LUKSO Token ($LYX) Review: A Data-Driven Look at Its Legitimacy and Risks

What Is LUKSO Token: An Introduction

The LUKSO Token ($LYX) is the native utility token of the LUKSO ecosystem, a Layer-1 blockchain built on an unmodified Ethereum architecture aimed at social, creative, and creator-centric use cases. According to available data, there are approximately 42 million LYX tokens initially minted at launch, now circulating measured at around 42.11 million tokens. The project emphasizes standards that enable verified digital identities, assets, and flexible NFTs, positioning itself as a standards-first ecosystem for culture-driven digital interactions.

Built with EVM compatibility, LUKSO seeks to facilitate the migration of Ethereum smart contracts and resources, fostering interoperability within its ecosystem. The goal is to support innovative social functionalities like Universal Profiles—blockchain-based social accounts with permissions, metadata, and governance features—making it attractive for creators, brands, and communities. This review offers an impartial examination of its strengths, risks, and long-term viability based on the current available data.

The Team and Vision Behind LUKSO Token

The project's leadership features notable Ethereum veteran Fabian Vogelsteller, co-author of ERC20 and ERC725 standards, signaling significant industry experience and influence. He is joined by co-founder Marjorie Hernandez, a designer and innovator in digital fashion through The Dematerialised, further aligning the project with creative and social innovation. These founders have a credible track record in blockchain development and digital creativity.

The roadmap indicates milestones such as the mainnet launch in May 2023, Universal Profiles activation in November 2023, and reaching over 100,000 validators by late 2023. The focus remains on enabling identity, community, and social standards, with emphasis on user experience and ease of migration from Ethereum. Despite some placeholder content in their official materials, the infrastructure demonstrates a commitment to standards-based, developer-friendly, and user-owned digital identities.

- Mainnet launched in May 2023 with initial supply of 42 million LYX

- Over 20,000 Universal Profiles on mainnet by June 2024

- Validator count surpassing 100,000 by late 2023

- Major upgrades like the Dencun hard fork in November 2024 for Ethereum compatibility

Overall, the team’s extensive experience and systematic roadmap lend legitimacy, though the project remains relatively early in its ecosystem development and adoption phases.

Assessing the Security and Integrity of LUKSO Token

The security evaluation of LUKSO is primarily based on the audit report from ConsenSys Diligence, a reputable firm in blockchain smart contract auditing. The audit, documented at here, indicates that the platform leverages audited smart contracts. The audit's relevance was confirmed via the Cer.live platform, which rated the token highly with a score of 4.85 out of 5.

Key findings include:

- Comprehensive audit coverage with detailed security assessments

- Implementation of standard security practices in smart contract deployment

- No known active incidents or major vulnerabilities reported

- Use of multi-layer permissioning via their LSP standards, e.g., LSP6 Key Manager

While these security practices are strong, reliance on the audit's scope and the inherent risks of evolving smart contracts mean caution is prudent. No public incident reports or major attacks are documented so far, indicating a relatively secure technical underpinning at present. Nonetheless, investors should monitor ongoing audits and engagement, as the ecosystem scales and new features are deployed.

A Breakdown of LUKSO Token [$LYX] Tokenomics

The economic model of LUKSO aims to support a sustainable, community-driven ecosystem. The key tokenomics points are:

- Total supply: Approximately 42 million LYX tokens issued at genesis, now about 42.11 million circulating tokens.

- Token utility: Used for staking to secure the network, participating in governance, and powering transaction fees and smart contract interactions.

- Distribution: Initial distribution included allocations for team, reserves, and community incentives; details on specific allocations are pending further disclosures.

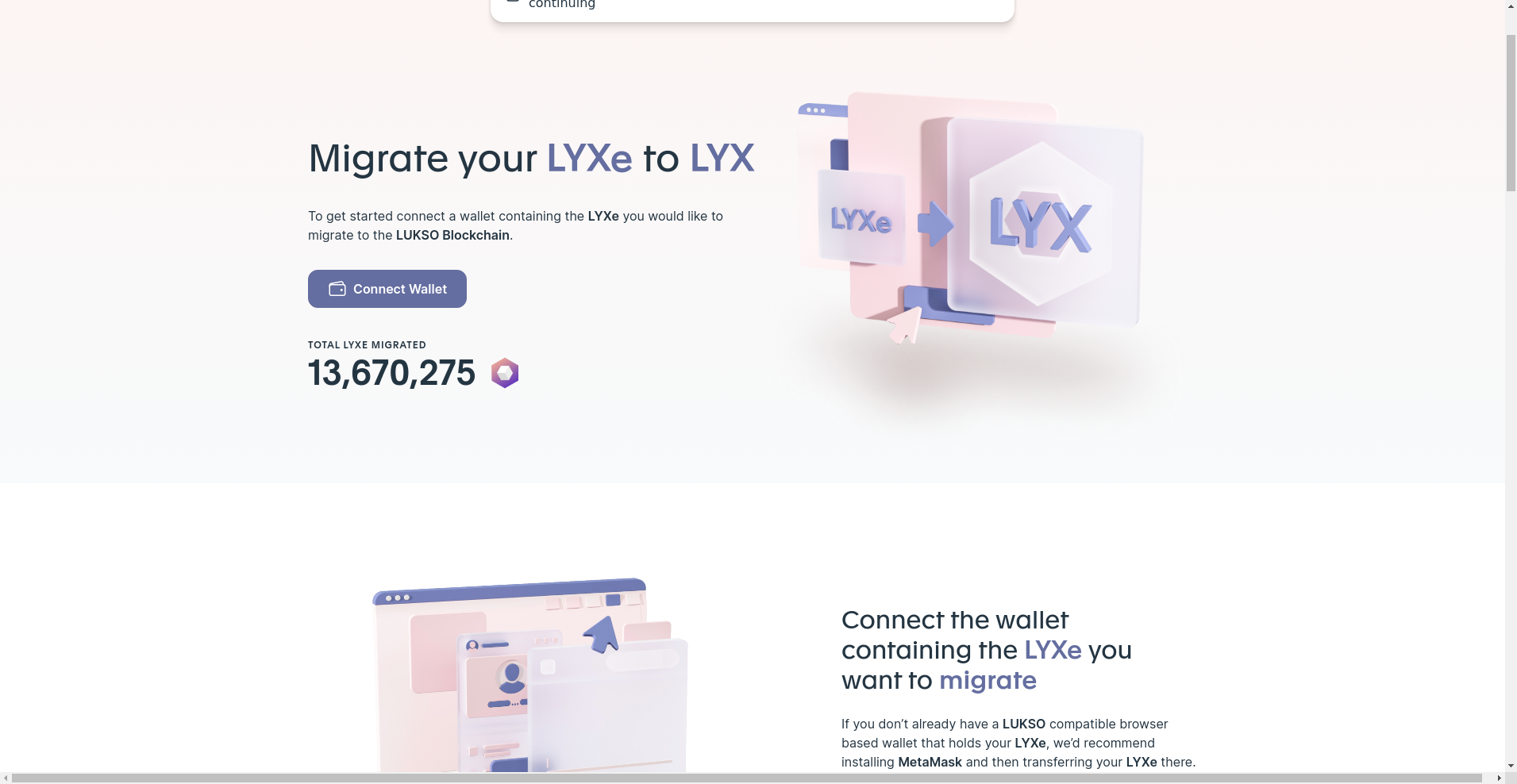

- Bridge and variants: The project also introduces LYXe, a representation of LYX on Ethereum via a bridge, facilitating interoperability and liquidity between chains. Additionally, a test token, LYXt, is used for testnets.

- Funding mechanisms: A reversible ICO (rICO) process for LYXe was conducted in 2020–2021, offering a fair distribution and reduced purchase risks via reversibility features.

The tokenomics seem designed to incentivize participation, staking, and ecosystem growth, although the long-term economic sustainability depends on network adoption, validator engagement, and asset utility. The current market cap stands near $14 million, with modest trading volume (~$2,467 in the recent snapshot), suggesting limited liquidity and trading activity to date.

Assessing LUKSO Token's Ecosystem and Development Activity

The ecosystem's activity signals official support and developer engagement, driven by multiple standards and a standards-first philosophy. The focus on Universal Profiles, NFT standards (LSP7, LSP8), and developer tooling (npm libraries, explorers) establish a developer-friendly environment.

Recent milestones include migration of Universal Profiles to mainnet, significant validator participation, and strategic upgrades aligning with Ethereum’s latest developments (like the Dencun fork). Community resources, content hubs, and active social channels like Medium, Discord, and Telegram support ongoing engagement.

While the overall activity profile indicates a burgeoning ecosystem with creative, identity, and social use cases, there remains a need for broader real-world adoption, case studies, and developer ecosystem maturity. The vibrant validator count and ongoing product launches suggest strong foundational momentum, but the project remains predominantly in early growth stages.

Reviewing the Terms and Conditions

The legal framework surrounding LUKSO is structured to ensure transparency and regulatory compliance. Their policies, primarily via the privacy policy and terms of service, clarify data handling, security measures, and user rights. Central points include:

- Data privacy is governed by Swiss law, with explicit rights for data access, rectification, and erasure.

- Blockchain data, such as on-chain transactions and wallet addresses, are inherently public and immutable, posing privacy considerations.

- Use of third-party tools and social media channels involves adherence to external privacy policies.

- Token transactions and software deployments are governed by established smart contract standards, audited and security-reviewed, but inherent blockchain risks persist.

Overall, the legal and user terms appear comprehensive, with emphasis on data subjects’ rights and security precautions. Risks are primarily related to the nascent ecosystem and the immutable nature of blockchain data.

Final Analysis: The Investment Case for LUKSO Token

In summary, LUKSO presents a promising, standards-driven ecosystem aimed at social, creative, and community-based digital economies. Its leadership, audit history, and technological foundations provide a credible footing. The project’s focus on Universal Profiles, NFT extensions, and developer standards underpin a strong niche in social/blockchain hybrid use cases.

However, the current scale and market activity are modest, with a market cap of around $14 million, low trading volume, and development milestones still in early deployment. The ecosystem’s growth will depend heavily on real-world adoption by creators, brands, and social platforms, alongside subsequent network upgrades and partnerships.

-

Pros / Strengths

- Experienced founding team with a solid reputation in Ethereum standards.

- Clear roadmap aligned with Ethereum upgrades and ecosystem maturation.

- Innovative standards (Universal Profiles, dynamic NFTs) catering to social/creative use cases.

- Security audited smart contracts and active validator network.

- Focus on developer tooling and ecosystem supports, including grants and initiatives.

- Ethereum compatibility facilitates migration and interoperability. Cons / Risks

- Limited adoption and liquidity to date—market cap and trading volume remain modest.

- Early ecosystem with potential to be overshadowed by larger competitors (e.g., Polygon, Flow, Immutable).

- Dependence on continued network upgrades and community engagement for scaling.

- Some documentation and milestone content are placeholders, requiring ongoing validation.

- Inherent privacy considerations due to blockchain transparency, especially with on-chain identities and assets.

Investors and users should weigh the project’s innovative standards and experienced team against its early market traction and ecosystem development stage. Continued monitoring of on-chain activity, community adoption, and security assessments will be essential for a comprehensive evaluation.

By adhering to best practices and leveraging its standards ecosystem, LUKSO can carve a niche as a social, creator, and community platform within the larger NFT and blockchain landscape, but it remains a nascent project with significant growth potential and equally significant risks.

James Carter

Chief On-Chain Analyst

On-chain analyst with a background in financial fraud detection. I use data science to dissect blockchains, find the truth, and expose scams. My motto: code doesn't lie.

Similar Projects

-

MeAI

MeAI Review: Scam or Legit Crypto? Scam Check & Legitimacy Analysis

-

EverETH

Review of EverETH: Is This Crypto Project a Scam or Legit? Crypto Scam Checker & Project Review

-

Bull_Coin

Comprehensive Review of Bull_Coin: Is This Crypto Scam or Legit Project? | Crypto Scam Checker

-

Book of Mew (BOMEW)

In-Depth Review of Book of Mew (BOMEW): Crypto Scam Checker and Project Scam Review

-

BNSD Finance

BNSD Finance ($BNSD) Review: Assessing Legitimacy and Risks