Hoge (HOGE) Review, Scam Check, and Risk Analysis: Latest Updates, Tokenomics, Ecosystem Overview & Developer Insights

Introduction: What Is Hoge (HOGE)? A Comprehensive Overview

The Hoge project markets itself as the "first deflationary redistributing meme token of its new era," initially launched on February 7th, 2021. Designed as a play on the popular Dogecoin, Hoge aimed to blend meme culture with DeFi utility, positioning itself as more than just a joke coin. Its community-driven evolution underscores a focus on utility, governance, and scarcity.

Official site: https://hoge.gg

Team, Mission, and Goals: Who Is Behind Hoge?

The project emphasizes a decentralized, community-led approach—"No bosses, no borders." The official team section prominently features a public Ethereum address (0xfAd45E47083e4607302aa43c65fB3106F1cd7607), suggesting transparency but also raising questions about central control. This address likely belongs to a core developer or treasury wallet, which can be scrutinized via blockchain explorers like Etherscan.

The mention of Hayden and the community-driven mantra indicate an emphasis on transparency, collective decision-making, and a grassroots ethos.

Tokenomics, Supply Mechanics, and Utility

Tokenomics Breakdown

Hoge’s smart contract is declared unchangeable, with a focus on scarcity and redistribution. It incorporates a 2% transaction tax, which is redistributed fractionally and burned, creating a deflationary supply dynamic:

- **Reflection (0.8%)**: Automatically redistributed to all token holders proportionally (frictionless yield), incentivizing holding.

- **Burn (1.2%)**: Sent to an inaccessible "burn wallet" holding over 60% of total supply, effectively removing those tokens from circulation permanently.

- **Total circulating supply**: Less than 40%, decreasing daily due to continuous burns.

The combination of a renounced contract and deflationary mechanics aims to incentivize scarcity and long-term value appreciation. Tokenomics details are available in the project's Tokenomics page.

Roadmap & Ecosystem Milestones

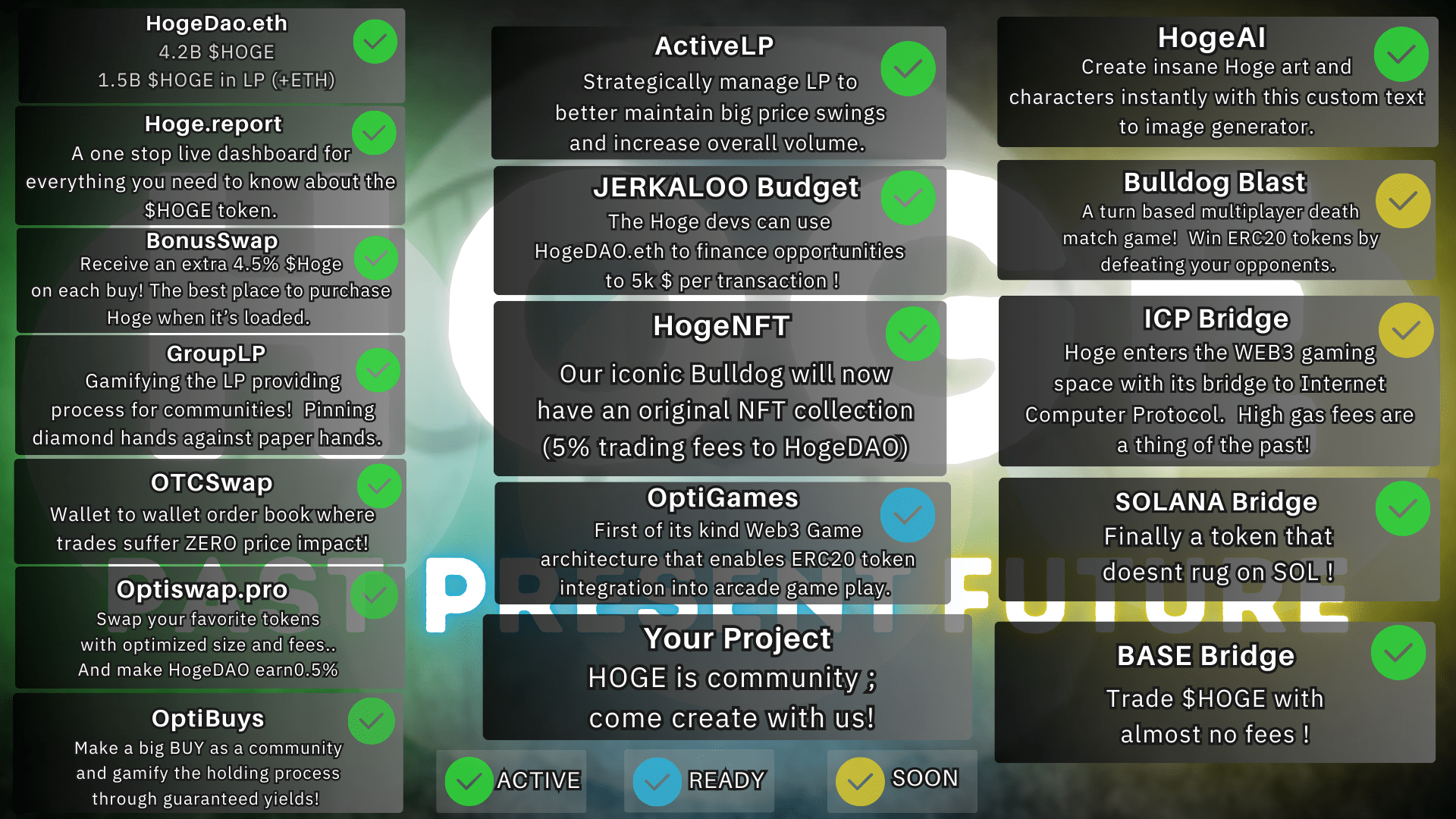

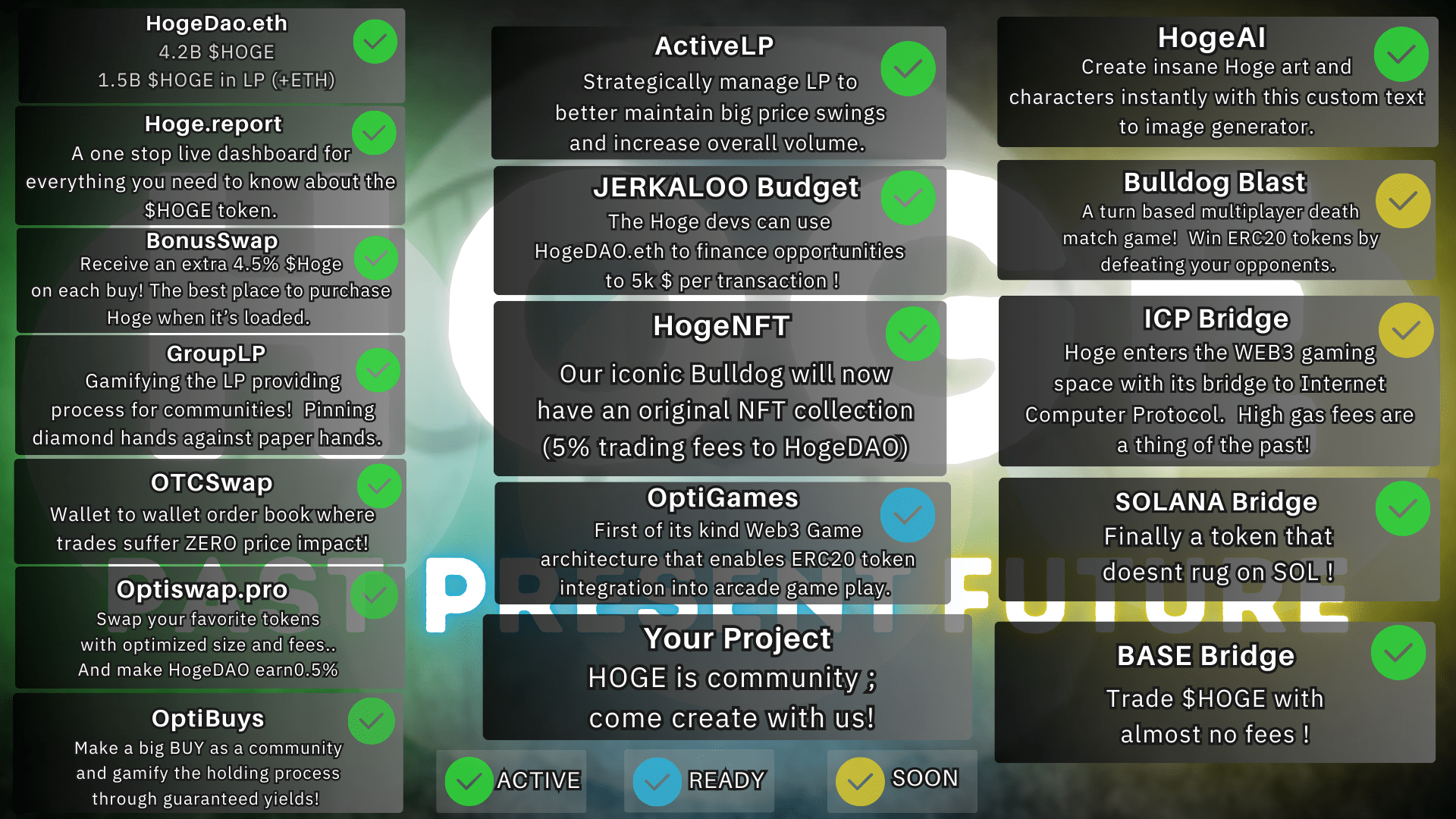

The project’s `Hogemap` provides a visual roadmap of ongoing and upcoming initiatives, including:

- HogeDAO and community governance

- Integration into multiple chains (Ethereum, Solana, Base)

- HogeAI development and deployment

- Partnerships with prominent exchanges and media coverage

- Development of various tools like HogeReport, HogeZone, and bridge integrations

Visit Hogemap for full details. The visual map showcases active projects, indicating a diversified ecosystem beyond a simple meme token.

Recent News, Media Coverage, and Notable Signatures

Hoge’s traction in mainstream media includes mentions in reputable outlets like USA Today, Forbes, and Bloomberg. Such coverage lends credibility but also calls for a cautious review of hype vs. real utility.

In addition, the project is tracked on aggregators like CoinGecko, CoinMarketCap, and CoinCodex, with real-time data available on platforms such as Dextools and Dexscreener. The presence of listings on Binance, Coinbase, and Bybit indicates liquidity and exchange interest, although the official listing status should be verified separately.

The Ecosystem: Tools, Bridges, DAO, and AI

The project spans a multi-chain presence, supporting Ethereum, Solana, and Base bridges for cross-chain interoperability. The Hogemap visually charts these initiatives, along with active community projects like HogeNFT, OptiGames, and Bridge connectors (Base Bridge).

HOGE’s emphasis on AI ("HOGE AI") suggests innovation beyond tokens, potentially involving smart contract automation, data analysis, and community engagement AI tools. These are communicated actively via social channels.

Investment Risks: What You Should Know

While Hoge presents a compelling community-driven narrative with deflationary mechanics, several risks need careful consideration:

- Tokenomics & Centralization: Over 60% of the supply is held in the burn wallet, not actively circulating, which could lead to excessive centralization of the remaining supply and influence over price movements.

- Smart Contract & Security: Despite claims of a "renounced" contract, the project's security heavily relies on the audit status from Certik and code transparency. Blockchain developers must review the verification reports for vulnerabilities.

- Market & Liquidity Risks: Listed on multiple high-profile exchanges, but actual liquidity, especially on smaller or newer platforms, should be scrutinized to prevent pump-and-dump scenarios or low liquidity trapping.

- Media Hype & Overpromising: Dominance in media mentions and optimistic roadmap may obscure speculative behavior. Always verify project claims independently.

- Cross-Chain and Bridge Risks: Interoperability tools introduce additional security concerns, as bridges have historically been exploited in the crypto sphere.

- Development & Community Engagement: The project’s future heavily depends on active development and community participation, which can wane over time, reducing project sustainability.

In conclusion, the balance of utility, scarcity, and community governance makes Hoge an intriguing project, but diligent due diligence, especially examining the security audits and liquidity conditions, is essential before investing.

Useful Links

Social Media & Community

Technical & Legal Resources

- Official About Page

- Certik Audit

- Etherscan

- Hogemap

- Team Wallet Address

- Team Details

- CoinRanking

- Digital Coin Price

- Crypto Slate

- CoinCodex

- CoinGecko

- CoinMarketCap

- Dextools

- Dexscreener

- Coinbase

- Yahoo Finance

- Binance

- Bybit

- Hoge Report

- LiveCoinWatch

Verdict: Is Hoge Legit? Investment Risks & Final Assessment

Hoge’s unchangeable contract, deflationary mechanics through a large burn wallet, and active media presence indicate a transparent project well-rooted in blockchain ethos. However, the centralization of over 60% of the supply in the burn wallet poses potential risks concerning market manipulation and price stability.

While the project boasts significant media coverage and broad exchange listings, the real challenge lies in verifying the security and true utility of its ecosystem, especially the AI component and cross-chain bridges. The claims of ongoing audits and community governance are encouraging but should be independently validated.

Invest with Caution: Always conduct your own due diligence, review audit reports, assess liquidity, and be wary of hype surrounding projects heavily featured in mainstream media but lacking clear, tangible use cases or transparency in operational control.

Conclusion

Hoge presents an ambitious blend of meme culture, decentralization, deflationary tokenomics, and ecosystem development—featuring cross-chain bridges and AI. Its active engagement across social media and media has bolstered its market presence. Nevertheless, potential investors must scrutinize the risks of centralized supply control, security vulnerabilities, and the speculative nature of its claims. This review aims to equip you with a balanced view—deepen your research by verifying audit, liquidity, and governance details—before considering investment.

Useful Links

Social Links

Technical & Legal Resources

- Official About Page

- Certik Audit

- Etherscan

- Hogemap

- Team Wallet Address

- Team Details

- CoinRanking

- Digital Coin Price

- Crypto Slate

- CoinCodex

- CoinGecko

- CoinMarketCap

- Dextools

- Dexscreener

- Coinbase

- Yahoo Finance

- Binance

- Bybit

- Hoge Report

- LiveCoinWatch

Final Assessment: Is Hoge a Scam or Legit? Essential Takeaways

The combination of claims of a renounced contract, transparent security auditing, and widespread press coverage lends credibility. Nevertheless, high centralization in the burn wallet, potential liquidity concerns, and the hype surrounding media mentions require meticulous review before investment.

It is advisable to independently verify audit reports, monitor liquidity, and scrutinize the ecosystem development on platforms like Hogemap and official social channels.

Bottom line: Hoge exhibits many traits typical of successful community-driven DeFi projects but carries inherent risks common to meme tokens, including centralization and speculative volatility. Proceed cautiously and conduct your own Due Diligence.

Daniel Clark

On-Chain Quantitative Analyst

I build algorithmic tools to scan blockchains for signals of manipulation, like whale movements and liquidity drains. I find the patterns in the noise before they hit the charts.

Similar Projects

-

Iluminary

Comprehensive Review of Iluminary Crypto Project | Crypto Scam Checker & Project Review

-

EdaFace

EdaFace Review: Is This Crypto Project Scam or Legit? Crypto Scam Checker and Project Review

-

Cipher (CPR)

Crypto Project Review & Scam Checker: Is Cipher (CPR) Legit or a Scam in 2025?

-

PREME Token

Review of PREME Token: Is this Crypto Project a Scam or Legit? Crypto Scam Checker & Project Review

-

Cashaa

In-Depth Review of Cashaa: Crypto Project Scam Checker & Risk Analysis