple audits (MixBytes, PeckShield, Zokyo).

- Active product development, including innovative features like algebra-inspired concentrated liquidity.

- Broad exchange and platform integrations increase accessibility and visibility.

- Community governance via inSPIRIT, incentivizing participation and yield boosting.

- Cons / Risks

- Limited transparency about the core team’s identities and long-term strategic roadmap.

- Tokenomics may face inflationary pressure without clear deflation mechanisms.

- Dependence on continuous development and community engagement to sustain growth.

- Potential vulnerabilities inherent to DeFi systems, especially in governance and cross-chain bridges.

- Disclaimers for third-party paid promotions indicate a landscape where some aspects might be opportunistic or speculative.

In sum, SpiritSwap demonstrates technical legitimacy with credible audits and active platform upgrades. Nonetheless, inherent DeFi risks, coupled with the decentralization of team identities and the typical volatility of native tokens like $SPIRIT, necessitate cautious participation. Prior to investing or engaging, users should consider their risk tolerance, thoroughly review official documentation, and stay informed on ecosystem developments.

Daniel Clark

On-Chain Quantitative Analyst

I build algorithmic tools to scan blockchains for signals of manipulation, like whale movements and liquidity drains. I find the patterns in the noise before they hit the charts.

Similar Projects

-

Lucia

Lucia Review: Scam or Legit Crypto? Comprehensive Legitimacy Check

-

Avante (AVAXT)

Review of Avante (AVAXT): Is This Crypto Project a Scam or Legit?

-

HashBit (HBIT)

HashBit (HBIT) Review: Crypto Scam Checker & Project Scam Review

-

Open Games Builders

Open Games Builders Review: Is This Crypto Scam Checker or Legit Project?

-

Gnars

Review of Gnars Crypto Project - Is It a Safe Crypto Scam Checker or Legitimate?