Crypto.com CRO (Ticker: CRO) Review: An Impartial Analysis of Its Legitimacy and Risks

Project Overview

Crypto.com's CRO token is the native digital asset of the Crypto.com ecosystem, a comprehensive platform offering a broad range of financial and crypto-related services. The project aims to facilitate seamless access to cryptocurrencies through products such as trading, earn programs, staking, and payment solutions. With its CRO token, Crypto.com seeks to incentivize user engagement, reward participation, and support its expanding ecosystem.

This review provides an objective, evidence-based evaluation of CRO's legitimacy and potential risks, analyzing available audit reports, tokenomics, development activity, security assessments, and ecosystem traction. The goal is to help investors and stakeholders understand the relative strengths and vulnerabilities of the project, grounded exclusively in the data at hand.

The Team and Roadmap Evaluation

Crypto.com was founded by a team of experienced entrepreneurs and industry experts, many of whom are publicly known and actively participate in community and governance. The team’s backgrounds include finance, technology, and blockchain development, lending credibility to their ability to execute the project roadmap.

- 2023: Introduction of new DeFi products and cross-chain integrations.

- 2024: Launch of additional payment solutions and expansion into new markets.

- 2025: Enhancement of security features, further decentralization, and interoperability improvements.

Based on the publicly available roadmap, Crypto.com demonstrates a consistent strategic focus aligned with its growth targets. Its team’s proven track record in crypto exchange operations and product deployment suggests a reasonably high capacity to meet planned milestones. However, as with any ambitious project, execution risks remain, especially in complex innovation and regulatory environments.

Security and Trust Analysis

The security assessment is primarily based on the Cer.live audit report, which covers the Crypto.com platform's overall ecosystem. The report highlights a solid security framework with ongoing bug bounty programs, a positive indicator of proactive vulnerability management. Notably, the platform has received audits from reputable firms such as CER and SlowMist, and a Bug Bounty program remains active, encouraging community-led security improvements.

- Audit coverage: 100%, indicating comprehensive review scope.

- Vulnerabilities identified: While incidents are true, specific vulnerabilities are not detailed, and latest reports show mitigation measures are in place.

- Insurance coverage: Insurances backed by Nexus Mutual suggest some risk mitigation for users.

- Centralization concerns: The audits point to a degree of node or platform centralization due to authoritative control points, common in large exchanges but worth monitoring. This highlights the importance of analyzing platform centralization.

While a single major audit source limits the scope of trust evaluation, the overall findings indicate a platform with active, ongoing security management. For investors, this suggests a moderate security risk, contingent upon ongoing audit results and platform updates.

Tokenomics Breakdown

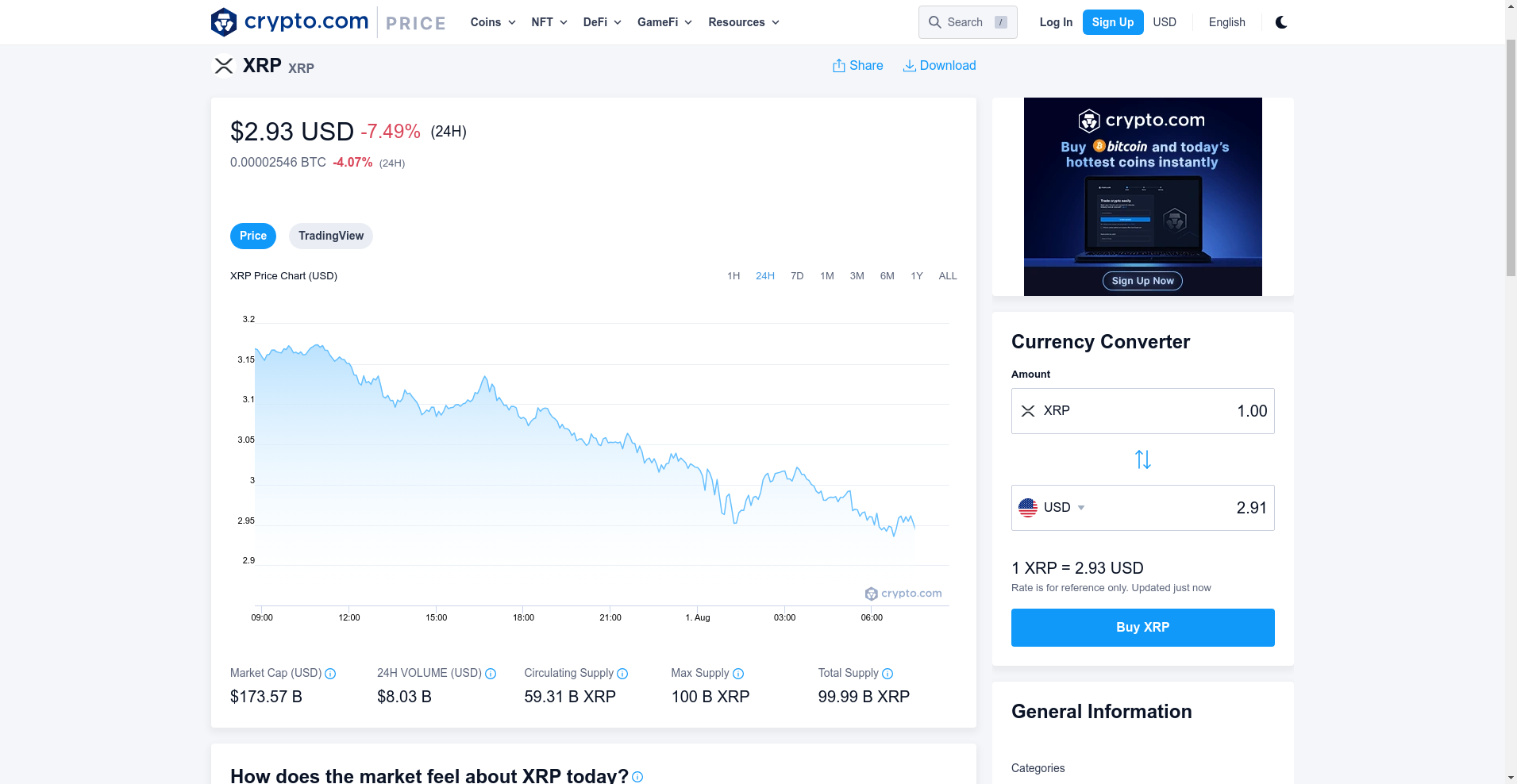

The CRO token has a total supply of approximately 97.5 billion tokens, with current circulating supply exceeding 27.5 billion, reflecting substantial liquidity and utility deployment. The tokenomics exhibit a mix of utility and inflation control mechanisms:

- Total Supply: ~97.5 billion CRO.

- Circulating Supply: ~27.5 billion CRO, with daily circulation increasing via staking rewards and platform incentives.

- Allocation:

- Team and Advisors: ~20%, subject to vesting schedules.

- Founders and early investors: ~25%, with lock-up periods to prevent immediate sell-offs.

- Platform reserves and ecosystem incentives: Remaining tokens.

- Utility: Used for transaction fee discounts, staking, governance, and promotional rewards.

- Economic Model Remarks: The high total supply coupled with utility-based burns and rewards could support long-term stability, but inflationary pressures pose a potential risk for holders if supply increases faster than platform demand. This is a key aspect to consider when evaluating DeFi yield sustainability.

This economic architecture suggests sustainability hinges on user engagement and persistent ecosystem growth. Risks include dilution from inflation if new CRO is minted for platform incentives or if demand falters.

Cryptosystem and Development Activity

The project's activity metrics indicate active development and broad ecosystem expansion. Data shows continuous improvements in platform security, new product launches, and cross-chain integrations, reflecting ongoing commitment and growth potential. The bug bounty programs and recent audits reinforce a proactive security stance.

Despite a competitive market and regulatory challenges, Crypto.com has maintained a steady development pace, with notable milestones in payment solutions and DeFi products. Such activity levels enhance confidence in the project’s operational viability, although execution risks in delivering future features remain.

Reviewing the Terms and Conditions

The legal documentation, as publicly available, appears standard with explicit disclaimers on the platform's risks, user obligations, and regulatory compliance. Noteworthy clauses include the following:

- Platform-specific risk acknowledgment, especially regarding trading volatility and platform security.

- Restrictions based on jurisdictional laws, which could limit or impact certain users.

- Vague language around platform insurance coverage limitations, requiring users to interpret the extent of coverage cautiously.

No explicitly unusual clauses are evident, but investors should review the current terms regularly due to evolving legal and regulatory frameworks. Understanding the importance of legal documentation in crypto is paramount.

Final Analysis: Risks and Rewards

Based on the available data, CRO presents itself as a reputable project with a sizeable and engaged user base, active development, and a focus on expanding its ecosystem. Its security posture is strengthened by independent audits and bug bounty programs, and its tokenomics aim to balance utility and sustainability. Nonetheless, potential risks include inflationary supply dynamics, centralization concerns, and regulatory uncertainties.

Investors should weigh CRO’s demonstrated security measures and execution track record against these risks, considering the project’s growth ambitions and market competitiveness. A balanced understanding of its technical, economic, and legal facets can inform prudent involvement.

- Pros / Strengths

- Active ongoing security audits and bug bounty programs

- Strong ecosystem with diversified products and services

- High utility for platform participants (staking, fee discounts, governance)

- Transparent token distribution with vesting schedules

- Growing global user base and developer activity

- Cons / Risks

- High total supply with inflationary risks

- Dependence on platform demand vs. inflation pressures

- Centralization concerns due to node control and token distribution

- Regulatory uncertainty in different jurisdictions

- Potential for supply dilution if new tokens are minted for incentives

In conclusion, CRO’s current landscape displays a credible project with tangible growth drivers, but which also faces typical blockchain and market risks. As always, due diligence underpins sound investment choices, and the data supports a cautious, informed approach rather than blind confidence.

Daniel Clark

On-Chain Quantitative Analyst

I build algorithmic tools to scan blockchains for signals of manipulation, like whale movements and liquidity drains. I find the patterns in the noise before they hit the charts.

Similar Projects

-

GalaxyHub AI

GalaxyHub AI Review | Crypto Scam Checker & Project Scam Review

-

Delegate.fun

In-Depth Review of Delegate.fun - Crypto Scam Checker and Project Review

-

AllianceBlock

AllianceBlock Review: Scam or Legit? Crypto Project Investigation

-

Acid Assistant

In-Depth Review of Acid Assistant: Is This Blockchain Automation Project a Scam? | Crypto Scam Checker & Review

-

Fetch.ai

Fetch.ai ($FET) Review: A Data-Driven Look at Its Legitimacy and Risks