OWO (Emote Frog) Review: A Data-Driven Legitimacy and Risk Assessment of the $OWO Meme Token

What Is OWO (Emote Frog): An Introduction

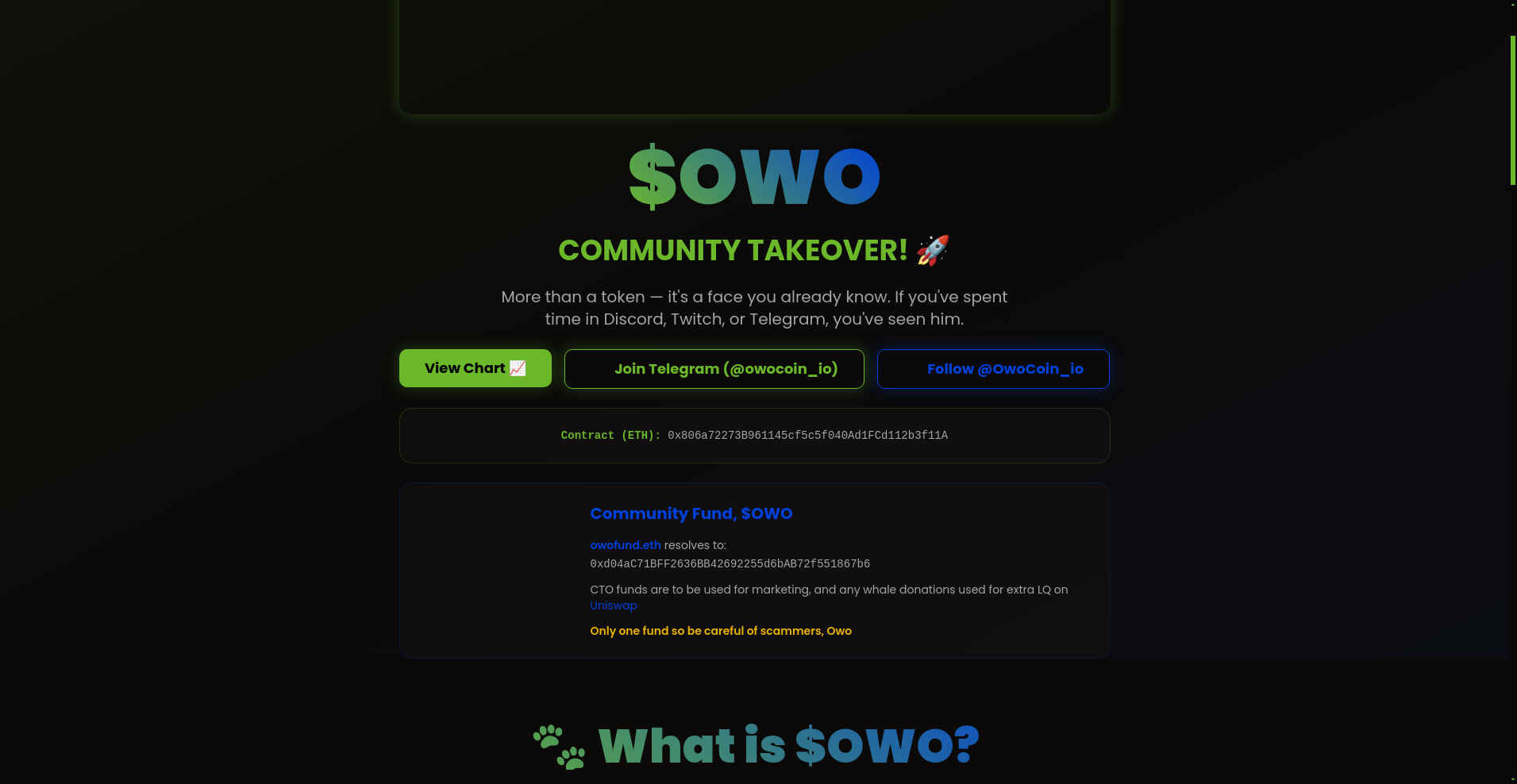

OWO (Emote Frog), trading under the token symbol $OWO, is a meme-based cryptocurrency that claims to embody internet culture through on-chain representation of the iconic emote face. Originating as a popular reaction image in Discord, Twitch, and meme forums since 2016, the project seeks to transform this digital icon into a community-led Ethereum token.

Contrary to traditional utility-driven tokens, OWO positions itself as a cultural phenomenon rather than a tech innovation. Its core philosophy revolves around organic growth driven by chat interactions, emote usage, and community participation. This review provides an impartial, data-based analysis of its legitimacy, security posture, tokenomics, and potential risks.

The Team and Vision Behind OWO (Emote Frog)

Evaluating the team behind OWO (Emote Frog) reveals a largely anonymous structure typical of meme coins. No formal development team or leadership figures are publicly identified. The project emphasizes a "community takeover" model, with ownership renounced and control spread among the community members, suggesting a decentralization ethos. However, the absence of a visible founding team raises questions about operational transparency and long-term viability. You can learn more about community takeover models in crypto, which are common in such projects.

The roadmap for OWO is minimalistic and non-traditional; its core milestones are centered around community engagement rather than development deliveries. Based on the available data, key milestones include:

- Token deployment on Ethereum (June 2025)

- Community fund setup — dedicated address for marketing and liquidity support

- Community takeover initiatives — promotion through viral chat interactions

While these milestones reflect a focus on organic growth, there is little evidence of strategic plans or technical development. This reliance on community momentum may sustain short-term interest but limits confidence in continued delivery of new features or ecosystem expansion.

Assessing the Security and Integrity of OWO (Emote Frog)

Analysis based on Cyberscope’s audit report: The project's security evaluation stems from a formal audit conducted by Cyberscope, which assesses the smart contract’s integrity and potential vulnerabilities. The audit, completed on August 21, 2025, concludes a high security score of approximately 95.48%, indicating minimal detectable vulnerabilities at the report time.

Key technical points from the audit include:

- Contract address: 0x806a72273B961145cf5c5f040Ad1FCd112b3f11a, deployed on Ethereum

- High-criticality issues: None explicitly reported; the audit iteration notes a “high criticality” label during review, but no major exploits listed. Understanding Cyberscope's criticality ratings for meme coins is crucial for assessing their security.

- Ownership and control: Ownership has been renounced, removing the possibility of governance hijacking or token minting beyond initial supply. This is a key aspect of assuring trust, similar to validating liquidity pool locks and ownership renouncements.

- Liquidity pool: Reported as 100% burnt, indicating no liquidity is centrally controlled or susceptible to manipulation

- Vulnerabilities: No critical vulnerabilities or logic bombs identified in the audit scope

Though the audit results appear positive, it’s crucial to recognize the limitations: only one major audit exists, and the token’s meme-centric design inherently relies on community trust rather than technical safeguards. The absence of ongoing security assessments or formal governance processes leaves potential attack surfaces unexamined beyond the initial audit.

A Breakdown of OWO (Emote Frog) Tokenomics

The economic model of $OWO centers around a massive supply: a total of 420,690,000,000,000 tokens, or roughly 420 trillion tokens. With a valuation of approximately $2.18e-10 per token at press time, the high supply combined with zero transaction taxes underscores a focus on virality over utility. A deep dive into meme coin tokenomics, like that of $OWO, can shed light on their unique economic strategies.

Detailed tokenomics include:

- Total Supply: 420,690,000,000,000 $OWO tokens

- Taxation: 0% buy and 0% sell taxes—encouraging free trading and viral chat interactions

- Liquidity: Liquidity pool has been reported as burnt, effectively removing centralized control over trading pairs

- Ownership: Renounced, with no ability for formal governance or minting functions

- Fund Allocation: The dedicated OWO Community Fund address (0xd04aC71BFF2636BB42692255d6bAB72f551867b6) is the sole source for marketing and liquidity operations

- Utility & Usage: Primarily serves as a community and social signaling token with no coded utility beyond its meme appeal

Potential risks lie in the token’s hyper-supply and lack of inherent value, which make it vulnerable to pump-and-dump schemes or market manipulation. Its sustainability hinges on community engagement rather than a sound economic or utility-driven model.

Assessing OWO (Emote Frog)'s Development and Ecosystem Activity

Given the meme-centric nature, OWO’s ecosystem activity predominantly manifests in community engagement, social media presence, and meme propagation. The project maintains active channels on Telegram (@owocoin_io) and Twitter (@OwoCoin_io), with a combined following exceeding 5,000 users and followers. The importance of communication channels in crypto projects cannot be overstated for fostering trust and transparency.

Although on-chain metrics such as trade volume are currently negligible or absent, the project leverages viral chat activity, meme posting, and community-driven marketing to sustain interest. Notably, the real-world impact remains limited, with no reported substantial partnerships, decentralized applications, or ecosystem integrations.

This approach aligns with typical meme tokens—rely on social momentum rather than technical progress. The absence of significant development updates or ecosystem features suggests the project’s trajectory primarily depends on cultural resonance rather than sustainable growth initiatives.

The Fine Print: Analyzing OWO (Emote Frog)'s Terms

Reviewing the provided documentation and communications yields no alarming legal clauses or risky contractual language. The project explicitly states that it is a meme-only token, with disclaimers emphasizing:

- No intrinsic value or investment promise

- No formal team or roadmap

- Ownership has been renounced

- Markets are purely speculative and driven by community activity

- Potential scammers may impersonate official addresses and entities—users should verify assets carefully

Overall, the terms are straightforward and transparent about the project's entertainment purpose. There are no complex legal provisions or disclaimers that hint at hidden liabilities, yet the lack of regulation or consumer protections inherently increases risk for investors. Understanding general DeFi platform risk assessment can also provide valuable context for evaluating meme tokens.

Final Analysis: The Investment Case for OWO (Emote Frog)

In summary, $OWO embodies the classic meme coin model: high supply, zero utility, community-driven, and reliant on viral social dynamics. Its legitimacy rests largely on community trust, visual culture, and the transparency of its smart contract—assets that are transparent and seemingly secure but far from guaranteeing long-term success or value.

From a risk perspective, the project’s lack of intrinsic value, absence of a team, and reliance on community momentum underscore significant speculative risks. The security audit indicates a robust smart contract setup, but this alone does not protect against market manipulation, scams, or shifts in community interest. Understanding exit scams in DeFi is a critical skill when navigating such speculative assets.

Strengths include high security score, ownership renouncement, and transparent fund allocation — strengthening its legitimacy in terms of contract integrity. Conversely, vulnerabilities stem from its meme-based nature, no utility, and vulnerability to social sentiment swings.

- Pros / Strengths:

- High security audit score (approx. 95.48%)

- Ownership renounced, reducing central control

- Transparent community fund for marketing and liquidity

- Active social channels and cultural resonance

- Cons / Risks:

- No intrinsic value or utility—pure meme project

- Dependent on community engagement for longevity

- Potential for scams or impersonation given lack of regulation

- High supply with no deflationary mechanisms

- Limited on-chain activity or tangible ecosystem development

Overall, prospective investors must weigh the cultural appeal and technical security against the inherent volatility and speculative nature of meme tokens. Although the smart contract appears solid, the project’s future hinges on community persistence and cultural relevance. This analysis aims to arm you with the critical, factual perspective necessary to make an informed decision—beyond the hype and meme energy.

Emily Davis

Digital Forensics Investigator

Digital forensics investigator. I follow the money on the blockchain to uncover the truth behind crypto scams and exploits. Every transaction tells a story—I'm here to make sure it's heard.

Similar Projects

-

MitaoCat

Comprehensive Review of MitaoCat Crypto Project | Scam Checker and Risk Assessment

-

Planet Finance

Planet Finance ($AQUA) Review: Analyzing Its Collapse and Risks

-

Kennedy Memecoin

Kennedy Memecoin ($2-Bobby) Review: Project Collapse & Red Flags

-

SPORTBET ARENA

SPORTBET ARENA ($SBA) Review: In-Depth Analysis of Its Collapse and Risks

-

Xedacoin

Xedacoin ($XEDA) Review: Assessing Its Security and Abandonment