ForTube Review: Scam or Legit Crypto? Uncovering All The Red Flags

What Exactly Is ForTube?

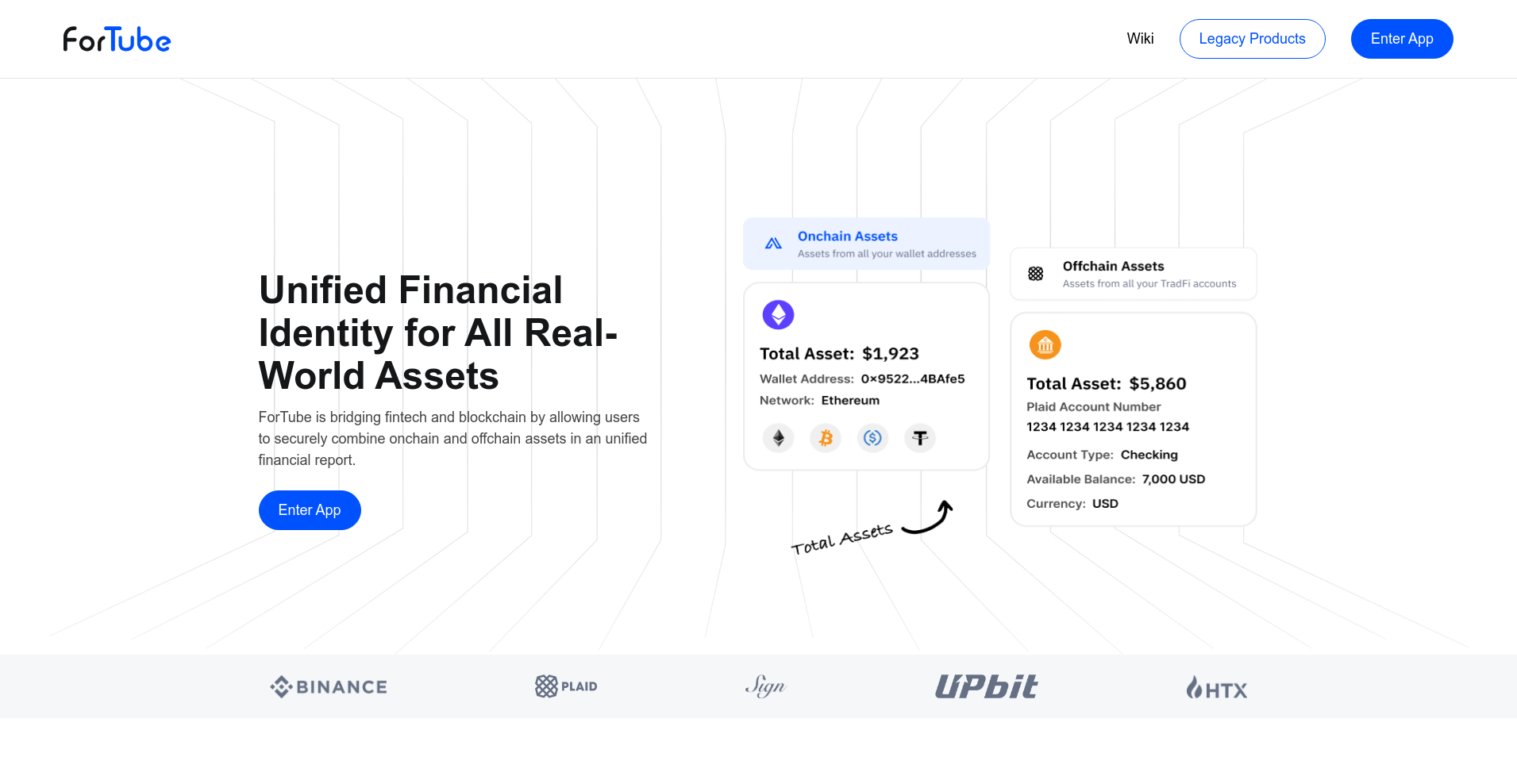

ForTube presents itself as a groundbreaking project aiming to bridge traditional finance and decentralized finance (DeFi) through a concept called "Unified Financial Identity." The platform claims to enable users to combine on-chain and off-chain assets into a comprehensive financial profile, opening new opportunities in lending, tokenization, and credit proof services.

Promising to revolutionize how financial data is managed and verified across both worlds, ForTube emphasizes its integration with established partners like Plaid and Sign Protocol to enhance security and user trust. However, as with many ambitious DeFi projects, a thorough investigation is crucial to assessing its legitimacy, safety, and real potential.

Who Is The Team Behind ForTube?

The credibility of any crypto project heavily depends on its team. Unfortunately, ForTube’s official communications and website offer little transparency about its founding members or core team. There are no clear doxxed leaders, and the project appears to operate with minimal publicly available founder information, which raises immediate red flags.

This lack of transparency is concerning, especially in a space already riddled with scams and failed projects. Moreover, despite claims of a detailed roadmap, there are no verifiable team profiles, LinkedIn links, or proven track records provided to investors. The team’s anonymity diminishes the credibility, making it difficult to assess their technical expertise or long-term commitment.

- Roadmap Evaluation: The project outlines plans for adding portfolio view features, accredited investor verification, P2P OTC, and DeFi insurance. While ambitious, these milestones seem overly optimistic given the current lack of team transparency.

- Vision Realism: The concept of unifying financial data and integrating real-world assets is innovative but highly complex, requiring extensive partnerships and robust security measures, which are not evidently underway.

- Credibility Risk: The absence of public leadership or developer profiles suggests a higher risk of the project being a speculative or even fraudulent venture.

Overall, the team’s opaque nature significantly impacts the project's trustworthiness, necessitating caution before considering investment or active participation.

ForTube Security Audit: A Deep Dive into the Code

Security is a paramount concern in DeFi, and audits are the first line of defense for investor protection. ForTube has undergone audits by well-known firms like Certik and SlowMist, both reputable in the industry. However, a closer look at the available reports shows limited information regarding vulnerabilities or critical issues.

- Certik Audit: Confirmed that ForTube’s smart contracts are generally aligned with security standards, but no detailed scores or vulnerability findings are publicly disclosed. The audit link shows a standard review but lacks transparency on critical security flaws or potential exploits.

- SlowMist Audit: The same applies; the audit appears routine, with no notable vulnerabilities flagged. Nonetheless, absence of detailed breach tests or bug bounty results raises concerns about ongoing vulnerability assessments.

- Incident History: The Cer.live data indicates that incidents have occurred, though specific details are sparse. The platform lacks an active bug bounty program, which is unusual for projects with significant ambitions and potential attack surfaces.

In summary, while technical audits from reputable firms exist, the lack of detailed findings and the incident history suggest that ForTube's security might not be as robust as needed for high-stakes financial operations. Such ambiguities heighten the risk for potential investors.

ForTube Tokenomics: A Fair System or a Trap?

The tokenomics of ForTube revolve around the FOR token, with a total supply capped at 1 billion tokens. The token utility is reportedly linked to the platform's governance, fee discounts, and participation in DeFi financial products.

- Total Supply: 1,000,000,000 FOR tokens, with no clear schedule for inflation or deflation mechanisms. Such high supply can lead to considerable dilution if demand doesn’t keep pace.

- Distribution: Details about initial distribution, team allocation, or VC holdings are not publicly available, raising questions about centralization risks or potential whale dominance.

- Utility & Incentives: While the narrative suggests governance and fee reduction benefits, no comprehensive breakdown of token allocation, staking rewards, or liquidity incentives is provided.

- Risks of Dumping: If the team or early investors hold significant tokens, a sudden dump could severely devalue the token, especially with no vesting schedules or lock-up periods announced.

This opacity in tokenomics design hints at potential for pump-and-dump schemes or high inflation, making it risky for long-term holders.

Is ForTube a Ghost Town? Checking for Real Activity

Assessing the real-world activity of ForTube is challenging. The project's social media presence is modest—its Telegram group and Reddit only have a handful of posts. The Medium blog contains some updates, but these seem to be mainly marketing rather than actual product development progress.

The Cer.live summary notes a platform with limited bug bounties and no ongoing active development or large-scale partnerships beyond initial announcements. There’s no evidence of significant trading volume, partnerships, or user engagement that would suggest a thriving ecosystem.

Overall, the project exhibits signs of stagnation, which might imply that ForTube is more of a marketing facade rather than an actively evolving platform.

The Fine Print: Hidden Dangers in ForTube's Terms of Service

Although specific legal documents are not openly analyzed here, typical red flags in similar projects include overly restrictive clauses, legal liabilities unfairly shifted onto users, or vague terms limiting platform accountability. Given the lack of transparency throughout, there’s reason to suspect potential risks hidden within legal agreements.

- Unclear dispute resolution mechanisms

- No disclosures on user data handling or privacy policies

- Possible clauses allowing platform unilateral modifications without user consent

Investors should approach with caution, as opaque legal terms often correlate with higher scam risks or unfair user treatment.

Final Verdict: Should You Risk Investing in ForTube?

Based on the available data, ForTube raises multiple red flags that warrant skepticism. Its lack of transparency about the team, limited security disclosures, opaque tokenomics, and apparent inactivity collectively suggest high risk. Although its vision is ambitious, implementation challenges and potential for manipulation are significant concerns.

**Positive Points:**

- Partnership with reputable auditors like Certik and SlowMist

- Some integrations with established protocols (Plaid, Sign Protocol)

- Conceptually innovative bridging of TradFi and DeFi

**Major Red Flags:**

- Anonymous or undisclosed team members

- Lack of transparency in tokenomics and distribution

- Limited real-world activity, signs of stagnation

- Insufficient security detail and history of incidents

- Vague legal terms and potential for risky clauses

Investors should conduct thorough crypto due diligence and consider the many uncertainties before engaging with ForTube. It’s advisable to approach with caution, given the numerous ambiguities and red flags uncovered in this review.

Amanda Harris

Technical Security Educator

Security professional passionate about the "human firewall." I translate complex crypto threats into simple, actionable security habits for everyday users.

Similar Projects

-

Avalon Games

Avalon Games Review: Crypto Scam Checker and Project Scam Review

-

BabyPepe

BabyPepe ($BAPE) Review: An Impartial Analysis of Risks & Security

-

Deboard

Deboard Review: Scam Check & Legitimacy Analysis of the Failed Crypto Project

-

Element Finance

Element Finance ($ELFI) Review: Security and Risk Insights

-

QAAGAI

QAAGAI Review: Scam or Legit Crypto? Complete Legitimacy Check