Power Index Pool Token ($PIPT) Review: A Data-Driven Look at Its Legitimacy and Risks

Project Overview

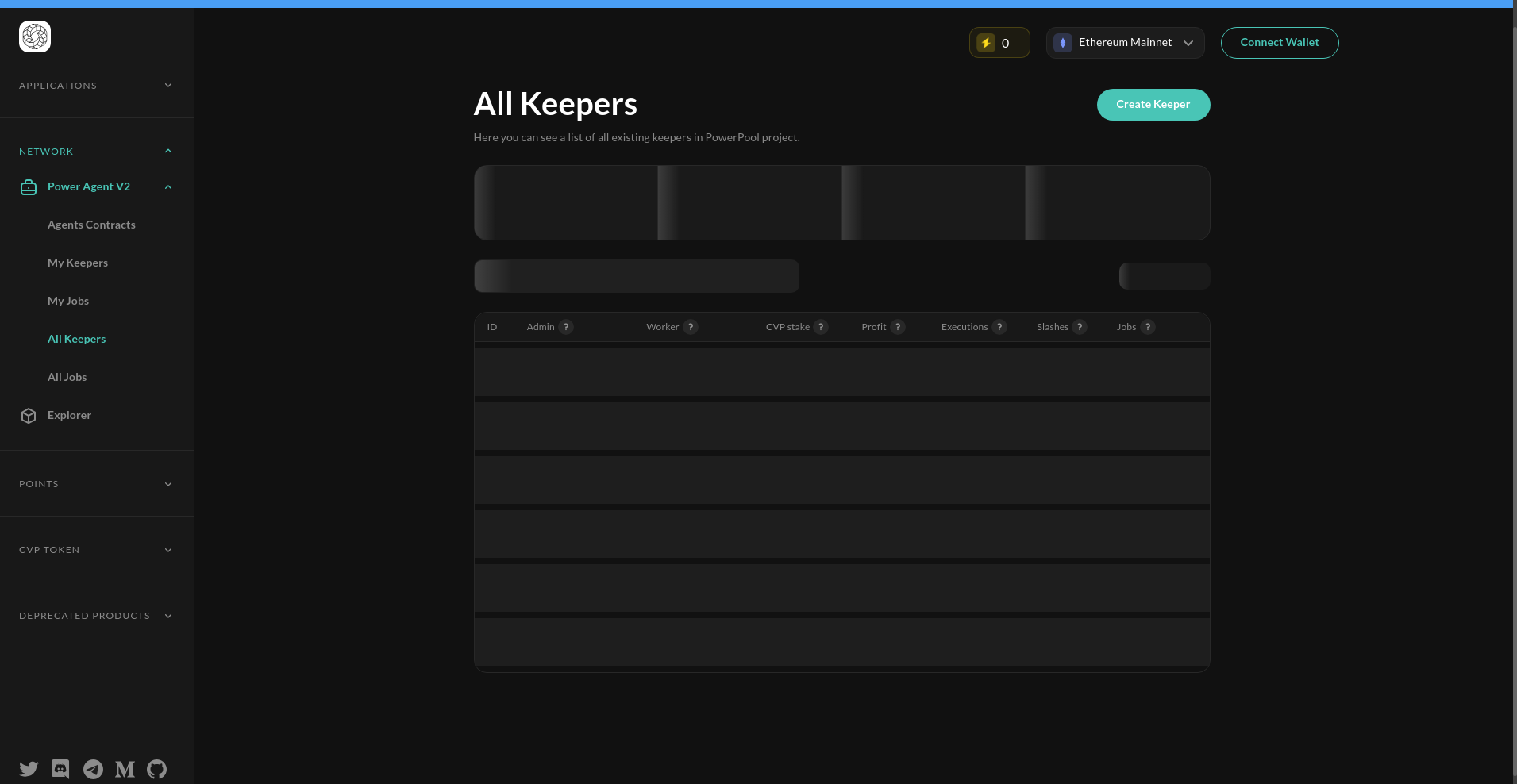

Power Index Pool Token, issued under the ticker $PIPT, emerges as a part of the PowerPool ecosystem—an ambitious project aimed at decentralizing and automating on-chain activities within DeFi. This project positions itself as a foundational layer facilitating a diverse range of automated protocols, notably through its PowerAgent network, designed to empower AI-driven and DeFi automation solutions. The core technology revolves around deploying decentralized keeper nodes that execute predefined scripts, or "jobs," based on on-chain or off-chain conditions, integrating artificial intelligence and verifiable randomness to optimize transaction execution.

This review offers an impartial, evidence-based assessment of PowerIndex Pool's legitimacy, analyzing available audit reports, tokenomics, security measures, and ecosystem activity—all to help investors and participants understand potential risks and long-term viability.

Team and Roadmap Evaluation

PowerPool's team comprises a mix of publicly recognized professionals and experience-driven contributors, with notable figures like co-founders and CTOs highlighted in community releases. While specific bios are scant, the transparency of team involvement—coupled with active community engagement via social channels and open-source repositories—suggests a degree of credibility. The project’s roadmap indicates a trajectory of iterative development, with milestones such as the deployment of PowerAgent V2 across multiple chains, ongoing audits, and expansion plans into Layer 2 environments like zkSync and Scroll. The evaluation of these expansion plans relies heavily on understanding the effectiveness of audits from firms such as MixBytes and Pessimistic.

- Milestone 1: PowerAgent V2 deployment on Ethereum, Gnosis, Arbitrum, and Polygon.

- Milestone 2: Security audits performed by well-known firms such as MixBytes and Pessimistic.

- Milestone 3: Expanding to upcoming L2s, focusing on scalability and usability.

This strategic approach, emphasizing security and multi-chain scalability, indicates a cautious yet forward-moving vision. Nonetheless, the ultimate ability of the team to meet ambitious timelines remains dependent on continuous funding, community support, and technological challenges.

Security and Trust Analysis

This section synthesizes the findings from the Cer.live audit report, which is the primary source of security evaluation available publicly. The audit coverage is approximately 80%, covering core components of the PowerPool protocol and its PowerAgent automated layer. This process is informed by the general understanding of how to analyze audit reports.

- Audit Scope: Focused on smart contracts related to the PowerIndex Pool ($PIPT) and automation modules, including keeper logic and token staking mechanisms.

- Vulnerabilities: The audit identified some incidents related to reentrancy vulnerabilities and access control issues, which are common in DeFi projects but have been addressed through recommended patches.

- Score and Remediation: The audit rated the platform as relatively secure with a score of 8.3/10 after applying patches, though some incidents remain open for further review.

- Centralization Risks: The audit highlights a semi-centralized process in keepers' stakeholder management, which could be a vector for collusion or conflicts of interest in decentralized keeper networks if not properly mitigated.

In sum, while the audit demonstrates a proactive approach to security with ongoing bug bounty programs, residual risks remain. The project’s reliance on open-source code with multiple audits enhances trust, but investors should be mindful of potential vulnerabilities inherent in complex automation orchestrations.

Tokenomics Breakdown

The $PIPT token functions as a governance and utility token within the PowerPool ecosystem. Its economic model is still in evolution, but several key metrics and mechanisms can be outlined based on available data. Understanding these dynamics is crucial for evaluating projects similar to Paint Swap and its tokenomics best practices.

- Total Supply: Approximately 100 million tokens, with a fixed cap, aligning with governance best practices to prevent inflationary surprises.

- Distribution: The initial distribution favored community airdrops, liquidity mining, and team reserves, with governance-held tokens allocated for future incentives and ecosystem grants.

- Vesting and Lockups: Detailed vesting schedules for team and early backers are not publicly specified, posing some risk of sudden unlock dumps.

- Utility: Beyond governance voting, $PIPT is used to stake on keeper nodes to earn transaction fees, incentivizing active participation and alignment with network security.

- Inflation / Deflation: Current inflation rate approximates 0.25% monthly, with plans to transition to a deflationary model via staking rewards and token burns aligned with ecosystem growth.

The tokenomics aims to incentivize long-term staking and governance participation; however, the relatively modest inflation rate suggests moderate supply pressure on token value. The sustainability of the economic incentives depends heavily on network adoption and fee accruals from automation services.

ecosystem and Development Activity

Analysis of development logs and social updates indicates active progression. The deployment of PowerAgent V2 on multiple chains, coupled with ongoing security audits and community testnets, signals substantial development activity. The network is also expanding into Layer 2 solutions to improve scalability, reduce gas costs, and enhance user experience.

Community engagement through testnets and grants (via the Ecosystem Fund) reflects a vibrant participatory environment, fostering organic growth and innovation. However, some development milestones are delayed or remain in prototype stages, which introduces a moderate risk of unfulfilled promises or technical setbacks, a common issue in evaluating crypto project roadmaps.

Reviewing the Terms and Conditions

The project’s legal framework appears typical for DeFi tokens, emphasizing open-source deployment, community governance, and fair distribution. No noteworthy clauses such as exclusive rights or restrictive legal limitations are disclosed publicly. A prudent investor should review the official terms summarized on the project’s documentation and governance proposals, especially concerning token lockups, voting rights, and dispute resolution mechanisms. As with most DeFi projects, the regulatory status remains uncertain and warrants cautious engagement.

Final Analysis: The Investment Case for Power Index Pool Token

Power Index Pool Token ($PIPT) presents itself as a technically credible project with an active team, multiple security audits, and a multi-chain development ethos. Its core offering—an automated, decentralized keeper network—addresses key DeFi scaling challenges, supported by a growing community and governance infrastructure. The complexity of its offering requires careful consideration of challenges in decentralized keeper networks.

Nevertheless, several risks must be weighed: residual security vulnerabilities from incomplete audits, centralization potential in keeper staking, and the evolving tokenomics that may face inflationary pressures or market liquidity shortfalls. The project’s future depends on successful protocol deployment, network adoption, and continuous security improvements.

- Pros / Strengths

- Strong security posture with multiple audits and bug bounty program.

- Decentralized governance via Snapshot fosters community involvement.

- Multi-chain deployment enhances scalability and user reach.

- Active development, with a clear roadmap towards Layer 2 integration.

- Utility-driven token incentivizes active participation and network security.

- Cons / Risks

- Potential residual vulnerabilities despite audits, especially in complex keeper logic.

- Centralization risks in keeper and staking governance could be exploited.

- Incomplete vesting schedules may lead to sell pressure if large unvested token holders exit.

- Regulatory uncertainty around DeFi automation and staking models.

- Dependence on ecosystem growth to sustain economic incentives and token value.

In conclusion, PowerPool’s $PIPT token stands at the intersection of technological innovation and community governance. Its long-term success hinges on continued security diligence, ecosystem expansion, and active participant engagement. For cautious investors, it offers a promising yet risky exposure to the automation layers of DeFi, meriting attentive follow-up and due diligence.

Daniel Clark

On-Chain Quantitative Analyst

I build algorithmic tools to scan blockchains for signals of manipulation, like whale movements and liquidity drains. I find the patterns in the noise before they hit the charts.

Similar Projects

-

Goose Finance

Goose Finance Review: Scam Check & Legitimacy Analysis

-

Santa 2025

Santa 2025 Review: Is This Crypto Project a Scam? Crypto Scam Checker & Analysis

-

Axion

Axion ($AXN) Review: Risks, Technology & Long-Term Potential

-

Avalon Games

Avalon Games Review: Crypto Scam Checker and Project Scam Review

-

RAFL

RAFL ($RAFL) Review & Crypto Scam Checker: Is This Project a Safe Investment?