Peony Coin ($PNY) Review: A Data-Driven Look at Its Legitimacy and Risks

Project Overview

Peony Coin ($PNY) is positioned as a key component within the broader DECENOMY ecosystem, which hosts numerous masternode-enabled cryptocurrencies spanning diverse sectors such as agriculture, environment, healthcare, and more. Rooted in the concept of real-world utility, Peony aims to facilitate a "Pasture-to-Plate" (P2P) agriculture framework that emphasizes transparency, sustainability, and direct farm-to-consumer interactions.

This cryptocurrency seeks to empower consumers and farmers by enabling participation in agricultural assets, ensuring fair pricing, and promoting animal welfare, all underpinned by a blockchain-based reward and governance structure. This impartial review collates available data, technical insights, and ecosystem context to evaluate Peony's legitimacy as an active project and assess the associated risks.

Team and Roadmap Evaluation

The publicly available information on Peony Coin does not detail specific team members, advisors, or their backgrounds, which introduces a degree of opacity. The project is anchored within the DECENOMY platform, which advocates a community-driven model revolving around masternodes, with governance and reward mechanisms embedded in its ecosystem. The absence of explicit team credentials, whitepapers, or verifyable development milestones raises questions about accountability and future delivery capacity.

Regarding the roadmap, insights are limited. The project's diverse sector focus suggests an ambitious multi-project vision aligned with the DECENOMY platform's thematic structure. Key milestones such as platform launches, deployments, or integrations are not explicitly documented in publicly available summaries. The reliance on community contributions and the suggested reward schemes imply a decentralized, participatory development ethos, but concrete indicators of achievement are lacking in the accessible data.

- Major milestones and development phases are unspecified.

- Team credentials and past experience are not publicly disclosed.

- Delivery timelines and technical roadmaps are absent from available sources.

Overall, while the project’s ecosystem design hints at a committed collective effort, the lack of transparent, verifiable progress metrics could pose a challenge for assessing long-term reliability.

Security and Trust Analysis

Our evaluation is based on the Cer.live audit report, which provides limited but crucial security insights. The audit indicates a low level of formal security scrutiny, with no large-scale platform audit completed, which is typical for many smaller or newer projects. The anonymity of team members, combined with a lack of comprehensive audit results, necessitates caution.

- An audit coverage score of 1.5 out of 5 suggests vulnerabilities or unverified code segments.

- No formal bug bounty programs or third-party audits are reported, increasing potential security risks.

- Absence of insurances or incident mitigation measures leaves some exposure to operational risks.

This security posture warrants careful consideration, especially given the project's emphasis on community participation and reward distribution. Investors should remain aware that potential vulnerabilities could impact network stability, especially if the codebase remains unverified or incompletely audited.

Tokenomics Breakdown

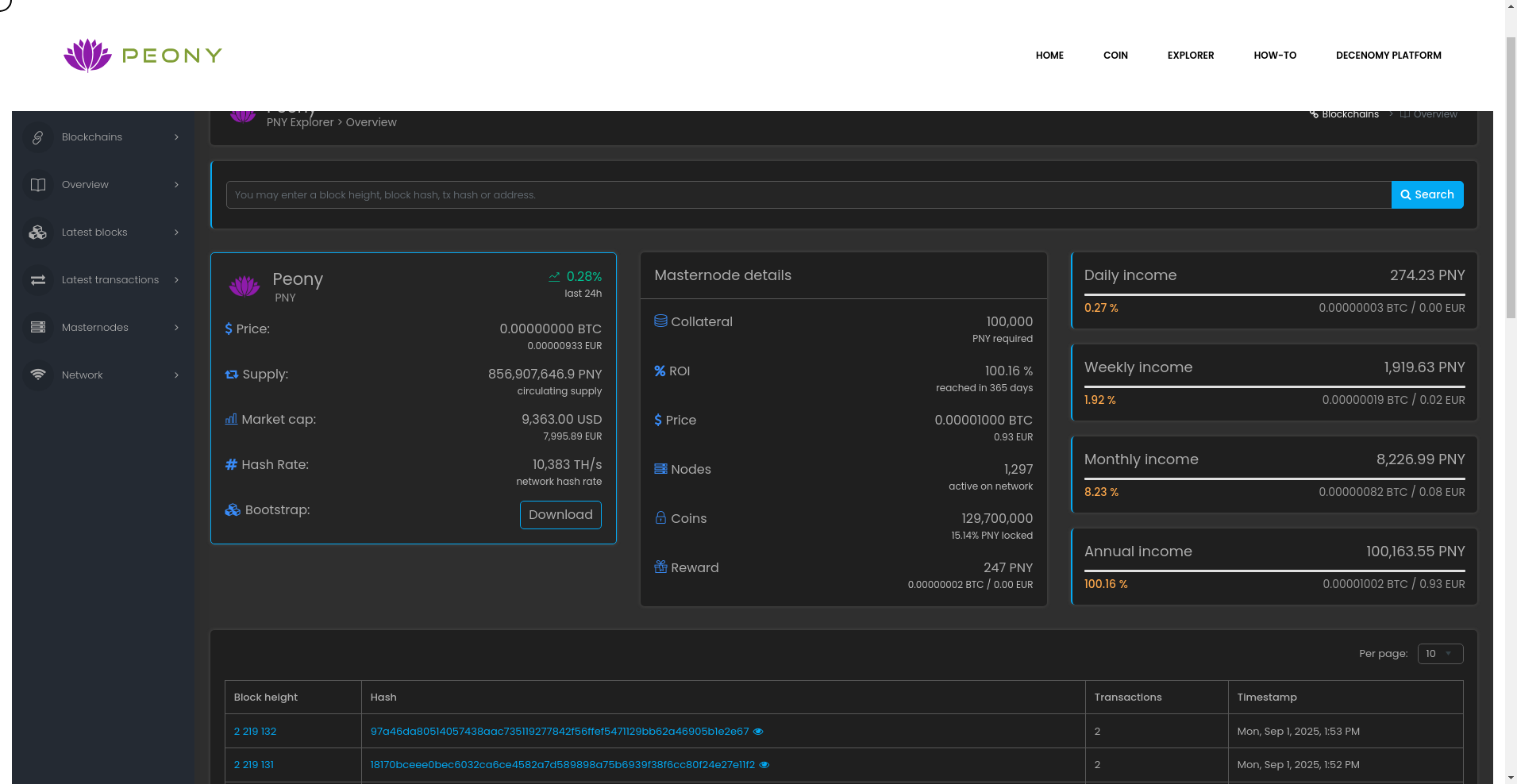

Peony Coin ($PNY) tokenomics reflect a substantial supply with a capped maximum of 1.2 billion tokens. An initial premine of 7,750,000 PNY was set aside at project inception, with allocation mechanisms involving maturation and burn processes aimed at reducing circulating supply over time.

- Total Supply: 1,200,000,000 PNY

- Premine: 7.75 million PNY (approximately 0.6% of total supply)

- Distribution: Maturation and burn procedures decrease circulating tokens, aiming to sustain long-term scarcity

- Consensus mechanics: Hybrid of Proof-of-Work (PoW, blocks 1–1000), Proof-of-Stake (PoS, starting from block 1001), and Masternodes (from block 3001)

The reward structure allocates approximately 65% of each block reward to Masternodes, with the remaining 35% distributed through staking. This incentivizes both active node operation and holder participation. The token utility centers around network security, governance, and incentivizing agricultural ecosystem participation.

Potential risks include inflation from block rewards, centralization risks if masternode operators concentrate holdings, and the reliance on an unverified reward algorithm, which could impact long-term sustainability if economic incentives are misaligned or adversarial actors exploit code vulnerabilities.

ecosystem and Development Activity

Development activity and real-world adoption metrics are not explicitly documented in the available data. The project promotes active participation through community rewards, governance, and educational resources such as wallets, masternodes, and staking management guides.

The broader DECENOMY platform emphasizes transparency, analytics, and advertising modules, which could support ecosystem growth. However, absence of on-chain activity metrics or recent milestone updates limits the ability to assess current traction. Many projects within the ecosystem appear in early or developmental stages, emphasizing future potential rather than existing momentum.

Reviewing the Terms and Conditions

The provided documentation lacks explicit legal, governance, or operational terms. There are no red flags documented such as lock-in periods, controversial clauses, or opaque legal footnotes. However, the lack of detailed terms on reward distributions, team accountability, or governance procedures leaves ambiguity about dispute resolution and protocol upgrades.

- No formal legal or compliance documentation available in the summarized data.

- Absence of jurisdictional or regulatory disclosures could pose legal uncertainties, especially in agritech and financial use-cases.

Thus, while nothing immediately appears problematic, due diligence should include reviewing official legal documents, whitepapers, and governance policies once available.

Final Analysis: The Investment Case for Peony Coin

Peony Coin presents itself as an ambitious project aiming to revolutionize agricultural supply chains through blockchain technology. Its integration into the DECENOMY ecosystem, with a diverse portfolio of sector-specific projects and community reward schemes, suggests a comprehensive, community-centric approach.

However, the project's legitimacy is somewhat tempered by limited public disclosures on team background, development milestones, and security audits. The low audit rating and absence of formal risk mitigation measures imply that it should be approached with caution, especially for those considering large or long-term investments.

- Pros / Strengths:

- Innovative sector focus with real-world utility in agriculture and sustainability.

- Blended reward system combining PoW, PoS, and masternodes, incentivizing multiple participation channels.

- Part of a broad ecosystem offering analytics and community engagement modules.

- Accessible wallets and emphasis on transparency in participating in the ecosystem.

- Cons / Risks:

- Limited transparency regarding team, development progress, and technical roadmaps.

- Security audit scores and vulnerability assessment are weak, with no formal audits reported.

- Potential centralization if masternode operators hold significant token shares.

- Regulatory uncertainties given the diverse use-cases in agriculture, healthcare, and finance sectors.

- Market traction and liquidity are currently minimal or undocumented.

In conclusion, Peony Coin embodies an intriguing niche project with high societal promise. Nonetheless, due diligence should prioritize verification of technical security, team credibility, and ecosystem activity before considering investment or extensive participation. Its success remains contingent upon transparent governance, security improvements, and tangible adoption within its target sectors.

Olivia Lewis

Sociotechnical Systems Analyst

I analyze the intersection of social networks and blockchain systems. I use data to expose how scammers manipulate communities with bots, FUD, and engineered hype.

Similar Projects

-

Gamster

Gamster ($GOIN) Review: Assessing Its Safety and Risks

-

QAAGAI

QAAGAI Review: Scam or Legit Crypto? Complete Legitimacy Check

-

Gremly (The Meme King)

Review of Gremly: Is This Meme Coin a Scam or Legit? Crypto Project Scam Checker

-

dTRINITY

Comprehensive Review of dTRINITY: Crypto Project Scam Checker & Risk Analysis