Fringe Finance ($FRIN) Review: A Thorough Legitimacy and Risk Assessment of Its DeFi Ecosystem

What Is Fringe Finance: An Introduction

Fringe Finance positions itself as a decentralized ecosystem aiming to unlock dormant capital across traditional financial markets and a spectrum of crypto assets. Its core proposition revolves around enabling users to lend, borrow, and trade using liquidity provider tokens, ERC-4626 vault tokens, and various crypto collaterals across six blockchain networks. The platform emphasizes capital efficiency, broad asset support, and innovative collateralization strategies, particularly leveraging tokenized vault standards and LP tokens for enhanced utility.

This review offers an impartial analysis of Fringe Finance’s foundational claims, technological architecture, security posture, and potential risks. While it markets itself strongly on security assurances, such as multiple audits and upcoming insurance features, a comprehensive risk assessment reveals areas requiring due diligence — especially around platform maturity, security validation scope, and the economic sustainability of its yield offerings.

Team and Roadmap Evaluation

According to available data, Fringe Finance’s specific team members are not publicly detailed in the provided sources. The platform’s emphasis on security and audits suggests a focus on technical robustness and security consciousness, potentially undertaken by reputable third-party auditors rather than an in-house team with a publicly disclosed background. The platform’s recurring references to partners like HashEx, CyberUnit, and Immunefi hint at collaboration with established security and bug bounty providers, rather than solely relying on proprietary development teams.

Evaluating their roadmap, the architecture shows active development across multiple product versions. Notably, the platform is currently utilizing and improving upon versions V2, V2.5, and testing V3 alpha contracts. Milestones include:

- Introduction of ERC-4626 support, with dedicated audits (e.g., QuillAudits, August 2024).

- Implementation of LP token support and integration with Uniswap V3 assets, reflecting ongoing ecosystem expansion (audited August 2024).

- Deployment of insurance and risk mitigation features, planned as upcoming modules.

While the team’s specific credentials or prior DeFi experience are not publicly outlined, the presence of multiple audicts and bug bounty payouts indicates a security-conscious development approach. Their ability to deliver on promised updates hinges on transparent communication and continued security validation, which appears to be actively managed through an established audit and bug bounty ecosystem.

Assessing the Security and Trustworthiness of Fringe Finance

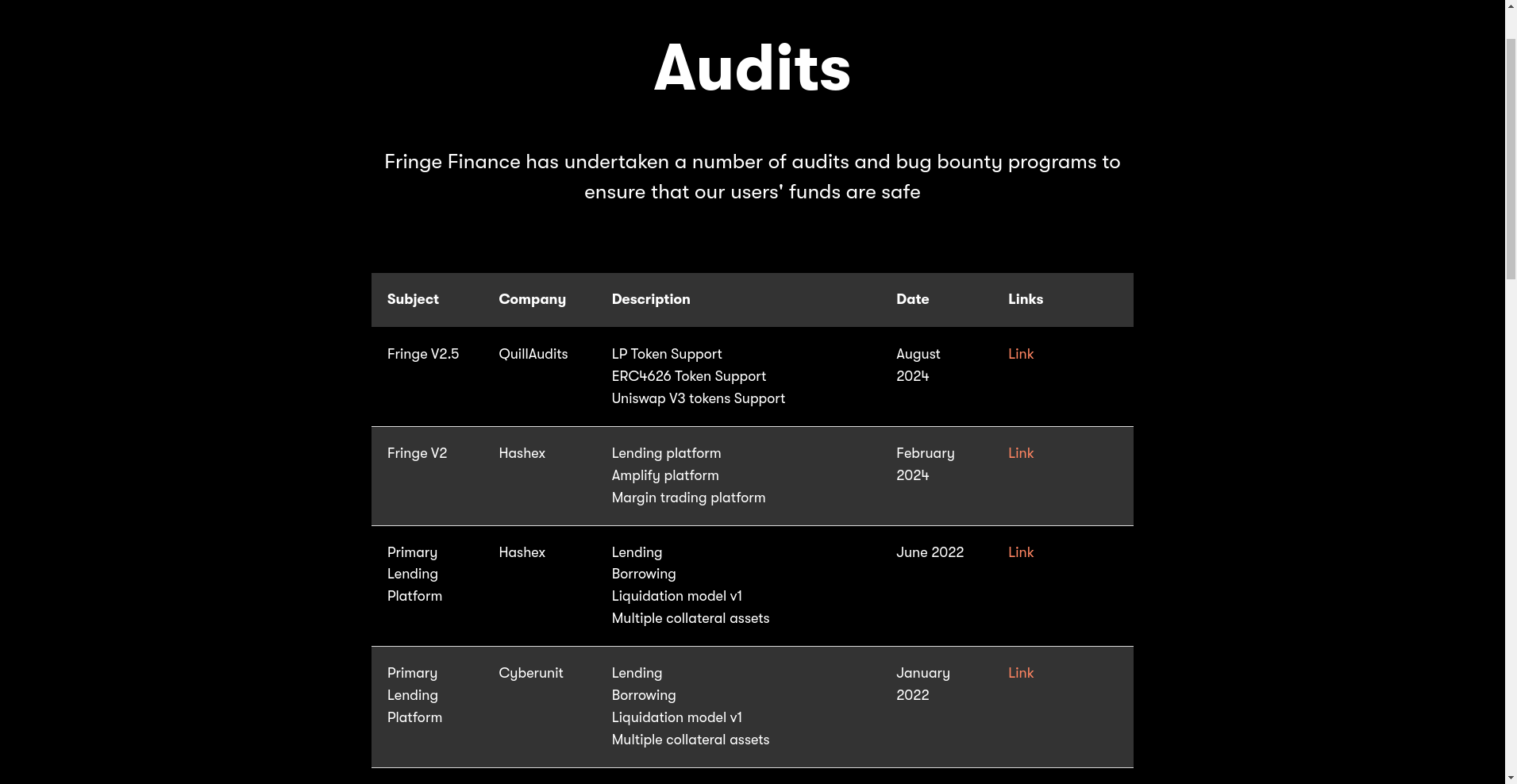

Based on the available audit reports, Fringe Finance’s security analysis relies heavily on third-party validation. The platform has undergone multiple audits, notably:

- HashEx audited core lending, borrowing, and liquidation mechanics in June 2022 and again in February 2024 for the V2 modules.

- CyberUnit also conducted audits for core modules in January 2022, focusing on foundational mechanics.

- QuillAudits evaluated newer features such as LP token support, ERC-4626 vault support, and Uniswap V3 integrations in August 2024.

These audits cover critical components like collateral management, liquidation logic, and token standards support, with no publicly disclosed major vulnerabilities or exploits. Additionally, the platform’s bug bounty program facilitated over $50,000 in payouts for responsibly disclosed bugs, indicating active vulnerability hunting and remediation efforts.

However, a crucial caveat is that the scope of the audits varies — initial core modules were audited years ago, with recent assessments focusing on specific features like LP tokens and Uniswap integration. The absence of detailed audit reports in this summary means potential residual risks — such as unverified smart contract interactions or oracle dependencies — require further scrutiny, particularly concerning the scope of these audits.

Upcoming safety features, like trustless insurance and liquidation coverage, are announced but not yet operational, which means platform users should remain cautious until these are formally live and tested under real-world conditions.

Tokenomics Breakdown

While specific tokenomics for $FRIN are not exhaustively detailed here, several key points emerge from available data:

- Total Supply: 1,000,000,000 FRIN tokens.

- Usage and Utility: The token is primarily used within the ecosystem for governance, fee reductions, and incentivization of participation across lending, borrowing, and earning modules.

- Distribution: Details on initial distribution, allocations for team, advisors, funding rounds, or community incentives are not specified in the provided data.

- Economic Model: The platform's economic health depends on platform activity — borrowing demand influences APYs, and token incentives incentivize liquidity provisioning.

- Inflation/Deflation: No explicit mention of inflationary mechanics or burn mechanisms; focus appears on utility and governance rather than monetary policy.

Overall, the economic sustainability hinges on attracting sufficient platform activity to generate yields and transaction fees that support token value. The lack of detailed tokenomics data necessitates further investigation into token distribution schedules, governance rights, and liquidity incentives for a comprehensive risk/reward analysis.

Assessing Ecosystem and Development Activity

Development activity appears vigorous, with multiple versions of the platform successfully audited and expanded functionalities focused on support for ERC-4626, LP tokens, and cross-chain support. The presence of detailed, versioned Docker-like audits (V2, V2.5, V3 alpha) suggests ongoing iteration aimed at reducing security risks and expanding capabilities. The platform also engages in cross-chain operations, suggesting a need for robust interoperability.

The platform’s ecosystem is also supported by partnerships with established auditors, bug bounty programs, and integration with liquidity providers, DeFi protocols, and data feeds. These steps indicate a deliberate effort toward building a trustworthy, scalable, multi-asset ecosystem rooted in security best practices.

However, the actual development pace, the release of upcoming features, and real-world adoption metrics remain undisclosed in the provided materials. Surveillance of protocol activity, TVL (Total Value Locked), and community engagement metrics from external aggregators like DefiLlama can shed further light on market traction.

Reviewing the Terms and Conditions

The data indicates that Fringe Finance maintains standard legal frameworks such as Terms of Service and Privacy policies. There are no explicitly disclosed risky clauses or unusual legal provisions within the supplied content. Nevertheless, as with many DeFi projects, the absence of detailed legal disclosures, jurisdictional clarifications, or compliance statements warrants caution — especially when engaging in cross-chain and multi-asset operations.

Investors should seek clarity on their legal jurisdiction, user rights, dispute resolution mechanisms, and compliance with regional regulations. As the project involves leverage, collateral, and potentially complex financial instruments, clear legal terms are vital for long-term trustworthiness.

Final Analysis: The Investment Case for Fringe Finance

Fringe Finance presents a compelling, innovation-driven platform designed to expand DeFi's utility through multi-chain, multi-asset collateralization, ERC-4626 vault integration, and decentralized margin trading. Its security posture is bolstered by multiple audits and an active bug bounty program, signaling a focus on security and trust, although some audit scopes are recent and should be reviewed directly for vulnerabilities.

Risks primarily arise from its relatively young development cycle, the limited publicly available audit reports’ scope, the nascent insurance features, and the inherent volatility of DeFi markets. The platform’s reliance on algorithmic interest adjustments, while innovative, also introduces economic complexity and potential instability if platform demand shifts significantly. Understanding the economic sustainability of its yield offerings is crucial.

Pros:

- Multi-chain, multi-asset support with ERC-4626 standards

- Multiple independent audits and a large bug bounty payout

- Strong emphasis on security and upcoming trustless insurance

- Innovative use cases for LP tokens and vault-based collateral

Cons:

- Limited transparency on team background and governance

- Uncertain long-term sustainability of yield rates, dependent on platform demand

- Partial audit reports and upcoming insurance features lack detailed disclosures (need to review audit scopes carefully)

- Complex ecosystem with multiple modules requiring user education

Based on current available data, Fringe Finance shows promising features and a security-conscious approach. However, prospective users and investors should weigh the risks of early-stage DeFi development, the reliance on third-party audits, and the need for further transparency before fully committing. Continuous monitoring of audit disclosures, insurance product rollout, and real-world usage metrics is advised to refine this initial assessment.

Amanda Harris

Technical Security Educator

Security professional passionate about the "human firewall." I translate complex crypto threats into simple, actionable security habits for everyday users.

Similar Projects

-

MetaLend

MetaLend Review: Crypto Project Scam Checker & DeFi Scam Review

-

JokInTheBox

JokInTheBox Review: Scam or Legit Crypto? Scam Check & Legitimacy Analysis

-

ZEXX Coin

ZEXX Coin ($ZEXX) Review: A Deep Dive into Its Tech & Risks

-

APSA Token

Crypto Scam Checker Review: APSA Token - Is It a Legit Project or a Rug Pull?