Frax Review: Scam or Legit Crypto? Uncovering All The Red Flags

What Exactly Is Frax?

Frax is a decentralized financial ecosystem centered around its flagship product, the Frax stablecoin. Marketed as a highly scalable, transparent, and institutional-grade digital dollar, the project promises to revolutionize the way stablecoins function by integrating a hybrid approach—combining algorithmic mechanisms with collateral backing. The platform also claims to support a high-performance blockchain, the Fraxtal Layer 1, designed for over 100,000 transactions per second, and a versatile platform called FraxNet for minting, redeeming, and earning on frxUSD.

At first glance, Frax presents itself as an ambitious project aiming for cross-border money movement, decentralized issuance, and a broad ecosystem of DeFi integrations. However, a thorough investigation into its claims, tokenomics, security posture, and long-term viability is essential before considering it safe or legitimate. This article dives deep into whether Frax is a promising innovation or simply a well-marketed crypto scheme cloaked in high-tech jargon.

Who Is The Team Behind Frax?

Understanding the team behind any crypto project is key to ascertaining its legitimacy. Unfortunately, Frax's core team remains largely anonymous or pseudonymous, as is common with many DeFi startups. The project primarily promotes partnerships, industry backing, and a broad ecosystem, but publicly available information about founders, developers, or advisors is scant.

- Leadership Transparency: Little to no public profiles or verified identities reported, raising red flags about accountability.

- Roadmap & Vision: The outlined goals include creating a "world's most scalable stablecoin infrastructure" and integrating with agencies like BlackRock, which seems overly ambitious given the lack of concrete team credentials.

- Development & Backers: While the project claims partnerships with industry giants, most collaborations are vague, and no direct backing from notable venture capital or well-known blockchain figures is confirmed.

In summary, the absence of verified team members diminishes transparency and raises suspicion that Frax might lack the experienced leadership needed for长期 sustainability. Investors should approach such pseudonymous projects with caution, especially when high promises are involved.

Frax Security Audit: A Deep Dive into the Code

Frax has undergone an audit by Trail of Bits, a well-respected cybersecurity firm in the blockchain space. The audit summary from Cer.live indicates a partial coverage of only 50%, along with documented incidents, which warrants concern.

- Audit Scope & Coverage: The audit covers some parts of the protocol, but only about half. This leaves significant sections unexamined, potentially harboring vulnerabilities.

- Outcome & Findings: The report highlights existing incidents, but specifics are limited. There is no indication of critical vulnerabilities being discovered or fixed, but incomplete coverage generally signals higher risk.

- Insurability & Fixes: The project has some insurance coverage through InsurAce, but the scope and coverage adequacy remain unclear.

While the existence of an audit from Trail of Bits is a positive sign, the incomplete scope and reports of incidents without detailed transparency suggest vulnerabilities or risk vectors may still exist. Investors should interpret this cautiously, considering the potential for undiscovered issues.

Frax Tokenomics: A Fair System or a Trap?

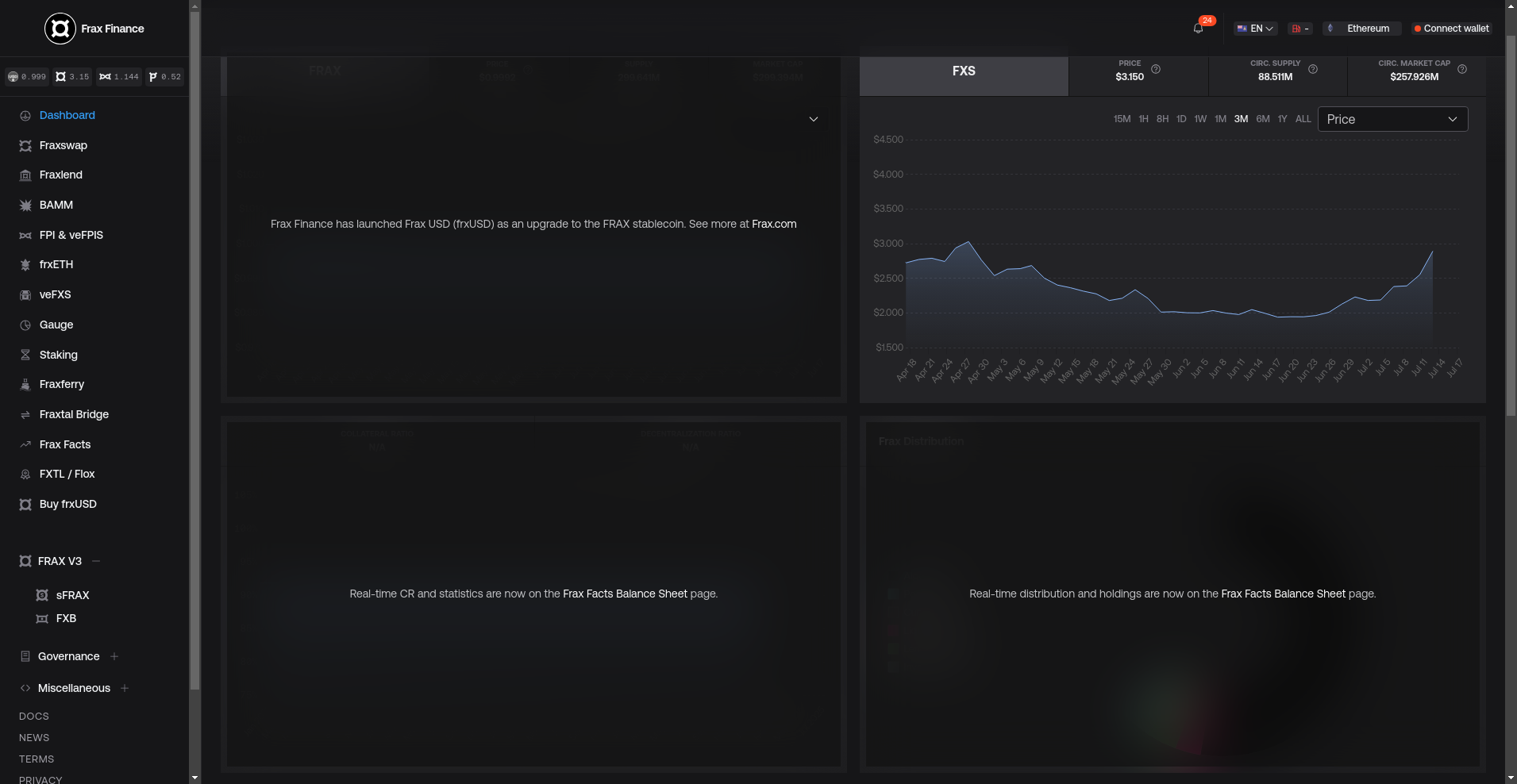

The core tokenomics revolve around the FRAX stablecoin, which is purportedly backed 1:1 by tokenized U.S. Treasury assets, and possibly governance tokens (not explicitly detailed). The circulating supply currently stands at over 319 million FRAX tokens, with a market cap close to $320 million. The platform claims that holders can earn passive yield of around 4.1%, sourced from treasury yields, and facilitate minting and redemption of frxUSD.

- Supply & Distribution: The total and circulating supplies are significant, but distribution details are opaque. Without transparency into early allocations, vested tokens, or potential centralization, risk of whale accumulation exists.

- Utility & Incentives: The primary utility is stablecoin minting, with passive yield as an incentive. The governance aspect is implied but not clearly outlined.

- Inflation & Dump Risks: Large supply combined with possible incentives for early miners or whales can lead to dumping, risking peg stability and investor confidence.

Tokenomics seem to favor token holders and insiders without transparent controls, increasing the risk of sudden dumps or inflationary pressure, especially if the project hits difficulties or whales exit.

Is Frax a Ghost Town? Checking for Real Activity

From available summaries and social references, Frax remains actively engaged within the DeFi community. The project maintains a Telegram presence and boasts integrations with well-known protocols such as Curve, Convex, and Velodrome, suggesting some level of ecosystem activity. Moreover, recent developments such as funding support from industry giants and the launch of frxUSD indicate ongoing efforts.

However, the depth of actual development activity and user adoption is less clear. The platform's reported metrics show some volume and liquidity, but these figures are relatively modest compared to major stablecoins or DeFi protocols. The community engagement, while existent, does not appear to be growing explosively and may rely heavily on marketing buzz rather than substantive product adoption.

Thus, while not entirely inactive, the ecosystem’s vibrancy and long-term commitment remain uncertain, and most of the apparent activity could be an echo chamber of marketing incentives.

What Frax's Legal Documents Are Hiding

Given the limited publicly available legal documentation, it is difficult to assess the regulatory transparency of Frax. This lack of detailed terms and conditions or legal disclosures raises concerns about user protections and the project's compliance with emerging regulations.

- Potential Risks: Absence of clear legal frameworks or investor protections could leave users vulnerable to sudden protocol shutdowns or fund freezes.

- Risk of Centralization: Delegated control over a significant asset reserve or governance powers without legal safeguards may favor insiders or large players.

- Red Flags: The lack of comprehensive legal disclosures aligned with local laws could complicate regulatory actions and leave investors without recourse.

In the absence of transparent legal documentation, investors should be wary of hidden risks, especially regarding asset custody and dispute resolution.

Final Verdict: Should You Risk Investing in Frax?

After a meticulous review, Frax presents itself as a project with ambitious goals, but one riddled with red flags and uncertainties. A largely anonymous team, incomplete security audits, opaque tokenomics, and limited legal transparency all contribute to a cautious outlook. While the project has some active community engagement and industry partnerships, these do not compensate for fundamental risks.

Investors should approach Frax with skepticism. It resembles many crypto schemes that overpromise and underdeliver, with potential for sudden volatility or project failure. Conduct thorough due diligence, especially on security and legal aspects, before considering any exposure.

-

Positive Points

- Partially audited by Trail of Bits, a reputable firm

- Integration with established DeFi protocols like Curve and Velodrome

- Ongoing development efforts and partnerships

-

Major Red Flags

- Largely anonymous team with limited transparency

- Incomplete security audit coverage and unaddressed incidents

- Opaque tokenomics and potential inflation risks

- Lack of comprehensive legal documentation or regulatory clarity

In conclusion, unless you have a high risk tolerance and are prepared for potential losses, proceed with extreme caution. Frax’s promise of a revolutionary stablecoin ecosystem must be tested against tangible security, transparency, and legal standards—areas where it currently falls short.

Daniel Clark

On-Chain Quantitative Analyst

I build algorithmic tools to scan blockchains for signals of manipulation, like whale movements and liquidity drains. I find the patterns in the noise before they hit the charts.

Similar Projects

-

DIA

DIA Review: Is This Crypto Project a Scam or Legit? | Scam Check & Legitimacy Analysis

-

X Trade AI

Crypto Scam Checker Review of X Trade AI: Is This project a scam or legit?

-

Superposition Finance

Superposition Finance Review: Scam Check & Legitimacy Analysis

-

NXT Technologies

NXT Technologies: Post-Mortem Analysis of Its Rise and Fall

-

Super Bonk

Super Bonk Review: Is This Crypto Game a Scam or Legit? Crypto Scam Checker & Project Review