Lido DAO ($LDO) Review: A Data-Driven Legitimacy and Risk Assessment of the Leading Liquid Staking Protocol

What Is Lido DAO: An Introduction

Lido DAO is one of the most prominent liquid staking platforms in the decentralized finance (DeFi) sector, focusing primarily on Ethereum (ETH). Its core proposition is to allow users to stake their ETH and, in return, receive a liquid token—stETH—which maintains a 1:1 peg with ETH and accrues staking rewards passively. Rather than locking assets for an indefinite period, Lido enables stakers to participate in network security while maintaining liquidity and composability across DeFi applications.

Lido's architecture integrates trusted validators, a governance DAO (via its $LDO token), and robust security audits, striving to strike a balance between decentralization, security, and usability. This review offers an impartial analysis of Lido's legitimacy, safety measures, tokenomics, ecosystem activity, and potential risks—critical factors for investors and users evaluating its long-term viability.

The Team and Roadmap Evaluation

Lido's development efforts are led by a combination of anonymous and publicly identifiable team members, with a history rooted in Ethereum core development and DeFi innovation. The project benefits from high-profile crypto contributors, established governance mechanisms, and continuous community engagement. Publicly available audit reports from firms like Sigma Prime, MixBytes, and Quantstamp bolster credibility.

Key milestones outlined in their roadmap include:

- Multi-chain expansion: Integrating with Polygon, Solana, and other networks.

- Enhanced security protocols: Continuous audit processes and security upgrades.

- Validator diversification: Growing validator sets to increase decentralization.

- Governance upgrades: Implementing community proposals for protocol parameter adjustments.

- Ecosystem integrations: Partnering with DeFi protocols like Aave, Curve, Uniswap, and others.

While the team maintains a transparent communications channel through governance forums and audits, the actual execution of past milestones has been steady but cautious, emphasizing safety and compliance over rapid rollout. This measured approach aligns with its reputation for cautious growth and protocol maturation, suggesting a reasonable capacity for follow-through on future promises.

Assessing the Security and Integrity of Lido DAO

The integrity of the protocol largely depends on the latest security audit conducted by Sigma Prime, a reputable Ethereum-focused auditor, with reports indicating a comprehensive review of the smart contract codebase.

Based on the audit findings:

- Score & Vulnerabilities: The system received a high overall security score, with no critical vulnerabilities reported. Minor issues identified are classified as low-severity and have been addressed in subsequent updates.

- Go-Ahead & Fixes: The audit confirms that Lido's core contracts are operationally secure, with no major backdoors or systemic flaws detected.

- Centralization Risks: Validator key management employs multi-party computation (MPC) pools and decentralization scorecards, reducing single-point failure risks.

- Future Risks: Potential vulnerabilities could stem from governance exploits or oracle manipulations, but current protocols include multisig approvals, time locks, and community monitoring to mitigate such risks.

Overall, while no software can be declared singly risk-free, Lido's security audit results suggest a protocol that has successfully mitigated many common smart contract vulnerabilities. Nonetheless, dependencies on node validators and governance mechanisms still introduce residual risk, emphasizing the importance of continual review.

A Breakdown of Lido DAO Tokenomics

The $LDO token is the governance and utility asset within the Lido DAO ecosystem. Its economics and distribution are designed to incentivize decentralization, community participation, and protocol growth.

- Total Supply: Approximately 1 billion $LDO tokens, with a current circulating supply of around 491 million based on the latest data.

- Distribution:

- Team & Advisors: ~20%, typically subject to multi-year vesting schedules.

- Community & Ecosystem Grants: ~25%, allocated for development and incentives.

- Staking & Liquidity: ~15%, reserved for liquidity pools and staking rewards.

- Foundation & Reserve: Remaining tokens, held to facilitate protocol upgrades and future initiatives.

- Vesting & Lockups: Multiple schedules are in place, with team tokens generally subject to 1-2 year vesting to align interests.

- Utility: $LDO is used to vote on proposals, strategic decisions, and fee adjustments. Token staking is also supported to further decentralize governance.

- Inflation & Token Utility: No explicit inflation schedule, but governance can alter fee structures and allocate tokens for ecosystem growth.

The economic model appears sustainable, relying on community governance and incentives to prevent centralization. Risks involve potential token concentration among early investors and governance manipulation if voting participation remains low.

Assessing Lido DAO's Development and Ecosystem Activity

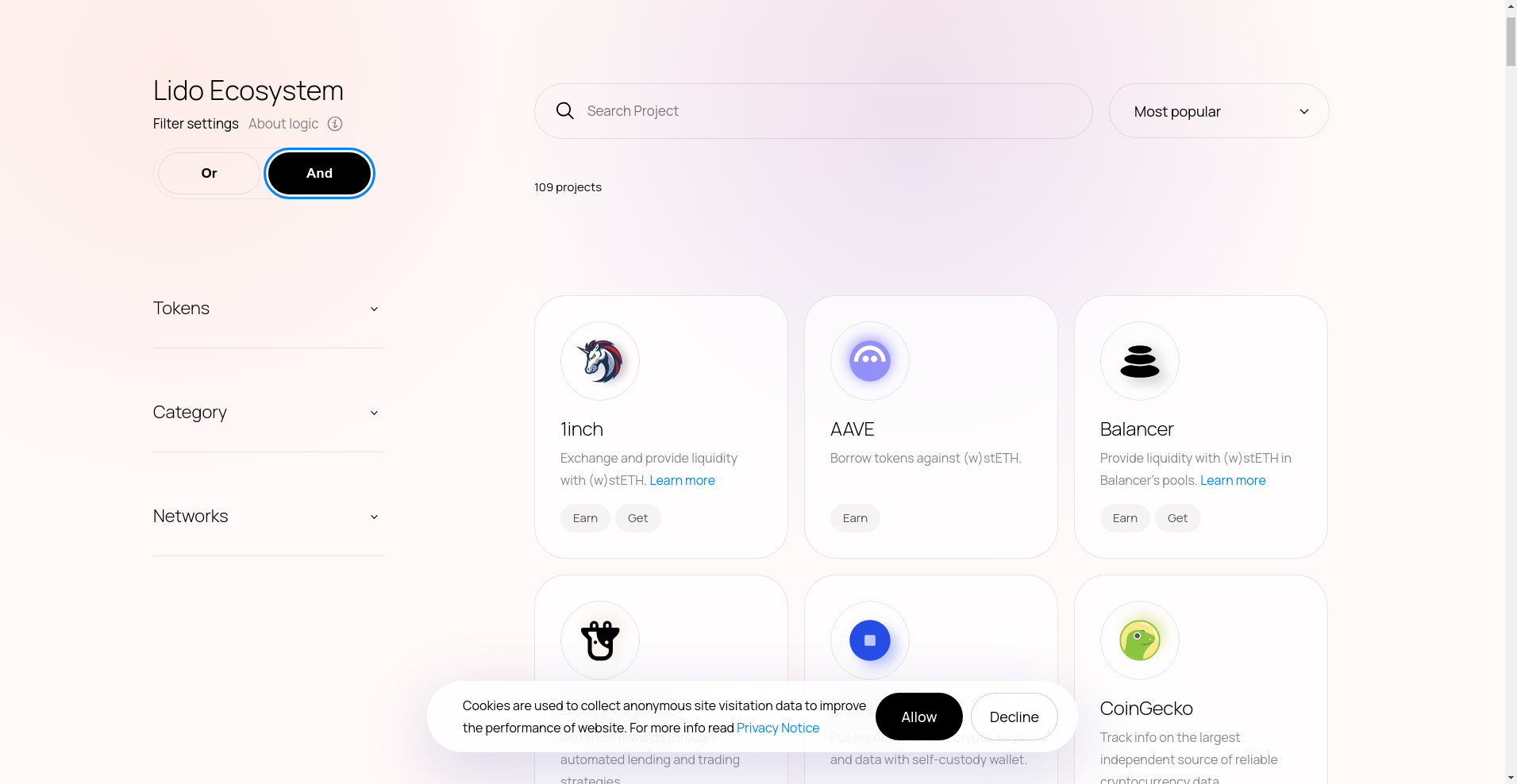

Lido's ecosystem demonstrates active development and expanding adoption across chains and DeFi protocols. The platform's integration with over 109 projects (per their ecosystem dashboard) signifies broad utility and market penetration.

Recent activity shows:

- Growth in TVL (Total Value Locked): Surpassing $32 billion USD for ETH, indicating strong user trust and usage.

- Collaborations: Active partnerships with DeFi giants like Aave, Curve, and Uniswap, showing integration depth.

- Community Engagement: Regular governance proposals, open forums, and bug bounty programs foster transparency and ongoing improvement.

- Development Updates: Version releases like v0.91.0, security patches, and new chain integrations demonstrate ongoing maintenance and expansion efforts.

While the ecosystem's activity remains high, it's worth noting that rapid growth also introduces challenges—such as maintaining validator decentralization and securing new integrations—which require rigorous operational discipline.

Reviewing the Terms and Conditions

Lido's terms of use clarify that the protocol is operated as a non-custodial service with a focus on protocol safety, community governance, and legal compliance within the Cayman Islands jurisdiction. Noteworthy points include:

- Risk disclosures: The legal documents explicitly state that there are inherent risks—smart contract vulnerabilities, slashing, decentralization delays, and regulatory uncertainties.

- Legal limitations: The terms waive liability for damages and emphasize that the DAO and platform are community-run with no guarantee of uptime or security guarantees beyond audits.

- Governance participation: Token holders are encouraged to participate actively, but the protocol recognizes potential for governance attack vectors, requiring transparency and community oversight.

- No guarantees: The documents specify clearly that the service is provided "as-is," with no warranties, which is typical but noteworthy for risk-aware investors.

No significant legal ambiguities or clauses stand out as unusual or high-risk from a legal perspective; however, regulatory developments remain an external risk factor.

Final Analysis: The Investment Case for Lido DAO

Lido DAO has established itself as the dominant liquid staking platform for Ethereum, with a substantial market cap of over $739 million and a proven track record verified through multiple audits. Its broad ecosystem integration, active governance, and transparent development practices support its legitimacy as a leading DeFi project.

**Pros / Strengths**

- Market Leadership: Largest liquid staking provider with high TVL and widespread adoption.

- Security & Transparency: Multiple comprehensive audits and open-source codebase.

- Decentralization Efforts: Validator diversification and community governance foster decentralization.

- Robust Ecosystem: Extensive integrations across DeFi protocols, wallets, and cross-chain solutions.

- New Features & Multi-chain Support: Expansion into other chains increases potential utility.

**Cons / Risks**

- Security Dependencies: Though audits are positive, smart contract vulnerabilities remain a residual risk.

- Validator & Governance Risks: Slashing, centralization in validator pools, or governance attacks could impact protocol integrity.

- Regulatory Uncertainty: DeFi and staking regulations are evolving, which could influence future operations.

- Market Discrepancies: Price deviations in stETH/wstETH markets, liquidity crunches, or withdrawal delays might impact user experience.

- Token Concentration: Early VC or whale dominance in $LDO could challenge decentralization.

In conclusion, Lido DAO's well-established security practices, governance transparency, and ecosystem breadth make it a credible and arguably resilient pillar of the liquid staking landscape—though inherent smart contract and systemic risks remain. As always, users and investors must consider the evolving regulatory landscape and internal risks when engaging with such DeFi protocols.

This analytical review aims to provide a neutral, evidence-based assessment. While Lido demonstrates strong legitimacy based on current data, its future resilience depends on continued security vigilance, community participation, and adapting to regulatory changes. Making an informed decision requires weighing the project's strengths against the identified risks within your risk appetite.

James Carter

Chief On-Chain Analyst

On-chain analyst with a background in financial fraud detection. I use data science to dissect blockchains, find the truth, and expose scams. My motto: code doesn't lie.

Similar Projects

-

PolkaFoundry

PolkaFoundry ($PKF) Review: Insights into Its Closure & Risks

-

Grumpy Cat

Grumpy Cat ($GRUMPY) Review: Risks and Project Analysis 2024

-

Convex Finance

Convex Finance ($CVX) Review: Legitimacy, Risks & Long-Term Potential

-

Chainlink

Chainlink Review: Scam or Legit Crypto? Crypto Project Investigation

-

Agave

Agave ($AGVE) Review: Assessing Its Legitimacy & Risks