Paint Swap Review: Scam or Legit Crypto? Uncovering All The Red Flags

Project Overview

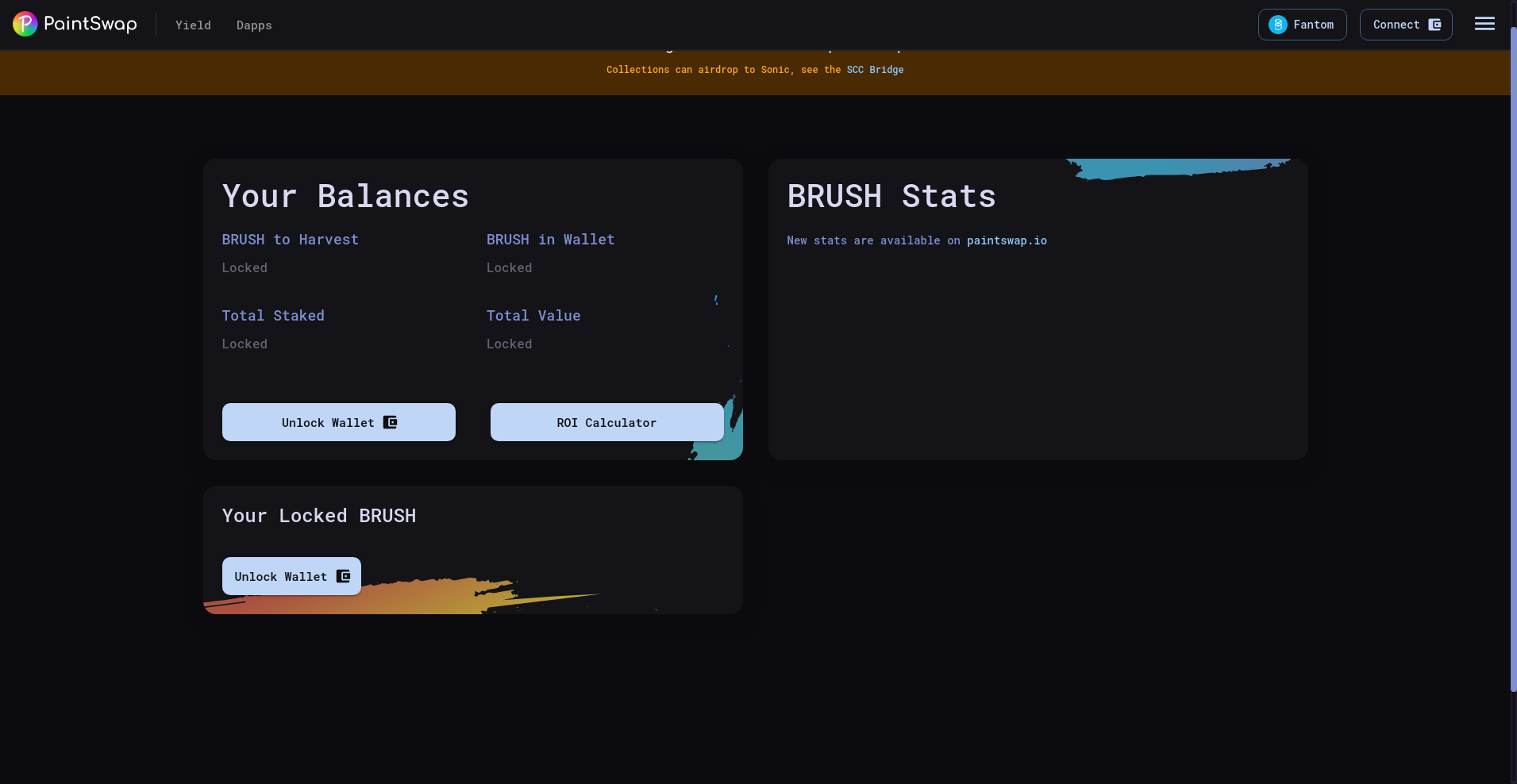

Paint Swap presents itself as a decentralized NFT marketplace built on the Fantom blockchain, promising users a robust platform for buying, selling, and minting digital assets. With features like peer-to-peer swaps, yield opportunities through its native $BRUSH token, and a range of integrated dApps, the project aims to carve out a space in the rapidly growing NFT ecosystem.

However, as with many emerging crypto projects, due diligence is crucial. This investigation critically examines Paint Swap’s claims, its security posture, tokenomics, and overall legitimacy to help investors identify potential risks and red flags before getting involved.

Who Is The Team Behind Paint Swap?

One of the most significant concerns with Paint Swap is the lack of publicly available information about its core team. The project appears to operate without openly doxxed founders or transparent leadership, which is often a red flag in the crypto space and a key aspect of understanding NFT marketplace red flags.

- The platform and its website do not provide detailed team bios or verified identities.

- No clear information about founders, developers, or advisors is readily accessible.

- The project seems primarily community-driven or possibly developed by anonymous contributors.

Its roadmap and features are ambitious, including cross-chain bridges like the "SCC Bridge" and migration plans to "Sonic," yet these strategic moves lack verifiable backing or official statements from recognized industry figures. This opacity raises serious questions about the credibility and intentions behind Paint Swap, making it difficult to determine whether it is a legitimate project or a potential scam.

Paint Swap Security Audit: A Deep Dive into the Code

Paint Swap has undergone a security review from Solidity Finance, a reputable blockchain auditing firm. The audit, which coverage was approximately 50%, indicates ongoing efforts to verify the platform’s smart contracts and coding standards.

- The audit revealed some vulnerabilities, though none appeared to be critically exploitable at the time of review.

- Key findings included standard security practices, but also highlighted areas needing improvement for better security assurances.

- The project does not currently appear to be affected by any major exploits or incidents, but the partial audit coverage means risks remain.

While an audit from a credible firm is reassuring, the limited scope and ongoing security concerns warrant caution. Investors should be aware that incomplete audits and the absence of a comprehensive security verification process can leave critical vulnerabilities unaddressed, posing potential risks of smart contract exploits or fund loss.

Paint Swap Tokenomics: A Fair System or a Trap?

The $BRUSH token is central to Paint Swap’s ecosystem, facilitating yield farming, staking, and governance features. Its total supply stands at approximately 411.8 million tokens, with detailed metrics and utility functions outlined in the platform but lacking clarity on initial distribution or vesting schedules. Understanding tokenomics best practices for crypto projects is vital here.

- Total Supply: Around 411.8 million tokens, which is relatively high, potentially leading to inflationary pressures.

- Distribution & Allocation: No transparent data on token pre-sale, allocations to team, advisors, or early investors, raising concerns about centralization.

- Utility: Used for yield farming, staking, and governance, but the true value depends on platform adoption and trading volume.

- Risks: High supply combined with limited clarity on distribution increases the risk of mass dumps, devaluation, or pump-and-dump schemes.

Without a transparent tokenomics plan and clear vesting schedules, investors face the risk of sudden sell-offs that could drastically impact the token’s price. The token’s utility seems promising, but the lack of transparency invites suspicion regarding possible inflationary risks and market manipulation.

Is Paint Swap a Ghost Town? Checking for Real Activity

Despite claims of an active ecosystem, available data suggests that Paint Swap’s activity levels are modest. The platform’s recent trading volume is around 22,504, which, while not insignificant, indicates relatively low user engagement compared to major NFT marketplaces.

The recent migration to "Sonic" and the development of bridges indicates some level of ongoing development effort. However, the absence of prominent partnerships, widespread community engagement, or notable media coverage points towards a potential stagnation of user interest or a project struggling to gain mainstream traction.

Moreover, the platform’s aesthetic interface and dashboard, while functional, do not demonstrate large-scale or sustained activity, which is often a sign of a healthy, active ecosystem. This raises the possibility that some claimed features may be in early stages or not widely adopted.

What Paint Swap’s Legal and Operational Fine Print Hides

There is limited publicly available information regarding Paint Swap’s legal documents, terms of service, or user agreements. The lack of transparent legal documentation and clear privacy policies may pose risks for users in terms of ownership rights, dispute resolution, and fund safety.

- Absence of clear terms regarding ownership of NFTs and tokens in case of platform malfunction or shutdown.

- Potential issues with data privacy and user rights due to vague or incomplete policies.

- Uncertain legal standing which could affect user protections in different jurisdictions.

Such opacity is common among dubious projects; the absence of legally binding or clear terms is a red flag indicating potential hidden clauses, and users should proceed with caution. This falls under the broader category of how to spot a scam NFT marketplace.

Final Verdict: Should You Risk Investing in Paint Swap?

Based on the evidence gathered, Paint Swap exhibits many warning signs that warrant a cautious approach. The project operates with minimal transparency regarding its team, has limited security audits, unclear tokenomics, and questionable activity levels. These factors together paint a picture of a platform that may not be as legitimate or secure as it purports to be.

While there are some promising features, such as decentralized NFT trading and cross-chain functionalities, the overall lack of verified leadership, transparency, and broad adoption raises serious concerns.

- Positive Points:

- Reported security audit from a reputable firm (but limited in scope)

- Presence of an active-looking dashboard interface

- Offers a variety of NFT marketplace tools and yield features

- Major Red Flags:

- Opaque team and development history

- Limited security audit coverage and potential vulnerabilities

- Unclear token distribution and high supply risks

- Modest activity levels and possible stagnation

- Lack of transparent legal documentation

Investors should conduct thorough crypto due diligence and remain skeptical. Until more transparency and comprehensive audits are available, engaging with Paint Swap involves considerable risk, making it advisable to approach with caution.

Jessica Taylor

NFT Market Data Scientist

Data scientist specializing in the NFT market. I analyze on-chain data to detect wash trading, bot activity, and other manipulations that are invisible to the naked eye.

Similar Projects

-

Cryptex Finance

Cryptex Finance ($CTX) Review: An Expert Analysis of Risks & Potential

-

DeFiAI

DeFiAI Review: Scam Check & Legitimacy Analysis of the Dead Crypto Project

-

GENERAL DOGGY (GD)

Comprehensive Review of GENERAL DOGGY (GD) Token on Solana: Scam or Legit Project? Crypto Scam Checker

-

Kekius Maximus Ai

Kekius Maximus Ai Review: Scam Check & Legitimacy Analysis

-

Nord Finance

Nord Finance ($NORD) Review: Risks and Opportunities in DeFi