PAID Network ($PAID) Review: A Data-Driven Legitimacy and Risk Assessment

What Is PAID Network: An Introduction

PAID Network is positioned as a crypto-native investment platform that facilitates early access to curated token, equity, and hybrid deals across various high-growth sectors. Its core proposition revolves around providing a structured and community-oriented marketplace where investors can participate in promising projects before they reach mainstream liquidity venues. The platform emphasizes transparency, deal curation, and tiered membership benefits, all underpinned by its native $PAID token. To access these deals, users often need to stake the native token, a process that can be explored further in our staking guide.

This review aims to provide an impartial, evidence-based assessment of PAID Network’s legitimacy, security posture, tokenomics, and long-term risk factors. By analyzing available audit reports, project fundamentals, and ecosystem activity, we seek to evaluate whether PAID Network remains a trustworthy avenue for investors and project participants.

The Team and Roadmap Evaluation

The credibility of a blockchain project largely hinges on the backgrounds and experience of its core team, as well as the outlined roadmap milestones. PAID Network claims to have a robust executive team, including individuals like Luis Carbajo, an ex-Amazon executive, and Marta Valles, recognized as a leading woman in tech. CTO Alex Lopez also brings experience from Accenture and involvement in Ethereum forks. Their impressive resumes, especially in traditional tech and blockchain, support a stronger legitimacy claim.

Regarding transparency, the project publicly displays its legal entity “PD Network Inc.” and has ongoing social engagement through platforms like Telegram, Reddit, and Medium. Their roadmap delineates phases for ecosystem expansion, deal curation, community growth, and technological updates. Key milestones, such as launching the platform's deal pipeline, community membership tiers, and strategic partnerships, suggest a clear development trajectory. The purported delivery of these milestones appears consistent with their communicated timeline, although independent verification of the deal curation process remains limited.

- Establishment of active development and community engagement channels.

- Progress in onboarding promising deals in sectors like AI, gaming, and infrastructure.

- Clear plan for platform upgrades and ecosystem partnerships.

Overall, the team’s experienced profiles and transparent roadmap enhance PAID Network’s perceived ability to deliver on its promises. Nonetheless, execution risks inherent in early-stage DeFi and investment platforms persist, especially in managing deal quality and regulatory compliance.

Assessing the Security and Trust of PAID Network

Our security assessment for PAID Network primarily relies on the Cer.live audit report, which indicates a platform that has undergone professional review. The audit covered roughly 50% of the platform’s scope, with a certification from Certik—a reputable firm in blockchain security. The audit details, accessible via Certik’s report, suggest that the core smart contracts adhere to standard security best practices.

Key findings from the audit include:

- Platform scored approximately 5.1 out of 10, indicating room for security improvements.

- Incidents or vulnerabilities identified include specific bugs or flaws, although none appear to be actively exploitable at present.

- High centralization concerns may exist if control over key smart contract functions is concentrated among a few accounts or individuals, which can pose systemic risks.

- Insurance coverage is absent, implying that users’ funds or assets are not fully insured against potential exploits. This lack of insurance is a critical factor to consider, similar to the broader implications discussed in our article on the impact of no insurance in DeFi security.

This snapshot suggests that while PAID Network has taken steps to implement security measures, the risk of undiscovered vulnerabilities remains, typical for platforms of this nature. For investors, the absence of comprehensive insurance and moderate audit scores warrant caution—especially when dealing with deal pools and user funds. Understanding how to interpret such audit scores is vital, as detailed in our guide on interpreting Certik audits.

A Breakdown of PAID Network Tokenomics

The $PAID token serves as the backbone of the network ecosystem, primarily used for staking, tier access, governance, and reward mechanisms. Its tokenomics reflect an attempt to balance incentivization with scarcity, though some aspects require closer scrutiny.

- Total Supply: approximately 590 million tokens, with historical circulation at around 490 million.

- Market Cap: roughly $9.7 million, with recent slight decreases in price and market cap, indicating modest market activity.

- Token Distribution:

- Team and Advisors – a significant portion, typically with vesting schedules.

- Community & Ecosystem – allocations for staking, rewards, and liquidity pools.

- Private Sale & Investors – early backers, with lock-up periods.

- Utility: Staking to unlock deal access, participate in governance, and earn rewards; fee reductions based on tier level; incentivization for active community members.

- Economic Model Risks: The reliance on continuous inflow of new deal projects and user engagement to sustain demand may be vulnerable to project or market downturns. Additionally, token inflation through ongoing rewards could exert downward pressure if not managed carefully.

The economic outline suggests a typical utility token model with some inflationary push for rewards. The lack of significant burn mechanisms beyond certain allocations, and a modest market capitalization, imply potential liquidity and valuation risks, especially in volatile markets.

Evaluating Ecosystem Activity and Development Progress

PAID Network exhibits visible signs of ongoing development effort and ecosystem activity. The platform reports participation of over 100 funded projects, with detailed fundraisers for sectors like AI, gaming, and infrastructure, frequently raising substantial sums—e.g., over $200K in several deals.

Community engagement is reinforced through active social media channels, with thousands of followers on Telegram, Discord, and X (Twitter). The community appears vibrant, with regular updates, AMA sessions, and advertising campaigns aimed at expanding user participation.

While public deal activity suggests operational momentum, the actual post-deal success and project performance remain unconfirmed externally. For a risk-conscious investor, this warrants monitoring of project outcomes and platform governance processes to assess if deal curation remains rigorous and aligned with expectations.

Review of Terms, Conditions, and Legal Disclosures

The legal framework provided by PAID Network indicates standard terms and conditions aligned with typical DeFi and investment platforms. The notable points include:

- A clear risk disclosure emphasizing that private investments are illiquid and may lead to total loss.

- Limited explicit mention of user fund insurance or custody protections, which raises caution on exposure to smart contract exploits or project failures.

- Terms of service and privacy policies are publicly available, but the platform's legal protections against investor loss are minimal—consistent with most blockchain projects.

There are no apparent red flags, such as restrictive clauses or unfavorable legal terms. However, the absence of formal fund insurance or dispute resolution mechanisms suggests that investors must rely on due diligence and risk management strategies.

Final Analysis: The Investment Case for PAID Network

Based on the comprehensive data, PAID Network presents itself as a credible project with notable team members, transparent albeit modest security audits, and active development activity. Its core offering—access to curated deal flow with tiered benefits—aligns with trends in decentralized fundraising and community engagement.

However, several risk factors temper the overall attractiveness:

- Security Vulnerabilities: Audit scores suggest room for improvement, and the platform lacks insurance protections. Understanding the intricacies of smart contract vulnerabilities is crucial for assessing this risk.

- Market and Liquidity Risks: The project’s relatively small market cap and circulating supply indicate potential volatility and liquidity issues. These are common challenges for many meme tokens and smaller cap projects.

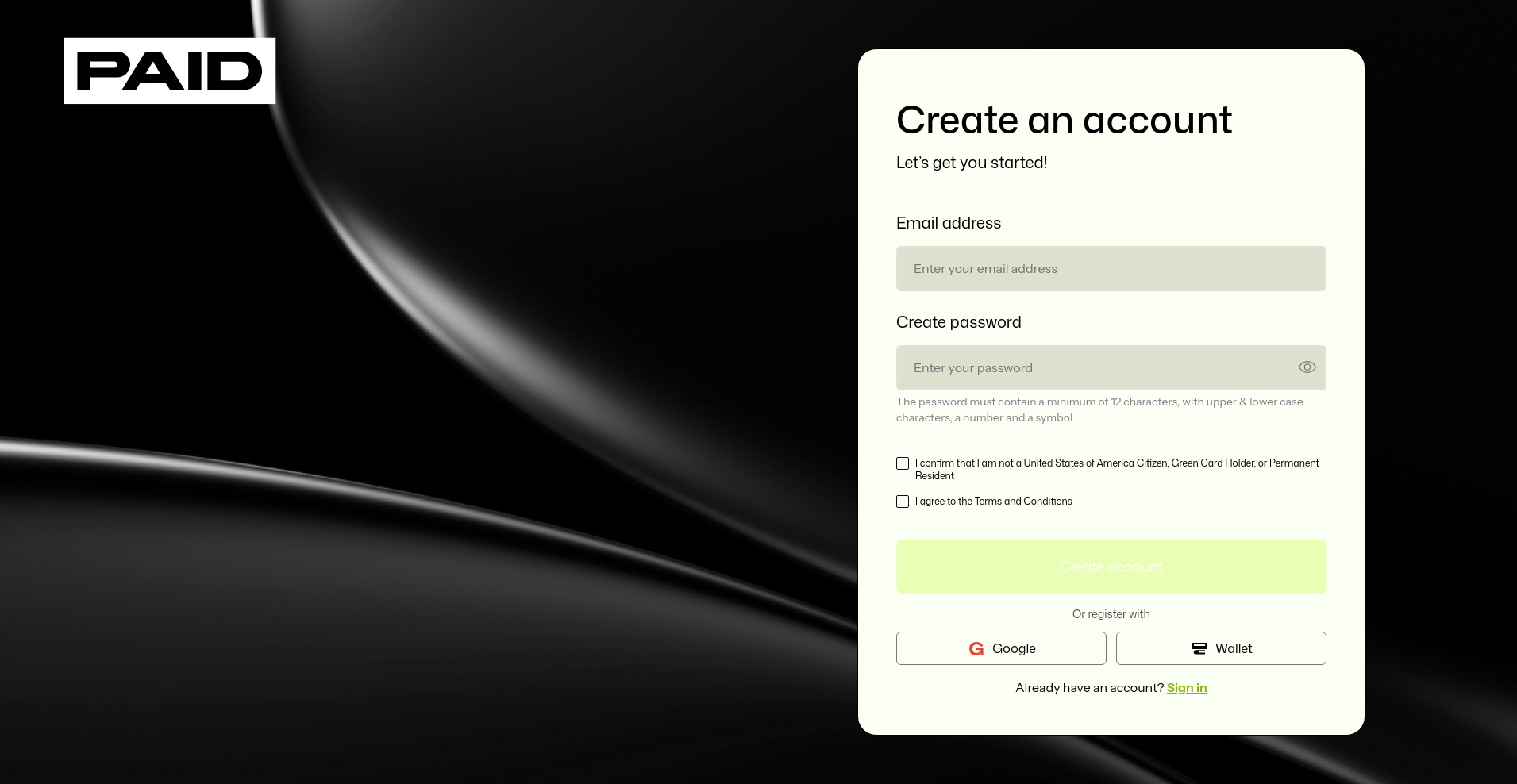

- Regulatory Considerations: Selected jurisdictions, especially US residents, are excluded from participation, signaling regulatory compliance complexities.

- Execution Risks: Despite promising roadmaps, actual project adoption and deal performance could fall short due to market volatility or execution lapses.

On the positive side, the project’s experienced team, community backing, and active partnership network suggest it has the means to sustain operations and expand its ecosystem. Its tiered incentive structure and deal curation approach aim to align stakeholder interests, but due diligence remains essential.

Investors should weigh the platform’s innovative appeal against the inherent risks of early-stage crypto projects, especially those with moderate audit results and nascent market liquidity. A cautious, well-researched approach is advisable before engagement.

In conclusion, PAID Network exhibits many hallmarks of a legitimate and well-structured project, but as with many blockchain initiatives involving investment and opportunity creation, risk management and ongoing monitoring are crucial. Its future viability depends on sustained development, security enhancements, and market adoption—factors that require diligent observation from potential investors.

James Carter

Chief On-Chain Analyst

On-chain analyst with a background in financial fraud detection. I use data science to dissect blockchains, find the truth, and expose scams. My motto: code doesn't lie.

Similar Projects

-

Tranchess

Tranchess ($CHESS) Review: A Deep Dive into Its Technology & Risks

-

Beratrax

Comprehensive Review of Beratrax: Is This Crypto Project a Scam? Crypto Scam Checker & Review

-

stabilityX AI

stabilityX AI Review: Scam or Legit Crypto? Scam Check & Analysis

-

CrazyyFrogCoin

CrazyyFrogCoin Review: Scam Check & Legitimacy Analysis

-

Badger DAO

Badger DAO Review: Crypto Scam Checker & Project Scam Review