Tranchess ($CHESS) Review: A Data-Driven Legitimacy and Risk Assessment

What Is Tranchess: An Introduction

Tranchess is a DeFi protocol that offers structured, risk-adjusted investment strategies centered around asset tokenization and tranche-based products. Established in early 2020, it aims to provide users with flexible yield-enhancing options, combining traditional tranche fund concepts with innovative crypto-specific features. Its core technological foundation involves creating diversified risk matrices from underlying assets like BTC, ETH, and BNB, and facilitating their management through tokenized instruments.

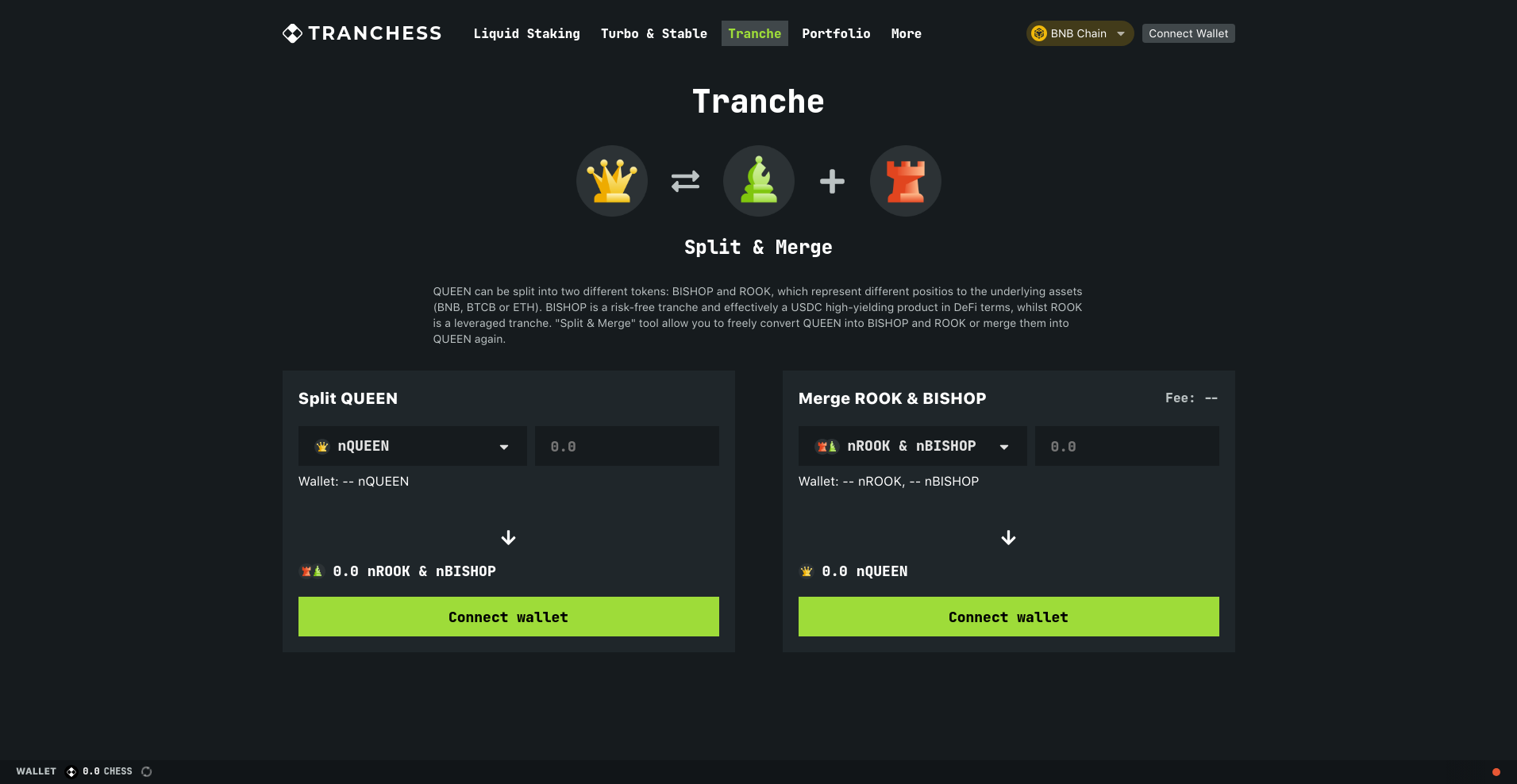

The platform primarily operates on BNB Chain and Ethereum, providing a suite of financial products such as liquid staking, leveraged tranches, and risk-banded asset pools. Notably, Tranchess’s unique ecosystem revolves around four tokens: QUEEN, BISHOP, ROOK, and the governance-native CHESS token, each serving distinct roles from long-term holding to leveraged exposure and governance governance.

The Team and Roadmap Evaluation

The publicly available data does not specify detailed information about Tranchess’s development team, such as individual backgrounds or prior experience. The project appears to have engaged reputable auditors, including PeckShield and CertiK, which indicates an investment in security and credibility, but no specific team members or VCs are explicitly named. This opacity on leadership is common in the DeFi sector but warrants caution. For a deeper understanding of how to evaluate such projects, consider a robust framework for assessing DeFi protocol risks.

- Audits conducted by renowned firms (PeckShield, CertiK, Immunefi bug bounty active).

- Active bug bounty program supports ongoing security validation.

- Multiple upgrades, including V2 features, suggest ongoing development efforts.

- Roadmap details are not explicitly provided in the extracted data, making future execution assessment difficult.

Overall, while the project demonstrates active development and security measures, the lack of transparent team backgrounds or detailed milestones makes it challenging to fully assess their capacity to deliver on their promises. Investors should weigh the strong audit presence against the operational opacity.

Assessing the Security and Integrity of Tranchess

Based on the Cer.live audit report, Tranchess has undergone audited security assessments from reputable firms; notably, PeckShield and CertiK, which are highly regarded in the blockchain security space. The audit reports are accessible through links, suggesting transparency regarding smart contract security. The audit results mention the protocol as being 'platform audited' with ongoing bug bounty initiatives, emphasizing an investment in security assurance.

- Audit Coverage: 100% for the relevant smart contract code.

- Major vulnerabilities: None indicated explicitly; incidents are flagged but not detailed as critical.

- Ownership and governance controls are not detailed but active audits imply a baseline security standard.

- Insurance coverage: Mentioned, providing an added layer of trust for potential investors.

The security analysis, based on a single major audit source, suggests a reasonably secure platform but falls short of comprehensive multi-audit validation. For an investor, the active bug bounty and recognized auditing firms are positives, yet due diligence should include review of the audit reports themselves and precautionary assessment of the governance structures.

A Breakdown of Tranchess Tokenomics

The tokenomics underpinning $CHESS and the associated assets are designed to incentivize participation, governance, and liquidity provision. However, much of the detailed data remains as placeholders ("--"), requiring real-time data for conclusive analysis. Still, the overarching model involves issuance, staking, and reward distribution mechanisms built around four core tokens:

- Total Supply: 300 million CHESS tokens.

- Token Distribution: Includes allocations for team, ecosystem incentives, community rewards, and security reserves (specific breakdown not provided).

- Vesting & Locking: veCHESS (vote-escrowed CHESS) represents staked governance tokens, with voting power influencing protocol parameters such as reward split and emission schedules. This is a key example of the veToken model in DeFi.

- Utility: Governance voting, protocol rebates, liquidity mining, and staking.

- Sustainability Risks: The reliance on emissions and governance votes could pose centralization or environmental risks if emission schedules are not well-managed or if large stakeholders dominate voting.

While the tokenomics segment supports a sustainable ecosystem through governance and rewards, the lack of explicit figures necessitates caution. Investors should monitor on-chain data for supply changes and emission rates to evaluate long-term viability.

Assessing Tranchess's Development and Ecosystem Activity

Development activity appears active, with multiple audit reports, version upgrades (notably to V2), and integration of novel features like instant swaps, expanded rebate pools, and multi-chain operations. Social channels—Discord, Medium, Telegram—also show ongoing community engagement. However, concrete milestones such as partnerships, new product launches, or user growth metrics are not explicitly detailed in the provided summaries.

From the available data, Tranchess maintains momentum through technical upgrades and security enhancements, but the relative absence of real-world usage stats, transaction volume growth, or expanded ecosystem partnerships tempers confidence in market traction. Potential investors should seek additional data on active user metrics and TVL trends before concluding long-term sustainability.

What Investors Need to Know About Tranchess's Terms and Conditions

The provided documentation and summaries do not highlight any unusual legal clauses or risky contractual provisions. As with many DeFi protocols, users should be aware of typical risks such as smart contract failures, governance centralization, and exposure to impermanent loss for liquidity providers. The project emphasizes audits and bug bounties to mitigate these risks but does not specify terms regarding user liabilities or dispute resolution mechanisms.

Overall, the terms appear standard for DeFi projects, but absence of detailed legal disclosures means this should be interpreted as a protocol with typical DeFi risks rather than outright red flags.

Final Analysis: The Investment Case for Tranchess

In sum, Tranchess presents a compelling, multi-product DeFi ecosystem with innovative tranche-based structures, diversified asset exposure, and active security measures. Its architecture caters to a broad spectrum of users—from long-term holders and yield farmers to leveraged traders—offering flexibility and governance participation through $CHESS. The project's security posture is strengthened by reputable audits and bug bounty programs, and recent upgrades demonstrate active development.

However, significant gaps remain: placeholders for critical data points, limited transparency on team backgrounds, and modest publicly available real-world metrics. These factors suggest a higher-risk profile, especially for new or risk-averse investors. Due diligence should include reviewing audit reports, monitoring on-chain activity, and assessing governance proposals for future emission and security decisions.

Pros / Strengths

- Reputed audits by PeckShield and CertiK bolster security confidence

- Active bug bounty program indicates ongoing security vigilance

- Innovative tranche architecture offers diversified risk-reward strategies

- Multi-chain support (BNB Chain, Ethereum) increases flexibility and access

- Governance through veCHESS token enables community-driven decision making

Cons / Risks

- Opaque team background and limited publicly shared development milestones

- Heavy reliance on placeholders ("--") for key data, indicating real-time data dependency

- Potential centralization in governance if large stake owners dominate votes

- Complex product offerings that may be difficult for new users to fully understand and utilize

- Risks inherent in smart contract-based DeFi, including impermanent loss and contract vulnerabilities

This review aims to empower you to make an informed judgment about Tranchess's legitimacy and risk level rather than offering financial advice. Its innovative approach and active development merit attention, but transparency and current data gaps call for cautious engagement.

Christopher Anderson

Smart Contract Auditor & Legal Tech Analyst

I have a dual background in law and computer science. I audit smart contracts to find the critical gap between a project's legal promises and its code's reality.

Similar Projects

-

Warlord

Comprehensive Review of Warlord: Crypto Project Scam Check & Scam Alert

-

LYNO

In-Depth Review of LYNO Crypto Project | Scam Checker & Risk Analysis

-

DISTRIBUTE

DISTRIBUTE Project Review: Crypto Scam Checker & Future Insights

-

BEEVO

Review of BEEVO: Crypto Scam Checker & Project Scam Review 2024

-

Peace Guy

Crypto Review: Is Peace Guy a Scam? Crypto Project Scam Checker & Honest Review