BANG Review: Scam or Legit Crypto? Uncovering All The Red Flags

What Exactly Is BANG?

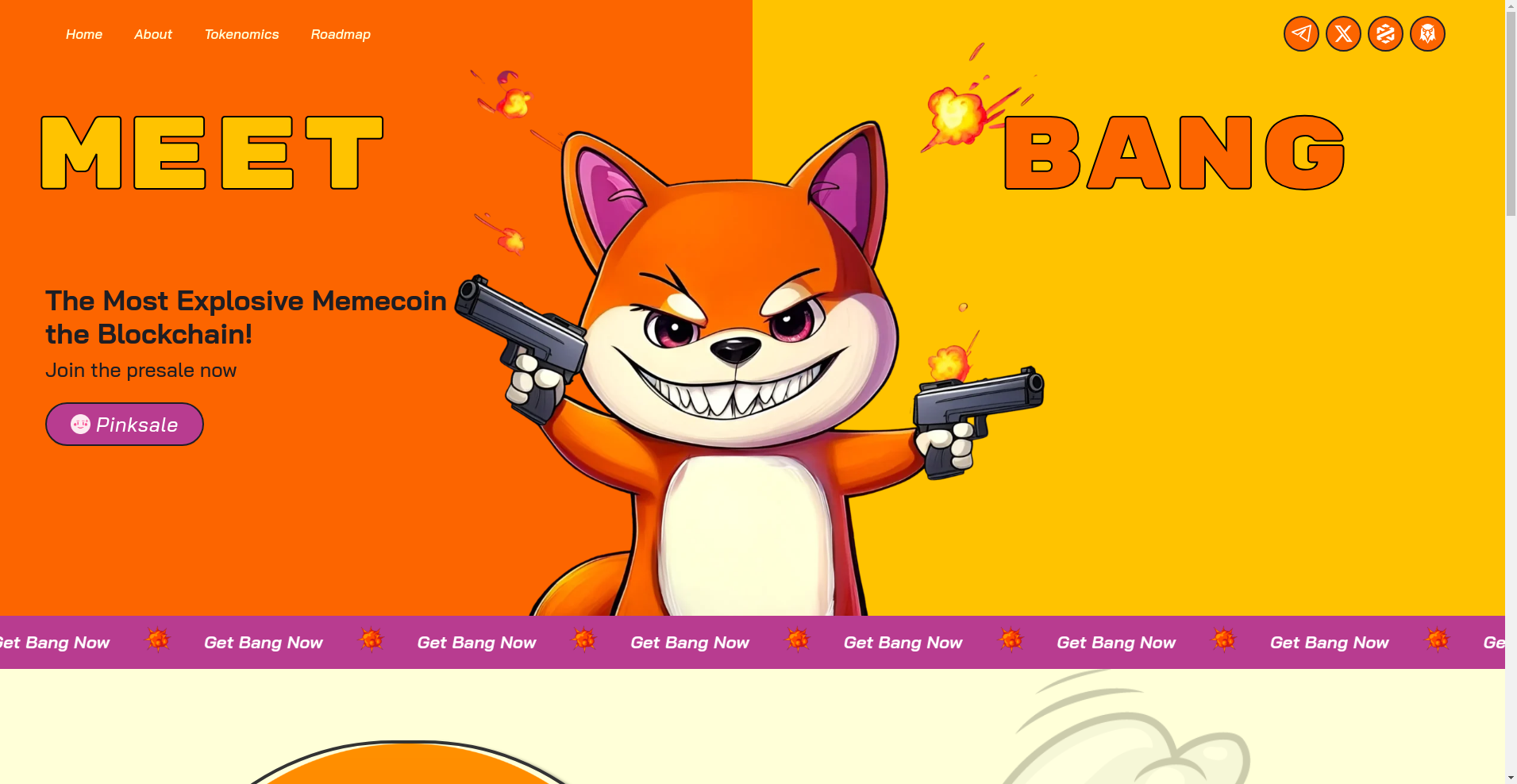

Imagine a memecoin promising to dominate the crypto scene with explosive growth, community vibes, and viral energy. That’s the pitch behind BANG, a project branding itself as "The Most Explosive Memecoin on the Blockchain." Its website and promotional materials highlight speed, decentralization, and viral potential, positioning BANG as a high-impact investment opportunity.

Yet, beneath these bold claims lies the crucial question: is BANG legit or just another crypto scam? As a discerning investor or observer, it's essential to dig deep into the project’s fundamentals, auditing reports, and development activity to understand what you're really risking. This article aims to critically evaluate BANG’s claims and uncover red flags that could influence your investment decision.

Who Is The Team Behind BANG?

One of the first indicators of a project's legitimacy is the transparency of its team. Unfortunately, BANG’s founders remain anonymous, with no publicly disclosed identities or credible backgrounds. The website and social media channels offer little to no information about the developers or the leadership behind the project.

- Team members are not doxxed or publicly identified.

- The website lacks an "About Us" or team section.

- Social links include a Telegram group with only 188 members, indicating a small or niche community.

- The project emphasizes decentralization but provides no verifiable credentials or leadership transparency to back this claim.

In terms of roadmap and vision, BANG states ambitious goals like "dominating the memecoin space" and "viral growth," but offers no concrete milestones or development timelines beyond a vague "Phase 4 coming soon." This lack of clear, verifiable objectives raises questions about the project's long-term planning and commitment.

BANG Security Audit: A Deep Dive into the Code

From an security perspective, BANG has undergone an audit from Cyberscope, a recognized audit provider, with the findings accessible publicly. The audit confirms that BANG's contract is based on the SOL network and has been tagged as having a high criticality issue during the assessment.

- The audit report notes a high criticality vulnerability, which could potentially be exploited by malicious actors.

- The project has a security score of approximately 95%, indicating general safety but with notable areas to improve.

- Decentralization score is around 65%, reflecting moderate decentralization; however, without detailed governance structures, the real level of decentralization remains opaque.

- Important to note is the absence of an KYC process, meaning there's no verification of the developers' identities or credentials.

While the security audit shows procedural compliance, the presence of high-criticality vulnerabilities warrants caution. An investor should recognize that a single audit does not guarantee safety from future exploits or vulnerabilities.

BANG Tokenomics: A Fair System or a Trap?

Tokenomics — the economic model of a crypto project — is critical in assessing its sustainability and fairness. For BANG, there is minimal publicly available data on token distribution, utility, or governance, raising red flags about potential centralization or unfair advantages.

- Total Supply: 998,497,594 BANG tokens, with no clear vesting or lock-up periods disclosed for founders or early investors.

- Distribution: Specific breakdowns such as team allocation, community incentives, or reserve funds are absent.

- Utility: The project claims to be community-driven, but there is no detailed information on how tokens are used within the ecosystem or what benefits holders receive.

- Inflation Risks: Without clear vesting or buyback mechanisms, the large supply could easily lead to dumping or inflation-driven depreciation.

This opacity about tokenomics suggests potential risks of pump-and-dump schemes and high inflation, especially if team tokens are not subject to vesting constraints.

Is BANG a Ghost Town? Checking for Real Activity

Analyzing ecosystem health is vital. Despite active marketing, BANG shows limited real-world activity beyond its presale platform and social media posts. The Telegram group, with fewer than 200 members, provides little engagement, indicating a lack of organic community growth.

The project’s website indicates ongoing development phases like "Phase 4 coming soon," but no concrete updates or progress reports have been provided recently. Social media activity on X/Twitter appears minimal, with no significant development announcements or partnerships to validate the project's claims of viral growth and high-impact potential.

Such inactivity could imply that BANG is primarily a marketing effort designed to attract quick speculative investment rather than a sustainable project with real-world utility.

What BANG's Legal Documents Are Hiding

The website prominently features a disclaimer emphasizing that all information is purely for educational purposes, explicitly stating no financial advice or responsibility for any losses. This is standard in many projects but does little to assure investors of safety.

Potential concerns include:

- Absence of detailed Terms of Service or privacy policy.

- No mention of compliance with regulatory standards or licensing.

- The lack of KYC/AML procedures increases the potential for abuse, scams, or illicit activity.

Investors should be wary that such omissions may indicate the project’s intention to operate in a legally gray area, further compounding risks.

Final Verdict: Should You Risk Investing in BANG?

Based on the available data, the BANG project exhibits many red flags typical of high-risk or potentially fraudulent schemes. The lack of transparent team information, minimal real-world activity, security vulnerabilities, and opaque tokenomics collectively undermine its credibility. Although the project claims to be community-driven and decentralized, these assertions are not backed by verifiable evidence.

-

Positive Points

- Underwent a security audit from a recognized provider (Cyberscope).

- High security score (~95%), indicating robust basic security measures.

- Inclusion on CoinScope indicates some level of external review.

-

Major Red Flags

- Anonymous team with no verifiable credentials.

- Lack of detailed tokenomics and development roadmap.

- Minimal community engagement and activity.

- High-criticality vulnerability in the audit report.

- Operation on a platform with no legal disclosures or KYC.

In conclusion, while BANG might appeal to speculative traders seeking quick gains, the risks are substantial, and due diligence suggests caution. Never invest more than you’re willing to lose, especially in projects with such significant red flags.

Sarah Wilson

Offensive Security Engineer

I'm a professional "white-hat" hacker. I think like an adversary to find holes in crypto projects before the bad guys do. My job is to break things so you don't get broken.

Similar Projects

-

Streamflow Finance

Streamflow Finance Review: Scam or Legit Crypto? Full Legitimacy Check

-

KirbyCoin

KirbyCoin Review: Crypto Project Scam Checker & In-Depth Analysis

-

BoredSpace

Crypto Scam Checker Review: Is BoredSpace a Legit Project or Scam?

-

Crybaby ($CRYBB)

Crypto Scam Checker Review: Is Crybaby ($CRYBB) a Safe Project or Scam?

-

Long Dragon

Long Dragon Review: Crypto Project Scam Checker & Risk Analysis 2025