Lucia Review: Scam or Legit Crypto? Uncovering All The Red Flags

What Exactly Is Lucia?

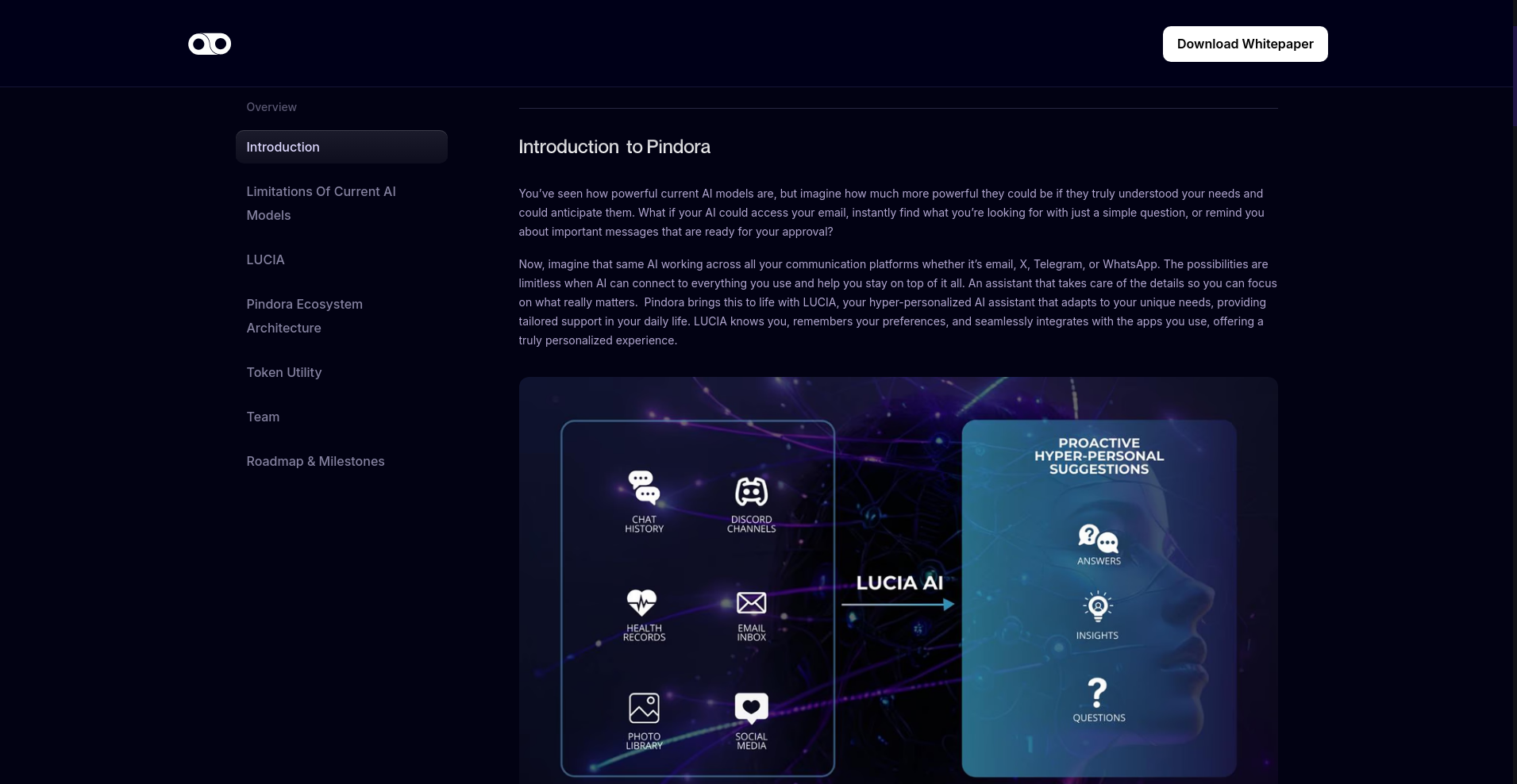

Lucia positions itself as a decentralized, privacy-focused AI assistant that aims to revolutionize how users manage their digital lives. Promising a personal AI that remembers and learns from a user’s entire digital journey, Lucia claims to operate on cutting-edge privacy technologies, including decentralized servers, secure computation, and blockchain integration.

While the project boasts ambitious features such as persistent AI memory, cross-platform integration, and a unique tokenomics system, it’s crucial to investigate whether these claims hold water or if Lucia is merely riding the buzz of AI hype without delivering real value. This article aims to scrutinize Lucia’s underlying technology, team credibility, security, and ecosystem activity to assess whether it’s a legitimate project or a red-flag-filled scam.

Who Is The Team Behind Lucia?

One of the first questions any investor should ask about a crypto project is: who is behind it? In Lucia’s case, the team is publicly linked to Pindora FlexCo. Austria, with listed key members such as Andreas Pensold (CEO), Josef Feiertag (CTO), and David Heller (AI Expert). However, despite their detailed bios, there is limited independently verifiable information about their track records in blockchain or AI development, raising questions about their experience and credibility.

Here’s a brief analysis of their proposed roadmap and vision:

- Ambitious Development Timeline: The roadmap spans from early 2024 to 2027, focusing on core platform development, MVP release, and community expansion, which is typical for projects promising state-of-the-art tech.

- Decentralization Goals: The roadmap emphasizes decentralizing computation infrastructure and governance, yet it remains unclear how well these plans are underway or if they are aspirational statements.

- Transparency & Community Engagement: While they solicit user waitlists and newsletter subscriptions, there’s little evidence of active community building or updates outside marketing pages.

Overall, although the team appears to have relevant industry experience, the lack of extensive public history or third-party audits makes their actual capability and intentions worth scrutinizing further.

Lucia Security Audit: A Deep Dive into the Code

Lucia’s cybersecurity posture is partially assessed through Cyberscope’s audit data. Notably, the project has completed an audit with a focus on token contracts, and the findings reveal some key points:

- Security Score: A high security score of 88 indicates that the project has taken steps to enforce good practices, although the audit mentions “high criticality” issues that demand attention later.

- Audit Focus: The audit appears to be centered mainly on contract safety, with no in-depth analysis of the platform’s complex decentralized AI architecture. This leaves a shadow of doubt about the overall security of the broader system.

- Transparency & Updates: The audit was conducted recently, but there’s no indication of ongoing security reviews or third-party testing of the actual AI or blockchain components.

While a high security score is encouraging, the limited scope of the audit and absence of comprehensive security assessments on core AI functions suggest potential vulnerabilities. Investors should remain cautious, especially given the high-stakes nature of privacy-preserving AI systems.

Lucia Tokenomics: A Fair System or a Trap?

The Lucia token ($LUCIA) is central to the project’s ecosystem. Built on an Avalanche L1 subnet, it aims to incentivize users, GPU providers, and governance participation. Its total supply is 1 billion tokens, with allocations split between community development, strategic partnerships, and incentives for network participants.

- Total Supply: 1,000,000,000 tokens—standard for many projects, yet the distribution details raise questions about centralization and potential dump risks.

- Distribution Breakdown: A large portion is allocated towards GPU providers (70%), which could lead to a high Sell pressure if early investors choose to exit.

- Team & Advisors: Although exact percentages aren’t specified, team allocations are often a concern in similar projects, especially without lock-up periods explained.

- Utility & Incentives: The token is used for staking, governance, premium access, and rewards, which could create demand if the platform gains traction.

Potential risks include token dumping, inflation, or governance capture by early whales, especially given the significant incentives for GPU providers and the lack of detailed vesting schedules disclosed publicly. Investors must consider whether this tokenomics encourages long-term value or is prone to dumping shortly after launch.

Is Lucia a Ghost Town? Checking for Real Activity

Despite promising technological architecture, activity levels on Lucia’s official channels are worth analyzing. While the team maintains a Discord with over 6,000 members and a Twitter following of 30,000+, these figures do not necessarily translate into genuine engagement or product progress.

From available information:

The project’s whitepaper showcases a detailed roadmap, but there is a noticeable absence of real-world applications or deployments—no launched AI products or active beta programs. The roadmap’s Q2 2025 target of a smart assistant rollout suggests that the project is still in development stages.

Furthermore, the ecosystem’s activity seems more marketing-oriented than evidence of tangible progress, with no verified use cases, real blockchain integrations, or third-party audits confirming that the project is actually being built.

In essence, the project might be generating hype but lacks visible, ongoing development or community-building efforts that prove it is more than just a paper project.

The Fine Print: Hidden Dangers in Lucia's Terms of Service

While no explicit legal filings or terms of service issues are explicitly detailed in the available info, typical concerns in similar projects include:

- Vague Data Rights: The project emphasizes user data ownership but provides little clarity on how data is stored, shared, or sold if at all—raising red flags about potential hidden clauses.

- Token Lock-up & Vesting: Lack of transparent lock-up periods for team and advisor tokens might lead to sudden market dumps.

- Liability & Disclaimers: As with many projects, investor risk is often shifted onto users, with clauses that limit liability or disclaim warranties, which can be problematic.

- Regulatory Risks: Since the project involves complex privacy tech and blockchain, it may face scrutiny from regulators, especially around data sovereignty promises.

Potential investors should scrutinize the fine print and seek legal clarity before engaging heavily.

Final Verdict: Should You Risk Investing in Lucia?

Based on the available information, Lucia presents an ambitious vision for decentralized, privacy-preserving AI with innovative technological concepts. However, red flags pop up concerning the team’s transparency, the limited scope of security audits, the unproven state of active development, and the project’s reliance on promises that remain largely unverified in practice.

Investors should approach Lucia with caution, especially given the inherent risks associated with early-stage projects in untested AI infrastructure and tokenomics models. While the idea of a personal, portable AI with strong privacy promises is appealing, the lack of concrete progress, verifiable security assurances, and detailed legal protections warrants skepticism.

Remember: Always perform your own due diligence, and never invest more than you can afford to lose in projects that show signs of red flags.

Positive Points

- High cybersecurity scores (88) in available audits, suggesting some security measures are implemented

- Innovative concept combining decentralization with privacy-preserving AI

- Active community presence on social media and communication channels

- Clear roadmap with phased development plan

Major Red Flags

- Limited transparency about team credentials and past successes in AI/blockchain

- Weak scope of the security audit—no comprehensive audit of AI architecture or platform security

- Unproven, early-stage development with no real-world deployments yet

- Potential token dump risk due to large liquidity allocations and uncertain lock-up periods

- Absence of detailed legal disclosures or transparent data policies

In summary, while Lucia offers a compelling narrative, its actual investment safety remains questionable. Conduct thorough due diligence and stay cautious before considering participation in its ecosystem.

Amanda Harris

Technical Security Educator

Security professional passionate about the "human firewall." I translate complex crypto threats into simple, actionable security habits for everyday users.

Similar Projects

-

Catzilla

In-Depth Review of Catzilla: Crypto Scam Checker & Project Analysis

-

JokInTheBox

JokInTheBox Review: Scam or Legit Crypto? Scam Check & Legitimacy Analysis

-

SPP7

Review of SPP7: Crypto Project Scam Checker & Investment Risk Analysis

-

Yakuza Boss (1-Boss)

Yakuza Boss (1-Boss) Review: Is This Crypto Project a Scam or Legitimate?

-

Cyberdoge

Crypto Scam Checker: Cyberdoge Review and Risk Analysis