Quidax Token Review: Scam or Legit Crypto? Uncovering All The Red Flags

Project Overview

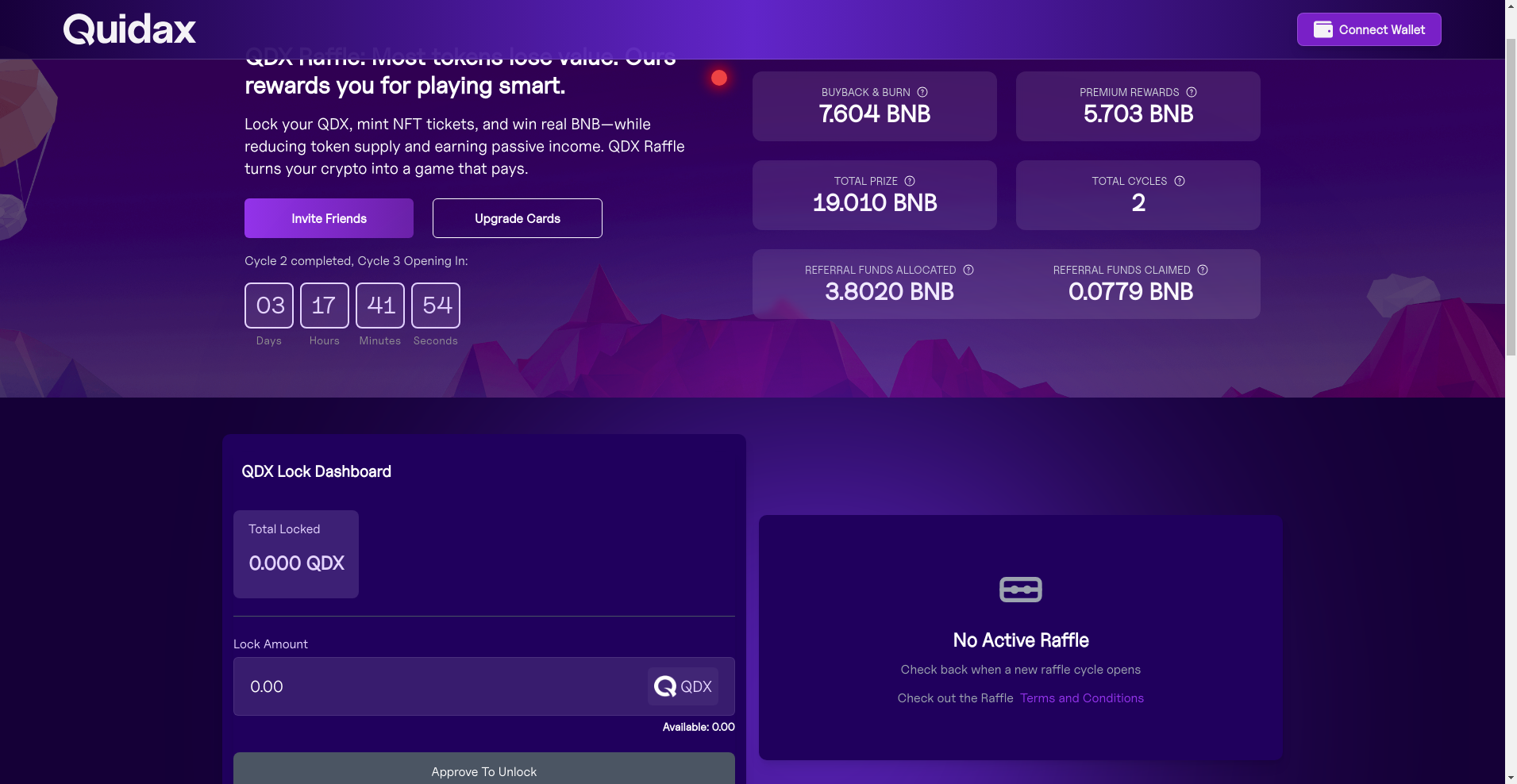

Quidax Token (QDX) presents itself as a utility token integral to the thriving ecosystem of the Quidax platform, promising a range of benefits such as trading fee discounts, passive income through vaults, governance rights, and participation in a gamified raffle system with rewards in BNB. The project emphasizes its connection with the well-established Quidax exchange, which claims to serve over one million users across more than 70 countries since launching in 2018.

However, amidst these bold claims and a complex array of features—including NFT integration, deflationary mechanics, and multi-layered reward systems—it's crucial to scrutinize whether these promises are backed by genuine development and trustworthy governance or if they conceal potential scam tactics. This article conducts an in-depth "scam check" and legitimacy review to help investors evaluate the risks associated with Quidax Token.

Who Is The Team Behind Quidax Token?

The transparency and credibility of a crypto project heavily depend on the team's identity and expertise. In the case of Quidax Token, the available data offers no public information about the founders, core developers, or advisory board. The project appears to be largely anonymous, with no clear links to verified individuals or corporate entities. This lack of transparency raises alarm bells for investors seeking accountability and trustworthy development.

- Roadmap and Vision: The project presents an ambitious multi-chain vision, including Ethereum, Binance Smart Chain, and future expansions, with features like NFT cards, raffles, and deflationary mechanics. However, the roadmap's details are vague, and there is no publicly available team behind its strategic planning.

- Community Engagement: The official social channels (Telegram, X) show limited activity—Telegram group members are around 12,700, but engagement levels appear tepid or automated, with no evident developer AMA sessions or transparent updates.

- Credibility Consideration: Without verified team credentials or partnerships with reputable entities, a project's legitimacy becomes questionable. The reliance on anonymous development teams often correlates with higher scam risks, especially when combined with complex, high-reward promises.

Overall, the absence of transparency suggests that the project’s long-term credibility is weak. Investors should be cautious, especially given the lack of verifiable background or independent audits of the core team.

Quidax Token Security Audit: A Deep Dive into the Code

The primary source for security assessment is the Cyberscope audit, which was performed for Quidax Token. Notably, the audit indicates that the contract was thoroughly reviewed with a focus on critical vulnerabilities. Nevertheless, a few red flags are evident.

- Audit Status: The audit status is marked as "has_audit": true, with a security score of approximately 95.23%. This high score suggests that the code has been checked for obvious flaws.

- Critical Issues: The audit details highlight high-criticality checks, including the presence of a "high_criticality": true flag, which is concerning. For example, functions like minting, burning, and pausing are present but depend heavily on admin or owner roles that seem concentrated.

- Decentralization & Control: The decentralization score is low (around 35%), and the audit reveals that crucial control functions—such as pausing, updating contract addresses, and blacklisting—are under centralized control by the "Chief" address, identified as `chainportCongress`.

- Code Security & Red Flags: The audits identify potential issues with access restrictions, blacklisting mechanisms, and the ability for the admin to mint tokens arbitrarily. These features, while common in certain tokens, can be exploited or abused if not properly overseen.

While the high security score indicates that the codebase has no obvious bugs, the centralization and control mechanisms pose significant risks. A malicious or compromised admin could manipulate supply, freeze assets, or execute rug-pull-like actions, making this a red flag for cautious investors.

Tokenomics Deep Dive

Quidax Token’s tokenomics describe a total supply of 500 million QDX, with approximately 77 million in circulating supply. The rest is subject to a 10-year vesting schedule to prevent immediate dump and reduce volatility—which is a positive sign. The token claims utility within the Quidax ecosystem, offering fee discounts, governance, and passive income features.

- Total Supply: 500,000,000 QDX, with a vesting schedule spreading release over ten years.

- Circulating Supply: Approximately 77 million QDX are currently active, suggesting limited immediate liquidity.

- Distribution Breakdown: The project does not disclose detailed initial distributions, including allocations to founders, team, or advisors. This opacity invites suspicion of potential centralization or pre-mined tokens held by insiders.

- Use Cases & Utility: The token’s value proposition revolves around governance, fee discounts, passive income, and access to exclusive features. The deflationary mechanic involving buy-back and burn aims to create scarcity over time.

- Risks: The large uncirculated supply and lack of transparency about initial token allocation pose high risks for dumping after vesting completes. A sudden influx of tokens could drastically depress the market price, especially if the project lacks active trading volume or liquidity support.

Investors should be wary of the potential for high inflation in the short to medium term. Without clear details on token distribution, the risk of large stakeholders dumping tokens remains significant, possibly leading to price manipulations.

Is Quidax Token a Ghost Town? Checking for Real Activity

Examining the project’s activity levels reveals a concerning picture. Despite claims of ongoing development, the publicly available metrics show limited community engagement and minimal on-chain activity beyond initial launches.

The official Cyberscope data indicates a community score of 73 out of 100, but this metric largely reflects community sentiment rather than actual development progress. The following notable points are evident:

- GitHub and Development: The audit references multiple code iterations uploaded to GitHub, but no recent commits or ongoing development activity are publicly observable. This suggests stagnation or abandonware.

- Community Engagement: The Telegram group has about 12,700 members but shows low interaction rates, with few meaningful updates or developer AMA sessions. The Twitter account has around 7,881 followers, with irregular posting activity, indicating a lack of active outreach.

- On-Chain Activity: Trading volume is relatively low (~3.25 BTC equivalent), and the platform's internal metrics, such as total value locked and token transfers, do not indicate a vibrant or growing ecosystem.

This stagnation hints that the project might be just a facade or only in early development stages, with little real-world traction, which increases the risk of investing in an inactive or bot-driven setup.

The Fine Print

Closing the investigation, it is vital to highlight certain aspects of Quidax Token's legal and operational structure that may contain risks:

- Lack of Regulatory Clarity: The project claims to operate in multiple jurisdictions, including Nigeria, where Quidax received a provisional SEC license. However, there is no clarity on whether the token itself is classified as a security or utility, exposing investors to potential legal pitfalls.

- Centralized Control: Most critical functions—such as token minting, pausing, blacklisting, and governance—are under the control of a central admin or governance address. This centralization allows the possibility of unauthorized manipulation or rug-pulls.

- Ambiguous Terms: The platform's terms and conditions, privacy policy, and other legal documents are either unavailable or generic, providing little transparency on user rights or dispute resolution processes.

- Operational Risks: The project's heavy reliance on a single platform (Quidax exchange) and limited community activities make it vulnerable to operational shutdowns, regulatory crackdowns, or governance disputes.

These factors underscore the importance of conducting thorough legal due diligence and recognizing that many of the project’s claims are poorly substantiated or lack transparency.

Final Verdict: Should You Risk Investing in Quidax Token?

Based on the available data and analysis, Quidax Token exhibits many red flags typical of a high-risk or potentially scam project. Its lack of transparency, centralized control mechanisms, sparse development activity, and opaque tokenomics suggest that investors should approach with extreme caution.

While the project touts promising utility features, the absence of verifiable team credentials and the questionable security posture elevate the risk of loss. Accordingly, anyone considering involvement should perform thorough crypto due diligence, considering these warnings before committing their funds.

- Positive Points:

- High security audit score (approx. 95%) indicating no obvious code bugs.

- Vesting schedule aims to prevent immediate dumping of tokens.

- Part of a legitimate exchange platform with some regulatory recognition.

- Major Red Flags:

- No verifiable team or founder information, raising trust concerns.

- Control over critical functions centralized in admin addresses.

- Limited community engagement and no active development updates.

- Potential for large token dumps post-vesting, risking market stability.

- Legal opacity and operational risks with no clear regulatory strategy.

In conclusion, without significant transparency, ongoing development, and community backing, Quidax Token remains a risky pursuit. Investors are advised to exercise vigilance and consider whether speculative high-reward projects with such red flags align with their risk appetite.

Michael Brown

Head of Protocol Security & Audits

Systems engineer applying mission-critical principles to DeFi. I stress-test smart contracts and economic models to find the breaking points before they find your wallet.

Similar Projects

-

KeeperDAO

KeeperDAO ($ROOK) Review: Analyzing Its Security and Risks

-

LATOKEN

LATOKEN Review: Scam or Legit? Complete Legitimacy Check

-

BAYC

Review of BAYC Crypto Project - Scam or Legit? Crypto Scam Checker & Project Review

-

Shopping.io

Shopping.io Review: Scam or Legit Crypto? Full Legitimacy Check

-

Dragosanta

Dragosanta ($DRAG) Review: Security & Risks in 2024