Starlay Finance ($LAY) Review: A Data-Driven Analysis of Its Legitimacy and Risks

What Is Starlay Finance: An Introduction

Starlay Finance is a decentralized finance (DeFi) protocol positioned within the Polkadot ecosystem, primarily supporting the Astar and Acala Networks. The project aims to provide a comprehensive lending and borrowing platform, enabling users to deposit assets to earn interest or leverage their holdings without selling. Its architecture emphasizes security, community governance, and cross-chain compatibility, making it an intriguing player in the evolving DeFi landscape.

This review offers an impartial assessment of the project's strengths and vulnerabilities based on available data, audits, tokenomics, development progress, and community engagement. It is designed to aid potential investors and users in understanding the legitimacy and risks associated with Starlay Finance.

The Team and Vision Behind Starlay Finance

The available information does not specify whether the core team behind Starlay Finance is publicly known or operates anonymously. This lack of transparency regarding leadership can impact trust and perceived reliability. However, the project leverages established security audits from reputable firms such as Certik and Runtime Verification, indicating a serious commitment to protocol security.

- Strong emphasis on security through multiple audits, including Certik’s detailed assessment (linked here: Certik Audit Report)

- Community governance features such as token locking and voting suggest a decentralized decision-making process

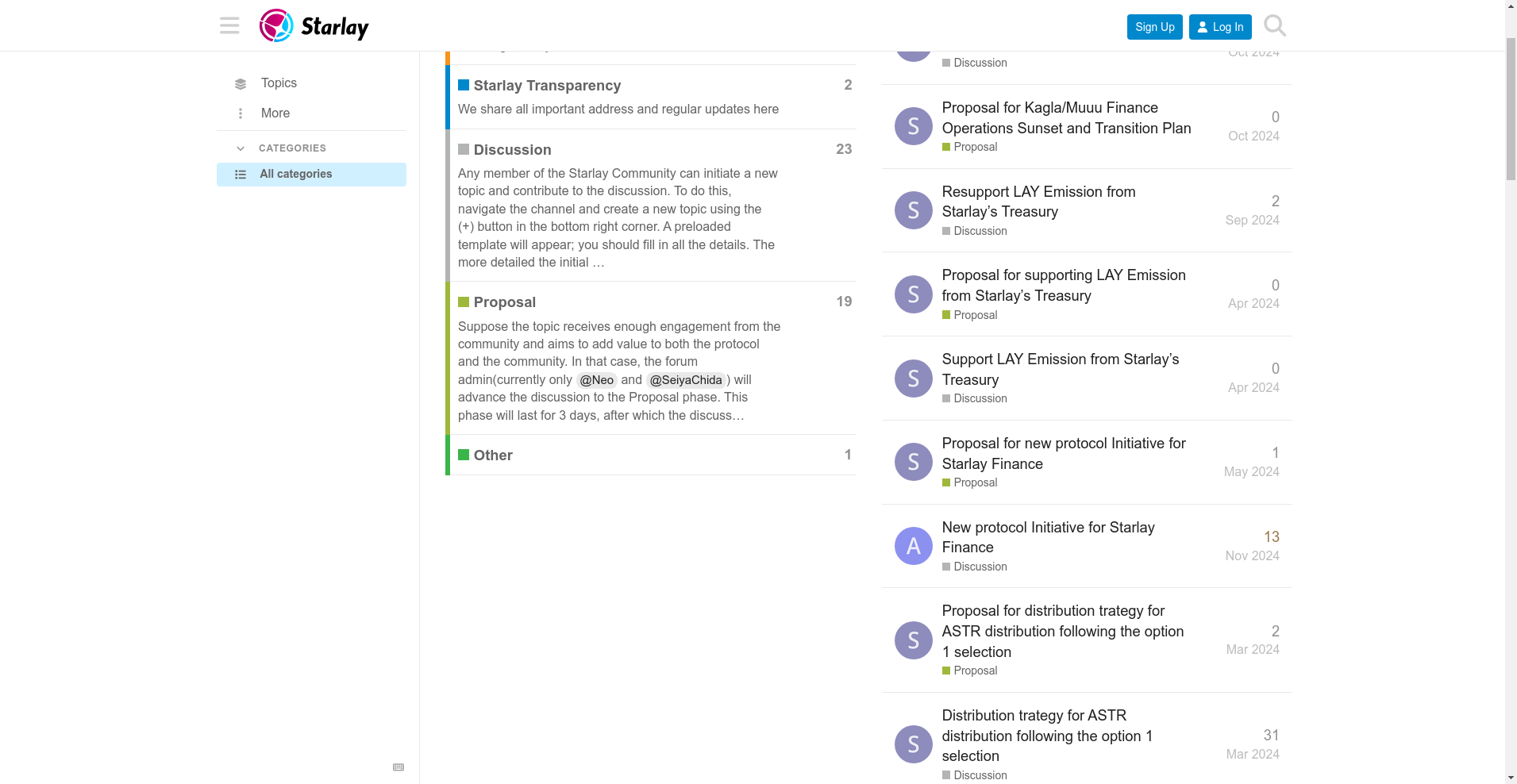

- Active community proposals on forums highlight ongoing development, asset management, and strategic plans

Despite the absence of specific team biographies, the project’s roadmap and audit commitments suggest a focus on building credibility and long-term sustainability.

Assessing Starlay Finance Security Audit Results

Based on the Cer.live audit report, Starlay Finance has undergone a thorough security inspection, which lends some confidence to its smart contract integrity. The overall rating from Cer.live is 4.95 out of 5, indicating a relatively high security score. However, it is crucial to recognize that only one major audit source was available, with no details on the specific vulnerabilities identified or remaining issues.

- Audit coverage: 100%

- Platform audit status: Not fully audited by the platform itself but reviewed by Certik and Runtime Verification

- Incident history: Mentioned as "incidents" but no specifics are provided, which warrants further investigation

- Bug bounties: None active or listed at present, suggesting limited external testing beyond audits

- Current vulnerabilities: Not publicly detailed; readers should consider the potential for undisclosed risks

While the audits from reputable firms indicate diligent security practices, the lack of ongoing bug bounty programs and detailed vulnerability disclosures should be considered when evaluating risk exposure. Analyzing Cer.live security scores can provide a good starting point for due diligence.

A Breakdown of Starlay Finance Tokenomics

The native token of Starlay Finance is $LAY. The tokenomics encompass supply dynamics, distribution strategies, and utility functions vital for its economic sustainability.

- Total supply: 1,000,000,000 LAY tokens

- Circulating supply: Data not explicitly specified, but initial circulation appears to be limited

- Distribution: Details on allocations to team, early investors, community rewards, or liquidity mining are not specified in the provided info, which raises questions about decentralization and inflation control

- Token utility: Used for governance (locking veLAY), protocol participation, and potentially staking rewards

- Vesting and lock-up schedules: Not explicitly detailed, which could impact token price stability and governance influence. Understanding token vesting schedules is crucial for assessing project stability.

The absence of detailed vesting or emission schedules introduces risks related to token inflation and market manipulation. The utility of veLAY suggests an incentive mechanism for long-term holders and active governance participation, but actual implementation details remain unclear, warranting further due diligence. Understanding veToken models in DeFi can shed light on such mechanisms.

Assessing Starlay Finance's Development and Ecosystem Activity

The project’s documentation indicates a structured development approach, with features like leveraging, liquid staking, and cross-chain integrations actively discussed and proposed within community forums. The last update on technical documentation was approximately one year ago, implying potential delays or stagnation in active development updates.

Market activity data presents a stark contrast: trading volume sits at approximately $52.51, with the current price around $0.00004589 (based on the token ticker $LAY). The low trading volume emphasizes limited liquidity at this stage, which can increase volatility and risk for early investors.

Community proposals concerning adding new assets, adjusting parameters, and expanding to other chains (e.g., Aleph Zero) demonstrate an active governance process, but the actual product deployment and real-world usage must be continuously monitored for progress and effectiveness.

The Fine Print: Analyzing Starlay Finance's Terms

Currently, there is no publicly available information indicating unusual, risky, or unfair clauses within the project's legal documentation. The transparency reports and community proposals suggest an effort towards clear operations. Nonetheless, investors should remain cautious due to the typical risks associated with DeFi protocols, such as smart contract bugs, governance attacks, or unforeseen economic vulnerabilities.

Final Analysis: The Investment Case for Starlay Finance

Starlay Finance presents itself as a promising cross-chain DeFi lending platform leveraging the Polkadot ecosystem, with credible audits and an active community governance process. Its comprehensive suite of features—including deposit, borrow, liquid staking, and governance—indicates a long-term focus.

However, significant risks are present:

- Limited transparency regarding team composition and financial distribution

- Absence of a public bug bounty program or ongoing security audits beyond the initial reports

- Low liquidity and trading volume, which may cause price volatility and slippage

- Potential delays or stagnation in development updates, as suggested by the documentation's age

- Market and protocol risks typical of emerging DeFi projects, including smart contract failures and governance attacks

Conversely, its technical audits, strong community involvement, and strategic integrations point to a protocol with a potentially solid foundation, provided users conduct thorough due diligence and remain aware of the inherent early-stage risks.

Ultimately, whether to participate or invest should depend on an individual’s risk appetite, the capacity for active engagement with ongoing project developments, and vigilance regarding security disclosures.

Conclusion

Starlay Finance demonstrates a promising approach within the cross-chain DeFi space, supported by reputable audits and a vibrant governance community. While its security posture is relatively strong based on current audits, uncertainties surrounding development progress, governance transparency, and token distribution merit cautious engagement. Like many nascent DeFi protocols, it offers potential rewards that are balanced by significant risks, underscoring the need for due diligence before participation.

Sarah Wilson

Offensive Security Engineer

I'm a professional "white-hat" hacker. I think like an adversary to find holes in crypto projects before the bad guys do. My job is to break things so you don't get broken.

Similar Projects

-

Crowdbit Academy Token (CBA)

Comprehensive Review of Crowdbit Academy Token (CBA): Is It a Crypto Scam or Legit Project? | Crypto Scam Checker

-

GamerCoin (GHX)

Comprehensive Review of GamerCoin (GHX): Crypto Scam Checker & Project Analysis

-

Cake Panda

Cake Panda Review: Crypto Scam Checker & Project Scam Review

-

ONI.exchange

Comprehensive Review of ONI.exchange: Is This Crypto Project a Scam? | Crypto Scam Checker & Review

-

Bull_Coin

Comprehensive Review of Bull_Coin: Is This Crypto Scam or Legit Project? | Crypto Scam Checker