Uquid Coin (UQC) Review: A Data-Driven Legitimacy and Risk Assessment

What Is Uquid Coin: An Introduction

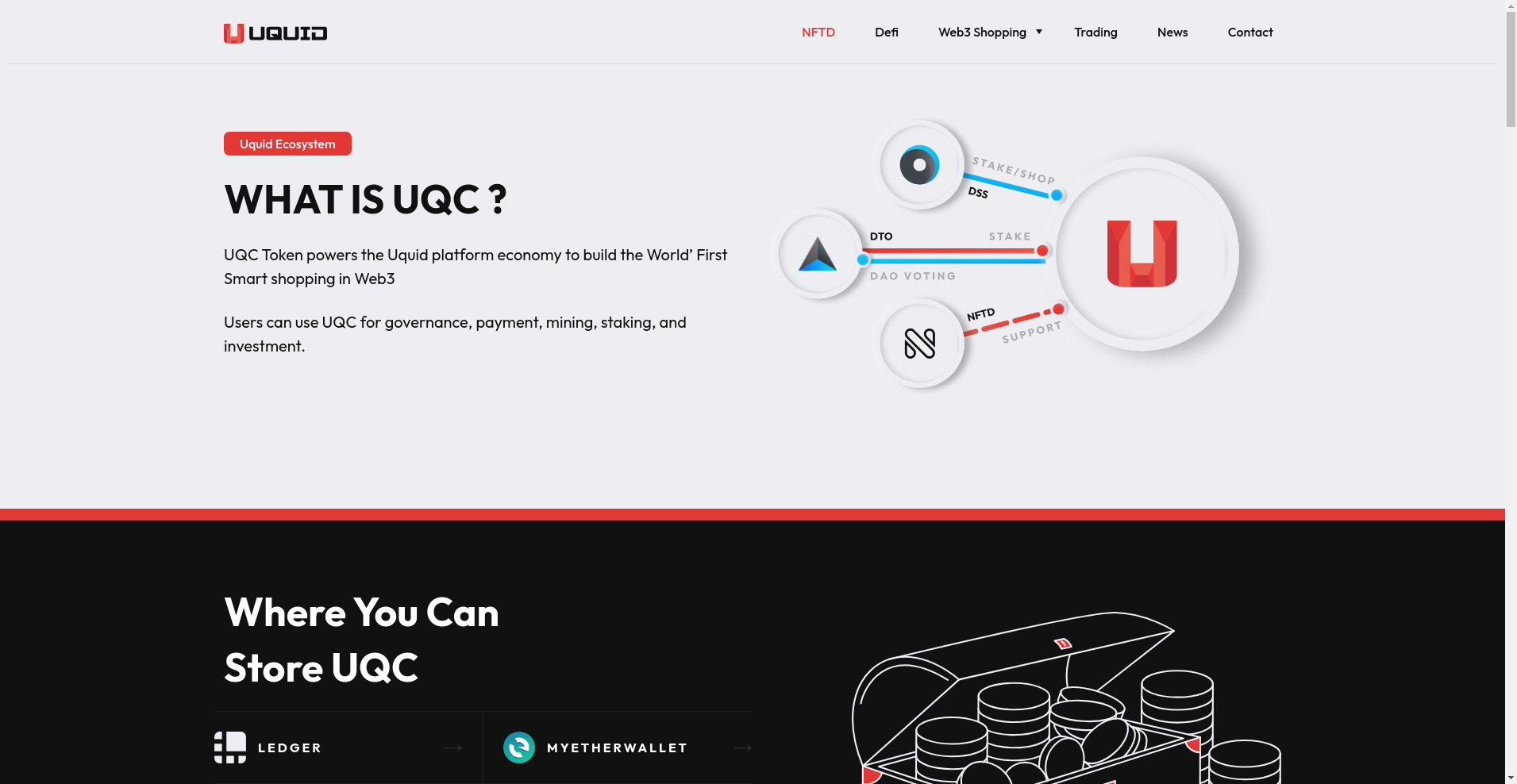

Uquid Coin (UQC) is the native utility token powering the Uquid platform—a project aiming to integrate e-commerce with the emerging Web3 ecosystem. Launched with the ambition to build the "World's First Smart Shopping in Web3," Uquid combines decentralized finance (DeFi), non-fungible tokens (NFTs), and real-world commerce in a comprehensive ecosystem.

The platform seeks to bridge traditional retail and digital investments, with the UQC token facilitating governance, payments, staking, and community rewards. Its broader goal is to establish a seamless interface where cryptocurrency and everyday shopping converge, supported by strategic partnerships and innovative functionalities.

The Team and Vision Behind Uquid Coin

The publicly accessible information about the Uquid team is limited but indicates a licensed entity in Estonia, a jurisdiction favorable for fintech and blockchain ventures. The project emphasizes transparency through its official website, detailed whitepapers, and documented partnerships.

Key milestones outlined in their roadmap include the listing of NFTD on PancakeSwap, integration with Binance Pay, and the development of multiple ecosystem components such as DeFi solutions and Metaverse features. These milestones suggest an active development trajectory, although the absence of detailed team member backgrounds warrants a cautious approach when evaluating credibility.

- Q1-Q2 2021: Platform foundation and initial token launch

- Q3 2021: Partnerships with Binance Pay and NFT platform listing

- Q4 2021 - Q1 2022: Ecosystem expansion with DeFi and Metaverse features

- Q2 2022: Deployment of trading systems and community initiatives

While these milestones demonstrate strategic growth plans, investor confidence hinges more on actual delivery and technical evolution than mere roadmap promises, especially given limited publicly available team credentials. For a deeper understanding of the economic structure driving such projects, exploring Uquid Coin's tokenomics is crucial.

Assessing the Security and Integrity of Uquid Coin

The security analysis for Uquid Coin is primarily based on the audit conducted by KnownSec, a recognized security firm, as referenced in their publicly available PDF report. This audit scrutinizes the token’s smart contract, which is critical for assessing potential vulnerabilities and overall platform robustness.

Key findings from the audit include:

- Audit Coverage: The smart contract was audited thoroughly, but with an overall rating of 7.3/10, indicating moderate confidence with some areas for improvement.

- Vulnerabilities: Multiple minor issues were identified, such as potential reentrancy risks and ownership controls, but no critical vulnerabilities were reported.

- Centralization Concerns: Certain functions are governed by owner privileges, which could be exploited if not managed carefully.

- Bug Bounty: No ongoing bug bounty programs were noted, which might suggest limited external security testing.

It’s important to recognize that a single-point audit offers a snapshot rather than an exhaustive security guarantee. For investors, this means Uquid Coin has a foundation of security practices but remains potentially vulnerable to future exploits if further audits are not conducted and security measures not maintained. Delving into the specifics of the KnownSec audit report for Uquid can provide more clarity.

A Breakdown of Uquid Coin Tokenomics

The tokenomics of Uquid Coin underpin its economic sustainability and community engagement. The total supply and distribution strategy are essential elements to understand for assessing potential inflationary pressures or scarcity-based value preservation.

- Total Supply: 40,000,000 UQC tokens, with a circulating supply of approximately 10 million as per the latest data.

- Market Data: Current price around $3.88, with a market cap near $38.8 million and a 24-hour trading volume of approx. $790,000.

- Distribution Breakdown:

- Token Sale (ICO): Enabled at $0.03, with a high all-time high of $33.71, indicating substantial price appreciation historically.

- Team & Advisors: Specific vesting schedules are not publicly detailed, raising questions about potential token lockups and future unlocks.

- Reserves & Partnerships: Allocations for ecosystem development, partnerships, and marketing are not fully transparent.

- Utility & Incentives: UQC is used for governance, staking, community rewards, and platform incentives. This multi-use approach aligns incentives but introduces complex economic considerations, including potential inflation if staking rewards are high.

In summary, while the tokenomics show an active ecosystem with utility and growth potential, the absence of detailed vesting and release schedules complicates long-term value projection. The high historical price spike suggests speculative activity, which could be volatile for holders if fundamentals don’t support sustained demand. A detailed examination of the Uquid Coin tokenomics is essential for a comprehensive understanding.

Assessing Uquid Coin's Development and Ecosystem Activity

Growth and activity metrics are crucial for validating the project’s legitimacy and long-term viability. According to available data, Uquid demonstrates active development, evidenced by partnerships, new platform features, and ecosystem expansion.

Recent developments include the integration of NFTD as a gas-free NFT marketplace, collaboration with Binance Pay, and the launch of DeFi modules designed for e-commerce solutions. These initiatives suggest strong technical progression aligned with their strategic roadmap.

On social engagement, the presence of multiple official channels like Reddit, Telegram, and Medium shows ongoing community outreach. The volume of trading (~$790,000) indicates active market participation, but it remains relatively modest. For a project with a market cap approaching $39 million, the activity levels suggest a niche but engaged user base rather than broad mass adoption.

It’s worth noting that real-world ecosystem traction is still developing. The true test will be sustained user adoption and the execution of delayed roadmap milestones, which could significantly influence the project’s prospects.

What Investors Should Know About Uquid Coin's Legal Framework

Uquid explicitly states it is fully licensed in Estonia, a strategic jurisdiction for blockchain projects aiming for regulated operations. The project’s website provides standard legal mentions, terms of use, and compliance policies, but does not specify detailed legal structures or licensing certificates beyond general claims.

Potential red flags include the lack of detailed disclosures about jurisdictional licenses, fund management transparency, and whether the project is regulated beyond Estonia. While licensing suggests a formal operational structure, investors should remain cautious about jurisdictional enforcement and legal protections, especially in an evolving regulatory landscape.

- Unclear if the license extends to cross-border operations or other jurisdictions.

- Absence of explicit KYC/AML policies disclosed publicly.

- Possible risks if the legal environment shifts or regulations tighten.

In conclusion, while the legal claims add a layer of legitimacy, they do not replace comprehensive due diligence nor mitigate all legal risks inherent in blockchain projects operating across jurisdictions. Understanding the nuances of Estonia's licensing for crypto projects can shed light on the regulatory environment Uquid operates within.

Final Analysis: The Investment Case for Uquid Coin

Uquid Coin presents a multifaceted project with ambitions to revolutionize e-commerce within the Web3 paradigm. Its ecosystem features innovative components like gas-free NFTs, DeFi integrations, and a metaverse expansion, supported by strategic partnerships with established players like Binance. Its token metrics suggest a high-growth potential, especially given its astronomical ATH, but recent volume and market cap indicate a niche user base rather than mass-market penetration.

Security appears reasonably structured, backed by an audit from KnownSec, but there remain areas for improvement, notably in transparency and ongoing security assessments. The project's legal standing in Estonia provides some legitimacy, yet regulatory risk persists.

From a quantitative perspective, the project's sustainability hinges on execution of roadmap milestones, user adoption, and maintaining a healthy token economy. The current price volatility and limited disclosure of vesting schedules highlight inherent risks for holders.

Pros / Strengths

- Innovative ecosystem: Combines e-commerce, NFTs, DeFi, and Metaverse functionalities.

- Partnerships: Collaborations with Binance Pay and PancakeSwap increase credibility.

- Utility token: UQC underpins various platform features, aligning incentives with users.

- Security audit: Conducted by KnownSec, identifying no critical vulnerabilities.

- Legal licensing: Fully licensed in Estonia, supporting operational legitimacy.

Cons / Risks

- Limited team transparency: No detailed backgrounds on key developers or advisors.

- Vulnerability concerns: Some minor issues identified in security audit, potential for future exploits.

- Market and volume limitations: Modest trading volume relative to market cap suggests limited liquidity and adoption.

- Tokenomics complexity: Lack of detailed vesting schedules could lead to supply shocks.

- Legal/regulatory risks: Dependence on Estonian licensing, uncertain regulatory outcomes.

In sum, Uquid Coin is a project with notable innovation and strategic partnerships, but it exhibits typical early-stage risks, including lack of full transparency and moderate market activity. Investors should weigh the potential upside against these hurdles and consider the probabilities of successful execution and sustained adoption before allocating significant capital.

As with any investment in the crypto space, thorough due diligence and risk assessment aligned with one's risk tolerance are essential. This review aims to provide a fundamental, evidence-based orientation to inform that process.

Michael Brown

Head of Protocol Security & Audits

Systems engineer applying mission-critical principles to DeFi. I stress-test smart contracts and economic models to find the breaking points before they find your wallet.

Similar Projects

-

Agent Heroes

In-Depth Review of Agent Heroes: Is This Crypto Project a Scam or Solid Investment? | Crypto Scam Checker

-

Financia Futures Prop Token

In-Depth Review of Financia Futures Prop Token: Is It a Crypto Scam or Legit?

-

Niza Global

In-Depth Review of Niza Global: Crypto Scam Checker & Project Scam Review

-

Propchain

Propchain Review — Crypto Scam Checker & Project Scam Checker | Is Propchain Legit?