ZEXX Coin ($ZEXX) Review: A Data-Driven Look at Its Legitimacy, Risks & Potential

Project Overview: What Is ZEXX Coin?

ZEXX Coin is a cryptocurrency project positioned at the intersection of blockchain technology, artificial intelligence, and decentralized finance (DeFi). Built on the Solana network, ZEXX aims to combine high-performance blockchain infrastructure with AI-powered trading and analytics tools. The project emphasizes transparency, long-term community engagement, and innovative utility features such as staking, governance, and merchant integrations.

This review offers an impartial analysis based on available data, including a recent cyberscope audit, tokenomics details, security assessments, and project documentation. The goal is to examine the project's legitimacy, identify potential risks, and assess its overall viability for investors or users.

The Team and Roadmap Evaluation

Looking into the background of ZEXX Coin’s team reveals limited publicly available information. The project’s founders and core contributors are not transparently identified by name, which is common in early-stage crypto projects but can introduce concerns regarding accountability and professionalism. The documentation states that the project intends to build an ecosystem with AI-powered trading, blockchain security, and regulatory compliance, but specific team credentials or past experience are not detailed.

Its roadmap, publicly accessible via their official website, outlines key milestones including presale phases, platform launches, security audits, and future feature rollouts such as staking and governance systems. Notable milestones include:

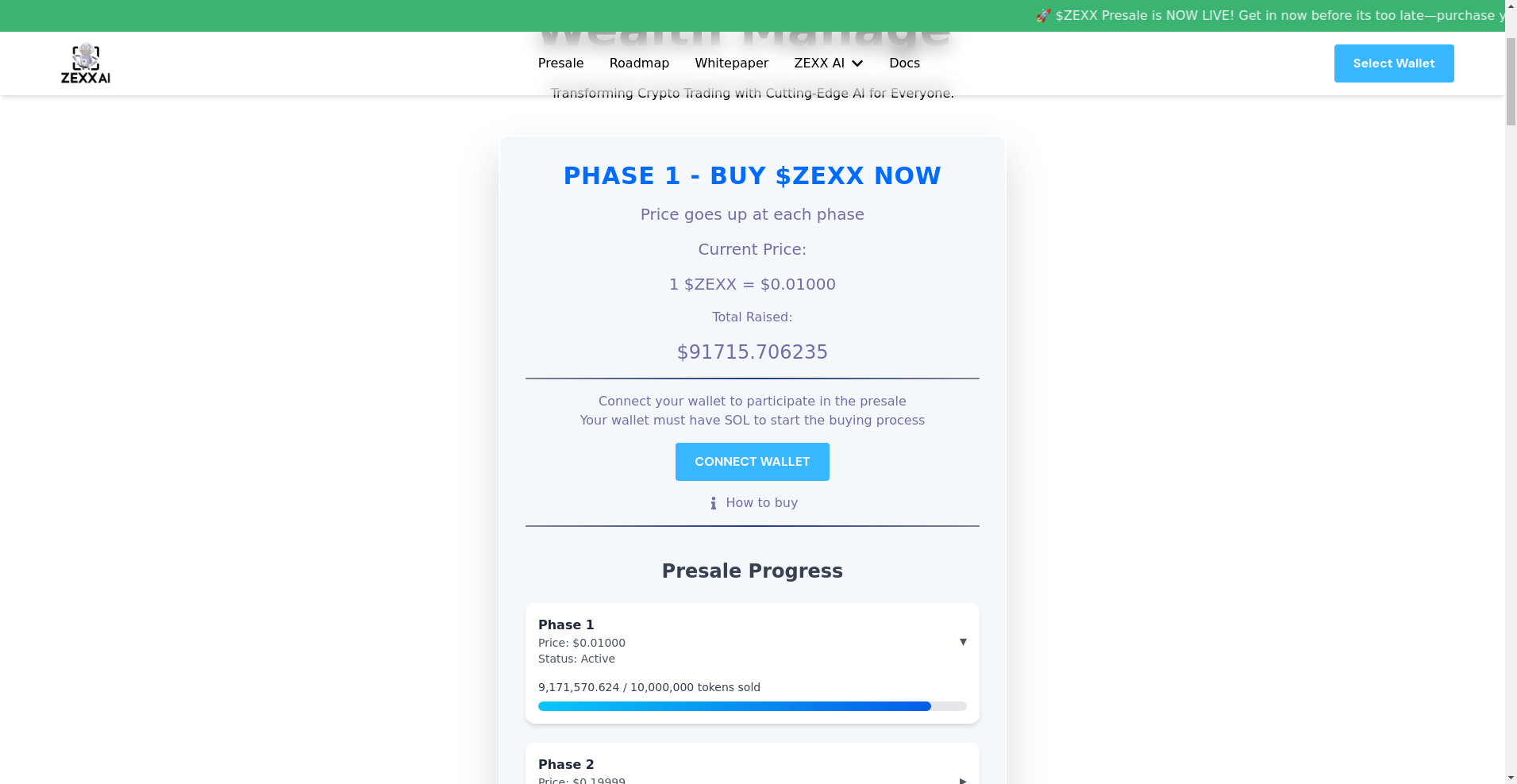

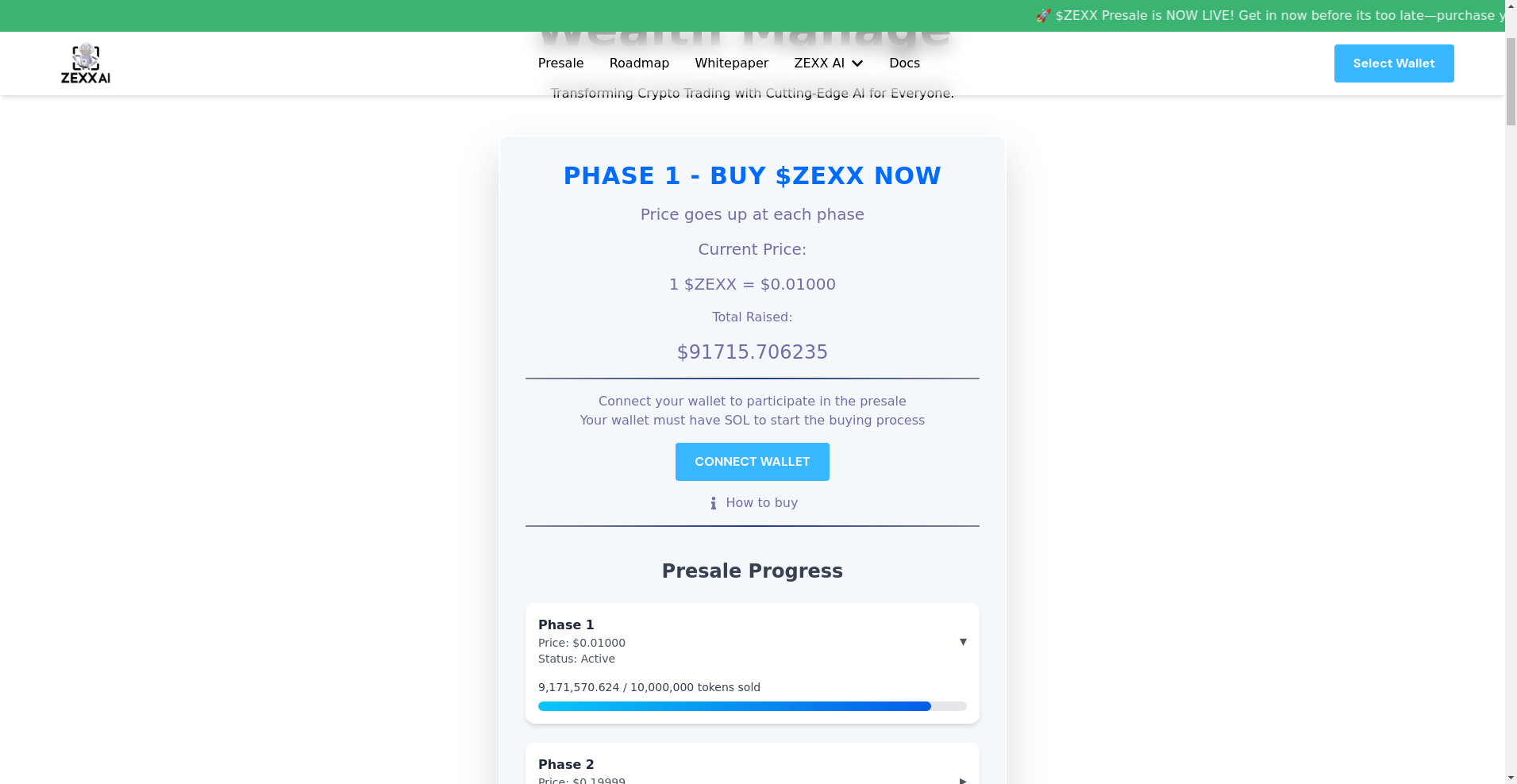

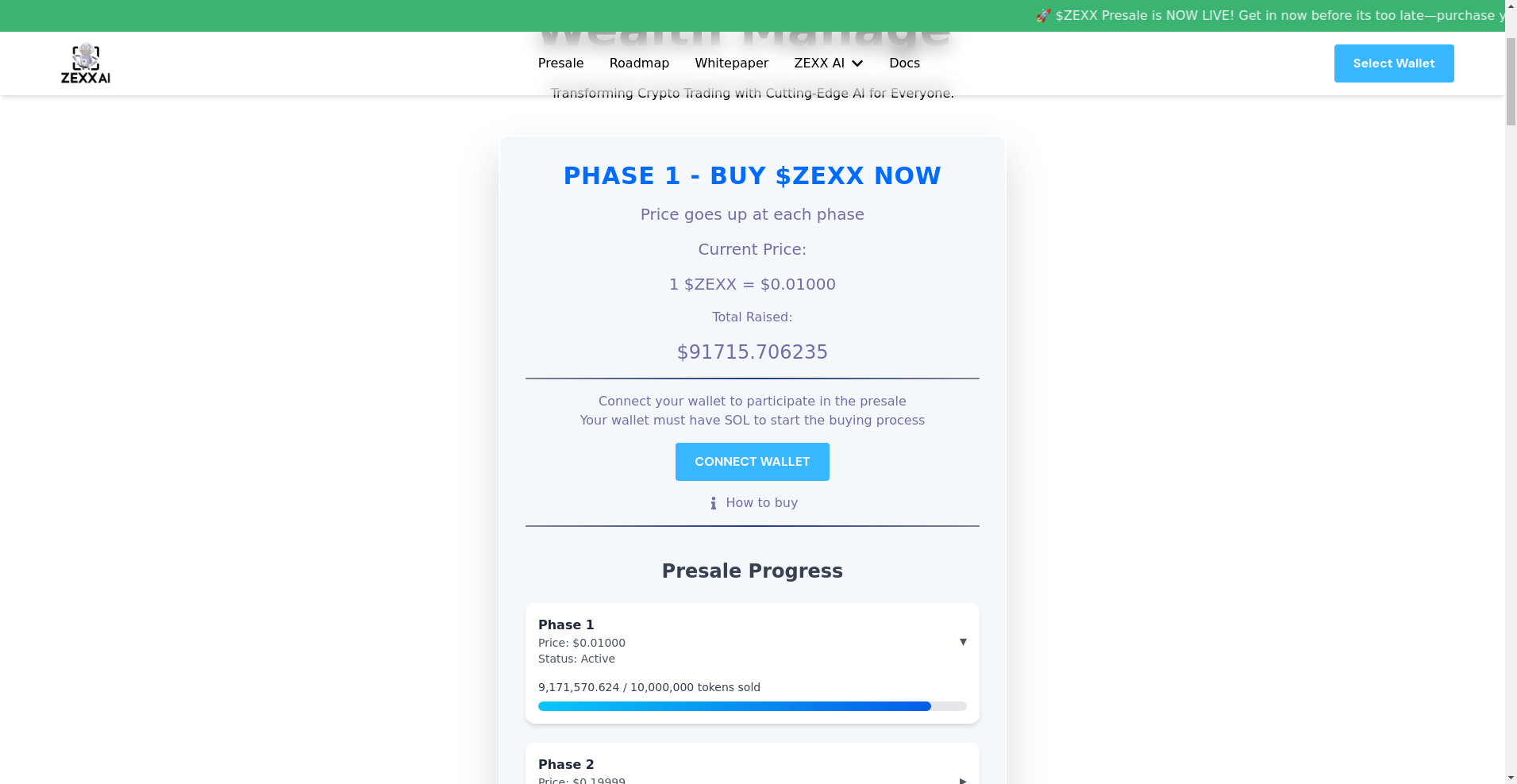

- Phase 1 – Presale: Currently active with targeted funds raised (~$91,715 so far).

- Phase 2 and beyond: Price increases at each successive phase with an aim to expand functionalities like staking, merchant integrations, and community-driven governance.

While these milestones are typical in early crypto projects, the absence of detailed team backgrounds and specific technical deliverables poses questions over their capacity to meet ambitious deadlines and goals.

Assessing Security and Trustworthiness

Based solely on the Cyberscope audit report, ZEXX Coin’s security assessment indicates a high security score of approximately 95%, which suggests that certain technical security measures have been evaluated, including potential vulnerabilities in smart contracts or infrastructure. However, the available data reveals only a partial picture, focusing on an audit layout that acknowledged a "high criticality" issue during their review. The audit did not specify detailed vulnerabilities or the nature of critical issues, which leaves some uncertainty. This highlights the importance of understanding partial audit reports.

- Audit Results: The audit flagged at least one high-criticality concern, indicating potential security risks that require further review.

- Community & Decentralization: The decentralization score is around 67%, signifying a moderate level of decentralization but still leaving room for improvement in the transparency of governance structures.

- Audit Transparency: The audit resource appears limited, with some critical issues yet to be fully disclosed, which is common at pre-launch stages but warrants caution for potential investors.

In conclusion, while the security score is comparatively high, the limited scope and the presence of high-criticality issues highlight the necessity for ongoing audits and community vigilance. This partial data suggests that the project has taken initial steps toward securing its infrastructure but continues to carry inherent risks typical of early-stage DeFi projects.

Tokenomics Breakdown: Supply, Distribution & Utility

ZEXX Coin’s tokenomics reveal a total fixed supply of 250 million tokens, with a primary presale allocation of 130 million (52%). The presale operates on a tiered pricing structure, starting at $0.010 per token and increasing in subsequent phases, incentivizing early participation.

- Total Supply: 250 million $ZEXX tokens.

- Presale Allocation: 130 million tokens (52%), with the presale still ongoing.

- Other Allocations: Remaining tokens reserved for development, staking rewards, marketing, and team vesting, though detailed distribution percentages are not fully disclosed.

- Pricing Tiers: Phase 1: $0.010; Phase 2: ~$0.20; subsequent phases escalate up to $0.70+.

- Vesting & Lockups: Post-presale, tokens are to be airdropped within 14 days, with some minimum lock-up periods for strategic allocations.

- Utility: The token functions as a utility asset, enabling access to platform features, staking, governance voting, and community rewards. Referral programs also use the $ZEXX token as a reward.

This economic model is common among presale projects but carries inherent risk: the long-term value depends heavily on actual project delivery, community engagement, and market conditions. The absence of detailed vesting schedules for the team or early investors introduces potential centralization or inflationary risks.

Assessing Ecosystem and Development Activity

The project has actively conducted a presale with already raised funds and ongoing token distribution. The documentation emphasizes advancing towards platform launch, security audits, and ecosystem integrations involving AI trading tools, staking, and merchant partnerships. There is also mention of a “whitepaper” and detailed roadmap, which suggest a structured approach to development.

However, there is limited public evidence of ongoing development activity beyond the presale and initial marketing pushes. No verifiable code repositories, recent bug bounty disclosures, or community updates are prominently available, which makes it difficult to assess true technical progress. Much of the activity appears to be speculative marketing aligned with presale efforts.

The Fine Print: Token Terms & Legal Considerations

From the provided legal documents, several notable points emerge:

- Risk Disclosures: The project explicitly states that $ZEXX is highly speculative, and participants risk losing their entire investment. No guarantees are made regarding profits or future utility.

- Non-Refundable Presale: All purchases are final. No refunds are offered, emphasizing the high-risk nature of participation.

- Legal Status: The project claims no official security registration and is structured to avoid securities classification, but legal interpretations vary by jurisdiction.

- User Responsibilities: Participants are responsible for compliance with local laws. The project disclaims liability for losses, regulatory issues, or unintended legal violations.

- Disclaimers & Limitations: The project clearly states it is not liable for any damages or losses arising from participation, smart contract bugs, or market volatility.

The legal information reinforces the importance of caution; no specific investor protections are offered, and the project emphasizes the risks inherent in early-stage crypto offerings.

Final Analysis: The Investment Case for ZEXX Coin

In summary, ZEXX Coin presents itself as a promising project at the intersection of AI and blockchain, with ambitions for decentralized finance, security, and innovative utility. Its high security score, active presale, and clear roadmap are positives. However, notable concerns include the anonymous or opaque team background, limited third-party audit disclosures, and partial security concerns raised during the audit. Additionally, the economic model relies heavily on continued project delivery and market acceptance.

Investors should be particularly cautious given the project's early stage, limited operational history, and significant risks associated with technical vulnerabilities and legal uncertainties.

Pros / Strengths:- Active presale with rising token prices incentivizing early participation

- Built on Solana, offering high-speed, low-cost transactions

- Incorporation of security audits, with an impressively high security score

- Clear utility and feature roadmap including staking and governance

- Community engagement through referral programs and social channels

- Limited transparency around team credentials and project founders

- Partial security audit indicates potential vulnerabilities

- High speculative risk with no guaranteed utility or attendance of post-launch features

- Inherent legal and regulatory uncertainties in the crypto space

- Absence of detailed vesting or lock-up schedules for tokens, risking inflationary pressure

Overall, ZEXX Coin demonstrates many hallmarks of a typical early-stage crypto project: ambitious goals, active presale, market positioning, but also some red flags regarding transparency and security. It could be appealing for risk-tolerant investors seeking exposure to innovative DeFi and AI integrations—but only with thorough due diligence and awareness of the associated risks.

As always, potential participants should exercise caution, consider their risk appetite, and consult with financial and legal professionals before engaging with new tokens like $ZEXX.

Christopher Anderson

Smart Contract Auditor & Legal Tech Analyst

I have a dual background in law and computer science. I audit smart contracts to find the critical gap between a project's legal promises and its code's reality.

Similar Projects

-

KuCoin Token

KuCoin Token ($KCS) Review: Legitimacy, Risks & Use Cases

-

Snake

Snake ($SNK) Review: Risks and Lessons from Its Collapse

-

Plasma Finance

Plasma Finance Review: Scam or Legit Crypto? Scam Check & Analysis

-

HappyPenis

HappyPenis ($PENIS) Review: A Deep Dive into Its Tech & Risks

-

NoCap (NOCAP)

Review of NoCap (NOCAP): Is This Cryptocurrency Project a Scam or Legit? Crypto Scam Checker & Review