SKALE Review: Scam or Legit Crypto? Uncovering All The Red Flags

Project Overview

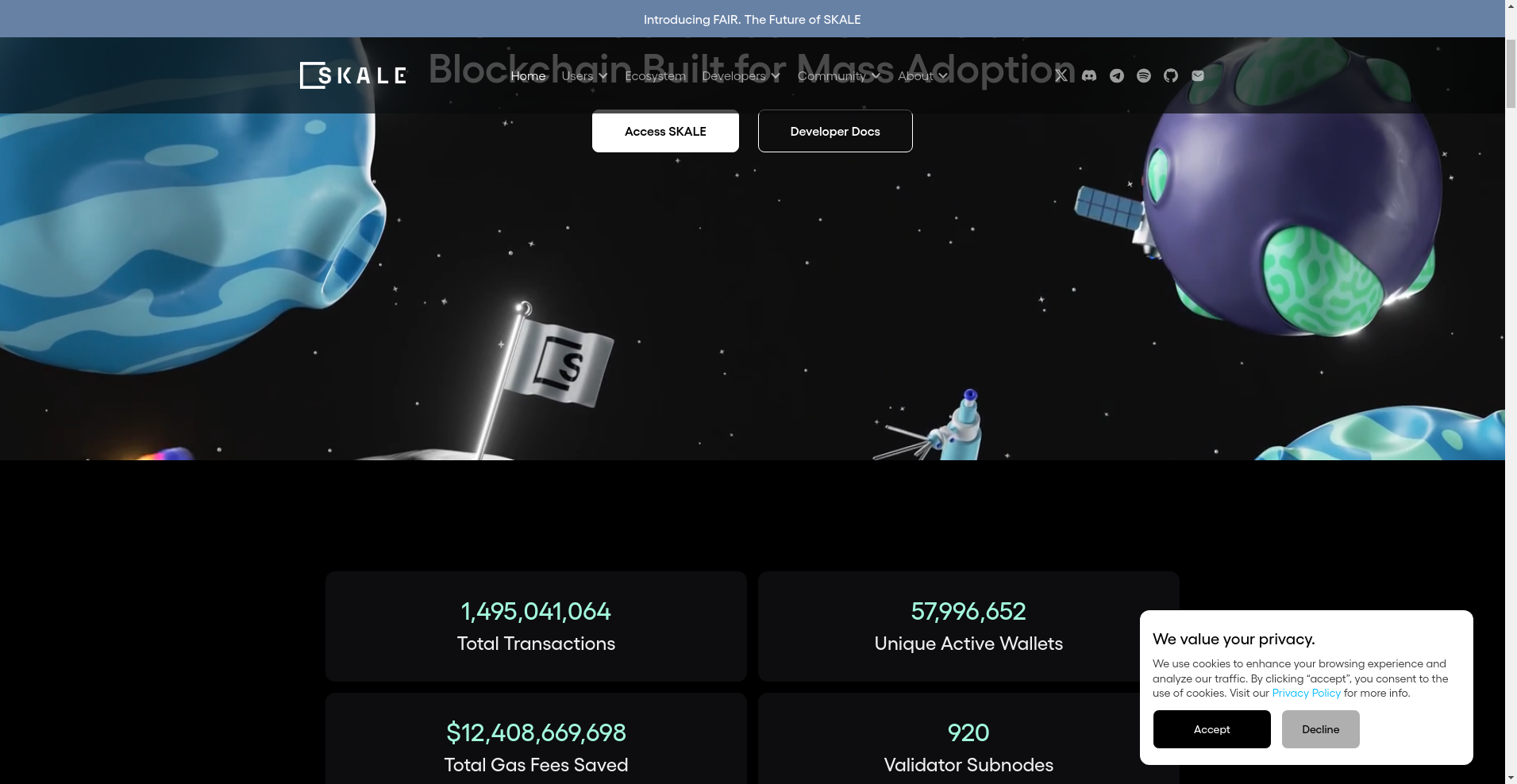

SKALE claims to be an Ethereum-native, modular blockchain network designed to revolutionize decentralized applications with high throughput, zero gas fees, and fast finality. The project promises a platform where developers can deploy customizable, high-performance chains tailored for gaming, DeFi, AI, and more — all while offering end-users a seamless experience without transaction costs.

However, as with many ambitious blockchain projects, skepticism is warranted. This investigation aims to scrutinize SKALE's claims, evaluate its security, team credibility, and ecosystem activity to determine whether it truly stands on solid ground or masks deeper red flags.

Who Is The Team Behind SKALE?

The leadership of SKALE includes Jack O'Holleran, a co-founder and CEO with a background in blockchain and technology startups. Many core team members are publicly doxxed and provide transparent backgrounds, which is a positive sign. Yet, some of the project's broader credibility depends heavily on the team’s execution and transparency regarding their progress and partnerships.

- Most executives have previous tech or blockchain experience, lending some credibility.

- Several strategic partnerships and notable hires, such as Andrew Saunders (former Arbitrum CMO), are highlighted to boost confidence.

- Nevertheless, the project’s primary communication relies heavily on marketing with limited technical disclosures or detailed roadmaps publicly available.

In conclusion, while the team features known industry veterans, the lack of detailed technical transparency and the proprietary nature of some claims suggest a cautious approach when evaluating their long-term credibility. Further understanding of blockchain teams can be gained by looking at tokenomics best practices for crypto projects.

SKALE Security Audit: A Deep Dive into the Code

SKALE's security posture largely depends on third-party audits. The available Cer.live audit indicates that SKALE's platform, including its core contract systems, has undergone an 80% coverage audit—though details remain limited. Notably, the audit was conducted by Quantstamp, a reputable firm in blockchain security. For more on these processes, you might be interested in the Solidity Finance audit process.

- The audit reports identify active bug bounties, suggesting ongoing security checks.

- There is no evidence of any critical vulnerabilities or exploit incidents publicly disclosed.

- However, the audit coverage is not exhaustive, leaving some potential vulnerabilities unexamined.

While the presence of audits and bug bounties is encouraging, the partial scope and lack of comprehensive transparency mean risk remains. Investors should be cautious of any underlying security flaws that might not have been uncovered. Understanding the broader landscape of blockchain security can be aided by exploring understanding NFT marketplace red flags, as security protocols are often debated across different blockchain applications.

SKALE Tokenomics: A Fair System or a Trap?

The SKALE token ($SKL) circulates with a total supply of approximately 6.08 billion tokens, with a market cap hovering around $130 million. The token’s utility involves staking, governance, and transaction fee payments, although SKALE touts itself as a gas-free platform for end-users. This presents a paradox: while users enjoy gasless transactions, token value is tied to network activity and staking incentives.

- Total Supply: 6,076,000,000 SKL — questions about distribution and allocation are not fully transparent.

- Team and founders likely hold a significant portion, increasing the risk of a dump if early investors panic.

- Utility is tied to network security and governance, but the current market cap suggests limited adoption and demand.

- The token price has seen a decline (~7.75%), indicating a potential drawdown or lack of sustained momentum.

High inflation risks and concentrated holdings pose red flags for long-term holders, especially without clear lock-up schedules or buyback mechanisms. For a deeper understanding of these issues, consider exploring SKALE tokenomics explained: supply and demand and general tokenomics best practices in crypto projects.

Is SKALE a Ghost Town? Checking for Real Activity

Although SKALE advertises multiple partnerships and initiatives, genuine activity metrics tell a more cautious story. The platform has facilitated over 1.49 billion transactions, saving users billions in gas fees—an impressive figure. However, the user base of nearly 58 million wallets and ecosystem partners over 40+ suggests extensive marketing efforts to elevate perceived activity.

Recent summaries mention significant transaction volumes, new integrations with exchanges like MEXC, and ongoing grant programs. Yet, the landscape appears heavily led by promotional announcements with limited evidence of widespread, organic developer adoption or real-world DApp development. Examining SKALE integrations and ecosystem partnerships can provide more clarity on its actual adoption.

- Many reports rely on inflated ecosystem statistics and marketing claims.

- No robust data indicates a thriving, active developer or user community beyond initial hype.

- Very few mainstream dApps or high-profile projects have verified ongoing deployment on SKALE.

This raises concerns over whether SKALE's ecosystem is lively or largely theoretical, driven more by marketing than real-world usage. For those interested in other high-performance blockchains, a review of the Fantom blockchain explained can offer comparative insights.

What SKALE's Legal and Terms of Service Are Hiding

No publicly available evidence points to egregious legal traps or contractual pitfalls in SKALE's terms. However, the project's reliance on multiple proprietary integrations, technical dependencies, and a broad ecosystem can obscure the fine print.

- Potential for centralization of validator nodes, as detailed in some governance documents, could pose risks. Understanding these risks is crucial, so a deep dive into SKALE validator node risks is recommended.

- Opaque token allocation and lack of lock-up terms may facilitate sudden dumps.

- Vendor lock-in for developers through proprietary SDKs could limit flexibility or expose users to risks of vendor disputes.

Investors should scrutinize these aspects, especially given the lack of detailed transparency on governance and token distribution policies.

Final Verdict: Should You Risk Investing in SKALE?

Based on the available data, SKALE presents itself as an innovative, scalable platform promising zero-gas transactions and high performance. While it features some reputable audits and a seasoned team, significant red flags remain—particularly concerning real ecosystem activity, transparency, and potential token centralization risks.

For cautious investors, SKALE's ambitious claims warrant skepticism. The project’s heavily promoted ecosystem may not reflect organic growth, and vulnerabilities or centralization issues could threaten investor funds.

-

Positive Points

- Reputable security audits (though partial)

- Experienced team with industry veterans

- Innovative technology with multiple advanced features

- High transaction throughput and integrations

-

Major Red Flags

- Limited transparency on token distribution and lock-up

- Risk of token dump due to concentrated holdings

- Questionable real-world activity versus marketing hype

- Partial security audits leaving potential vulnerabilities

Overall, potential investors must conduct thorough crypto due diligence before considering SKALE, recognizing that much of its enthusiasm could be driven by marketing narratives rather than proven adoption or security. Reviewing understanding NFT marketplace red flags can also provide valuable lessons applicable to evaluating any blockchain project.

Olivia Lewis

Sociotechnical Systems Analyst

I analyze the intersection of social networks and blockchain systems. I use data to expose how scammers manipulate communities with bots, FUD, and engineered hype.

Similar Projects

-

Ball Inu

Crypto Scam Checker Review: Is Ball Inu a Legitimate Project or a Rug Pull?

-

Evolution Finance

Evolution Finance ($EVN) Review: Data-Driven Risk & Security Analysis

-

ApeSwap Finance

ApeSwap Finance: Comprehensive Review of Features and Risks

-

ForTube

ForTube Review: Scam or Legit? Crypto Project Legitimacy Check

-

Gnars

Review of Gnars Crypto Project - Is It a Safe Crypto Scam Checker or Legitimate?