Soleer ($SLR) Review: A Data-Driven Look at Its Legitimacy and Risks

What Is Soleer: An Introduction

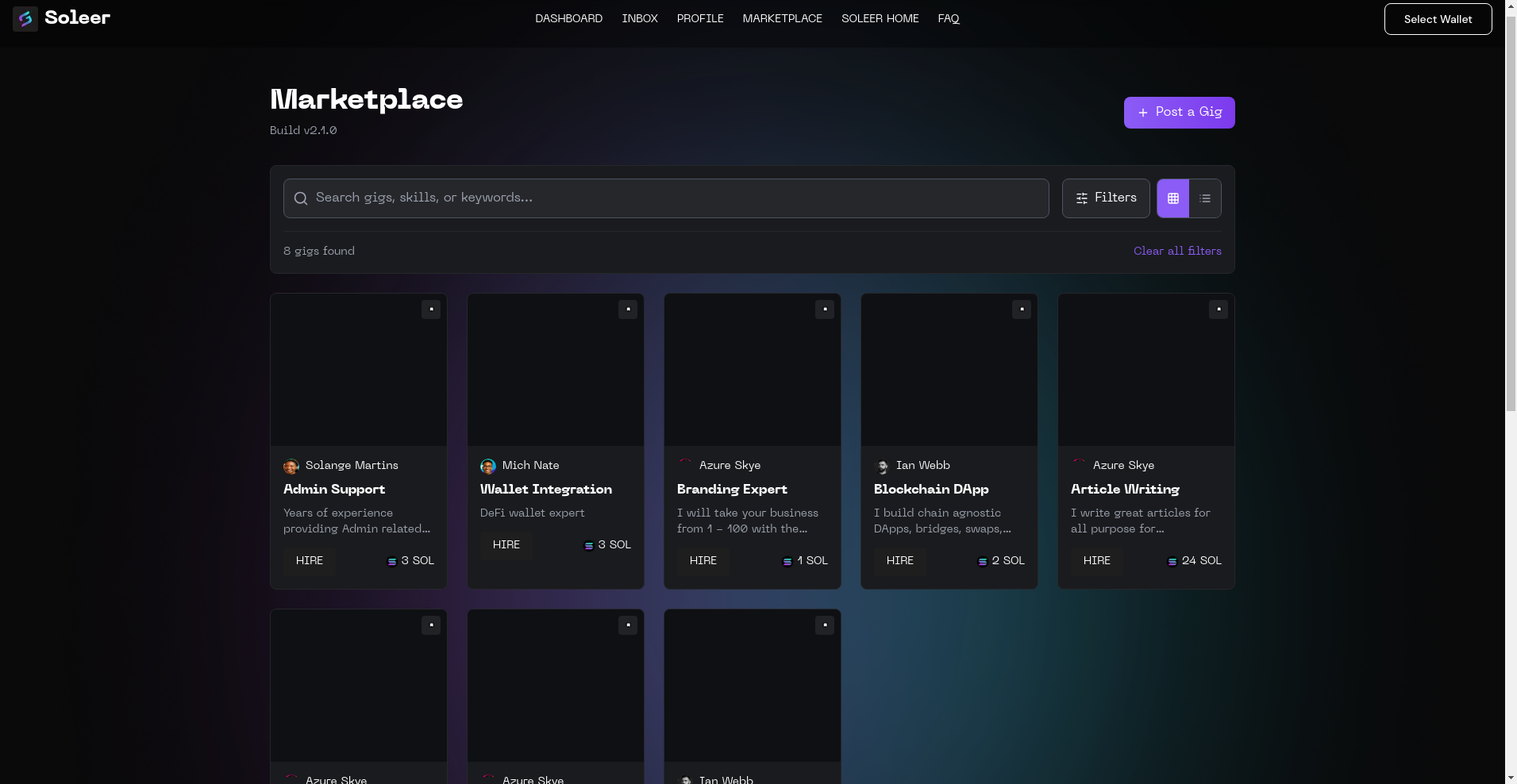

Soleer positions itself as a decentralized peer-to-peer services marketplace built on the Solana blockchain, aiming to revolutionize the gig economy. Its core goal is to connect freelancers and clients globally, offering a platform that emphasizes security, transparency, and low-cost transactions.

This project seeks to provide an alternative to traditional centralized freelancing platforms by leveraging blockchain technology, user reputation systems, and automated smart contracts. Based on available findings, the platform details its functionalities through website documentation, audit reports, and community activities. This review strives to assess its legitimacy, technological security, and potential risks without bias or assumptions.

The Team and Roadmap Evaluation

The publicly available information indicates that Soleer is powered by Soleer Labs, but detailed backgrounds of the founding team are not explicitly disclosed in the core documentation. Their transparency measures include audit reports and strategic partnerships, but without concrete evidence of an experienced and reputable leadership team, due diligence remains limited. The risks associated with anonymous teams are significant and should be carefully considered; for more insights, see our guide on anonymous teams in crypto due diligence.

Key milestones outlined in their roadmap include platform enhancements like marketplace updates, an integrated DAO governance system, and the expansion of service categories. Here are some notable roadmap points:

- Platform upgrades (v2.1.0): Indicates ongoing development and feature refinement

- Decentralized governance implementation: Suggests community-driven decision-making, which can be further explored in the context of DAO governance mechanisms for marketplaces.

- Partnership integrations: Potential collaborations with entities like Google Cloud and other blockchain service providers

- Legal and security milestones: Audit completions and KYC procedures

While these milestones imply a roadmap geared toward growth, the lack of public team credentials and specific technical deliverables warrants cautious optimism. The ability to realize these plans depends on the project's operational transparency and execution capacity.

Assessing the Security and Integrity of Soleer

All security analysis stems from Cyberscope's formal audit report, which confirms Soleer underwent a comprehensive security assessment. The audit specifically evaluated the project's smart contract deployed at address SLRqkZ69pw3tq8aDAv4gJZmadSGeHeyQst3cYRtoD3a within the Solana network.

The audit’s key findings include:

- High Criticality Issues: The report highlights one major vulnerability related to upgradeability risks, which could pose a significant threat if exploited, including potential unauthorized contract modifications.

- Security Score: The project's security score stands at approximately 94.5%, placing it in the high-security range, but not without concerns about the aforementioned critical issue.

- Audit Date & Scope: Completed in November 2024, the audit focused on token contract functions, governance mechanisms, and upgrade paths.

- Remaining Risks: The primary concern involves the contract's upgradeability, which if not properly managed, may create a 'hidden back door,' risking fund loss or governance hijacking.

While the high audit score indicates robust security practices overall, the critical vulnerabilities highlight the need for continuous monitoring and clear governance controls. Investors should recognize that a single audit, especially with critical findings, warrants ongoing caution.

A Breakdown of Soleer Tokenomics

The $SLR token functions as the core governance and utility token within the Soleer ecosystem. With a total fixed supply of 21 million tokens, its design aims to align incentives among users, incentivize staking, and facilitate fee discounts for platform participants.

- Total Supply: 21,000,000 SPL tokens

- Token Distribution:

- 50% (10.5M) — Public sale

- 20% (4.2M) — Private investors & strategic funding

- 15% (3.15M) — Liquidity provisioning and market stability

- 8% (1.68M) — Partnerships & marketing

- 7% (1.47M) — Community rewards & ecosystem growth

- Vesting & Lock-up: Specific vesting schedules are unspecified, raising potential concerns over token dumps and market stability. Understanding the importance of token vesting schedules in crypto is crucial for investors.

- Utility:

- Governance participation (DAO voting)

- Fee discounts for transactions paid in $SLR

- Staking rewards for network security

- Access to premium features and increased service visibility

Economically, the fixed supply combined with an allocation favoring public sale suggests a risk of dilution or price volatility once tokens are actively traded. Additionally, reliance on future ecosystem growth to sustain token value remains speculative.

Evaluating Soleer's Development and Ecosystem Activity

Development activity has been consistent, with audits, platform upgrades, and strategic partnerships displayed publicly. The latest audit from Cyberscope was completed recently, indicating ongoing security evaluations.

The platform itself showcases active patterns such as gig postings, user onboarding, and wallet integrations, implying a functional marketplace capable of real-world use. Nonetheless, the absence of significant trading volume—indicated by current zero marketcap and volume data—exposes the project to liquidity, adoption, and network effects risks. Analyzing liquidity for smaller projects is vital, and our article on risk mitigation strategies for low market cap tokens can offer guidance.

Community engagement appears modest, with social media followers and community scores indicating room for organic growth. While technical progress is evident, market traction remains limited, a common challenge for nascent blockchain projects.

What Investors Should Know About Soleer's Terms and Conditions

Legal documentation such as terms of service and privacy policies are publicly accessible. There are no overtly unusual or misleading clauses affecting investor rights or token security. However, several aspects warrant attention:

- Upgradeability Risks: The smart contract's upgrade permissions could be a potential backdoor if not tightly controlled, as highlighted in the audit.

- Vesting Transparency: Lack of detailed token vesting schedules may lead to uncontrolled issuance and token dumps.

- Decentralization Aspects: Community governance and decision-making processes are partially implemented; until fully operational, central authority may influence platform evolution.

In sum, the legal framework appears standard for blockchain projects but underscores the importance of scrutinizing governance controls and upgrade permissions.

Final Analysis: The Investment Case for Soleer

Soleer presents itself as a promising decentralized marketplace harnessing Solana’s high throughput and low fees. Its alignment with global freelance needs, coupled with blockchain transparency, lends it technological credibility. The recent security audit confirms a generally sound technical foundation, albeit with one critical vulnerability related to upgradeability.

However, several risks temper this optimism:

-

Pros / Strengths

- High security score with an audit conducted by Cyberscope

- Advanced marketplace features such as on-chain reputation, dispute resolution, and DAO governance

- Native utility $SLR token with multiple incentive mechanisms

- Leverages the speed and cost-efficiency of Solana blockchain

- Growing strategic partnerships and roadmap initiatives

-

Cons / Risks

- Limited publicly available information on the core team and their backgrounds

- Single audit with identified critical vulnerability, risking security if unaddressed

- Zero trading volume and unclear actual user adoption at this stage

- Potential for token inflation or price volatility due to distribution structure

- Dependence on community governance to mitigate centralized control issues

In conclusion, Soleer exhibits foundational strengths rooted in blockchain innovation and strategic planning. Still, critical security vulnerabilities, lack of extensive market traction, and opaque team backgrounds suggest it remains a high-risk, early-stage project. Investors should weigh these considerations carefully, recognizing that while the technical framework is promising, actual platform adoption and governance maturity are vital for long-term legitimacy.

Daniel Clark

On-Chain Quantitative Analyst

I build algorithmic tools to scan blockchains for signals of manipulation, like whale movements and liquidity drains. I find the patterns in the noise before they hit the charts.

Similar Projects

-

DOGEN

DOGEN ($DOGEN) Review: A Deep Dive into Its Tech & Risks

-

Blesscent Meta Coin

Blesscent Meta Coin Review | Crypto Scam Checker & Project Scam Review

-

Unicoin

Unicoin Review: Cryptocurrency Scam Checker & Project Analysis

-

Agent Heroes

In-Depth Review of Agent Heroes: Is This Crypto Project a Scam or Solid Investment? | Crypto Scam Checker

-

CrazyyFrogCoin

CrazyyFrogCoin Review: Scam Check & Legitimacy Analysis