CACHE Gold ($CGT) Review: A Data-Driven Legitimacy and Risk Assessment

Project Overview

CACHE Gold ($CGT) is designed as a blockchain-enabled platform that tokenizes physical gold, aiming to bridge traditional asset management with modern Web3 technology. The core proposition is to create a secure, transparent, and compliant digital representation of gold ownership that can facilitate easier trading, transfer, and storage of real-world assets. This tokenization effort seeks to unlock liquidity, reduce transaction costs, and broaden access to gold as a financial asset.

Throughout its operational timeline, CACHE emphasizes transparency by leveraging advanced tracking systems such as GramChain® and Chainlink Proof of Reserve (PoR). These technologies are intended to provide ongoing proof of backing for the tokens with actual gold reserves, ensuring that each token is verifiably backed at all times. However, recent communications indicate that the project is entering a winding down phase, with significant implications for token holders and prospective investors.

Team and Roadmap Evaluation

The CACHE team comprises experienced professionals with backgrounds spanning software development, precious metals, legal compliance, and financial regulation. Notable figures include Gregor Gregersen, a software veteran with two decades of experience, and Nizam Ismail, a regulatory compliance expert with extensive tenure at Singapore's MAS. The leadership's credentials suggest a strong foundation in both technology and compliance, critical for a project operating at the intersection of traditional assets and blockchain. This expertise is crucial when considering tokenizing physical gold.

Regarding the roadmap, CACHE has pursued milestones involving partnerships with vaulting agencies, establishing insurance coverage, integrating Chainlink’s proof mechanisms, and expanding storage capacity via global vaults. These milestones underscore a focus on operational security, transparency, and regulatory adherence. However, given the current notice of winding down operations, the ability of the team to deliver on long-term promises remains uncertain.

- Partnerships with major vaults such as IDS Dallas, The Safe House Singapore, and Loomis Zurich

- Integration of Chainlink Proof of Reserve (PoR) for transparency

- Implementation of GramChain for immutable asset tracking

- Registration under Singapore’s PSPM Act, ensuring AML/CFT compliance

While the team’s expertise appears credible, the project's imminent winding down suggests a substantial shift in its operational trajectory that potential investors should carefully consider.

Security and Trust Analysis

This evaluation is primarily based on the audit report from Cer.live, which covers the CACHE Gold smart contract system. The audit, conducted by ZeroTrust, rates the project highly with a score of 9.1 and a relevance level indicating importance for token holders.

- Audit Scope: Focuses on token smart contracts, including mechanisms for backing, minting, and redemption.

- Findings: Reports incidents and assets insurance coverage but notes a “coverage of 30,” hinting at ongoing risk areas.

- Vulnerabilities: No critical vulnerabilities are explicitly listed; however, the presence of incidents suggests operational or security challenges

- Centralization: The use of multi-signature ownership and oracle-based validation provides layers of governance, reducing single points of failure.

- Insurance: The project has insurance coverage, which adds an extra layer of trustworthiness in the event of unforeseen losses.

Despite the positive audit ratings, it’s essential to recognize that audits are snapshots and cannot guarantee the absence of future vulnerabilities or operational failures. The project’s transition towards winding down and the significant event of a compulsory token redemption highlight that risk factors, including project sustainability and the potential loss of backing, are serious considerations for investors.

Tokenomics Breakdown

The CACHE Gold ($CGT) tokenomics revolve around representing grams of physical gold stored in secure vaults. The token supply mechanism, fees, and redemption process are critical factors influencing its economic viability and potential risks.

- Total Supply: Currently approximately 100,771 CGT tokens, with active circulation around 3,999 CGT, indicating significant redemption and potential shrinkage as winding down progresses.

- Backing: Tokens historically claimed to be fully backed by physical gold, with ongoing proof-of-reserve via GramChain® and Chainlink PoR systems.

- Fee Structure:

- Storage Fee: 0.25% annually

- Redemption Fee: 1% for physical gold

- Transfer Fee: 1% (waived until Jan 2023)

- Inactivity Fee: 0.5% per annum after 3 years of inactivity

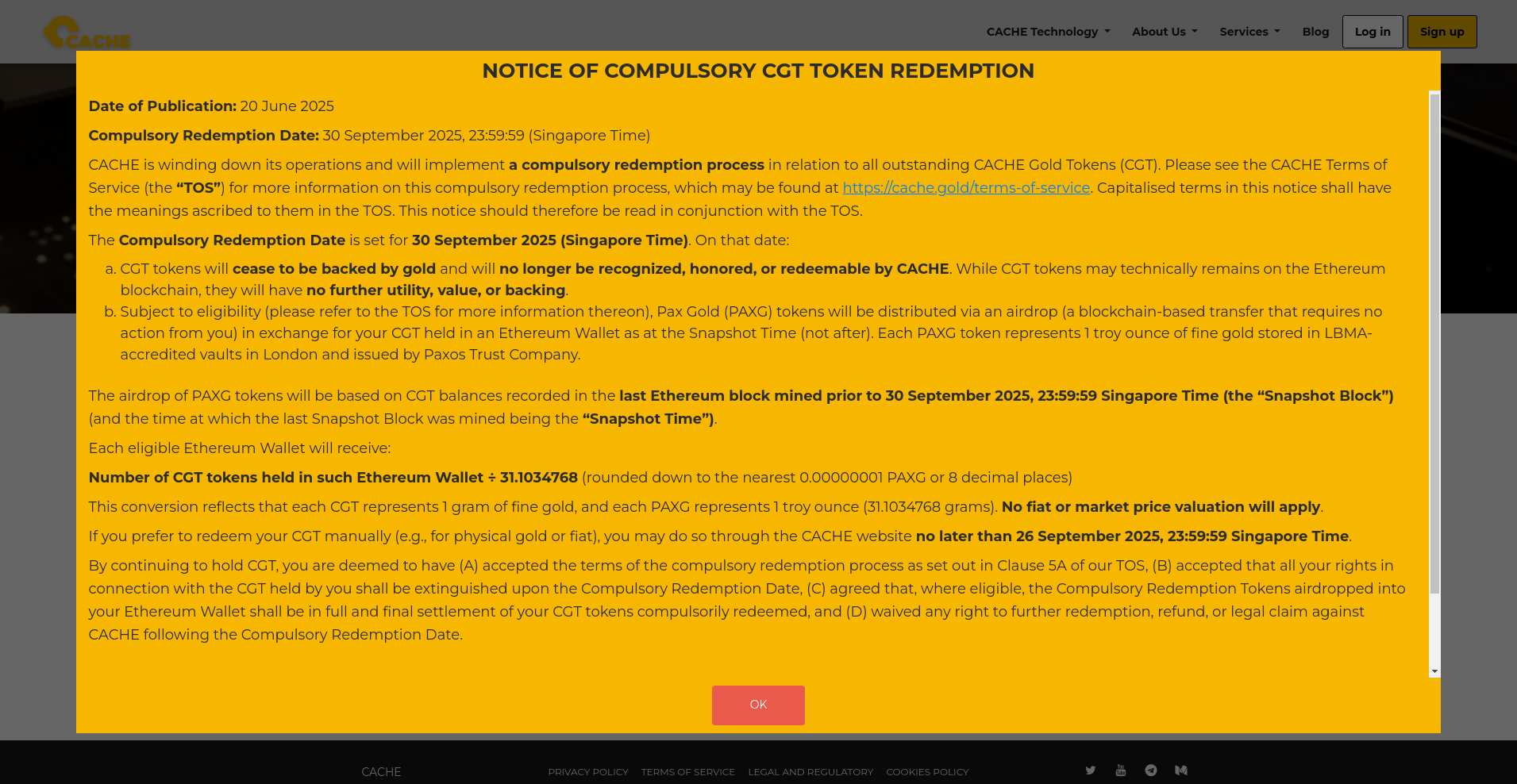

- Redemption & Winding Down: The project is initiating a compulsory redemption that will convert CGT into Pax Gold (PAXG) via an airdrop, equating 1 gram of gold to 1 Troy ounce (via the division by 31.1034768).

- Risks: The economic model's sustainability is compromised by the winding-down event, which extinguishes the backing of CGT, effectively rendering remaining tokens worthless unless redeemed through the official process.

In summary, the tokenomics are designed for stability and transparency at inception, but the imminent winding down introduces notable risks — mainly, the loss of backing and value for unsponsored tokens post-redemption.

Ecosystem and Development Activity

The CACHE ecosystem showcases a commitment to transparency and security through partnerships with vault providers, insurance coverage, and technological safeguards like GramChain® and Chainlink PoR. These efforts aim to maintain “real-time” proof of reserves and facilitate audits of the physical gold backing.

Development activity appears consistent with industry benchmarks for asset-backed token projects, emphasizing regulatory compliance and operational security. Nonetheless, recent announcements about winding down operations significantly impact the ecosystem’s future activity and trust. The ongoing transparency measures likely serve as mitigants for current holders, but prospective investors should note that the project’s active development phase is effectively concluding in anticipation of the redemption event.

In practical terms, the ecosystem’s current status revolves around fulfilling existing commitments (such as redemption) rather than expansion or new features—marking a transition towards closure.

Reviewing the Terms and Conditions

The project’s Terms of Service and related legal documentation specify the process for redemption, project winding down, and user rights. The key clauses include:

- Compulsory Redemption: Effective on September 30, 2025, all CGT tokens will cease to be backed and must be redeemed via the outlined process.

- Final Settlement: The airdrop of PAXG tokens constitutes full and final settlement for those redeemed, with no further claims allowed post-redemption.

- User Acceptance: Continued holding of tokens after the notice date implies acceptance of all redemption terms and waivers.

No notably unusual clauses are evident, but the merger of redemption rights and winding down clauses warrants careful review by potential investors. The legal framework aligns with standard practices for asset-backed tokens but underscores the importance of understanding the ongoing risk of token devaluation upon redemption.

Final Analysis: The Investment Case for CACHE Gold

Based on the comprehensive review of available data, CACHE Gold ($CGT) presents itself as a fundamentally transparent platform for gold tokenization, ensured by robust technology, auditing, and regulatory compliance. However, recent disclosures about winding down operations and a mandatory redemption process fundamentally alter the project’s long-term outlook.

Strengths:

- Strong regulatory compliance with Singapore’s PSPM Act

- Use of advanced, publicly auditable proof mechanisms (GramChain®, Chainlink PoR)

- Partnerships with reputable vault and logistics providers

Risks:

- Imminent winding down, ending backing and utility of CGT tokens

- Potential for remaining tokens to become worthless if not redeemed before deadline

- Dependence on third-party vaults and insurance, which may be disrupted

- Loss of confidence after redemption, affecting residual liquidity and value

In conclusion, while CACHE Gold achieved notable technological and regulatory milestones, its current phase of winding down significantly impacts its investment appeal. Investors interested in long-term, secure gold-backed tokens should consider the gold tokenization process carefully, as unredeemed tokens post-September 2025 will hold no backing or value.

This analysis aims to equip readers with an objective understanding of CACHE Gold’s legitimacy, technological integrity, and inherent risks, helping inform prudent decision-making in the dynamic crypto-asset space.