cUSDC Review: Scam or Legit Crypto? Uncovering All The Red Flags

What Exactly Is cUSDC?

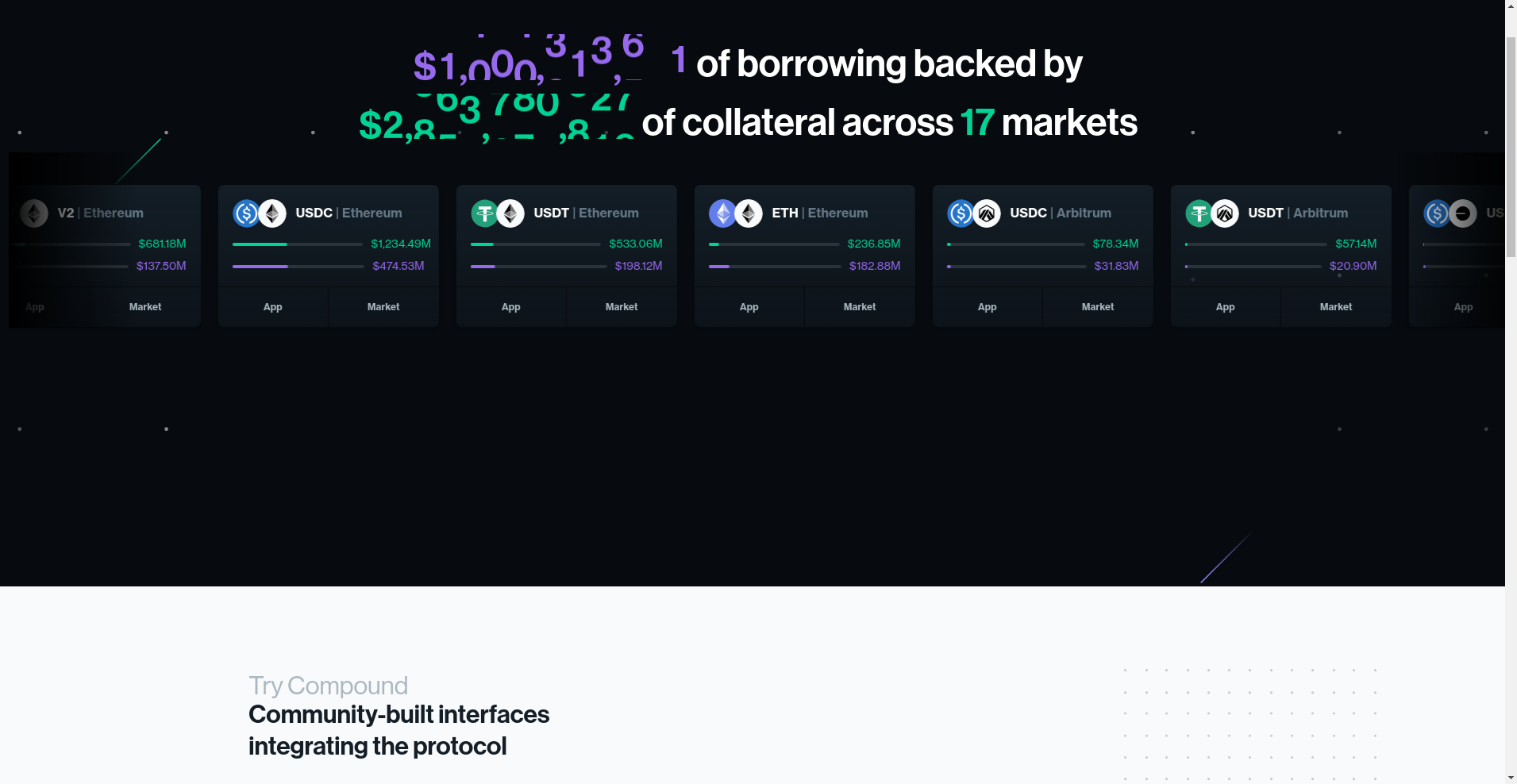

cUSDC is presented as a prominent stablecoin-backed token integrated within the decentralized finance (DeFi) ecosystem. Marketed as a "collateralized USDC" instrument, it promises users the ability to earn interest, lend, and borrow within a supposedly secure protocol. Its connection to the well-known Compound ecosystem lends an air of legitimacy, making it appear as a trustworthy component of the growing DeFi landscape.

However, beneath the surface lies a complex web of smart contracts, audits, and technical assurances that require thorough scrutiny. This article aims to perform a deep dive into cUSDC’s claims, assess the authenticity of its security measures, and identify red flags that investors need to watch out for before jumping in.

Who Is The Team Behind cUSDC?

One of the most critical aspects of any crypto project is the credibility of its team and leadership. From available data, cUSDC appears to be an extension of the Compound protocol, a project that has established some degree of reputation within the DeFi space. However, the core team behind cUSDC itself remains largely anonymous or, at best, lightly documented.

- Official sources cite Compound Labs as the primary developer, but no specific team members or founders are publicly doxxed or verified.

- The project's roadmap emphasizes expansion, security audits, and increased community engagement, standard for DeFi projects.

- Investors should be wary that a lack of transparency about the team raises red flags about accountability and long-term commitment.

Without transparent leadership or verifiable credentials, the project's longevity and security remain questionable, especially if it heavily relies on unclear governance protocols and third-party audits.

cUSDC Security Audit: A Deep Dive into the Code

Security and trustworthiness hinge on comprehensive audits and verifiable code integrity. According to Cer.live audit data, cUSDC has undergone some usual security verifications by reputable firms, including Quantstamp, OpenZeppelin, and Trail of Bits. The audit coverage is reported as 100%, and ongoing bug bounty programs are in place, which is a positive indicator.

- The external audits by Quantstamp and OpenZeppelin are industry-standard, focusing on smart contract vulnerabilities and potential exploit vectors.

- Despite these audits, no codebase is infallible, and the complex nature of DeFi smart contracts means vulnerabilities could still exist, especially in areas not covered by audits.

- Potential risks include centralization of control (if any admin functions exist), upgradeability issues, or hidden backdoors that auditors might have missed.

While the audit reports seem reassuring, investors should remember that audits do not guarantee immunity from exploits. The perceived safety is only as strong as the transparency and thoroughness of these external reviews.

cUSDC Tokenomics: A Fair System or a Trap?

The tokenomics of cUSDC, like many DeFi assets, appear complex but lack detailed public disclosures. The available data indicates that the total circulating supply is approximately 1.42 billion tokens, with the market cap fluctuating around $35 million. The distribution seems to be primarily driven by the Compound ecosystem, but the specifics of initial allocations, team holdings, or vesting schedules are not clearly disclosed.

- Total Supply: Around 1.42 billion cUSDC tokens.

- Distribution: Largely influenceable by protocol mechanics rather than transparent allocation plans.

- Team & Incentives: No detailed breakdowns, raising concerns over possible pump-and-dump schemes if majority holdings are concentrated.

- Utility: Designed for interest accrual, collateralization, and participation in governance, but the real threat is if the token utility is solely speculative.

The absence of transparent tokenomics increases the risk of sudden dumps, especially if insiders or whales decide to exit en masse, collapsing the token's value and shaking investor confidence.

Is cUSDC a Ghost Town? Checking for Real Activity

The available summaries and audit data paint a picture of a project that’s somewhat dormant in active development, with most activity centered around implementation and security checks. The protocols appear to be integrated into the larger Compound ecosystem, but recent public activity, developer updates, or community engagement seem minimal.

Genuine ecosystem activity, such as new partnerships, active governance proposals, or frequent code updates, are absent or limited. This stagnation suggests cUSDC might be just a "front" product or a derivative that depends heavily on the main Compound protocol, with little in terms of independent development or innovation.

Investors should question whether the lack of active development signals underlying issues or simply an unpublicized shutdown. Due diligence should extend beyond audits into community chatter and code repositories for signs of ongoing progress.

The Fine Print: What cUSDC's Legal Documents Are Hiding

Scrutinizing the project's legal terms and documentation, there are several red flags worth noting:

- Limited transparency about user rights, liabilities, and dispute resolution mechanisms.

- Possible clauses that disclaim all warranties, leaving users vulnerable to loss without recourse.

- The legal framework may favor protocol developers or insiders, effectively silencing individual user claims in case of loss or exploit.

Such exclusions are common but dangerous—particularly if coupled with undisclosed upgrade functions or emergency controls that could be exploited or misused.

Final Verdict: Should You Risk Investing in cUSDC?

After thorough investigation, cUSDC presents itself as a typical DeFi product layered over the established Compound foundation. While audits and community endorsements offer some reassurance, multiple red flags—such as lack of team transparency, opaque tokenomics, minimal active development, and potential legal red flags—indicate high risk.

In the current environment, investing or interacting with cUSDC carries significant risks of smart contract vulnerabilities, market manipulation, and possible exit scams. It should only be approached by those willing to accept extreme caution and the chance of losing their entire stake.

Positive Points

- Audits by reputable firms (Quantstamp, OpenZeppelin, Trail of Bits).

- Active bug bounty programs indicating some focus on security.

- Integration with the broader Compound ecosystem.

- Standard DeFi mechanics like interest accrual and governance exposure.

Major Red Flags

- Opaque team and lack of verifiable leadership.

- Unclear tokenomics, high risk of inflation or dump scenarios.

- Minimal evidence of ongoing development or community activity.

- Potential legal ambiguities and disclaimer clauses that favor protocol operators.

- Possibility that cUSDC is just a clone or mere derivative with no real innovation.

In conclusion, without further transparency, ongoing updates, or community activity, cUSDC appears to be a risky proposition. Investors should exercise extreme caution, conduct personal due diligence, and avoid making hasty commitments based solely on audits or superficial claims.

Emily Davis

Digital Forensics Investigator

Digital forensics investigator. I follow the money on the blockchain to uncover the truth behind crypto scams and exploits. Every transaction tells a story—I'm here to make sure it's heard.

Similar Projects

-

Book Of Squid Wif Hat

Crypto Project Scam Checker Review: Is Book Of Squid Wif Hat a Scam or Legit?

-

Dharma

Dharma ($DHARMA) Review: A Deep Dive into Its Risks & Potential

-

OpSec

In-Depth Review of OpSec: Is This Crypto Project a Scam or Legit?

-

ETFSwap

In-Depth Review of ETFSwap: Crypto Scam Checker & Project Scam Review

-

Crybaby ($CRYBB)

Crypto Scam Checker Review: Is Crybaby ($CRYBB) a Safe Project or Scam?