The Second Best ($2ND) Review: A Data-Driven Look at Its Legitimacy and Risks

What Is The Second Best: An Introduction

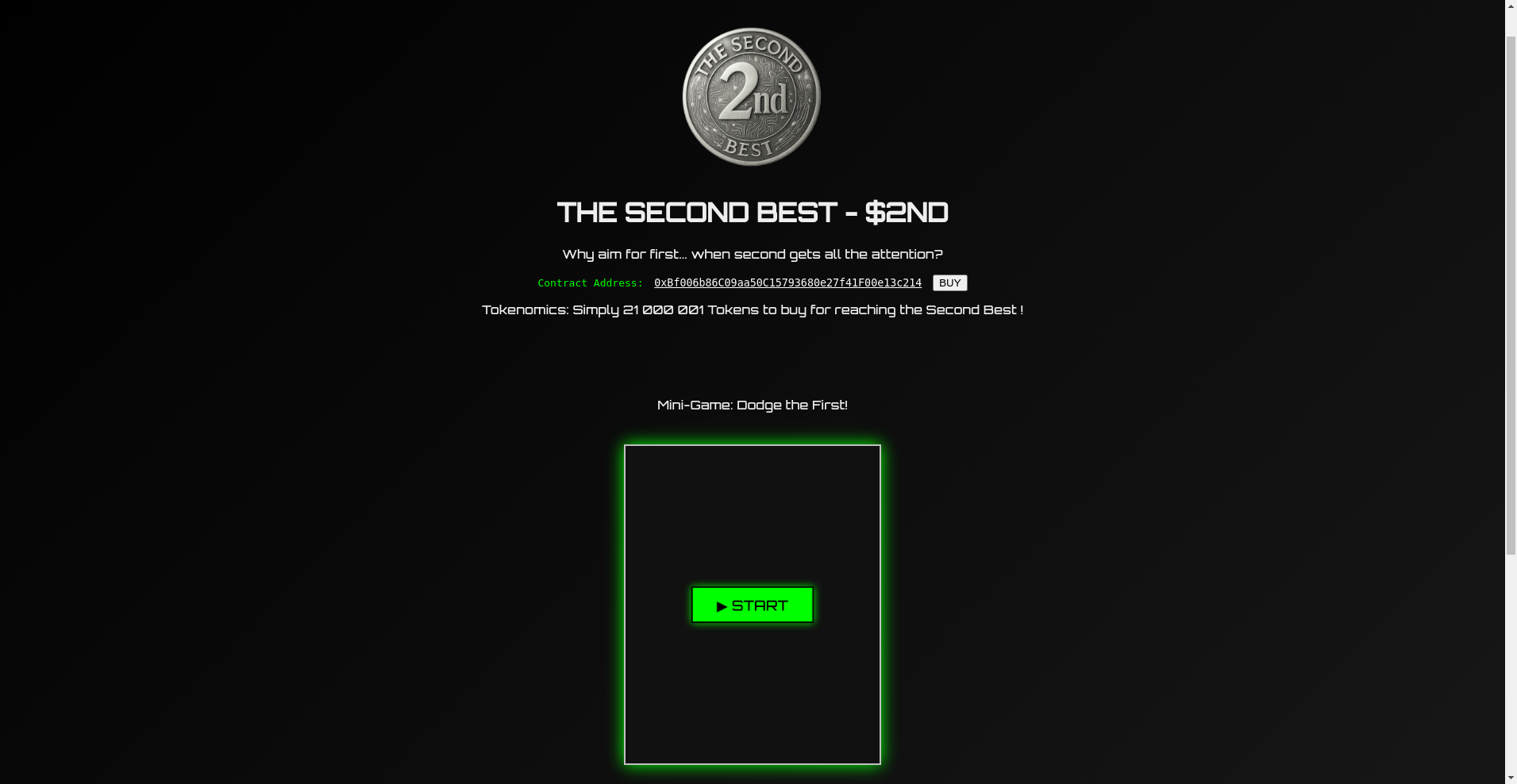

The Second Best ($2ND) is a relatively novel entrant into the blockchain ecosystem, positioning itself with a playful yet intriguing branding strategy: "Why aim for first... when second gets all the attention?" The project appears to blend humor, interactive entertainment, and community engagement through its core features, notably a mini-game called "Dodge the First!" which invites users to participate in an amusing, gamified experience in tandem with token acquisition.

Utilizing the Binance Smart Chain (BSC), the project issues a fixed supply of 21,001,001 tokens and emphasizes transparency—evident from its publicly available whitepaper and a focus on community interaction rather than traditional utility. However, this review aims to objectively analyze its underlying strengths, potential vulnerabilities, and the overall legitimacy within the crowded meme and entertainment token space.

The Team and Roadmap Evaluation

One notable characteristic of The Second Best is its approach to transparency and community branding. The project’s sentiment hints at humor and a self-deprecating tone: "Made with sarcasm by the 2nd Best Team." There is limited publicly available information regarding the individual team members, their experience, or any credible endorsements. This anonymity is common among meme-oriented projects but warrants caution regarding long-term execution.

Assessing the roadmap and milestones, the project highlights key components:

- Whitepaper Release: An explicit indication of a formalized project plan and detailed tokenomics.

- Interactive Features: Deployment of the mini-game "Dodge the First!" which includes gameplay mechanics, leaderboards, and community engagement tools.

- Token Launch: The token $2ND is available for purchase directly via the website, with explicit contract details provided.

- Community Engagement: Active Telegram with over 2,865 members and presence on social media platforms, which suggests some level of outreach.

While these milestones demonstrate a focus on building an engaging platform, there is little publicly documented strategic vision, partnership development, or expansion plans beyond initial engagement. The absence of concrete development timelines or technical roadmaps makes it difficult to gauge the project’s ability to evolve beyond its initial novelty.

In sum, the team’s credibility relies heavily on the community’s trust and the technical robustness of their release, given the lack of detailed team backgrounds and transparent governance structures.

Assessing the Security and Integrity of The Second Best

The security analysis of The Second Best hinges primarily on the Cyberscope audit report, which, according to available data, is the only major formal security assessment conducted thus far.

The Cyberscope audit, associated with the project’s contract at address 0xbf006b86c09aa50c15793680e27f41f00e13c214 on BSC, provides some insight into smart contract security vulnerabilities and systemic integrity.

- Security Score: The audit reports a high security score of 94.61%, placing it in the top percentile (~95%). This suggests that, at least from a technical coding perspective, the contract is well-constructed with minimal vulnerabilities.

- Critical Issues: There is mention of high criticality concerns, but no details indicate widespread exploit risks. The "high criticality" label may relate to certain structural aspects or potential attack vectors that, if exploited, could impact contract functionality.

- Audit Scope: Notably, the audit assesses only the token’s smart contract, and there is no indication of audits for associated off-chain components, governance mechanisms, or front-end security.

- Community and Decentralization: While the decentralization score of 75% is respectable, it remains under the threshold (commonly 80%+) for full trust, leaving room for centralization risks or controlling entities.

Given that the report is the sole comprehensive security evaluation available and is focused solely on the token contract, investors should remain cautious. The absence of multiple independent audits or third-party security assessments introduces residual risks—particularly if future enhancements or external integrations are planned.

In conclusion, the project demonstrates a commendable security posture based on this specific audit, yet reliance on a single source warrants conservative risk assessment, especially considering the project's novelty and minimal regulatory oversight.

A Breakdown of The Second Best Tokenomics

The economic model and tokenomics structure of The Second Best ($2ND) appears designed to foster community participation and amusement rather than utility-driven incentivization. Its fixed total supply of 21,001,001 tokens ensures scarcity but also raises questions about sustainability and growth potential.

- Total Supply: 21,001,001 tokens, which aligns with the project’s playful theme ("simply" just over 21 million), suggesting deliberate planning for a memorable numeric cap.

- Token Distribution: The project emphasizes direct purchase via the website, but detailed breakdowns of allocation—such as team reserve, development fund, marketing, or community rewards—are not explicitly provided.

- Vesting and Lock-up: The audit and available documentation do not specify vesting schedules or lock-up periods, which increases risk around sudden dumps or market instability.

- Token Utility: Primarily, the token is associated with access to the mini-game "Dodge the First!" and community engagement. There is no clear indication of staking, governance rights, or ecosystem-wide utility beyond entry into playful features.

- Incentive Structure: Rewards seem limited to popularity through leaderboard bragging rights rather than financial incentives. This bounds the token’s appeal for long-term investment or liquidity provision.

From an economic standpoint, the tokenomics is built for viral engagement rather than sustainability. Risks include potential dilution if the supply expands for future incentives, or price volatility given the absence of comprehensive utility and limited liquidity data of the token’s market presence. The current market cap (~$3,950) and negligible trading volume suggest a highly speculative environment prone to price swings driven by hype rather than fundamentals.

Assessing The Second Best's Development and Ecosystem Activity

Preliminary data indicates modest but genuine development activity centered around the initial release and engagement tools. The presence of a whitepaper, live mini-game, and active community channels suggests a foundational platform rather than a mere placeholder webpage.

However, quantitative measures like development commits, third-party integrations, or expansion modules are absent from the provided data. The project’s social media and community have grown gradually, with the Telegram group boasting over 2,865 members and a presence on X (formerly Twitter).

While community interest and initial engagement are promising, the absence of concrete future development milestones, ongoing feature releases, or ecosystem partnerships points to a project in early stages. The true test of sustainability will depend on how well the team can translate initial entertainment value into diversified functionalities and broader adoption.

Analyzing The Second Best's Terms and Conditions

There is no specific mention of comprehensive legal documents, terms of service, or privacy policies within the sourced information. The website prominently features a straightforward buy mechanism and describes the project as a humorous endeavor rather than a traditional financial product.

This lack of formal legal framing involves inherent risks—such as unclear liabilities, especially in the event of issues or exploits. Projects that bypass detailed terms and legal scrutiny can sometimes face regulatory challenges or community misunderstandings.

Until further documentation is available, potential investors should exercise caution regarding contractual protections or recourse mechanisms, particularly given the project's playful branding and minimal formal oversight.

Final Analysis: The Investment Case for The Second Best

Overall, The Second Best ($2ND) presents itself as a whimsical, community-centered project that leverages humor, gamification, and meme culture. Its security stance, based on a reputable audit, is promising but limited to the token contract alone. Similarly, its tokenomics emphasizes community engagement over utility, with risks associated with speculative trading and limited utility-based incentives.

From a legitimacy perspective, the project’s transparency is minimal beyond its social channels and audit report, with anonymous team members and no detailed long-term roadmap. Its playful branding may attract niche audiences, but scalability and sustainability hinge on how well the project can evolve beyond initial entertainment.

Pros / Strengths

- High security score (94.61%) indicating well-audited smart contracts

- Active community with Telegram and social media presence

- Transparent contract details provided

- Unique branding and engagement through mini-game

- Affordable entry point (~$0.0002 per token)

Cons / Risks

- Limited team transparency and no known leadership credentials

- Primary utility is entertainment and community engagement, lacking fundamental use cases

- No detailed development roadmap or future expansion plan

- Potential for market manipulation due to low trading volume (~$0)

- Absence of comprehensive legal documentation or formal governance

- Reliance on the novelty factor which may fade over time

In conclusion, while The Second Best ($2ND) exhibits promising security features and creative branding, its legitimacy relies heavily on community trust and minimal technical risks. Investors should weigh its entertainment value against the speculative environment and lack of utility-driven fundamentals. Due diligence and cautious position sizing are advised until further development milestones and community-driven utility are demonstrated.

Christopher Anderson

Smart Contract Auditor & Legal Tech Analyst

I have a dual background in law and computer science. I audit smart contracts to find the critical gap between a project's legal promises and its code's reality.

Similar Projects

-

DRAGON ON TRON

DRAGON ON TRON ($DGTRON) Review: Risks and Legitimacy Explored

-

Flux

Flux ($Flux) Review: Technology, Security & Risks Explored

-

LOLCOIN

Review of LOLCOIN: Crypto Scam Checker and Project Analysis

-

DISTRIBUTE

DISTRIBUTE Project Review: Crypto Scam Checker & Future Insights

-

Future Token

Crypto Scam Checker Review: Is Future Token a Legit Project or a Rug Pull?