Don-key ($DON) Review: A Data-Driven Assessment of Its Legitimacy and Risks

Project Overview

Don-key is positioned as a comprehensive DeFi platform that combines yield farming, staking, automation, and community-driven features under one ecosystem. Leveraging a multi-module approach, it seeks to democratize access to yield strategies, allowing users to participate via a user-friendly interface that emphasizes no-code strategy creation and community engagement. The platform promotes its core token, $DON, available in both BEP20 and ERC20 formats, and references an associated token, $KDON, on KuCoin, indicating multi-chain support and exchange presence.

As with many DeFi projects, Don-key aims to cater to both novice users seeking simplified yield options and more advanced farmers wishing to build or copy strategies. Despite the ambitious feature set, a thorough, impartial assessment of its legitimacy requires analyzing team credibility, security posture, tokenomics, and community transparency, which are critical for evaluating long-term sustainability and inherent risks.

The Team and Roadmap Evaluation

The publicly available team roster includes names such as Gil Shpirman, Yanir Goldenberg, Adarshdeep Singh, and Vijay Bhayani, along with a technical and marketing staff. While team transparency is a positive indicator, the absence of detailed bios, LinkedIn profiles, or project backgrounds raises questions about verification and prior experience. Trustworthiness in DeFi is often correlated with team credibility, especially in security and audit practices.

- Major milestones include a litepaper release, security audits, and platform features rollout, but specific dates or completion status are not detailed here.

- The project claims ongoing development with scheduled releases for Borrow, and plans to expand cross-chain capabilities.

- Without independent verification or verified credentials, investors should consider the overall transparency of team disclosures as moderate but not conclusive.

Overall, the team’s ability to deliver relies on transparent communication, credible partnerships, and successful execution of outlined milestones.

Assessing the Security and Trustworthiness

The security analysis provided is primarily based on an audit from Certik, one of the top auditing firms. According to the data, the audit coverage is 80%, with a platform audit completed, and a score of 6.35/10, which is moderate within the audit scoring spectrum. Critical vulnerabilities and incidents are noted as existing, which warrants cautious optimism.

- Certik’s detailed audit report is accessible via Certik.

- The platform emphasizes its use of Fireblocks Custody for key management, a respected institution in custody solutions, suggesting a strong focus on user fund protection.

- However, only one audit source is referenced; comprehensive risk mitigation would ideally include multiple independent audits, bug bounty programs, and incident response data.

This suggests a baseline of security measures, but not an absolute guarantee against exploits or vulnerabilities. Investors should monitor for updates on audits and bug bounty programs to better assess ongoing security efforts.

Tokenomics Breakdown

The core token, $DON, has a total supply of 100,000,000 tokens, with circulating supply around 66,294,797 tokens. The token exists both as BEP20 on Binance Smart Chain and ERC20 on Ethereum, supporting cross-chain compatibility. Its current market cap is approximately $180,186, with a trading volume of about $8.85K, indicating modest liquidity and activity.

- Distribution specifics, such as initial allocation, vesting schedules, and inflation/deflation mechanics, are not provided here but are crucial for assessing long-term value sustainability. For a deeper dive, refer to the Don-key tokenomics analysis.

- The $KDON token on KuCoin may serve as a tradable or utility variant, but its exact role remains unclear without detailed documentation.

- Reward mechanisms for staking, farming, or building strategies are not explicitly disclosed, making it necessary to review the litepaper or official tokenomics reports for clarity.

The economic model’s sustainability depends on proper token emission controls, community incentives aligned with platform growth, and transparent reward structures—all aspects to verify through the full project documentation.

Development Activity and Ecosystem Traction

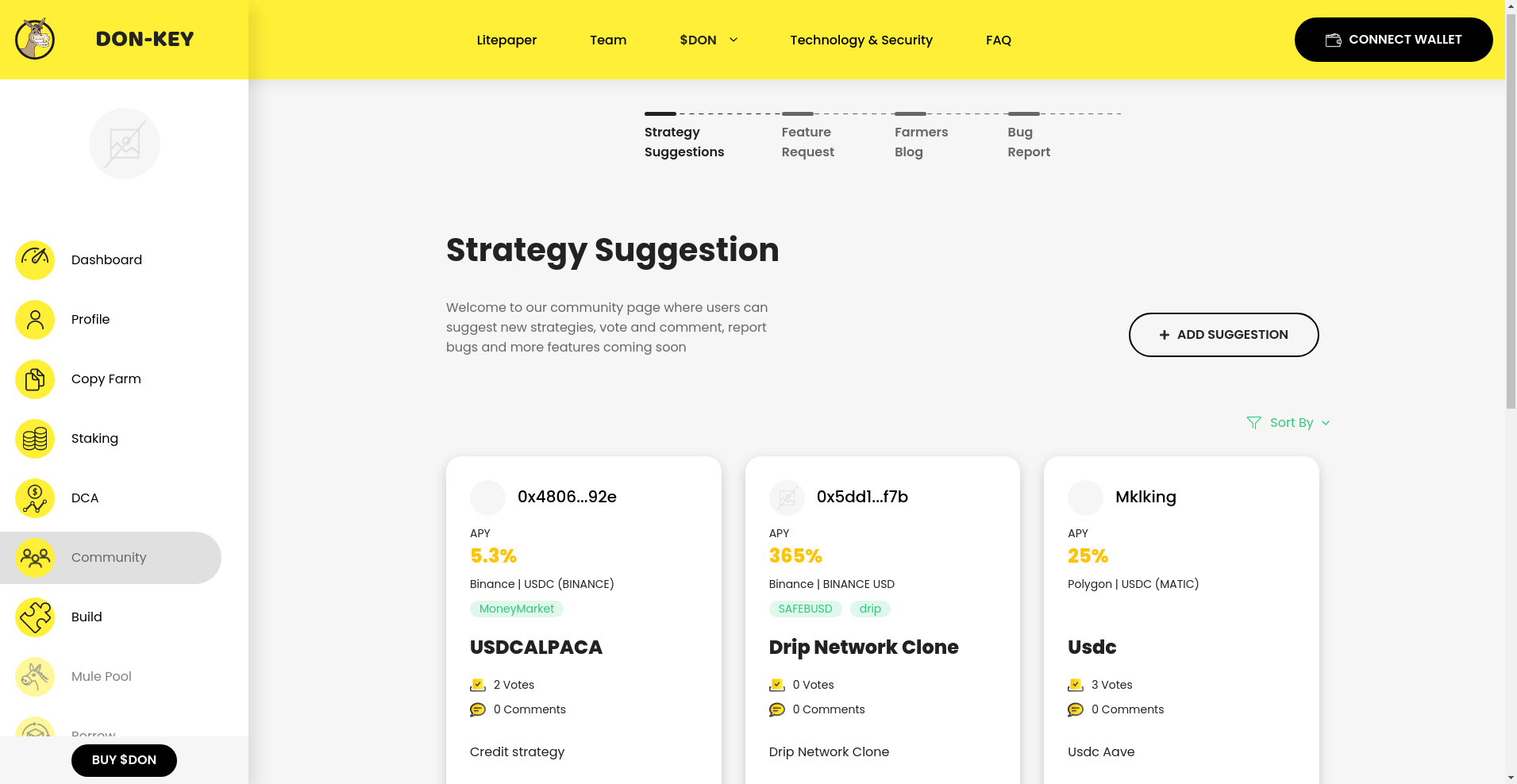

Public activity indicators show approximately 2,400 active users and a TVL (Total Value Locked) of around $1.5 million, signifying a modest but engaged community. The presence of multiple modules—Farm, Staking, DCA, Mule Pool, Borrow, Referrals—suggests ongoing feature development and expansion. This focus on automation is a key aspect of modern yield farming automation tools in DeFi.

However, distinguishing genuine development progress from marketing hype requires monitoring deployment of promised features (such as Borrow), and evaluating whether technical updates, bug fixes, or security patches are being communicated regularly. Platform activity should also be cross-verified with on-chain data and community updates.

Terms, Conditions, and Legal Considerations

The project is listed as being in beta, with the disclaimer that users should operate at their own risk. The platform openly emphasizes transparency but provides limited information on legal frameworks, user protections, or compliance measures. Notably, no KYC/AML processes are explicitly mentioned, which is typical for DeFi projects but worth considering from a regulatory perspective.

Red flags include the absence of detailed user agreements, formal disclosures on risk management, or clear terms on how the platform handles smart contract failures or security incidents.

Final Analysis: The Investment Case for Don-key

Overall, Don-key presents itself as an ambitious and versatile DeFi ecosystem blending yield strategies, automation, community participation, and multi-chain support. Its strengths include the availability of audits from a reputable firm, a transparent-looking team section, and a modular ecosystem supporting various financial products.

However, significant risks remain—chief among them the moderate audit score, limited detailed tokenomics, lack of multi-audit verification, and incomplete disclosures on security procedures and governance. The modest TVL and active user base indicate emergent traction but also highlight the need for more robust adoption and risk mitigation strategies before considering long-term investment.

Potential red flags include the lack of detailed reward mechanisms, uncertain platform security beyond initial audits, and unverified claims about feature delivery timelines. Moreover, platform reliance on community-driven content (suggested by the strategy suggestions and voting) introduces governance and coordination risks.

Informed investors should approach with due diligence: scrutinize the litepaper, seek out independent security audits, and verify team backgrounds. Due caution is advised until more comprehensive information becomes available regarding tokenomics, security, and regulatory compliance.

This impartial review emphasizes the importance of balancing platform innovation with transparent safeguards, long-term viability, and community trust for sustaining growth and trustworthiness in DeFi space.