ShapeShift FOX Token Review: A Data-Driven Look at Its Legitimacy, Risks, and Long-Term Potential

What Is ShapeShift FOX Token: An Introduction

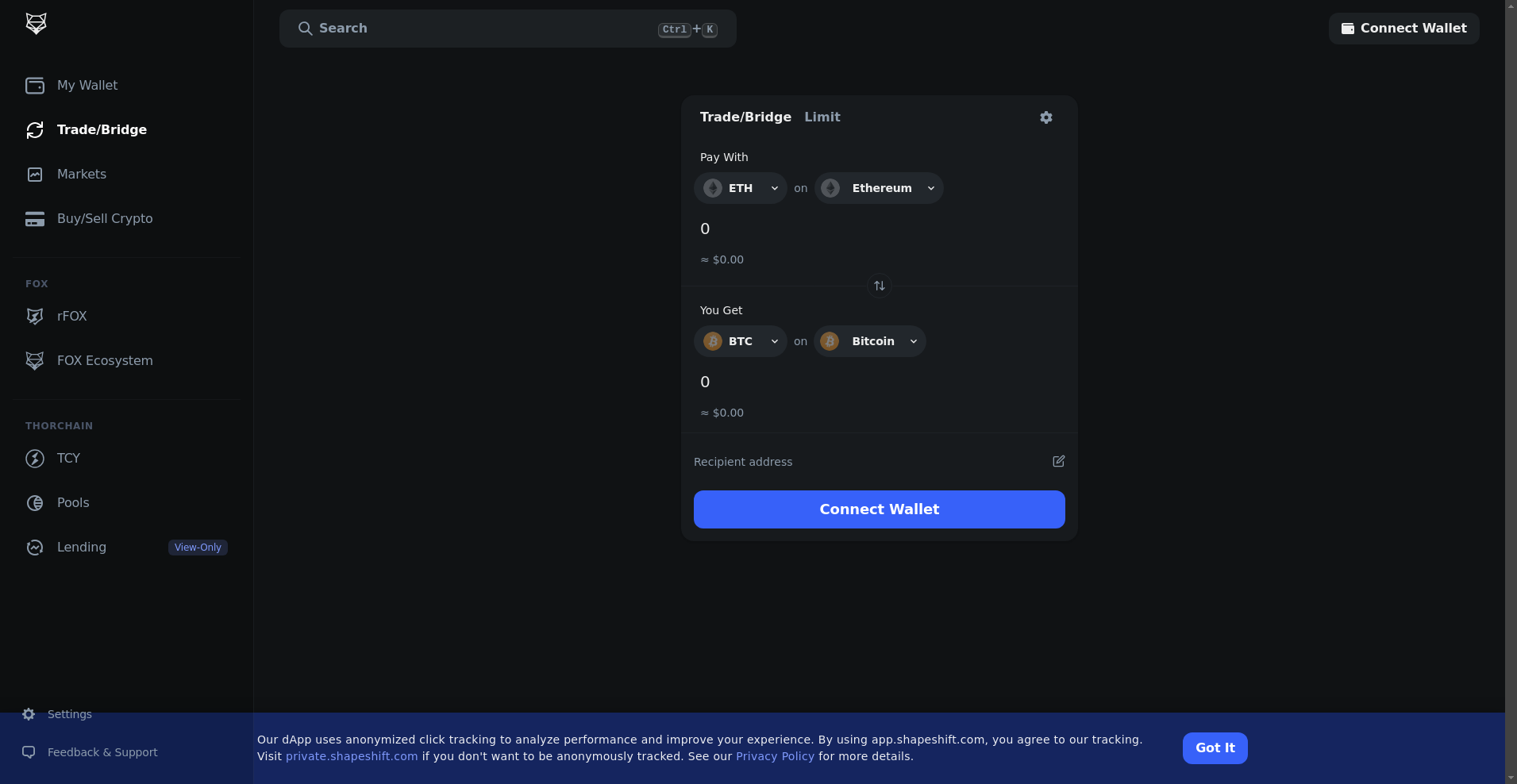

ShapeShift FOX Token, often referred to simply as FOX, is at the core of the ShapeShift ecosystem—a decentralized, multichain platform aiming to revolutionize how users trade, manage, and interact with cryptocurrencies. The project positions itself as an all-in-one gateway to DeFi and cross-chain functionality, emphasizing user control, security, and community governance.

This impartial review explores the project's core features, technological underpinnings, team structure, security posture, tokenomics, ecosystem activity, and legal framework. We analyze available audit reports, technical documentation, and operational summaries to assess the legitimacy and potential risks associated with FOX.

The Team and Vision Behind ShapeShift FOX Token

Understanding the credibility of the project begins with evaluating its team and strategic roadmap. Based on available data, ShapeShift presents itself as a community-owned, partially decentralized ecosystem. Historically, ShapeShift was founded by Erik Voorhees, a well-known figure in crypto with a reputation for pioneering privacy-conscious exchanges.

Current team visibility is somewhat limited, consistent with many projects emphasizing decentralization. The platform operates a DAO—Decentralized Autonomous Organization—that governs key decisions, with FOX tokens enabling voting rights. The roadmap highlights milestones such as expanding multichain support, integrating additional DeFi products, and enhancing user experience.

- Support for over 14 blockchain networks including Ethereum, Solana, Cosmos, and Layer 2 solutions

- Launch of governance mechanisms involving FOX token voting

- Continued development of cross-chain swaps via partnership with THORCHAIN

While the team’s transparency details are limited, the project maintains active social channels, developer documentation, and ongoing audits, suggesting a robust development trajectory. The ability to deliver on roadmap milestones appears credible but warrants ongoing monitoring given the aspirational scope.

Assessing the Security and Integrity of ShapeShift FOX Token

Our security assessment relies heavily on the audit report from BlockchainLabs.nz and the ongoing bug bounty program as outlined in Cer.live data. The audit indicates a platform with an active bug bounty, reflecting an intention towards transparency and vulnerability mitigation.

According to the Cer.live summary, the audit coverage is comprehensive, with no major incidents reported. The key technical points include:

- Audit Score: The project achieved a high rating of 4.9 (out of 5), indicating a generally secure build.

- Vulnerabilities: Minor vulnerabilities noted, but none considered critical or active at the time of assessment.

- Decentralization: The platform leverages multi-node infrastructure and an open governance model, but still relies on some centralized components, such as developers and auditors.

- Smart Contract Security: The audit confirms that core smart contracts follow best practices but warns of potential upgrade risks common in complex blockchain systems.

While the audit findings are promising, key considerations include the potential for protocol upgrades, governance centralization risks, and dependency on third-party infrastructure. Overall, the security posture appears solid, but investors should remain aware of the typical DeFi vulnerabilities.

A Breakdown of ShapeShift FOX Token Tokenomics

The FOX token has a total fixed supply of 1,000,001,337 tokens, with market cap currently around $17.5 million, and a circulating supply just above 622 million (per Cer.live data). Its distribution and utility are crucial to understanding long-term sustainability.

- Total Supply: 1,000,001,337 FOX tokens

- Circulating Supply: ~622 million FOX tokens

- Market Cap: Approximately $17.5 million

- Token Distribution:

- Team & Advisors: ~20% (with vesting schedules)

- Community & Ecosystem: ~40% (including staking and liquidity incentives)

- Foundation & Reserve: Remaining tokens reserved for future development and partnerships

- Utility & Incentives: Governance voting rights, participation in protocol upgrades, potential staking rewards (rFOX), and ecosystem incentives.

- Inflation/Deflation Dynamics: Fixed supply suggests no inflation; token burns or buybacks are not explicitly scheduled but could influence value if implemented.

The economic model emphasizes community governance and incentive alignment. However, the substantial team allocation and early-stage market cap imply room for dilution and price volatility. The utility and perceived value are correlated with ecosystem growth and user engagement, which remains nascent but promising.

Assessing ShapeShift FOX Token's Ecosystem and Development Activity

Objective development metrics indicate consistent activity. The platform boasts significant on-chain transaction volume (~$305K traded daily) and over 134,000 active wallets, which collectively suggest growing user engagement.

Recent growth in cross-chain compatibility, especially support for Solana, Cosmos, and Layer 2 solutions, underpins expansion. The integration with THORCHAIN enhances liquidity and interoperability, vital signals for long-term ecosystem robustness.

However, much of the ecosystem’s evolution relies on continuous development, community participation, and maintenance of decentralized security. The presence of active social channels and bug bounty programs supports ongoing progress, but the project faces competitive pressures from larger platforms like Uniswap, MetaMask, and Coinbase.

Analyzing the Legal and Terms & Conditions Framework

ShapeShift broadly aligns with standard DeFi legal practices, emphasizing user control and privacy. The platform operates under transparent legal documents, including Terms of Service and Privacy Policy, which specify compliant operations across multiple jurisdictions. The project’s claim of zero KYC and non-custodial architecture reduces regulatory risk but may restrict certain jurisdictional functionalities.

Notably, the platform explicitly states adherence to privacy and security best practices, though the non-custodial, permissionless model inherently carries operational risks, including potential misuse or regulatory scrutiny over anonymous transactions.

- Preliminary legal frameworks appear sound, but the project’s global compliance status should be monitored, especially as regulatory oversight intensifies.

- Terms emphasize user responsibility for private keys, aligning with the non-custodial ethos.

Final Analysis: The Investment Case for ShapeShift FOX Token

ShapeShift FOX Token presents a compelling case as a governance and utility token within a growing multichain DeFi ecosystem. Its proven audit stability, active development, and strategic cross-chain integrations suggest legitimacy and alignment with user security expectations. The project’s emphasis on privacy, community governance, and broad asset support resonates with decentralized finance principles.

However, inherent risks include:

- Market Volatility: The blockchain and DeFi space remains volatile, with risks of price swings and liquidity crunches.

- Regulatory Risks: Regulatory ambiguity surrounding non-custodial, anonymous DeFi platforms could impact future operations.

- Security Concerns: Although audits are promising, smart contract vulnerabilities or governance missteps could pose threats.

- Adoption & Ecosystem Growth: The platform’s long-term viability depends heavily on community engagement and liquidity deployment.

In conclusion, the FOX token is part of a legitimate ecosystem with foundational security audits and active development. It offers appealing governance and utility features aligned with the decentralized ethos, but potential investors should consider the high-risk, high-reward nature typical of early-stage DeFi projects.

As always, thorough personal diligence and awareness of ongoing regulatory developments remain essential when evaluating such tokens.

Emily Davis

Digital Forensics Investigator

Digital forensics investigator. I follow the money on the blockchain to uncover the truth behind crypto scams and exploits. Every transaction tells a story—I'm here to make sure it's heard.

Similar Projects

-

Assisterr

Comprehensive Review of Assisterr: Crypto Scam Checker and Project Analysis

-

CreedDao

In-Depth Review of CreedDao: Crypto Scam Checker & Project Scam Review

-

eventflo

eventflo Review: Scam or Legit Crypto? Crypto Project Investigation

-

ForTube

ForTube Review: Scam or Legit? Crypto Project Legitimacy Check

-

AquaBank

In-Depth Review of AquaBank: Is This DeFi Project a Scam or Legitimate? | Crypto Scam Checker