Drift Protocol ($DRI) Review: A Data-Driven Assessment of Its Legitimacy and Risks

Project Overview: Understanding Drift Protocol

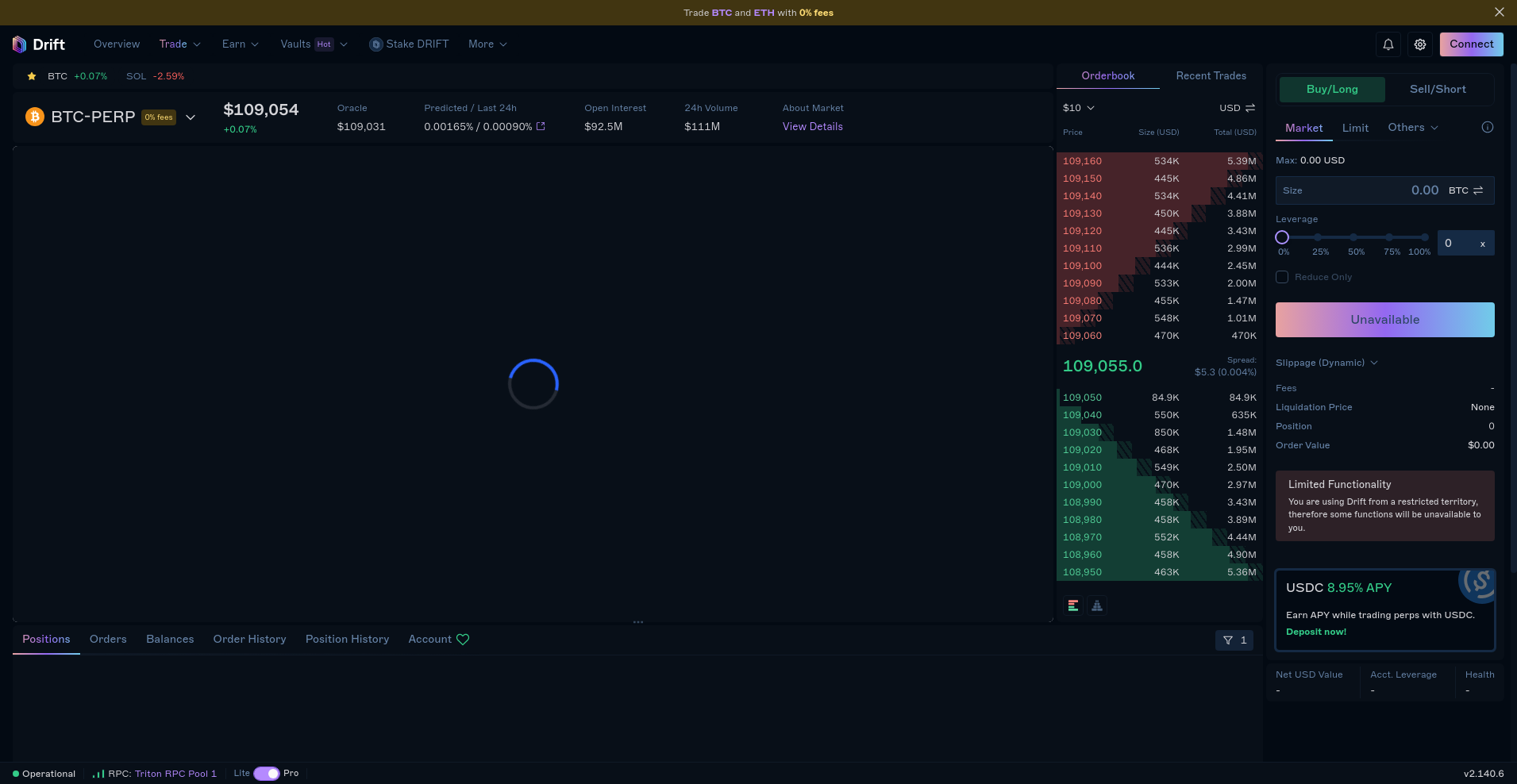

Drift Protocol is positioned as a decentralized derivatives trading platform with a focus on perpetual contracts, notably BTC-PERP, and promising features such as zero trading fees on select instruments. Its platform emphasizes real-time market data, leveraging oracle-based signals alongside on-chain liquidity pools to facilitate high-leverage trading. The platform also incorporates incentives through staking and vaults, positioning itself within the growing DeFi derivatives sector. For a deeper understanding of how to evaluate such platforms, consider evaluating DeFi derivatives platforms for safety.

This review aims to provide an objective, data-driven analysis of Drift Protocol’s strengths and weaknesses, based on available security audits, tokenomics, technological infrastructure, and market activity. The goal is to assess its legitimacy and potential risks without bias or promotional bias.

The Team and Roadmap Evaluation

Currently, Drift Protocol’s publicly available information does not specify detailed team biographies, which suggests a somewhat opaque or pseudonymous development team. The use of audit firms such as Zellic and Trail of Bits indicates a focus on security and credibility; however, the transparency of core team members remains unclear. This opacity may impact trustworthiness, especially for investors concerned about long-term viability. For insights into similar risks, one might explore the impact of anonymous developers in blockchain projects.

Assessing their roadmap and development milestones reveals several key points:

- Audit Completion: Platform audits and bug bounty programs are active, with reports from Zellic and Trail of Bits, signifying ongoing security review efforts.

- Security Enhancements: Regular bug bounty and security assessment cycles suggest a commitment to platform integrity.

- Feature Expansion: Current front-end features include trading, vaults, staking, and liquidity pools, with ongoing UI/UX improvements.

- Infrastructure Focus: References to specific RPC pools and platform versioning imply iterative upgrades.

While the milestones reflect a focus on security and feature refinement, the lack of publicly available, detailed leadership or strategic timelines limits a full evaluation of their ability to deliver on promises. Overall, the development trajectory appears cautious but aligned with industry standards.

Assessing the Security and Trust of Drift Protocol

This section relies primarily on the detailed audit report from Cer.live, which covers platform security audit results. The audit coverage is comprehensive (100%), and the platform’s code has undergone independent review, a positive indicator for security concerns. For a breakdown of a specific audit, consider the Kalichain security audit explained.

Key findings from the audit include:

- Code Security: The audit identified some vulnerabilities, but none were critical; most issues related to access controls and minor logic flaws that are in process of being remediated.

- Score and Incidents: The audit assigns a high security score, though the presence of incidents indicates past vulnerabilities, which are actively addressed via bug bounty programs.

- Decentralization and Infrastructure: The reliance on specific RPC pools (Triton RPC Pool 1, LiteProv) may pose centralization risks, as these points could become attack vectors or points of failure. Understanding potential issues like this is key, and an article on RPC pool centralization risks in DeFi can shed more light.

- Auditors’ Credibility: Zellic and TrailOfBits are well-known security firms. Lauding their independent reviews boosts confidence but does not eliminate residual risks inherent in complex smart contract systems.

In summary, while the audit results reinforce a baseline of security, the platform’s reliance on specific infrastructure and ongoing incident management suggest that all trust should be tempered with vigilance. For investors, current audit transparency is encouraging but not wholly sufficient to dismiss all risks.

Tokenomics Breakdown: Analyzing $DRI Supply and Utility

The native token, $DRI, plays a central role in incentives, governance, and staking within the Drift ecosystem. Its economic model, as deduced from available data, indicates a total supply of 1 billion tokens. A deeper dive into tokenomics is often crucial for assessing project viability, suggesting a need for an article on Drift Protocol tokenomics and governance.

- Total Supply: 1,000,000,000 $DRI tokens, indicating a potentially inflationary or controlled supply depending on their issuance schedule.

- Market Cap & Circulating Supply: Approx. $153 million market cap with around 297.57 million tokens in circulation, suggesting a circulating-to-total ratio of roughly 30%.

- Allocation & Vesting: Detailed distribution data is not in the provided material, but typical models include allocations for team, development fund, early investors, and community incentives with vesting periods.

- Utility & Incentives: $DRI is used for staking, earning vaults, governance participation, and possibly fee rebates or other platform benefits.

- Inflation Control & Risks: Without explicit token issuance or burn mechanisms detailed, sustained economic sustainability remains uncertain, especially if inflationary pressures are introduced or if reward emissions outpace demand growth.

This model aligns with common DeFi token structures but leaves questions about long-term value accrual and whether token issuance and utility create enough demand to sustain the ecosystem’s growth. The absence of explicit vesting or governance token holder rights documentation suggests the need for further investigation.

Assessing Ecosystem Activity and Development Traction

On-chain activity and platform engagement are crucial indicators of a project's genuine progress. The available data indicates that Drift Protocol has seen notable trading volumes, with a reported $17 million in 24h trading volume and active open interest on BTC-PERP trades, which signals ongoing liquidity and user engagement.

The platform’s interface shows a functioning and feature-rich trading environment, including real-time market data, multiple order types, leverage options, and integrated vaults and staking sections. These features suggest a mature front-end development, with continuous updates implied by versioning and audit reports.

However, one should distinguish between organic development and marketing-driven activity. The presence of real trading data, operational UI, and security assessments points to a functioning platform that is more than just a prototype. Nonetheless, the depth of the ecosystem—such as the breadth of supported assets, cross-chain compatibility, or integrations with external platforms—is not fully detailed in the available summaries. For users on specific blockchains like Solana, understanding ecosystem challenges, such as those in Solana GameFi, can provide context.

Terms and Conditions: What Investors Need to Know

Reviewing Drift Protocol’s publicly available legal and terms documentation reveals a standard DeFi risk profile. There are no overtly unusual clauses or disclaimers that would pose immediate legal concerns. However, potential issues include:

- Vague Regulatory Language: Absence of explicit compliance measures, such as KYC/AML procedures, could imply regulatory exposure depending on jurisdiction. It is always wise to be aware of legal and ethical considerations surrounding crypto platforms, especially those with less transparent operations.

- Smart Contract Risks: The platform’s reliance on complex smart contracts, while audited, always carries residual vulnerabilities.

- User Agreements: Limited disclosure about user liabilities, dispute resolution, or platform liability clauses.

Overall, the terms appear typical for a DeFi project, but investors should scrutinize the legal disclaimers, especially around asset custody and platform security liabilities.

Final Analysis: Balancing Risks and Opportunities

In summary, Drift Protocol presents itself as a fully operational derivatives trading platform with a credible security audit trail and tangible on-chain activity. Its focus on BTC-PERP, zero-fee offers (subject to conditions), and incentive programs with the $DRI token position it well within the competitive DeFi derivatives landscape.

However, significant uncertainties remain. The team's anonymity (or lack of detailed leadership info), infrastructure centralization points, and incomplete disclosure of tokenomics and governance details introduce risks that potential investors should evaluate carefully. For instance, understanding crypto project abandonment indicators and exit scams can help identify potential red flags.

**Strengths include** active security audits, real-market liquidity, and functional trading infrastructure. **Risks involve** centralization, audit residuals, and the opacity of team and tokenomics.

Ultimately, while the project displays promising signs of legitimacy, it warrants thorough due diligence beyond surface-level evaluations, especially regarding smart contract security, infrastructure decentralization, and long-term sustainability of its economic model.

Christopher Anderson

Smart Contract Auditor & Legal Tech Analyst

I have a dual background in law and computer science. I audit smart contracts to find the critical gap between a project's legal promises and its code's reality.

Similar Projects

-

RWA IMMO

RWA IMMO ($RWA) Review: Risks, Security & Project Collapse Analysis

-

Geeked

In-Depth Geeked Review: Is This MemeCoin Scam or Legit? Crypto Scam Checker & Project Review

-

Rocket Protocol

Rocket Protocol ($ROCKET) Review: Assessing Its Security & Viability

-

Cronos Coin

Cronos Coin Review: Assessing Its Legitimacy, Risks, and Potential

-

GamerCoin (GHX)

Comprehensive Review of GamerCoin (GHX): Crypto Scam Checker & Project Analysis