Memefrenzy Review: Scam or Legit Crypto? Uncovering All The Red Flags

What Exactly Is Memefrenzy?

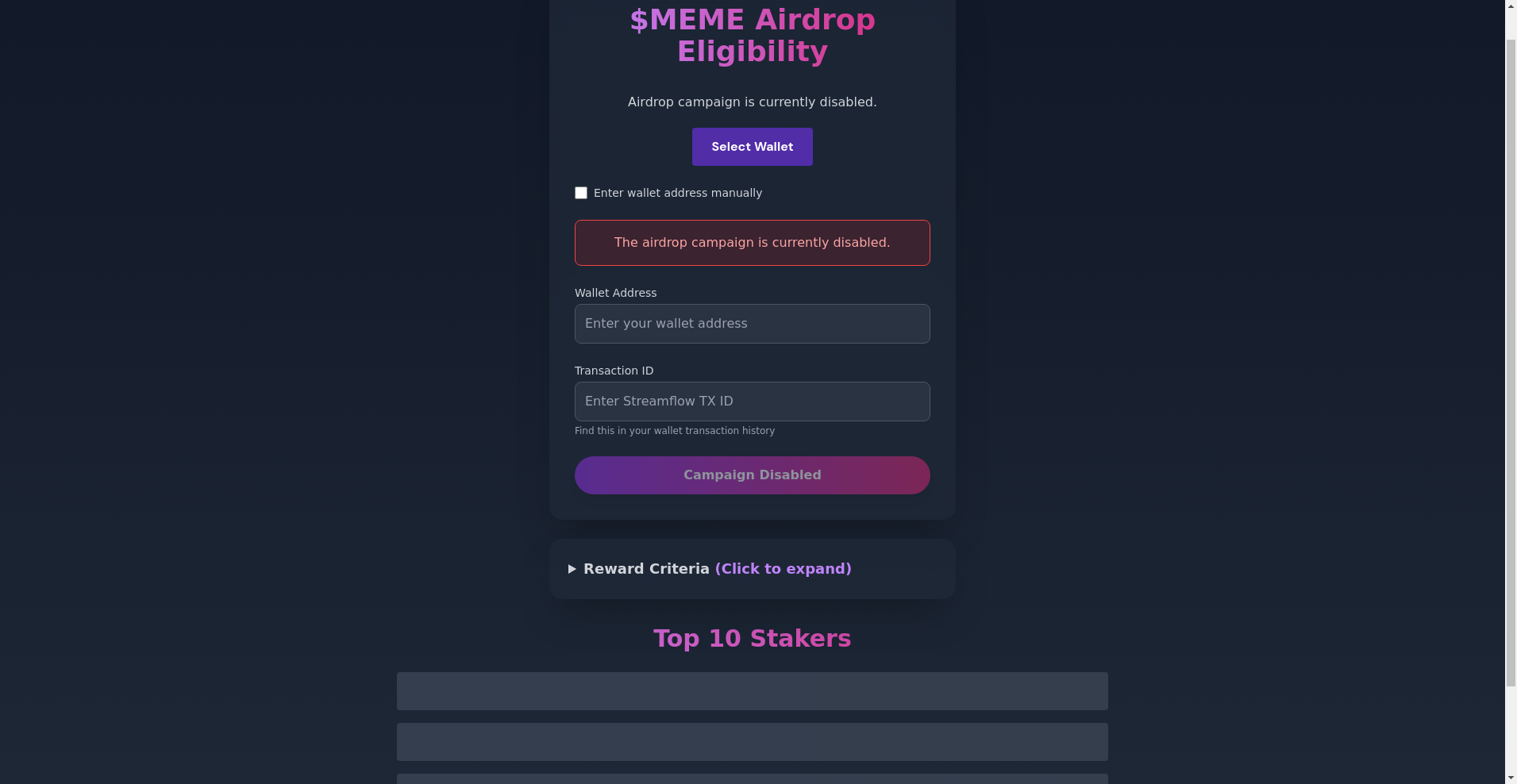

Memefrenzy presents itself as a vibrant, meme-centric project on the Solana blockchain, promising to harness the power of internet humor to foster a community-driven web3 ecosystem. The project touts its ability to blend meme culture with blockchain technology, aiming to become the ultimate meme movement in the crypto space. With features like staking, airdrops, and community contests, Memefrenzy claims to reward participants while building a fun, decentralized environment.

However, skepticism looms over such projects. This Memefrenzy review aims to dissect its claims, verify its credibility, and identify potential risks or red flags, especially for unwary investors seeking genuine opportunities in the crypto universe.

Who Is The Team Behind Memefrenzy?

One of the most critical aspects when evaluating a crypto project is transparency about its team members and developers. Unfortunately, Memefrenzy’s publicly available information provides little to no clarity regarding the founders or core team members. The project’s website and official channels do not disclose team identities or backgrounds, which is a common red flag in the crypto space.

This anonymity raises significant concerns, as accountability and trust are pivotal for long-term project viability. Without doxxed team members, investors have no way to verify expertise, experience, or intentions. The project’s roadmap and vision seem ambitious but lack credible backing, making it difficult to assess their feasibility.

- Anonymous creators with no verifiable identities

- No team profiles or LinkedIn links provided

- Vague roadmap relying heavily on hype rather than tangible milestones

In summary, Memefrenzy’s lack of transparency about its team considerably diminishes its credibility, aligning it more closely with potential pump-and-dump schemes common in meme coin communities.

Memefrenzy Security Audit: A Deep Dive into the Code

The only available audit for Memefrenzy is from Cyberscope, which states that the project has undergone a smart contract review and has received a KYC verification. The audit score reports a high security score of approximately 95%, which appears positive at first glance. The audit details indicate that the smart contract was developed for the Solana network, with a focus on standard token functionalities.

However, there are critical considerations:

- The audit covers only the token contract, not the broader ecosystem or staking infrastructure.

- No independent third-party audits for the entire project or its platform features are mentioned.

- While a high security score suggests low immediate vulnerability, it does not guarantee immunity against future exploits or centralized control issues.

- Notably, the audit was conducted early in development (January 2025), raising questions about ongoing security assessments.

Therefore, despite a seemingly reassuring audit report, the absence of comprehensive third-party validations or ongoing audits suggests potential vulnerabilities that could threaten investor funds.

Memefrenzy Tokenomics: A Fair System or a Trap?

The tokenomics of Memefrenzy are engineered around a total supply of 1 billion tokens, with different allocations designed to support liquidity, community growth, and development. The distribution is as follows:

- 55% Presale (550 million $MEME)

- 26.65% Liquidity pools (266.5 million $MEME)

- 17% CEX liquidity (170 million $MEME)

- 1.35% Team & Community rewards (13.5 million $MEME)

This distribution heavily favors presale and liquidity pools, which could facilitate large token dumps post-launch. The minimal allocation to the team (only 1.35%) is typical in meme projects that aim to appear fair but often lack transparency about whether team tokens are vested or locked.

Furthermore, the absence of a clear utility for the token apart from staking and community rewards raises questions about its intrinsic value. Investors should be cautious, as high initial allocations combined with no lock-up periods can lead to sudden price crashes if early investors sell en masse.

Is Memefrenzy a Ghost Town? Checking for Real Activity

The project boasts a social presence on X (Twitter) and a dedicated Telegram group with approximately 785 members. However, there is no active community on Reddit or a functional Discord channel, raising doubts about genuine user engagement.

Official updates and roadmap progress appear sparse since listing. The website references future features like NFT integration and meme contests, but there’s little evidence of ongoing development efforts or real-world activity beyond promotional hype.

Assessing the project’s ecosystem health, it resembles more of a marketing-heavy launch than an actively maintained platform. This superficial activity is typical of many "memecoin" projects that rely on initial hype and quick liquidity extraction rather than sustainable development.

What Memefrenzy's Legal Documents Are Hiding

There is no publicly available Terms of Service, privacy policy, or legal disclaimer on the official website. This omission is concerning as it leaves investors with no legal recourse in case of disputes, fund loss, or exit scams. Additionally, the absence of clear KYC/AML policies or regulatory compliance statements suggests a lack of safeguards typically expected in legitimate projects.

Potential risks include:

- Unclear or non-existent investor protections

- No formal dispute resolution mechanisms

- Potential for exit scam or rug pull scenarios

In absence of legal safeguards, investors participate at their own risk, and such omissions are a hallmark of dubious projects.

Final Verdict: Should You Risk Investing in Memefrenzy?

Based on the information available, Memefrenzy exhibits multiple red flags typical of questionable meme projects. Its lack of transparency, incomplete security validation beyond basic audits, high token allocation risks, and superficial community activity strongly suggest caution.

While the project claims to offer engaging meme-based activity paired with staking rewards, the absence of verifiable team members and legal safeguards make it a high-risk gamble rather than a trustworthy investment.

**Here are the key points to consider:**

- Positive Points:

- High security audit score for token contract

- Active social media presence, albeit limited

- Partnerships with established industry players

- Major Red Flags:

- Anonymous team and no credible founders

- Lack of comprehensive security audits

- Minimal legal documentation or investor protections

- Hyped community with limited real activity

- Potential for token dumps due to distribution structure

In conclusion, unless significant transparency and security guarantees are provided, investors should exercise extreme caution before participating in Memefrenzy. This review aims to equip you with the facts—ultimately, the decision rests on your risk tolerance and due diligence efforts.

David Martinez

Quantitative Risk Modeler

Quantitative analyst focused on crypto. I cut through the hype by modeling tokenomics and risk from a purely mathematical standpoint. If the numbers don't work, nothing else matters.

Similar Projects

-

Jeetcoin

In-Depth Review of Jeetcoin Scam and Crypto Project Review | Is Jeetcoin Legit or Scam?

-

MyVolt

MyVolt Review 2024: Is This Energy Blockchain a Scam or Legit Crypto Project? | Crypto Scam Checker

-

Benefit Mine

Benefit Mine ($BFM) Review: Project Failure & Lessons Learned

-

dTRINITY

Comprehensive Review of dTRINITY: Crypto Project Scam Checker & Risk Analysis

-

KeeperDAO

KeeperDAO ($ROOK) Review: Analyzing Its Security and Risks