CIPHER EPAY ($CPAY) Review: A Data-Driven Legitimacy and Risk Assessment

Project Overview

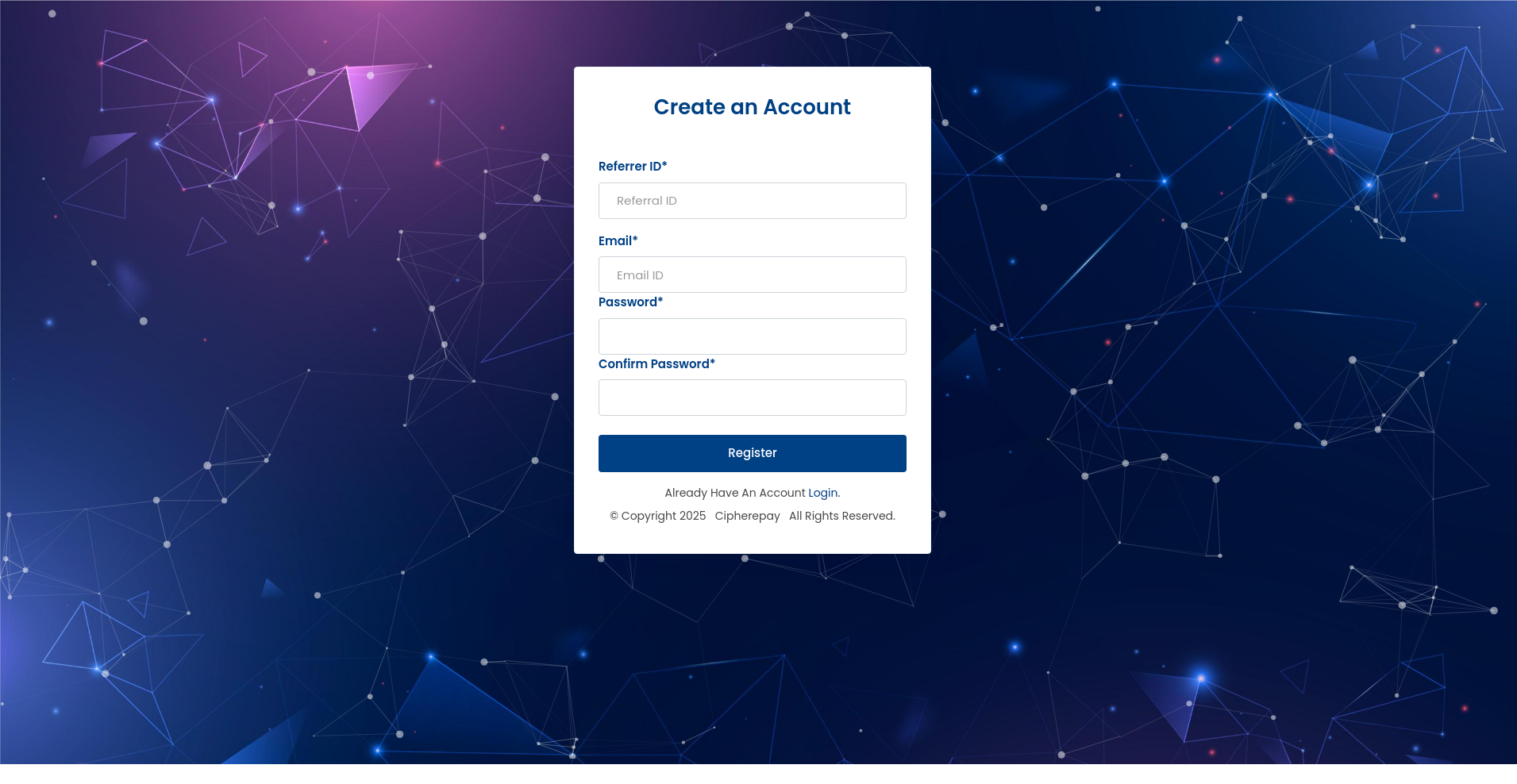

CipherEpay ($CPAY) presents itself as a digital payment solution leveraging blockchain technology, with a focus on facilitating fast, secure, and global transactions. Powered by Ethereum and Polygon PoS blockchains, it aims to position itself within the rapidly growing DeFi and crypto payment ecosystem. Its core offerings include a native token, mobile applications, and integration with major crypto data platforms, suggesting a comprehensive ecosystem targeting both businesses and individual users.

In this review, we focus on impartially assessing its legitimacy and potential risks based on available data, audits, and project documentation. The analysis considers the project's technology, team credibility, security posture, tokenomics, and development activity, aiming to offer a balanced view for potential investors or users. Understanding these transparency metrics is crucial for any potential investor.

The Team and Roadmap Evaluation

From the available information, CipherEpay's team background remains largely unpublicized. There are no detailed disclosures of individual team members, advisors, or their previous experience within the blockchain industry. The roadmap, as publicly shared, outlines promising milestones—launching the website, creating the token, mobile app releases, exchange listings, and multi-blockchain support. These are standard development steps for a crypto project but their timely delivery hinges on team competence. For a deeper dive into this aspect, consider understanding navigating anonymous teams in crypto.

- July 2024: Website and token creation, social marketing launch.

- August 2024: KYC implementation, highlighting compliance considerations.

- September - October 2024: Mobile app rollouts for Android and iOS.

- November - December 2024: Major exchange listings (CoinGecko, CoinMarketCap).

- January 2025: DEX integration.

- February - March 2025: Multi-blockchain development (Alpha & Beta phases).

- April 2025: Publishing future roadmap plans.

While the milestones are typical for a nascent project, the lack of team transparency and concrete strategic partnerships calls into question the project's ability to meet its targets without internal or external hurdles. The execution risk is notably high when foundational disclosures are absent. Evaluating the reliability of crypto project roadmaps is a key part of due diligence.

Security and Trust Analysis

Based on Cyberscope's audit report, CipherEpay’s smart contract security receives a high score of approximately 96%, placing it in the top percentile (98.7%). This suggests robust security standards in its code, with no critical vulnerabilities identified in the audit process.

- Security Score: 95.64/100, indicating strong adherence to best practices.

- Audit conducted on Ethereum and Polygon deployed contracts.

- Only one audit iteration appears to have been completed; no follow-up audits or third-party verifications disclosed. Understanding the importance of multiple audit iterations can provide further insight.

- There are no reported vulnerabilities, but the audit focuses solely on code security, not on broader risks like governance or operational security.

While the security score from Cyberscope is reassuring, it does not substitute for ongoing security assessments, due diligence on the team's ability to respond to potential exploits, or independent audits. As with all smart contract projects, vulnerabilities may still exist outside the scope of that single audit. It's also worth understanding the role of firms like Quantstamp in blockchain security.

Tokenomics Breakdown

Details regarding CipherEpay's token ($CPAY) reveal a supply structure and distribution plan that have yet to be fully disclosed publicly. From available data:

- Total Supply: Unknown, but market cap is approximately $690,440, with a token price near $0.0000639, implying a substantial circulating supply.

- Market Cap & Volume: The project’s current market cap is modest, and trading volume remains zero, indicating low liquidity and limited trading activity.

- Allocation: No specific allocation details for team, advisors, private investors, or community incentives are publicly available.

- Vesting & Lock-up: Absent from the supplied data; unclear if tokens are subject to lock-ups or unlocks, which can influence price stability and investor confidence. Projects should ideally provide clear token vesting schedules for investor protection and transparency.

- Utility: The token appears to serve as a payment or governance instrument within the CipherEpay ecosystem, but exact utility details are sparse.

The economic model's sustainability is unclear without transparency on token distribution, inflationary/deflationary mechanisms, or strategic token burns. The lack of detailed tokenomics introduces risks related to liquidity, centralization, and potential market manipulation. This lack of comprehensive detail is a major factor in why investors need to carefully evaluate DeFi project transparency metrics.

ecosystem and Development Activity

The project’s development activity, as per publicly available data, shows a strategic plan aligned with consistent milestones—app releases, exchange listings, and multi-blockchain interoperability. However, there is limited evidence of active development or community engagement, such as GitHub commits, social media activity, or user growth metrics.

While official announcements and roadmap timelines suggest ongoing progress, the absence of demonstrable real-world usage, user adoption metrics, or partnership deployments raises questions about actual ecosystem traction. Examining simulated trading strategies can sometimes shed light on projects trying to boost perceived activity.

Most activity appears to be promotional or preparatory, with tangible ecosystem growth yet to be observed beyond the completed milestones.

Reviewing the Terms and Conditions

The publicly available documentation lacks detailed legal Terms of Service or user agreements, which is a red flag for potential compliance risks. The only noteworthy points are standard project notices and copyright statements. Projects must have clear legal and compliance frameworks.

- Unclear on regulatory compliance, especially regarding AML/KYC regulations across jurisdictions.

- Vague on governance structure, upgradeability, or community voting rights.

- Absence of a whitepaper or legal disclaimer details could pose risks for users, especially if the project involves fundraising or token sales.

Investors should demand clear legal frameworks and transparent governance policies before engaging deeply. This lack of legal clarity is a significant factor when checking crypto project legal and compliance frameworks.

Final Analysis: The Investment Case for CipherEpay

In summary, CipherEpay ($CPAY) demonstrates some promising technical indicators, notably a high security audit score. The roadmap reflects typical milestone progression, with plans for marketplace listings, app launches, and multi-chain support. However, significant red flags remain:

- Lack of transparency: The team's identities, tokenomics, and token distribution are not publicly detailed. This lack of transparency is a common theme in, for example, anonymous crypto teams.

- Development & Adoption: Limited community engagement, no active trading or user metrics, and minimal public activity beyond announcements. The assessment of liquidity and trading volume is critical here.

- Legal & regulatory risks: Inadequate disclosures on compliance and legal frameworks.

- Liquidity & Market Risks: Zero trading volume and modest market cap suggest high volatility and low immediate liquidity.

Potential investors should weigh the high technical security against the risks of insufficient transparency and ecosystem activity. The project appears to be in early stages, and without further disclosures, the risk of overhyped promises remains high. As always, due diligence and cautious investment practices are advised. This review aims to provide an objective, evidence-based overview to inform your decision regarding CipherEpay.

Jessica Taylor

NFT Market Data Scientist

Data scientist specializing in the NFT market. I analyze on-chain data to detect wash trading, bot activity, and other manipulations that are invisible to the naked eye.

Similar Projects

-

XMAMA

XMAMA ($XMM) Review: A Deep Dive into Its Risks & Collapse

-

EuroStars2024

Crypto Project Review: Is EuroStars2024 a Scam or Legitimate? Crypto Scam Checker & Project Review

-

Acid Assistant

In-Depth Review of Acid Assistant: Is This Blockchain Automation Project a Scam? | Crypto Scam Checker & Review

-

Chainlink

Chainlink Review: Scam or Legit Crypto? Crypto Project Investigation

-

Fetch.ai

Fetch.ai ($FET) Review: A Data-Driven Look at Its Legitimacy and Risks