In-Depth Review, Scam Check, and Risk Analysis of FOMO.BIZ: Is It Legit? Latest Update, Tokenomics, and Red Flags Before You Invest

FOMO.BIZ has emerged as a multifunctional platform that claims to serve as a hub for discovering, launching, trading, and managing cryptocurrencies. Its broad feature set—including a decentralized exchange (DEX), token launchpad, cross-chain bridge, portfolio tools, and analytics—positions it as an ambitious aggregator in the competitive DeFi ecosystem. But does this all sound too good to be true? As an investigative journalist with a skeptical eye, I will dissect every aspect of FOMO.BIZ to answer pressing questions: Is FOMO.BIZ legit? What are the risks involved? And are there any red flags that potential investors should be aware of before diving in?

Project Overview and Official Details

FOMO.BIZ is accessible through its official site (fomo.biz), which presents a comprehensive ecosystem for crypto enthusiasts. The platform advertises multiple tools including a token launchpad, DEX, bridge, wallet and portfolio management, advanced charts, and real-time analytics. Their mission seems to focus on providing secure, transparent, and user-friendly access to various DeFi functionalities.

Team, Mission, and Goals

Despite the platform's comprehensive interface, there is no publicly available information about the team behind FOMO.BIZ. No transparent team profiles, partnerships, or backing entities are disclosed on the website or within their documentation. Their stated goal appears to be creating a decentralized ecosystem with features like anti-bot protections, token locks, and audited smart contracts — which, if genuine, could boost trustworthiness. However, the absence of leadership transparency raises concern about accountability and long-term viability.

**Red Flag:** Lack of team info and no verifiable founders or advisors. Trustworthy projects usually display clear credentials and backing.

Legal and Privacy Aspects: Terms of Service & Privacy Policy

FOMO.BIZ provides links to its Terms of Service and Privacy Policy. Key points include:

- Explicit agreement to platform rules, user responsibilities, and liabilities.

- Privacy protections aligned with standard practices, though specifics on data collection and sharing are limited.

- Key mention of open-source operation and decentralization, implying minimal centralized control—worthy of further verification.

**Caution:** No body of evidence suggests rigorous legal frameworks or regulatory compliance. Personal data handling and dispute resolution mechanisms remain unclear.

Roadmap and Milestones

The platform publicly shares progress updates and development milestones via their official roadmap. Recent highlights include:

- Ongoing feature enhancements for cross-chain bridges and security audits.

- Upcoming launches of new tools like advanced analytics and automated trading bots.

- Incremental rollout of security features and community engagement initiatives.

While the roadmap shows active development, the absence of concrete timelines and deliverables indicates a lack of transparency, common among unverified projects.

Latest News and Activity

FOMO.BIZ maintains a blog and announcement section. Recent updates indicate technical improvements and partnerships with auditing firms such as CredShields. However, these are isolated mentions without detailed technical reports or community feedback. The platform also claims to have a growing user base, but public metrics like user count, transaction volume, or TVL are not confirmed or visible.

The Ecosystem: Tools & User Experience

Crypto Discovery & Portfolio Management

The UI suggests a modern, polished interface built with React and RainbowKit, featuring wallet connection, sorting, and filtering options. Users can explore new tokens, track their holdings, and access market insights. Although these features are standard in modern DeFi dashboards, the lack of data on actual usage metrics (e.g., number of active users, trading volume) hampers assessing platform credibility.

Decentralized Exchange (DEX)

The DEX interface involves token swapping, liquidity pools, and trading features. The platform emphasizes security and liquidity incentivization. The interface explicitly states that "Chart is not available for the selected token pair" unless there's active liquidity — a typical feature in AMMs. However, no details on token listing procedures, fee structures, or internal audits are readily available.

**Red Flag:** Limited transparency about underlying smart contracts or token standards. Users must exercise caution.

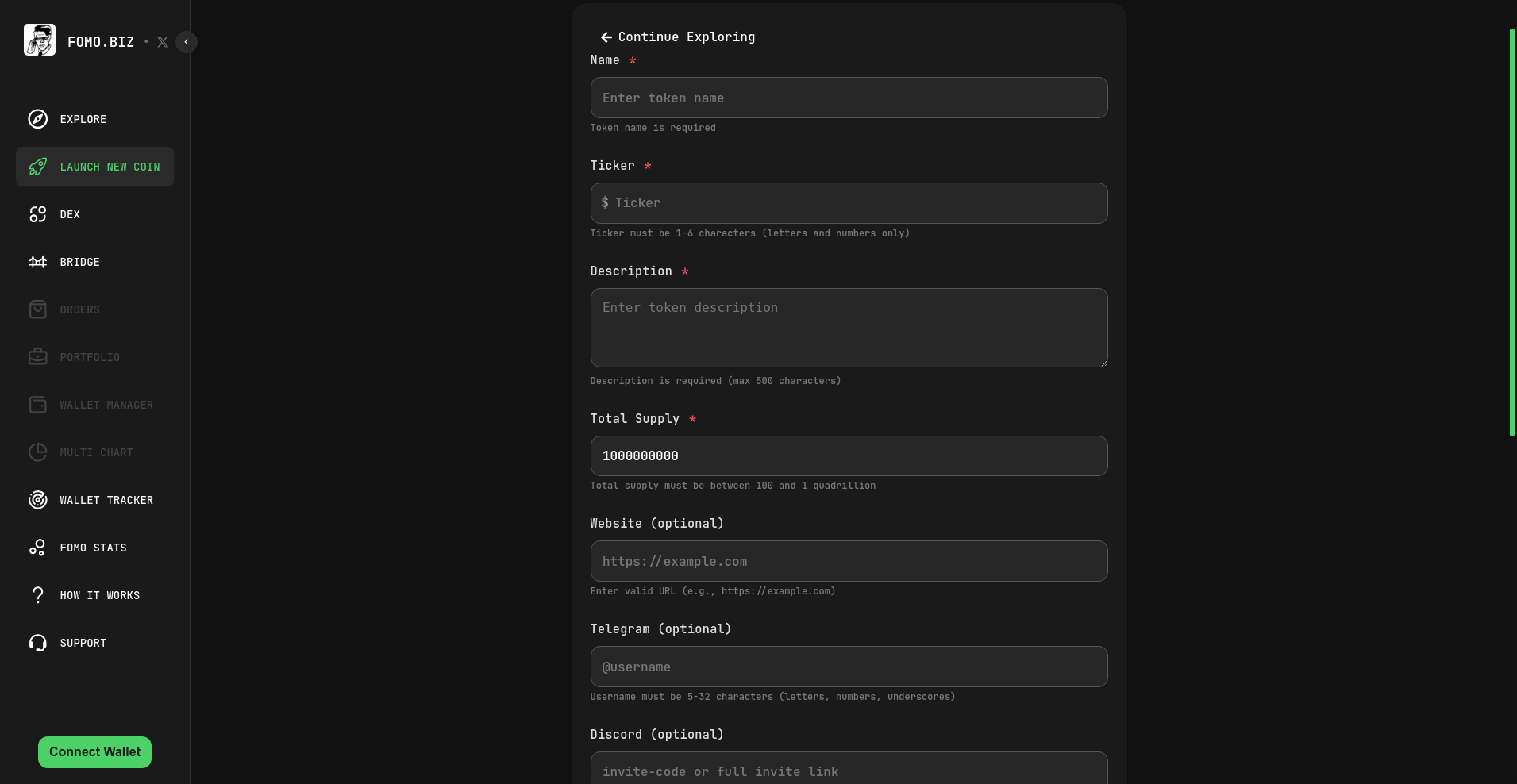

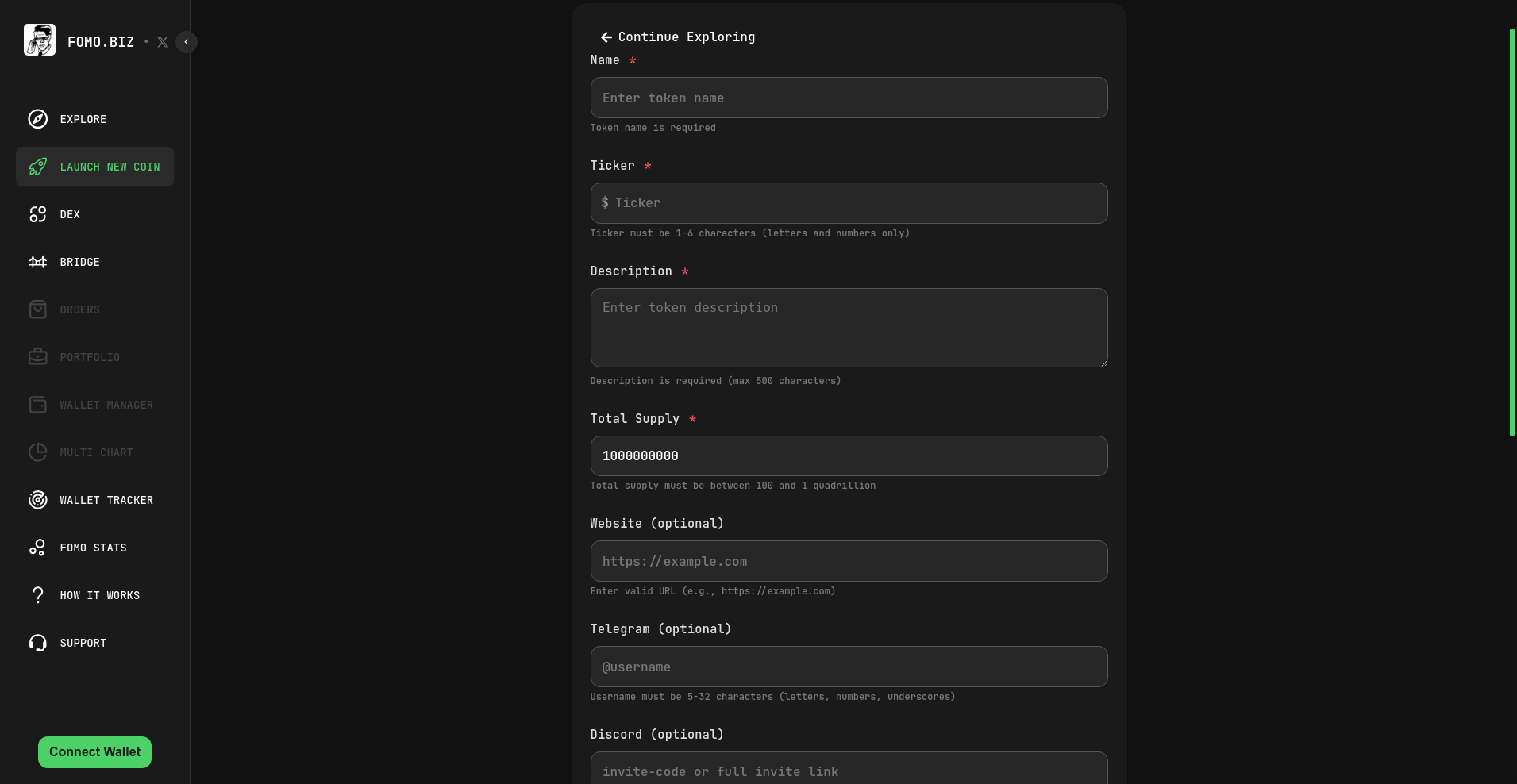

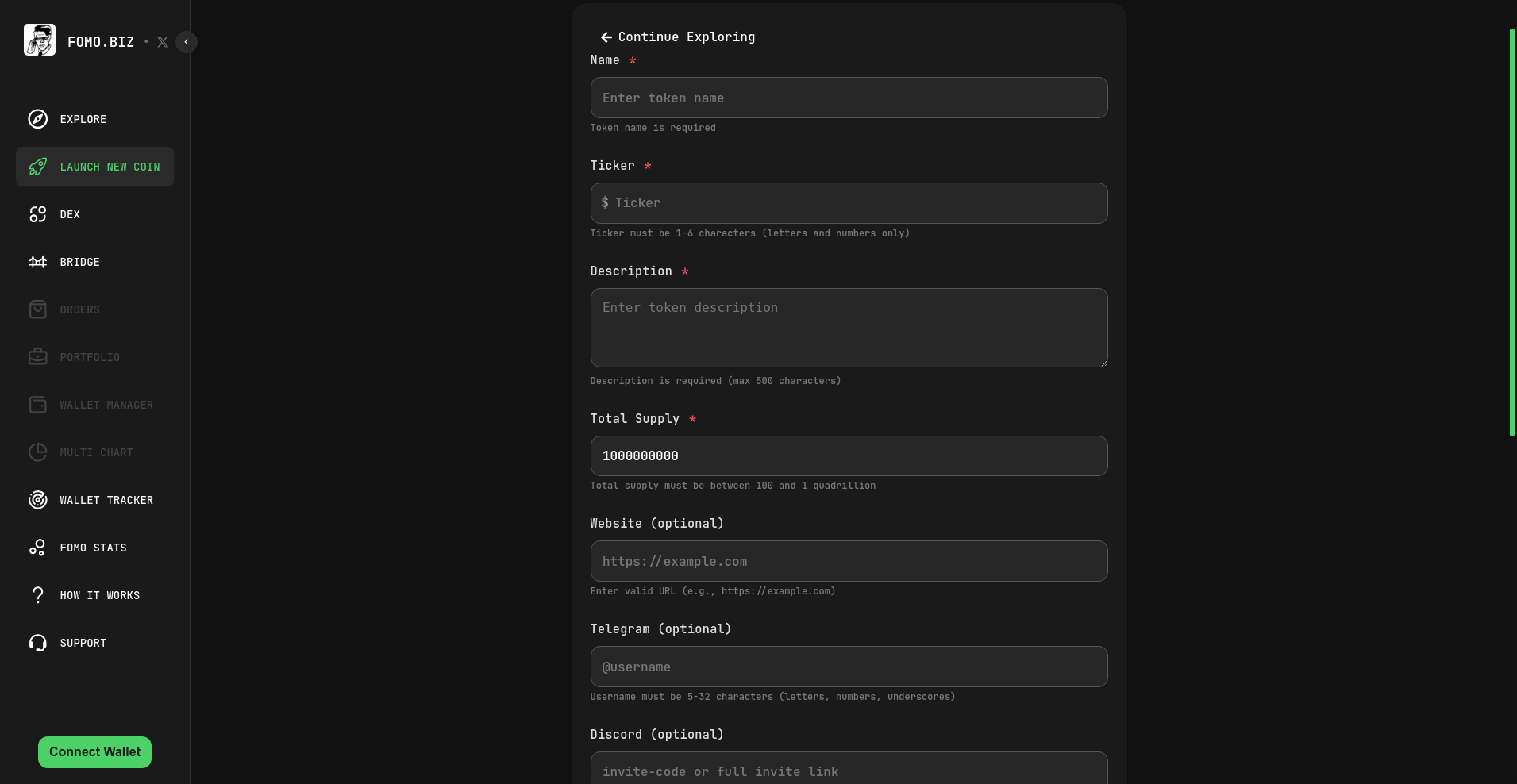

Token Launchpad & Bonding Curves

FOMO.BIZ's token creation form requires users to upload token details, with a fee of 100 TARA, and offers rewards for bonding curve completion. The system enforces specific input rules for token name, ticker, description, and website links. The platform promotes such launches to be secure, with features like custom supply control and developer token locks to prevent rug pulls. But without independent audits or code review disclosures, these claims remain unverified.

Tokenomics and Incentives

Native Token: TARA

The platform's primary token, TARA, appears integral to its ecosystem. The token is used to pay listing fees and rewards bonders (12.5k TARA upon bonding curve completion). Details on total supply, distribution, and utility are sparse. Transparency around market cap, inflation rate, or vesting schedules is missing.

**Risk:** Overreliance on a native token without clear economic models often signals manipulation risk or pump-and-dump schemes.

Airdrops and Community Incentives

No specific airdrop campaigns or community rewards are officially announced. Caution is advised, as unannounced airdrops can sometimes mask scams.

Developer Documentation & Technical Insights

FOMO.BIZ offers extensive documentation, allegedly hosted on GitBook, covering smart contract architecture, token standards, and security features. Audits by CredShields suggest a focus on transparency, but the audit link and details require verification.

Cyberscope Audit: According to recent Cyberscope analysis (see the audit report), the platform has undergone a security assessment, but the report notes certain vulnerabilities that require fixing before full deployment. Relying solely on multiple layer audits without independent verification increases risk.

Visual Content & Structure

The platform's visual strategy emphasizes modern, rounded UI elements with key color schemes for success and errors. The design is polished, but aesthetics alone do not guarantee security.

Investment Risks & Red Flags

- Lack of Transparency: No visible team info, no details on founders, or audited code disclosures. Projects with opaque origins are high-risk.

- Unverified Smart Contracts: Despite audits, the absence of open-source code or independent review raises suspicion.

- Market Data Scarcity: No public metrics (user base, TVL, trade volume) create difficulty in assessing real-world adoption or platform health.

- Tokenomics Concerns: Heavy reliance on the TARA token with unclear economic models and potential inflationary pressures.

- Potential for Rug Pulls: Developer token locks and multi-asset tools are good signs, yet unverified contract code and limited community oversight present risks of malicious deployments.

- Reputation & Community Engagement: Limited social presence or active community signals; consider Reddit, Twitter, or Discord activity levels before investing.

Final Verdict: Is FOMO.BIZ Legit?

FOMO.BIZ positions itself as a multi-tool DeFi platform with innovative features and visual appeal. However, the lack of transparency — particularly regarding the development team, independent audits, live data, and community engagement — raises red flags. While some security measures (e.g., CredShields audit) exist, they are not sufficient alone to assuage concerns about safety and legitimacy.

Investors should exercise extreme caution: Do not commit significant funds until detailed smart contract reviews, community feedback, and more transparent disclosures are available. The platform's claims of security and decentralization need independent verification. As always, beware of platforms with limited public info and unverified tech.

Summary

- Pros: Modern UI, multi-tool ecosystem, security audits conducted, token locks, anti-bot features.

- Cons: Lack of transparent team info, limited on-chain data, no detailed tokenomics, incomplete audit disclosures, low community verification.

- Risk Level: High. Suitable only for risk-tolerant, thoroughly researched investors.

Stay cautious, verify independently, and never invest more than you can afford to lose.

Jessica Taylor

NFT Market Data Scientist

Data scientist specializing in the NFT market. I analyze on-chain data to detect wash trading, bot activity, and other manipulations that are invisible to the naked eye.

Similar Projects

-

GalaxyHub AI

GalaxyHub AI Review | Crypto Scam Checker & Project Scam Review

-

Boa Hancock Inu (BOAINU)

Crypto Project Review: Is Boa Hancock Inu a Scam or Legit? Comprehensive Scam Checker

-

BitDemon

Crypto Project Review: Is BitDemon a Scam or Legit? Crypto Scam Checker

-

Altswitch

Comprehensive Review of Altswitch: Is This Cross-Chain Swap Crypto Project a Scam? | Crypto Scam Checker